News

TechMarketView’s UK Local & Regional Government Software & IT Services: Suppliers, Trends & Forecasts 2021-2024 report is the third of six deep-dive reports providing TechMarketView’s UK public sector SITS subsector analysis from a market and supplier perspective.

TechMarketView’s UK Local & Regional Government Software & IT Services: Suppliers, Trends & Forecasts 2021-2024 report is the third of six deep-dive reports providing TechMarketView’s UK public sector SITS subsector analysis from a market and supplier perspective.

The report accompanies the UK Public Sector Software & IT Services: Suppliers, Trends & Forecasts 2021-2024 report, which provides a sector overview, and follows the recently published reports on the Central Government and Defence SITS markets. Over the next few weeks, it will be followed by reports covering the Health, Police, and Education markets.

Within the Local & Regional Government report you will find TechMarketView’s Top 10 SITS suppliers rankings for this part of the public sector in 2020. You will also find our analysis of suppliers that are 'On the Rise' and challenging for a Top 10 position. We also look at 'Ones to Watch'; suppliers that are worthy of mention due to some interesting moves and/or an increasingly significant footprint.

The Local & Regional Government SITS market was challenging for some suppliers in 2020, but there was significant divergence in performance. Councils have had to cope with the challenge of COVID-19, increasing demand for services, and a reduction in income. These pressures increased IT expenditure in some areas e.g. remote working and making more services available online, but also resulted in other projects and procurements being delayed. Many of these delayed projects resumed in 2021 and the impact from insourcing major BPO programmes has stabilised. The pandemic has also accelerated digital transformation in local government and removed many of the embedded concerns about the role of technology. In this report we look at some of the trends that are now impacting the Local & Regional Government SITS market, including cyber resilience, social value, digital strategies, connected places and Levelling Up.

PublicSectorViews’ subscribers can download the research today. If you are not yet a subscriber, or are unsure if your company has a subscription, please contact Deb Seth to find out how you can access the research.

Posted by Dale Peters at '09:00'

- Tagged:

research

report

cybersecurity

public+sector

digital+transformation

smart+city

connected+places

levelling+up

Last week the Resolution Foundation and the Centre for Economic Performance at the London School of Economics (LSE) published a report on productivity in UK firms, the first in a series examining the readiness of the UK private sector for the challenges of the next decade. This first report can be accessed in full here.

Last week the Resolution Foundation and the Centre for Economic Performance at the London School of Economics (LSE) published a report on productivity in UK firms, the first in a series examining the readiness of the UK private sector for the challenges of the next decade. This first report can be accessed in full here.

It is widely understood that driving up productivity is fundamental to continued improvements in living standards. And yet the UK continues to perform badly against other major economies on productivity measures. The report explores the reasons for this poor performance and examines how policies to remedy it can best be targeted.

Ultimately the success or otherwise of UK efforts to increase productivity will depend on the extent to which innovation and adoption of new technologies can be encouraged. There are a variety of ways in which both government and private sector can stimulate the required investment - but one of the most essential tasks must surely be to equip young people with the education and training they need to pursue careers in STEM subjects, including IT.

TechMarketView has long advocated action to address the country's IT skills shortage, for example in our coverage of the March 2021 Learning & Work Institute report on that topic. The Resolution Foundation/LSE report brings a welcome new dimension to the skills debate and we cannot fail to draw a clear conclusion: unless the UK can train more young people in IT and other STEM skills and encourage them into careers in those sectors, continued improvements in our living standards will become harder to achieve. It is imperative that both government and the private sector take action.

HotViewsExtra subscribers can read a more detailed analysis of the Resolution Foundation/LSE report and our views on its links to IT skills here.

Posted by Tania Wilson at '08:41'

- Tagged:

skills

training

productivity

start-up

resilience

Thursday 25 November 2021

Mastek has won a significant healthcare contract, which positions it at the heart of a critical program focused on the wellbeing of citizens. The deal, with NHS Digital, is valued at £45m over the four-year period from October 2021 to October 2025. The programme in question is the Cumberlege Programme, which addresses the Secretary of State for Health and Social Care’s strategic requirements to ensure patient safety for the use of medical devices and implants.

Mastek has won a significant healthcare contract, which positions it at the heart of a critical program focused on the wellbeing of citizens. The deal, with NHS Digital, is valued at £45m over the four-year period from October 2021 to October 2025. The programme in question is the Cumberlege Programme, which addresses the Secretary of State for Health and Social Care’s strategic requirements to ensure patient safety for the use of medical devices and implants.

