News

Wednesday 23 December 2009

A little bit of Xmas reading for TechMarketView subscription service clients interested in learning more about the market for software testing products and services.

A little bit of Xmas reading for TechMarketView subscription service clients interested in learning more about the market for software testing products and services.

Our intrepid software research director, Philip Carnelley, scoured the recent annual SQS-sponsored Software Quality Conference to find out all the latest trends in software testing. He highlights the major – and some of the minor – players (good to see some UK names amongst them) and gives an interesting insight into how new technologies such as ‘controller free’ computer interfaces and the Cloud are likely to affect the market.

Subscribers can download SoftwareViews – Software Testing Trends today!

Posted by Philip Carnelley at '07:30'

TechMarketView subscription service clients can now download the latest edition of OffshoreViews, our quarterly review of the offshore services market.

TechMarketView subscription service clients can now download the latest edition of OffshoreViews, our quarterly review of the offshore services market.

In this issue we bring you up to date with how the leading India-based players are faring in the UK, including interviews with Mahindra Satyam European head, Vikram Nair and Infosys UK VP Sudhir Chaturvedi. We also summarise the highlights of recent European briefings from Cognizant and Patni, as well as publishing our regular metrics sheet for easy comparison of the India-based SIs’ key performance indicators.

If you are competing against the leading Indian players here in the UK – and who isn’t nowadays – you really should be reading OffshoreViews. Contact Puni Rajah to find out how to subscribe to OffshoreViews as part of the extensive TechMarketView Foundation Service.

Posted by Anthony Miller at '09:06'

- Tagged:

offshore

Two weeks ago, I presented a look back ten years to the start of the decade in Last Decade, Next Decade. All last week the TechMarketView team, under the title 2020 Vision, have presented their views for how their sectors will look in 2020.

Today I’d like to give you my ‘2020 Vision’.

2020 Vision – 2003

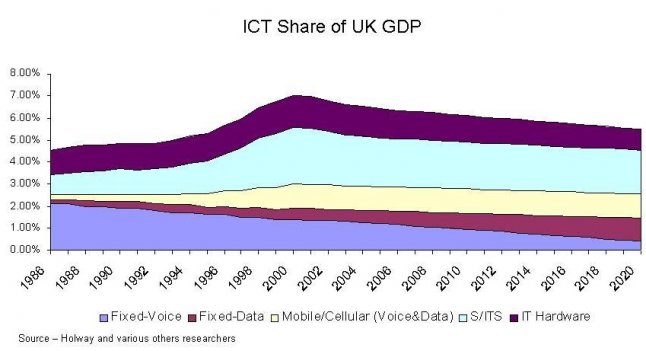

Actually I’ve done the 2020 Vision theme before. It was the title I gave to my 2003 Prince’s Trust State of the ICT Nation Presentation. 2003 was just halfway between 1986 (when I started as an analyst by forming Richard Holway Ltd) and 2020. I presented the following chart which showed how the make-up of the ICT sector had, and would, change between 1986 and 2020. It clearly continued my ‘IT’s all over now’ theme that ICT had peaked as a % of GDP in 1999 and would fall through the first decade of the 21st Century. I got that bit right!

It also showed how the makeup would change with Mobile (Voice and Data) rising from 5% in 1986 to 20% in 2010 at the expense of Fixed Voice. How Fixed Data would rise as a % of ICT spend because of Broadband. How Hardware would ‘fall from grace’ and how SITS, mainly because of the shift to BPO and ITO, would rise from 20% to 37% of total ICT spend. We could argue about a few percentage points here and there but the general drift was ‘spot on’. The shift in the fortunes of the sectors which make up ICT will have been truly major – creating pain for some (like BT) but major opportunity for others (like Capita).

2003 was also the year that I introduced Holway’s Martini Moment – the concept of being able to access the internet “Any time, Any place and from Any device”.

Ubiquitous internet access

And that really is what will define the next decade. Internet access will become Ubiquitous. No Not spots anywhere. It might cost you a bit more to get a satellite connection at the North Pole, but access will be possible anywhere. And ‘anywhere’ will include your car. Internet access in cars will be a popular option like SatNav. I will be able to listen to the Archers on the BBC’s iPlayer or use Spotify in my car!

