Are you a client?

Sign in to view the full news archive.

Beware Holway going on holiday

Something really rare happened to me this month. I took a week off to go walking in The Lakes. Almost every holiday I have seems to coincide with a wild fall in tech shares. It happened with my previous holiday to Venice in early March 20 as C-19 struck. It happened again this time. Perhaps Lockdowns do have Upsides as Holway can’t go away!

Something really rare happened to me this month. I took a week off to go walking in The Lakes. Almost every holiday I have seems to coincide with a wild fall in tech shares. It happened with my previous holiday to Venice in early March 20 as C-19 struck. It happened again this time. Perhaps Lockdowns do have Upsides as Holway can’t go away!

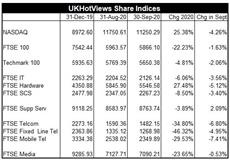

On 5th Sept in Tech shares entered a period of volatility. NASDAQ fell by nearly 10% in a few days. But, as you can see from the table, it had recovered about half of that fall to end down ‘just’ 4.3% on the month. Indeed, STILL up 25% YTD. Compare this to the FTSE100 which fell 1.7% in Sept but is down a pretty massive 22% YTD.

US tech really does dominate. The UK TechMark100 is still down 4.8% YTD and the FTSE SCS Index, which most closely tracks the UK quoted Software & IT Services companies that we track at TechMarketView was down 3.4% in Sept making it a 8.5% fall YTD.

Outlook

The outlook looks just as uncertain now as at any other time I have written this monthly review in 2020. So many uncertainties – all on the potential ‘Bad News’ pile. Second C-19 wave, Mass redundancies, tax hikes, No deal BREXIT, disputed US election.

I also detect a change of mood. Maybe when the sun shone one could believe that ‘Things could only get better’. But now we face many months of gathering gloom when so many more actitivies – including Christmas – will be severely  affected.

affected.

So far, tech stocks have provided the one bright spot. But for how long?

For an extensive review of Share Performance in Sept 20 see HotViews Extra. Available to all our paying subscribers including HotViews Premium.

Posted by: Richard Holway at 10:05