To read more about the Cumberlege Programme and Mastek’s role in its delivery, TechMarketView subscribers can read our UKHotViewsExtra article – Mastek: Significant healthcare win to support NHS transformation. If you don’t know how to access the article, please contact Deb Seth.

To read more about the Cumberlege Programme and Mastek’s role in its delivery, TechMarketView subscribers can read our UKHotViewsExtra article – Mastek: Significant healthcare win to support NHS transformation. If you don’t know how to access the article, please contact Deb Seth.

Posted by Georgina O'Toole at '14:35'

- Tagged:

contract

health

data

development

healthcare

Solutions

public+sector

Thursday 25 November 2021

There’s exciting news for previous TechMarketView Little British Battler, IEG4, which will enable it to accelerate investment and continue its strong growth story (see IEG4 thrives in local government).

There’s exciting news for previous TechMarketView Little British Battler, IEG4, which will enable it to accelerate investment and continue its strong growth story (see IEG4 thrives in local government).

The UK headquartered company, which focuses on offering digital solutions to enable better and more streamlined services in the public sector, has secured a minority (30%) investment from mid-market private equity firm, LDC.

IEG4 has continued to grow strongly of late. In its current financial year (to end March 2022) it has, once again, been tracking against a revenue growth rate of between 25% and 30%, by expanding existing accounts (selling more products) and adding new logos (with the sales into councils increasing in size and scope).

TechMarketView subscribers can read more about IEG4’s current position, its strategy, and its plans to use the investment for both acquisitive and organic growth in our UKHotViewsExtra - IEG4 secures LDC investment to scale the business.

If you are not a subscriber, are unsure if your organisation has a corporate subscription, or would like to understand how you can access this research and more, please contact Deb Seth.

Posted by Georgina O'Toole at '09:06'

- Tagged:

localgovernment

funding

investment

software

health

public+sector

The Department of Health and Social Care (DHSC) has announced that digital transformation will be at the heart of the NHS in England. The reforms announced by Secretary of State for Health and Social Care Sajid Javid today include merging NHSX and NHS Digital into NHS England and NHS Improvement (NHSE/I).

The Department of Health and Social Care (DHSC) has announced that digital transformation will be at the heart of the NHS in England. The reforms announced by Secretary of State for Health and Social Care Sajid Javid today include merging NHSX and NHS Digital into NHS England and NHS Improvement (NHSE/I).

Laura Wade-Gery, who was previously Executive Director, Multi-Channel at Marks & Spencer and CEO of Tesco.com, was appointed Chair of the NHS Digital Board in September 2020. Her remit included leading a review to determine the critical capabilities and digital operating model across NHSD, NHSX and NHSE/I, with the goal of developing the right capability to support Integrated Care Systems (ICS) to deliver better citizen health (see Integrated Care Systems: Analysing the opportunity for tech suppliers). Sajid Javid has now accepted the recommendations from Wade-Gery’s this review.

NHS Digital and NHSX will form part of a new Transformation Directorate in NHSE/I. This Directorate will lead the digital transformation agenda for the NHS and social care at national and ICS level. NHSX will become the strategy function of the Directorate and, once legislation allows, NHS Digital will cease to be an independent Arm’s Length Body of the DHSC. Simon Bolton, the interim CEO of NHS Digital will become the CIO of NHSE/I. Find out more...

In this HotViewsExtra article we take a look at the NHS reform announcements in more detail. Available to TechMarketView subscribers, including those signed up to UKHotViewsPremium. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Dale Peters at '10:16'

- Tagged:

nhs

strategy

healthcare

digital+transformation

Cisco’s management report seeing the company’s strongest demand in over a decade in terms of orders if not turnover, as supply chain issues continue to hamper product delivery and drive up prices.

Cisco’s management report seeing the company’s strongest demand in over a decade in terms of orders if not turnover, as supply chain issues continue to hamper product delivery and drive up prices.

Even so a strong first quarter follows an equally robust Q4 as a backlog of pent-up demand for hybrid cloud and high speed networking solutions amongst service providers and enterprises continues to play out, just as the company’s growth in cyber security solutions decelerates.