MIDs will also be Ubiquitous. Smartphones will be as widespread (and cheap) as today’s dumb phones. Most people will have multiple MIDs.

(and cheap) as today’s dumb phones. Most people will have multiple MIDs.

Every device will be internet-enabled as standard. I’ll control my gas boiler, my home security, my smart meter, watering my garden, even letting the cats in and out of the cat flap, from my MID.

Ubiquitous internet access will, in turn, make Cloud Computing a reality. In 2020 the current Cloud doubters will be akin to those in 1999 who suggested that internet retailing would never catch on. But some of today’s leading software providers will just not make the transition. I’m not suggesting they will fail but some of today’s leaders will be a mere shadow of their former self by 2020.

New exciting device announcements will come thick and fast

A decade of exciting new MID device announcements will start with the Tablet in 2010. I see the Tablet as being as ‘game changing’ for the publishing sector as the MP3/iPod was in the current decade for music. TV/Video will also go the same way with far more people consuming TV and video on their MIDs. Big screen TV will fight back with HD, 3D etc. Indeed, I see holographic ‘experience’ TV in your living room as a reality by 2020. I will be able to share a pint at the bar of the Rovers with Ken Barlow!

Where the Consumer leads, the Enterprise will follow

As you read in Puni’s post just as consumers have embraced the Cloud, so they have also embraced Social Networking. I fully agree with Puni that Generation Y will ‘demand’ that the system they use at work incorporate all the aspects of social networking that they have grown up with. Older folks may try to object but will find it as fruitless as those CIOs who tried to stop the spread of mobile phones, email, laptops, Google into the workplace.

Who will buy whom?

Consolidation will continue – indeed accelerate. Many of today’s mid-sized SITS players will disappear by 2020. The rapidly changing business model, as you read in Anthony’s IT Services post, will force some of today’s lead players to acquire to ‘get them back in the game’. I have suggested Microsoft buy FaceBook for two years now. They really need a ‘consumer-facing’ kicker. But Microsoft also needs a mobile strategy. Maybe they should buy RIM/BlackBerry too?

Conversely, small, niche ICT companies will proliferate. Everything from teenagers building Apps for MIDs in their bedrooms during half term all the way through to innovative new software and solutions.

A decade of Even More for Even Less

The next decade will mean Even More for Even Less. Another decade where the % of GDP spent on ICT will decline. But the opportunities within the ICT sector are better than ever before. The next decade will see several ‘new Googles’. Many entrepreneurs will make their fortune.

If you can forget about spiralling National Debt and International Terrorism, it might be a rather good Decade.

Posted by Richard Holway at '21:59'

In the last paragraph of her prescient post, Social goes to work, Puni Rajah struck a veiled warning to the IT industry: “We are at an inflection, where the proliferation of low-cost, high performance technologies will permanently change the way we run our lives, and consequently, our businesses”. In his equally provocative vision of Software, Philip Carnelley posited that the data centre world would be dominated by four vertically integrated systems vendors (Oracle, Cisco, IBM, HP) whose main purpose in life will be to “service companies providing external clouds (platform-as-a-service) to companies of all sizes; and those end-user companies (and government) large enough to create their own ‘private clouds’”. Tola Sargeant confidently predicted that in the UK Public Sector “shared services deals will increasingly cater for a range of public sector organisations in an area including local authorities, education establishments, the police and healthcare”.

Yes, IT delivery will look very different in 2020 and thus will the IT services industry.

Much of the change will indeed be the result of consumer technologies flowing ever more rapidly through to ‘the enterprise’ – both private and public sector. This is because each new generation of technology (hardware and software) expands the way people interact; consumer to consumer; enterprise to enterprise; and between consumers and enterprises. Mind you, harnessing these new interactions has been more a process of discovery than design. More recently it has involved establishing communities of like-minded (or like-interested) users (e.g. Friends Reunited through Facebook/Myspace/LinkedIn to Twitter) and then wondering ‘now what’? Profitably monetising these new interactions often proves a vexatious problem.

