Are you a client?

Sign in to view the full news archive.

Last night I gave my final ‘State of the ICT Nation” presentation for the Prince’s Trust at BT Tower. 50 of the very top Chairmen, CEOs or Country Managers from the leading suppliers of IT to the UK market attended. As BT paid all the costs, we raised £75,000 on the night. So, since my very first such talk in 2002, the 14 speeches have now cumulatively raised over £1m for crucial work of the Trust helping disadvantaged young people. I am chuffed!

This year’s speech – The Last Time – had a certain autobiographical feel. Indeed, I went back to reprise the my first two major themes.

Acquisition Indigestion

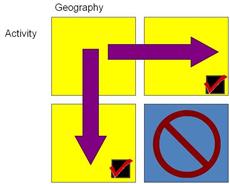

I introduced the concept of Acquisition Indigestion in my very first Holway Report published in 1988. “The after effects of taking over companies of the wrong type or size”. Being a simple kind of guy, I think that doing lots of small acquisitions is better than one huge ‘meal’. Indeed I do not know o f any acquisition which has worked where the acquiree is >50% of the size of the acquirer. I prefer something less than 10%! Also, acquisitions work when they extend the depth of an existing product or service in an established geography or taking an established product into a new geography. What doesn’t work is taking a leap into a whole new product area in a new geography. Eg Misys (established in general IT in the UK and global retail banking) deciding in 1997 to buy a healthcare provider in the US for something over 50% of their then size. It, of course, ended in tears. I have so many other examples that I could fill a book with them.

f any acquisition which has worked where the acquiree is >50% of the size of the acquirer. I prefer something less than 10%! Also, acquisitions work when they extend the depth of an existing product or service in an established geography or taking an established product into a new geography. What doesn’t work is taking a leap into a whole new product area in a new geography. Eg Misys (established in general IT in the UK and global retail banking) deciding in 1997 to buy a healthcare provider in the US for something over 50% of their then size. It, of course, ended in tears. I have so many other examples that I could fill a book with them.

Boring Awards

In 1992, the then technology correspondent of the FT, Alan Cane, asked for my views on Admiral’s results. My comment “Admiral’s performance is boringly consistent” got printed next day as “Admiral in Boring”. So grew Holway’s Boring Awards which were only given to companies with 10 or more years of uninterrupted EPS growth. Admiral got the first but relinquished it when they were acquired for £1.4b by CMG in 2000. (I remember one wag suggesting CMG had paid £400m for Admiral – about what it was actually worth in those crazy dot.com days! – and £1b for the Boring Award!)

In 1992, the then technology correspondent of the FT, Alan Cane, asked for my views on Admiral’s results. My comment “Admiral’s performance is boringly consistent” got printed next day as “Admiral in Boring”. So grew Holway’s Boring Awards which were only given to companies with 10 or more years of uninterrupted EPS growth. Admiral got the first but relinquished it when they were acquired for £1.4b by CMG in 2000. (I remember one wag suggesting CMG had paid £400m for Admiral – about what it was actually worth in those crazy dot.com days! – and £1b for the Boring Award!)

I had previously given 10 year Boring Awards to Sage (the late David Goldman) and Capita ((Sir) Rod Aldridge).

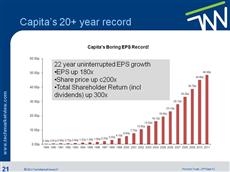

So last night I decided to give 20 year Boring Awards (these are proper engraved trophies – no expense spared!) to the only companies ever to achieve 20 or more years of uninterrupted EPS growth. A massive achievement.

I gave the Sage Boring Award to Paul Walker (CEO 1994-2010) and the current CEO Guy Berruyer. Since their 1989 IPO, Sage has increased EPS by 90x and its share price is up over 120x.

I gave the Capita Boring  Award to Paul Pindar (CEO 1999 – present). Since their 1989 IPO, Capita has increased EPS by 180x and their share price by 200x. Indeed, if you include reinvested dividends etc, the TSR since 1989 in over 300x.

Award to Paul Pindar (CEO 1999 – present). Since their 1989 IPO, Capita has increased EPS by 180x and their share price by 200x. Indeed, if you include reinvested dividends etc, the TSR since 1989 in over 300x.

Why?

Is it a coincidence that both Sage and Capita had/have accountants at the helm? Or that both companies hold records for the longest serving FTSE100 CEOs? Methinks not.

Although both companies have grown massively, they still have a very simple business message. I really can sum up what each of them do in a single sentence “Business and accounting software for SMEs” or “Business Process Services”

Both have adopted my “How to avoid Acquisition Indigestion” maxim. They have both done literally 100s of relatively small acquisitions additive to core business and/or to take their core business into new geographies. Interestingly Sage came a real cropper when they broke the rules in 2006 by buying buying healthcare software provider Embeon in the US for $297m. They sold it for a $70m loss in 2010.

Of course, they have both enjoyed good organic growth too. Indeed ‘Blended acquisitions and organic growth’ is the key.

So Sage and Capita are worthy Holway Boring Award recipients. Long may they continue to be both ‘Boring’ and UK HQed although my fear is that they won’t!

Thankyou again to all the people who have supported my series of presentations for the Prince’s Trust over the years. BT will be sponsoring another ICT Leaders Dinner for the Prince’s Trust in Sept 13 – but without me presenting. And TechMarketView will be running its first ever ‘Annual’ Conference on 26th June 2013 at BAFTA – involving presentations from all of the TMV team. See you there!

Posted by: Richard Holway at 07:00