TechMarketView subscribers, including those signed up to UKHotViewsPremium, can read more detailed analysis of Cisco’s performance in our HotViewsExtra “Cisco pushes ahead despite supply chain issues” here. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Martin Courtney at '09:49'

- Tagged:

results

5G

cybersecurity

telecommunications

networkinfrastructure

hybridcloud

Q122

REGISTRATIONS CLOSE NEXT FRIDAY 26TH NOVEMBER

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create trustworthy, ready-to-deploy enterprise-class sustainability solutions.

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create trustworthy, ready-to-deploy enterprise-class sustainability solutions.

All you have to do to get on our radar is to register for a 30-minute online chat with SICCAR via the online registration form at www.techmarketview.com/meetsiccar by Friday 26th November.

We’d like to hear from:

-

Independent Software Vendors (ISVs) developing new sustainability solutions or looking to upgrade existing solutions with a secure digital ledger technology platform.

-

Consultancies providing custom sustainability solutions to customers that require high-integrity data sharing across connected enterprises.

-

Systems integrators responsible for creating and integrating a digital ledger technology-based sustainability solutions into customer application ecosystems.

We will give a mention on UKHotViews in early December to all companies fitting the brief that register for a ‘Meet SICCAR’ session. What a chance to get your company’s name known in the marketplace!

There’s more detail on our website at https://www.techmarketview.com/siccarpartners/ including a downloadable flyer.

Please register by Friday 26th November to assure your online meeting slot and ‘shout’ on UKHotViews.

SICCAR is a blockchain-based data sharing platform that integrates seamlessly with existing applications and infrastructure. SICCAR gives enterprises full control over how data is shared and used across their business ecosystem by enabling them to extend rules on shared data to external organisations. SICCAR is trusted by the Scottish Government, Baillie Gifford, RSM International, Scottish Power, and many other private and public sector enterprises.

Posted by Anthony Miller at '06:00'

- Tagged:

tipp

Wednesday 17 November 2021

The TechMarketView Hot 10 UK Application Services Suppliers report is available to download here.

For many years, the list of leading Application Services (AS) suppliers in the UK market has remained relatively static. A market dominated by blue chip brands headquartered in the USA, India and France, newer entrants and aspiring Tier 2 players have struggled to make it into this segment's premier league. The accelerating rotation to the New, however, has created and is sustaining market conditions conducive to the accelerated expansion of digital

native and digitally re-invented AS providers.

native and digitally re-invented AS providers.

In this report we profile ten smaller and medium sized UK AS players which both have sustained double digit revenue growth through the pandemic affected months and stand well positioned for continuing success in the years ahead. All currently outside the TechMarketView list of Top 20 UK AS suppliers, the organisations featured include several domestically-HQ’d rising stars together with a number of fast expanding offshore and nearshore based AS suppliers.

If you are a subscriber to TechSectorViews click here to download the Hot 10 UK Application Services Suppliers report for the latest view of the emerging challengers in this market segment. If you don’t have a subscription and would like to gain access the report and our other research and services please contact Deb Seth.

Posted by Duncan Aitchison at '07:00'

- Tagged:

services

applications

newresearch

serviceproviders

Wednesday 17 November 2021

Here’s a unique opportunity to get YOUR sustainability solution onto TechMarketView’s radar!

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create trustworthy, ready-to-deploy enterprise-class sustainability solutions.

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create trustworthy, ready-to-deploy enterprise-class sustainability solutions.

All you have to do to get on our radar is to register for a 30-minute online chat with SICCAR via the online registration form at www.techmarketview.com/meetsiccar by Friday 26th November.

We’d like to hear from:

-

Independent Software Vendors (ISVs) developing new sustainability solutions or looking to upgrade existing solutions with a secure digital ledger technology platform.

-

Consultancies providing custom sustainability solutions to customers that require high-integrity data sharing across connected enterprises.

-

Systems integrators responsible for creating and integrating a digital ledger technology-based sustainability solutions into customer application ecosystems.

We will give a mention on UKHotViews in early December to all companies fitting the brief that register for a ‘Meet SICCAR’ session. What a chance to get your company’s name known in the marketplace!

There’s more detail on our website at https://www.techmarketview.com/siccarpartners/ including a downloadable flyer.

Please register by Friday 26th November to assure your online meeting slot and ‘shout’ on UKHotViews.

SICCAR is a blockchain-based data sharing platform that integrates seamlessly with existing applications and infrastructure. SICCAR gives enterprises full control over how data is shared and used across their business ecosystem by enabling them to extend rules on shared data to external organisations. SICCAR is trusted by the Scottish Government, Baillie Gifford, RSM International, Scottish Power, and many other private and public sector enterprises.