The role of IT services companies (in the broadest sense) in 2020 will therefore be to help enterprises profitably monetise the expanded interactions that new technologies force upon them. This will require adapting, and in some cases completely overhauling, fundamental business models – both of the customer enterprise and of the service provider. As such, The IT services industry will broadly segment into three roles: the ‘Visioners’, who will show enterprises how to profitably monetise the new interactions; the ‘Assemblers’ who will build the systems to do it; and the ‘Deliverers’ who will make the interactions happen. Loosely speaking, these are the ‘new world’ equivalents of the consultancies, systems integrators, and infrastructure providers.

The new IT services value chain

The Visioners will design the interactions. They will have broad and deep domain and technology experience. Visioners will be relatively high margin businesses - typically mid-high teens or even higher - charging premium prices, but mainly on a ‘time and materials’ businesses. Their fortunes will then, as now, wax and wane in line with the economy.

The Assemblers will piece together the ‘interaction modules’ mostly from readily available parts (i.e. ‘apps on tap’) and integrate them using architected platforms such as those from Salesforce.com, Microsoft, and Google. There will be a huge ecosystem of Assemblers, some ‘vertically’ focused on specific industries and sub-industries, others assembling ‘horizontal’ interactions, for example personnel management, procurement, etc. Where independent, they will primarily target mid-sized enterprises and as such will only be able to command high single-digit or low teens margins. Pricing will be more aligned to ‘functions assembled’ and numbers of interactions. This is a more resilient business model than for Visioners as there will be a long-term support requirement post-assembly, albeit at a relatively low annuity fee.

The ‘Deliverers’ will provide the interactions. Some will do it directly to the enterprise as SaaS Deliverers and Business Process Deliverers; others will just provide the raw infrastructure to Visioners and Assemblers – Utility Deliverers. Whichever, most interactions will be delivered from a ‘Cloud’. Deliverers will generally be relatively low margin businesses – mid-high single digits – running standardised processes using a low-cost base and highly leveraged assets (i.e. shared services). There will be little ‘value add’, especially for Utility Deliverers, though specialisation – notably in business processes – will command higher margins. Deliverers are the proverbial ‘keep the lights on’ businesses, but as pricing will be mainly output-, volume- or usage-based, they won’t be totally immune to downturns. Deliverers will themselves be supported by an ecosystem of technology support organisations, basically maintaining the hardware and software (e.g. break/fix).

The new supplier landscape - VISVs, GITSPs, RITSPs and the rest!

So what will become of the players in today’s IT services industry and what roles will they take?

-

Vertically-integrated systems vendors (VISVs) –as mentioned, IBM, HP, Cisco, Oracle - will aim to take all three roles (Visioners, Assemblers and Deliverers) in large customer enterprises. Some will also act as Deliverers for their mid-market channels (VARs as we know them today) whom they will transform into Assemblers.

-

Global ‘independent’ IT services providers (GITSPs) – today represented by the likes of Accenture, CSC, and increasingly, the top-tier India-based SIs such as TCS, Infosys, Wipro and Cognizant – will mainly gravitate towards becoming Visioners and Assemblers for large multinational or very large national enterprises (especially public sector), for whom they will also (remotely) manage legacy onsite infrastructure. There will be little difference between the ‘onshore’- and ‘offshore’-based GITSPs by 2020 (if not well before) as they will all have fully scaled onshore and offshore presence, and will appear ‘local’ in each country market (annulling the political issue).

-

‘Pure-play’ business process deliverers (BPDs) – such as Capita, Serco et al – will stick to their knitting. They will include sufficient Visioner and Assembler capability to transition common vertical and horizontal business processes to their own delivery platforms. They will also partner with VISVs and GITSPs for unique, large-scale, complex business processes (e.g. as might be found in central government).

-

Regional/national IT services players (RITSPs) (e.g. today’s Logica, Fujitsu, Capgemini, Atos Origin, Steria, et al) will have to make up their minds which role, and in which geographies, they are going to play. They will not have the scale to compete effectively against the VISVs and the GITSPs in the large enterprise market, nor the price-point to compete against the mid-market Assemblers. Those that have deep vertical expertise will gravitate towards becoming industry-specific Visioner/Assembler firms for large regional and national enterprises, partnering with Deliverers. The rest will get broken apart and snapped up by VISVs and GITSPs – or simply disappear.

-

Existing IT outsourcing and BPO divisions of the GITSPs and RITSPs will be spun out into independent Deliverer organisations, triggering a wave of M&A to build scale.

-

A new global Deliverer industry will embrace the ITO/BPO spin-offs of the GITSPs and RITSPs, as well as the ‘Cloud’ infrastructure services players such as Google and Amazon. Their ranks will rapidly swell with regional and national ‘unlikely suspects’ with their own IT infrastructure, particularly those targeting the SME market. For example, we could easily see the likes of Tesco providing Deliverer services to UK mid-market Assemblers – and offering double Club-card points on Tuesdays!

One thing is for sure. The Top Ten IT Services rankings in 2020 – both at a UK and at a global level – will look very different to that today!

Posted by Anthony Miller at '09:20'

- Tagged:

markettrends

Thursday 17 December 2009

In today’s “2020 Vision”, Philip Carnelley takes a look at the major changes ahead for the software market, and how this will lead to a fundamental restructuring of the global software industry.

The next decade will see even more radical change in the software landscape than the previous ten years. The last decade has sown the seeds of change, yet many aspects of computing have stayed unchanged. In many ways the Internet has already had a profound effect on enterprise computing – in employee and partner communication, universal access to hitherto undreamed-of amounts of information and the funding of software product development by advertising. But other areas have remained relatively untouched, particularly the enterprise software used by for large businesses. By the next decade, the innovations we have seen in consumer and personal computing will work through to mainstream business and government computing, changing the software landscape profoundly.

The Cloud will change everything

Following the disruption caused by the Internet’s takeoff, and the subsequent dotcom boom and bust, the software landscape has in many ways been pretty stable over recent years, the rise of Google being the main exception. The switch to mobile devices as a functional user interface for a wide variety of applications and the internet-based model instead of client-server computing, have taken a decade to gestate but are now really starting to take off: Netbooks and the iPhone as an application platform, and Google’s Chrome project supplying a new dedicated software layer. Google’s expansion and Apple’s resurgence in the last ten years have been quite remarkable, but will have even more impact in the decade to come.

The ‘desktop’ – for so long dominated by one paradigm, the Wintel hegemony – will over the next decade fragment into a series of devices and operating systems, all linked by the Internet and primarily aimed at service orchestration. Portability of applications across platforms will no longer be seen as important, whereas universal access (location and device) will be critical. The industry started talking about ASP – application service providers – about a dozen years ago and shortly afterwards, Salesforce.com, Netsuite and others were born. While the use of the software-as-a-service (SaaS) model is still relatively small (despite the hype) it is growing rapidly and will be dominant within ten years.

Software leadership will fragment

The software vendors who ruled at the start of the decade still rule today, and if anything their reach – bolstered by acquisitions such as Oracle’s purchase of PeopleSoft and SAP’s of Business Objects – is even stronger. But the decade 2010-20 will come to be seen as the decade when SAP lost its hold on big business and Microsoft lost its stranglehold on the desktop.

While Microsoft will remain a force to be reckoned with, it will have retreated into its strongholds of business software provider for the data centre and the desktop. It just doesn’t have the DNA to succeed in the new consumer orientated software world. Maybe it has a last chance to make a major acquisition such as Facebook to re-orientate itself, but we don’t expect it to happen.

Many companies will switch away from reliance on Microsoft-based software architectures towards Cloud-based alternatives from SaaS players like Salesforce.com, Google (Docs) or their successors. The consumer market will be at least equally owned by Google (running Chrome on netbooks and/or Android on smartphones) and by Apple. This will leave the Wintel alliance as just one amongst several options for users at home and work accessing cloud-based services for personal (social) interaction, for government services interaction and commercial transactions. So while the M&A we’ve seen in the past decade will undoubtedly continue, overall the software industry will become more diverse.