Posted by Anthony Miller at '07:00'

- Tagged:

tipp

Rimini Street’s announcement of its expansion into support for open sources databases illustrates how the company is evolving, with an increasingly diversified proposition that has moved a long way from break-fix third party support for established products from Oracle and SAP portfolios. The underlying change is that the Rimini Street of today is geared towards IT optimisation rather than just addressing maintenance and the cost saving agenda.

Rimini Street’s announcement of its expansion into support for open sources databases illustrates how the company is evolving, with an increasingly diversified proposition that has moved a long way from break-fix third party support for established products from Oracle and SAP portfolios. The underlying change is that the Rimini Street of today is geared towards IT optimisation rather than just addressing maintenance and the cost saving agenda.

Its stance is that it is not just there for licenced/legacy applications but is able to support current and future applications too, with a role as a strategic partner to organisations navigating their own transformation journeys. Likewise, there is more to the proposition than simple cost saving; that remains part of the rationale but more overtly as a means to an end than an objective in itself. However, changing the perception that it is a company centred on legacy environments, whose services have often been used tactically, is non-trivial.

The company is at an inflection point in terms of scale, positioning and perception. Having made inroads in both public and private sectors, the UK is a major market for Rimini Street and one it is keen to grow. TechMarketView subscribers, including those signed up to UKHotViewsPremium, can explore its plans in HotViewsExtra “Rimini Street – at an inflection point”. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

The company is at an inflection point in terms of scale, positioning and perception. Having made inroads in both public and private sectors, the UK is a major market for Rimini Street and one it is keen to grow. TechMarketView subscribers, including those signed up to UKHotViewsPremium, can explore its plans in HotViewsExtra “Rimini Street – at an inflection point”. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Angela Eager at '18:00'

- Tagged:

itservices

Resilience: “the capacity to recover quickly from difficulties; toughness” (Source: Oxford Languages)

Resilience: “the capacity to recover quickly from difficulties; toughness” (Source: Oxford Languages)

If any one of us goes through tough times and comes out the other side stronger and still smiling, it’s common to be praised for our resilience.

Over the last 20 months, all of us, collectively, have faced an unprecedented situation, created by the COVID-19 pandemic. Everyone’s situation has been different but, for most, the need for personal resilience, particularly psychological and emotional, has been clear. In business, corporate resilience took on new meaning. In sectors, like travel & hospitality, that were faced with a complete halt, we saw incredible innovation and creativity as businesses sought to keep the lights on until we came out the other side. While in Government, the nation’s resilience was tested as the economy was disrupted, supply chains were impacted, and systems, procedures and processes were placed under strain.

After such an experience, we cannot expect a return to the way things were. Our 2021 research theme was ‘Reset and Reimagine’, highlighting the need for technology companies and end user organisations alike to adapt their businesses in light of the COVID-19 pandemic and its immediate, as well as longer-term, effects. We have over the course of the year, highlighted numerous ways in which this has played out; the most prominent has been the shift to a hybrid working environment for many organisations.

As we head into 2022, we expect organisations – both the tech suppliers and their clients (in the public and private sectors) – to focus on resilience in a wide variety of ways. Hence our 2022 Research Theme: Building Resilience. In May, when UK Civil Service COO, Alex Chisholm, launched the Government’s review of national resilience, he said he anticipated “a resetting of the dial in terms of how much we prepare for low-probability, high-impact, events (like COVID-19).” It’s this change in mindset that we believe will result in a change in behaviours by individuals, businesses, and the Government. This, in turn, will result in new opportunities for tech suppliers.

Both the Government and businesses must consider a diverse range of threats, from cyber-attacks to health crises to climate change. They must seek to minimise risk, prepare for disruption, and be able to rebound swiftly when faced with unexpected events. At the national level and at the corporate level, the next few years will bring an increased focus on economic/financial resilience (“building back better”); strategic resilience; IT & cyber resilience; workforce resilience; and supply chain resilience, to name a few.

Across all these areas, technology will play a crucial role as organisations rethink every part of their operations and look to be ‘future ready’. In line with this, in the UK Government’s recent Integrated Review of Security, Defence, and Foreign Policy, Government stated science and technology would be elevated to the highest importance as a component of national security (see National Security & Resilience: The role of science & technology). And we’ve seen a raft of innovations globally that aim to improve the Earth’s resilience to human interference, such as the use of blockchain technology to help stop the Amazon rainforest from being plundered by so-called ‘biopirates’.