The software company as we know it will fade away

More profoundly still, the pure-play software provider will be a dying species. Software as we know it will only be sold by legacy systems providers to large businesses, or by niche providers catering for specialist requirements such as R&D, mathematical modelling or technical analysis;

For consumers and small-medium sized businesses, software development companies will be superseded by service development companies offering business functionality over the Web for a vast array of purposes, ranging from consumer banking (eg Barclays) through e-commerce, games and entertainment to collaboration and content creation (Google). Only large corporates and governments will continue to buy and run their own core business applications.

The integration of social computing

We have already written about the rise of social computing – consumer email has now been followed, even superseded, by Friends Reunited, Facebook, Twitter and so on. But in the next decade the new social software models will influence mainstream software applications, which will increasingly support collaborative working across business units and companies. Business applications companies like Oracle, Microsoft and SAP will scramble to include social software functions in their suites – either created by themselves or linking to popular applications (such as Facebook) through a new class of ‘social middleware.’

Return of the total systems provider: changing the role of IT

In the data centre, following its purchase of Sun, Oracle will lead a move back to provision of integrated infrastructure appliances with hardware, middleware and database all tightly coupled and therefore barely interoperable at the database or operating systems level. Oracle will have three key competitors offering similar stacks: Cisco, IBM and HP. The market they serve will consist of two distinct groupings: service companies providing external clouds (platform-as-a-service) to companies of all sizes; and those end-user companies (and government) large enough to create their own ‘private clouds’ with economies of scale to match the service companies.

Meantime, businesses will provide mix-and-match software solutions to their (internal) users, linking their core mission-critical in-house systems to services sourced over the Internet. The primary role of the IT department will be to enable service access by users. As such, the CIO will become the Chief Infrastructure Officer, primarily tasked with ensuring service access is possible cheaply, securely and reliably.

Posted by Philip Carnelley at '08:50'

- Tagged:

saas

cloud

software

In Last decade, Next decade, Richard reviewed the tremendous changes in the IT sector over the past ten years. This week we bring you our views on what the next ten years will offer.

We start with Tola Sargeant’s predictions for the UK Public Sector. We will publish views on Social Media, Software, and IT Services during the rest of the week.

2020 vision: Public Sector IT

The next decade will be very different from the last for the UK public sector. After years of increases in public spending, the public sector will have to cope with savage budget cuts as the government battles to reduce the record £180bn budget deficit racked up at the end of the previous decade. The resulting cuts in public spending in the early part of the decade will affect all areas of the public sector and drive some fundamental changes in the way many public services are delivered.

Technology enables change

The unprecedented nature of the savings required will force many public sector organisations to challenge the way they currently do things and transform their operations in the pursuit of efficiency and productivity improvements. The most forward thinking government departments and agencies will use this as an opportunity for true innovation. (Others, of course, will drag their heels but even they will be forced to make changes as the decade progresses.) Technology will be a key enabler for this change, and private sector organisations will play an increasingly important role.

Overcoming barriers

Significant budget cuts early in the decade will be the ‘stick’ that finally forces many public sector organisations to overcome the political and cultural barriers that had prevented the widespread adoption of shared services in the ‘00s. Shared services will finally gather momentum, particularly in the back office, as government organisations realise there is no alternative if they are to achieve such substantial cost reductions. Local government will lead the way with real up take from around 2012.

The pursuit of further savings and the desire to transform services will also drive greater use of IT and business process outsourcing across the public sector. Moreover, it will gradually become more acceptable for the public sector to use offshore services – both indirectly provided via onshore suppliers and directly with India-based companies - as the need to cut costs makes things that were inconceivable last decade a possibility. By 2020, the likes of TCS, HCL and Wipro will be appearing among the Top 20 suppliers to UK government.

Opening up the market

After a decade that brought us a series of huge government IT programmes - such as the National Programme for IT in the NHS (NPfIT) and the Defence Information Infrastructure (DII) - big national IT projects will be out of favour. Increasingly seen as high-risk and potentially high cost, large high-profile IT programmes will tend to be broken into smaller chunks or let locally to a range of suppliers using nationally agreed frameworks. In general, there will be greater emphasis on open standards and standards-based frameworks, particularly in health and social care. Open source software will gain popularity in education but will largely remain a bargaining tool in other areas of the public sector.

Blurring the boundaries

The desire to achieve efficiencies, share costs, join up services, devolve decision making and get closer to the citizen will all contribute to a blurring of the boundaries between different areas of the UK public sector. There will be much closer links between health, social care and education and between the different organisations responsible for ‘homeland security’, for example. The trend will be particularly apparent in ‘local’ government where shared services deals will increasingly cater for a range of public sector organisations in an area including local authorities, education establishments, the police and healthcare.

Power to the citizen

The next decade will also be characterised by a shift in the balance of power between the government and the citizen. The citizens’ expectations about the level of service they’ll receive from public sector organisations, and the way in which they should be able to access public services, will continue to increase. Generations who can’t live without social networking sites, You Tube and iPhones will demand more online interaction with public sector organisations – from their GP to their children’s school - and greater transparency than ever before. By the end of the decade all major government transactional services will be carried out online.

Personalisation will also be high on the agenda. For example, citizens will have much greater choice over how they spend the public funds available for the cost of their health or social care. The delivery of health and social care services will also be more closely integrated and the use of telehealth and telecare monitoring services will become the norm by the end of the decade.

Getting greener & reaching for the Clouds

The Greenness of IT will become an increasingly important consideration during procurements early in the decade, if only because of the cost savings implied by greater energy efficiency. Technologies such as virtualisation will benefit as a result, particularly in central government.

On the other hand, G-Cloud (or Government Cloud) will be the ‘shared services’ of the decade. There’ll be plenty of hype about the benefits it would undoubtedly bring to government but cultural and political barriers put up by risk-averse civil servants will hamper its adoption and progress will be frustratingly slow.

Posted by Tola Sargeant at '09:36'

- Tagged:

publicsector

We are now just a few weeks away not just from the end of the year but the end of the first decade of the 21st Century. Over the next couple of weeks, TechMarketView will be bringing you our predictions for the next decade,

But, before we start that series, let’s cast our minds back to Dec 1999.

Bursting the Bubble

In Dec 1999 I had my first (and only!) appearance on News at Ten with (Sir) Trevor MacDonald. I was being interviewed with Adam Faith (who had set-up the Money Channel), the lead singer of Brotherhood of Man who had set-up an internet investment fund, a grandmother from Up North who had mortgaged her house to buy internet stocks…and me. I still have the recording and my main contribution was to utter the phrase “It will all end in tears” four times.

Forecasting the bursting of the bubble had been a main theme of mine in 1999. 1998 had been a cracker of a year for our industry with 25% growth in real terms. This was fuelled by both the internet and the build-up to Y2K. But Y2K had gone into lockdown in 1999 and we had already forecast that the “Y2K hangover will not go away with the Alka Selzers on 1st Jan 2000”.

The last issue of the decade of my organ System House was headlined the Emperor’s New Clothes (a title I was mighty proud of!) It also contained the spoof www.freejellybeenz.com (how to turn a silly internet idea into a $15b IPO in six months..) which I then used at the Jan 2000 Regent Conference.

I also had the biggest FT headline of my career when I described Sage’s valuation of a P/E of 184 as ‘North of Stupid’. Sage was considered as the UK’s Best Internet stock bet. Sage shares hit £10. When they subsequently crashed to about £1, the grandmother from Up North emailed me asking “What was wrong with Sage?”. My answer was ‘Nothing – except you buying them at £10”. Indeed, Sage despite growing its EPS in every one of the 10 years since, are still only 230p!

10 years ago, the FTSE SCS Index was 4304 and the FTSE100 was 6930. Ten years on and the FTSE100 is down ‘just’ 25% compared to a massive 85% decline (to 616) for the FTSE SCS Index. So much for long term investment! Indeed let me be so bold as to predict that the FTSE SCS Index will not regain its end 1999 level in my lifetime.