Over the course of 2022, we expect this increased focus on resilience, and the need to persist, adapt, and transform, to result in an increased reliance on technology in decision making, in the design of new offerings, in the delivery of goods and services, and in internal and external communications. We also expect to see the desire to increase resilience to result in an enduring interest in social value creation, from environmental sustainability, through to diversity & inclusion initiatives with workforce resilience in mind.

We expect an acceleration in technology product and service investment in a range of areas such as remote working, hybrid computing, business continuity, data & analytics, cybersecurity, and supply chain management. Moreover, the need for ‘collective resilience’ will increase the need for collaboration, integration and more data sharing across the public, private, and voluntary sectors. What will be crucial is ensuring that any IT or digital strategy results in innovation can be introduced without building in new, unexpected, vulnerabilities.

Watch our 2022 Research Theme Launch video here: Building Resilience.

Posted by Georgina O'Toole at '08:00'

- Tagged:

trends

predictions

research

buildingresilience

Following on from our hugely successful live Autumn webinar series, TechMarketView subscribers can now download the slide decks that formed the basis of the presentations.

Hundreds of people - from both buyer and supplier organisations and academia - tuned in to hear our analyst team give their views on some of the most important topics and trends in the market right now.

First out of the blocks was Delivering Social Value, presented by Georgina O’Toole and Dale Peters. Our public sector experts explored the role of social value in Whitehall and looked at the implications for technology suppliers.

Second up was Hackers and Defenders, hosted by Kate Hanaghan and Martin Courtney. The session assessed how greater use of public cloud is changing the cyber security landscape while also outlining the current position of the hyperscalers in the UK and how the market is swinging to new technologies.

In Making Green from Green we explored the emerging sustainability market opportunity and how the supply side is gearing up to tap into the revenue streams that could flow from it. It was presented by TechMarketView’s Angela Eager and Duncan Aitchison.

And finally, in Clarity of purpose, Marc Hardwick and Jon Davies looked at how the pandemic helped financial services firms focus on what really matters and how supplier strategies and technologies have changed to enable that.

Dip into the decks but do be in touch with Chief Research Officer, Kate Hanaghan, to understand more about how the analysts can work with your organisation to understand the implications.

Posted by UKHotViews Editor at '09:00'

- Tagged:

cloud

financialservices

sustainability

socialvalue

webinars

Here’s a unique opportunity to get YOUR sustainability solution onto TechMarketView’s radar!

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create trustworthy, ready-to-deploy enterprise-class sustainability solutions.

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create trustworthy, ready-to-deploy enterprise-class sustainability solutions.

All you have to do to get on our radar is to register for a 30-minute online chat with SICCAR via the online registration form at www.techmarketview.com/meetsiccar by Friday 26th November.

We’d like to hear from:

-

Independent Software Vendors (ISVs) developing new sustainability solutions or looking to upgrade existing solutions with a secure digital ledger technology platform.

-

Consultancies providing custom sustainability solutions to customers that require high-integrity data sharing across connected enterprises.

-

Systems integrators responsible for creating and integrating a digital ledger technology-based sustainability solutions into customer application ecosystems.

We will give a mention on UKHotViews in early December to all companies fitting the brief that register for a ‘Meet SICCAR’ session. What a chance to get your company’s name known in the marketplace!

There’s more detail on our website at https://www.techmarketview.com/siccarpartners/ including a downloadable flyer.

Please register by Friday 26th November to assure your online meeting slot and ‘shout’ on UKHotViews.

SICCAR is a blockchain-based data sharing platform that integrates seamlessly with existing applications and infrastructure. SICCAR gives enterprises full control over how data is shared and used across their business ecosystem by enabling them to extend rules on shared data to external organisations. SICCAR is trusted by the Scottish Government, Baillie Gifford, RSM International, Scottish Power, and many other private and public sector enterprises.

Posted by Anthony Miller at '15:15'

- Tagged:

tipp

Thursday 11 November 2021

TechMarketView is helping SICCAR find partners who want to do just that!

Society needs high integrity data and trusted cooperation if we are to rewire whole industries to work in a sustainable way and account for their real impact on the environment.

Society needs high integrity data and trusted cooperation if we are to rewire whole industries to work in a sustainable way and account for their real impact on the environment.