Forecasts for the Internet too pessimistic

It’s the analysts who get blamed for over-hyping the internet. There are two types of analysts – equity analysts (who give Buy and Sell recommendations) and industry analysts (like us) The equity analysts got their valuation metrics totally wrong. But the industry analysts, if anything, underestimated the impact the internet would have.

The real breakthrough for the internet came with broadband. Remember that in 2000 almost every consumer used dial-up. Not only was it extremely slow but, as you paid for the time you were online, you didn’t dawdle. Always on, fast broadband, ‘all you can eat’ for c£15 per month means that internet use is ubiquitous. It is part of the fabric of everybody’s life. It is the 4th service. We literally cannot live without it.

Play it again, Sam

I’ve writte n many times throughout the decade about Holway’s Martini Moment. I defined this in 2002 as the ability to access the internet (and listen to The Archers) “anytime, anyplace and from any device”. Remember in 1999, there was no BBC Listen again, no iPlayer.

n many times throughout the decade about Holway’s Martini Moment. I defined this in 2002 as the ability to access the internet (and listen to The Archers) “anytime, anyplace and from any device”. Remember in 1999, there was no BBC Listen again, no iPlayer.

I achieved my audio Martini Moment several years ago and am well on the way to achieving my video Martin Martini moment too.

Apple of my eye#1

Ten years ago and music was the CD. Our music collections were physical. I have a room full of CD racks for the 5000 CDs I have amassed.

Then Apple introduced the iPod in Oct 2001 and the way we consumed music changed forever. It’s been hugely liberating. I can take my whole music collection everywhere I go.

Some in the music industry rue the day that music went digital. But music now is much better than ten years back. The industry is thriving making far more money from concerts, merchandising, advertising and subscriptions than it does from music tracks. Music is now the marketing channel to other stuff. Where music went in the last decade, so publishing will go in the next.

Apple of my eye#2

For Apple to be responsible for one of the iconic products of the decade is good enough. But, in my books, they made it twice with the iPhone/iPod Touch.

be responsible for one of the iconic products of the decade is good enough. But, in my books, they made it twice with the iPhone/iPod Touch.

We started the decade with phones used only for talk and text. In 2002 RIM introduced the Blackberry which brought mobile email to the enterprise and Apple, with the iPhone (introduced in Jan 2007), took it to the masses. It defined how we will use MIDs for the next decade.

But the iPhone/iPod Touch is more than that. It is just the most beautiful technological gadget ever produced. It feels right. It looks right and it performs right.

Consumers stick their head in the clouds

Ten years ago there were no ‘social networking sites’. Ten years ago the term ‘Cloud’ did not exist and the concept (variously known as ASP, SaaS etc) hardly registered on anybody’s radar screens.

It was the consumer who really embraced Cloud. Firstly for their emails, then for their photos. But the real Cloud breakthrough coincided with the advent of social networking sites. Sites that could be accessed from anywhere and on any device.

Where the consumer treads, the enterprise now follows. So Cloud and social networking will be ubiquitous in Enterise too in the next decade.

More for Less and less and Less

The four decades of IT leading up to 2000 were characterised by ever increasing % of GDP spent on IT. Indeed, even consumers felt inclined to spend MORE on each new generation of PC or laptop.

The last decade has seen the exact reverse. The UK will be spending less on IT as a % of GDP in 2009 than it did in 1999. Consumers expect each new step forward to be better but cost less. In 2009 I replaced both my laptop and my desktop – they both cost less than a quarter the price of the units they replaced.

Offshore

There was some offshoring in 1999 (indeed Anthony Miller had featured it in his 1996 Regent Conference speech) but it hardly registered. Certainly here in the UK we hadn’t heard of Wipro, Infosys, TCS etc.

Now we estimated that c20% by revenue and c40% by headcount of the UK’s SCS activities are undertaken either offshore or by staff from offshore companies working onshore.

Whether this is a ‘good thing’ we can debate elsewhere. But it is worthy of note that IT graduate recruitment was still buoyant in 1999. Seems now the only place you can get an entry level IT job is in India.

Enough of looking backwards. Look out for our series of predictions for the next decade in HotViews over the next few weeks.

Posted by Richard Holway at '19:07'

« Back to previous page