Your customers are demanding innovative solutions to address challenges such as emissions tracking and collating trustworthy records across value chains.

Decentralised and blockchain technologies provide the essential trust framework for such solutions.

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create trustworthy, ready-to-deploy enterprise-class sustainability solutions.

We’d like to hear from:

-

Independent Software Vendors (ISVs) developing new sustainability solutions or looking to upgrade existing solutions with a secure digital ledger technology platform.

-

Consultancies providing custom sustainability solutions to customers that require high-integrity data sharing across connected enterprises.

-

Systems integrators responsible for creating and integrating a digital ledger technology-based sustainability solutions into customer application ecosystems.

SICCAR is a blockchain-based data sharing platform that integrates seamlessly with existing applications and infrastructure. SICCAR gives enterprises full control over how data is shared and used across their business ecosystem by enabling them to extend rules on shared data to external organisations. SICCAR is trusted by the Scottish Government, Baillie Gifford, RSM International, Scottish Power, and many other private and public sector enterprises.

TechMarketView is organising a series of no-obligation, 30-minute online meetings so you can find out more about partnering with SICCAR. You can book your session via the online registration form at www.techmarketview.com/meetsiccar.

There’s more detail on our website at www.techmarketview.com/siccarpartners, including a downloadable flyer and answers to FAQs. Or drop an email to TechMarketView Managing Partner Anthony Miller (amiller@techmarketview.com).

Please register by Friday 26th November to assure your online meeting slot.

Posted by Anthony Miller at '00:00'

- Tagged:

tipp

THG Chief Executive Matt Moulding was quoted in the Times on Saturday saying that he regretted floating the group in London and wished he had floated in New York instead. The comments were made in an interview given by Moulding to GQ.

THG Chief Executive Matt Moulding was quoted in the Times on Saturday saying that he regretted floating the group in London and wished he had floated in New York instead. The comments were made in an interview given by Moulding to GQ.

The THG share price has been in freefall recently, not helped by a mid-October investor presentation led by Moulding, which raised concerns about business direction and the THG Ingenuity platform.

It's hard to see how the GQ interview can help the company's cause. Moulding is upset about the plummeting share price, blaming the London markets and short sellers in particular for the company's difficulties and hinting he may consider taking the company private again if share price does not recover. There are many company-specific issues at play at THG, which we won’t attempt to cover in this post. However, it is the assertion that London “has sucked from start to finish” and he “should have IPO’d in America” which gave us pause for thought.

TechMarketView has long been a champion for London listings. We comment on listings in HotViews and track listing data in our quarterly Quoted Sector review (see here for Q3 2021 and work back through linked articles). So to explore if London really does “suck”, we compared the performance of THG from IPO to current share price against the same performance data for six other recent large tech listings (Auction Technology Group, Trustpilot, Deliveroo, Darktrace, Wise and Oxford Nanopore).

TechMarketView has long been a champion for London listings. We comment on listings in HotViews and track listing data in our quarterly Quoted Sector review (see here for Q3 2021 and work back through linked articles). So to explore if London really does “suck”, we compared the performance of THG from IPO to current share price against the same performance data for six other recent large tech listings (Auction Technology Group, Trustpilot, Deliveroo, Darktrace, Wise and Oxford Nanopore).

In all cases except Deliveroo, share price has increased from listing to the current date. Even Deliveroo, which had an IPO to forget in March, is down far less on its listing price than is THG.

TechMarketView subscribers, including those signed up to UKHotViewsPremium can read the full details in Does it really suck to list in London?. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Tania Wilson at '06:00'

- Tagged:

listing

markets

Do you deliver sustainability solutions to your customers? Then we want to hear from you!

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create ready-to-deploy enterprise-class sustainability solutions.

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to create ready-to-deploy enterprise-class sustainability solutions.

We’d like to hear from:

-

Independent Software Vendors (ISVs) developing new sustainability solutions or looking to upgrade existing solutions with a secure digital ledger technology platform.

-

Consultancies providing custom sustainability solutions to customers that require high-integrity data sharing across connected enterprises.

-

Systems integrators responsible for creating and integrating a digital ledger technology-based sustainability solutions into customer application ecosystems.

SICCAR is a blockchain-based data sharing platform that integrates seamlessly with existing applications and infrastructure. SICCAR gives enterprises full control over how data is shared and used across their business ecosystem by enabling them to extend rules on shared data to external organisations. SICCAR is trusted by the Scottish Government, Baillie Gifford, RSM International, Scottish Power, and many other private and public sector enterprises.

TechMarketView is organising a series of no-obligation, 30-minute online meetings so you can find out about the benefits of transposing your solution onto SICCAR’s secure, digital ledger technology platform. You can book your session via the online registration form at www.techmarketview.com/meetsiccar.

There’s more detail on our website at www.techmarketview.com/siccarpartners, including a downloadable flyer and answers to FAQs. Or drop an email to TechMarketView Managing Partner Anthony Miller (amiller@techmarketview.com).

Please register by Friday 26th November to assure your online meeting slot.

Posted by Anthony Miller at '00:00'

- Tagged:

tipp

We were intrigued to read an article in the Times on Saturday quoting embattled Chief Executive of THG, Matt Moulding, that he regretted floating the group in London and wished he had floated in New York instead.

We were intrigued to read an article in the Times on Saturday quoting embattled Chief Executive of THG, Matt Moulding, that he regretted floating the group in London and wished he had floated in New York instead.

Moulding has not made light of his media opportunities of late. You may remember his mid-October investor presentation, after which the share price tumbled by a third on the back of investor concern about business direction and the THG Ingenuity platform.

Saturday's Times article quotes an interview given to GQ, which you imagine Moulding may soon come to regret. The tone is certainly unlikely to make the City feel any more warmly towards him - there are few things that rattle market confidence more than a leader who sounds like they've lost their cool.

But it is the assertion that London “has sucked from start to finish” and he “should have IPO’d in America” which got us thinking. TechMarketView has long been a champion for London listings. We comment on listings in HotViews and track listing data in our quarterly Quoted Sector review (see here for Q3 2021 and work back through linked articles). So to see if it really does "suck" in London, we've taken a look at the share price performance of some of the biggest tech listings of 2021 to-date. (Current share prices are taken at close on Friday 5 November):

-

Digital auction platform Auction Technology Group debuted in March at 600p a share. Its stock is now valued at 1408p a share, or a 135% increase on listing price, giving it a current market cap of £1.7bn.

-

Consumer review website Trustpilot also listed in March with a market cap at that date of £1.1bn. Its shares were offered at 265p and are now priced at 325p, an increase of 23% on listing price.

-

Cyber specialist Darktrace listed in April at a market cap of £1.7bn. After an initial surge in value, it has had a torrid time on the markets of late, with share price falling rapidly following a negative analyst report. Despite this rocky period, its shares stand at 577.5p, still an uplift of 130% on its listing price of 250p.

-

Money transfer fintech Wise debuted to great acclaim in July at a market cap in excess of £8bn, with an offer price of 800p. Its share price now stands at 832p, an increase of 4%.

And now let's consider the performance of THG. It listed in September 2020 and was at that date the biggest London IPO since 2015 at a market cap of over £5bn. Its share price opened at 500p and currently stands at 204p, a massive 59% decrease.

What can we infer from this? Aside from Deliveroo, all of these big 2021 tech stock listings have enjoyed net share price gains since listing. They may yet lost ground - prices go down as well as up of course - and life as a listed company is no easy ride. But even Deliveroo's much-documented fall from grace has not been as harsh as THG's.

Whilst investors don't always get it right and no market is perfect, Moulding can't ignore the basic truth that price is the mechanism by which supply is matched to demand. That same truth would hold in New York as it does in London. And if he really believes THG is an "amazing" business and "in better shape than it has ever been", as he bravely asserts in the GQ interview, he clearly has some work to do to convince investors. A calmer head in media interviews would be a good first step.

Posted by Tania Wilson at '16:15'

- Tagged:

listing

markets

Do you deliver sustainability solutions to your customers? Then we want to hear from you!

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to enhance their sustainability solutions with high-integrity data sharing.

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to enhance their sustainability solutions with high-integrity data sharing.

We’d like to hear from:

-

Independent Software Vendors (ISVs) developing new sustainability solutions or looking to upgrade existing solutions with a secure digital ledger technology platform.

-

Consultancies providing custom sustainability solutions to customers that require high-integrity data sharing across connected enterprises.

-

Systems integrators responsible for creating and integrating a digital ledger technology-based sustainability solutions into customer application ecosystems.

SICCAR is a blockchain-based, future-proof data sharing platform that integrates seamlessly with existing applications and infrastructure. The platform gives enterprises full control over how data is shared and used across their business ecosystem by enabling them to extend rules on shared data to external organisations. SICCAR is trusted by the Scottish Government, Baillie Gifford, RSM International, Scottish Power, and many other private and public sector enterprises.

TechMarketView is organising a series of no-obligation, 30-minute online meetings for prospective partners to meet SICCAR management and find out more. Book your session via the online registration form at www.techmarketview.com/meetsiccar.

There’s more detail on our website at www.techmarketview.com/siccarpartners, including a downloadable flyer and answers to FAQs. Or drop an email to TechMarketView Managing Partner Anthony Miller (amiller@techmarketview.com).

Please register by Friday 26th November to assure your online meeting slot.

Posted by Anthony Miller at '09:00'

- Tagged:

tipp

The UK insurance sector is once again facing the effects of disruptive innovation, having previously experienced technology-driven change with the rise of the aggregators in the 1990's. Modern approaches to risk-pricing are facilitating cost-effective new business models in tandem with the pursuit of streamlined systems and processes as a renewed imperative for change has taken hold.

Insurance Sector SITS - Suppliers, Trends and Forecasts examines the prevailing business and technology trends impacting the sector and provides an analysis of the key insurance segments.

Insurance Sector SITS - Suppliers, Trends and Forecasts examines the prevailing business and technology trends impacting the sector and provides an analysis of the key insurance segments.

The report also contains market forecasts and supplier rankings for the leading insurance SITS vendors that highlight the shifting balance of power as the technology needs of the sector evolves.

Subscribers to TechMarketView's FinancialServicesViews research stream can download this report now. If you are a SITS vendor or active in the insurance sector, this report provides essential insights into key market trends and the supplier landscape.

Posted by Jon C Davies at '16:40'

- Tagged:

insurance

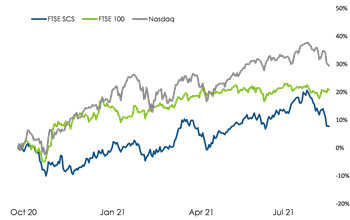

Q3 2021 was a tale of two halves for the tech indices we track. The opening two months of the quarter were robust for the Nasdaq and the FTSE SCS (Software and Computer Services), with the FTSE 100 remaining steady.

Q3 2021 was a tale of two halves for the tech indices we track. The opening two months of the quarter were robust for the Nasdaq and the FTSE SCS (Software and Computer Services), with the FTSE 100 remaining steady.

September marked a turning point however, with the markets rattled by a growing list of concerns as world economies emerge from Covid and the UK economy also seeks to adjust post-Brexit.

Subscribers to the TechMarketView Foundation Service and UKHotViews Premium can read more by downloading the Q3 2021 edition of IndustryViews Quoted Sector.

Posted by Tania Wilson at '08:00'

- Tagged:

markets

Do you deliver sustainability solutions to your customers? Then we want to hear from you!

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to enhance their sustainability solutions with high-integrity data sharing.

TechMarketView is helping Edinburgh-based digital ledger technology platform supplier, SICCAR, find new partners looking to enhance their sustainability solutions with high-integrity data sharing.

We’d like to hear from:

-

Independent Software Vendors (ISVs) developing new sustainability solutions or looking to upgrade existing solutions with a secure digital ledger technology platform.

-

Consultancies providing custom sustainability solutions to customers that require high-integrity data sharing across connected enterprises.

-

Systems integrators responsible for creating and integrating a digital ledger technology-based sustainability solutions into customer application ecosystems.

SICCAR is a blockchain-based, future-proof data sharing platform that integrates seamlessly with existing applications and infrastructure. The platform gives enterprises full control over how data is shared and used across their business ecosystem by enabling them to extend rules on shared data to external organisations. SICCAR is trusted by the Scottish Government, Baillie Gifford, RSM International, Scottish Power, and many other private and public sector enterprises.

TechMarketView is organising a series of no-obligation, 30-minute online meetings for prospective partners to meet SICCAR management and find out more. Book your session via the online registration form at www.techmarketview.com/meetsiccar.

There’s more detail on our website at www.techmarketview.com/siccarpartners, including a downloadable flyer and answers to FAQs. Or drop an email to TechMarketView Managing Partner Anthony Miller (amiller@techmarketview.com).

Please register by Friday 26th November to assure your online meeting slot.

Posted by Anthony Miller at '00:00'

- Tagged:

tipp

« Back to previous page