News

Atos’ financial position is precarious. You’d have to have been living under a rock not to have picked up on that already. Today’s financial results (for the year ending 31st December 2023) serve to put a bit more meat on the bone (see here in the UKHotViews archive and work back).

Atos’ financial position is precarious. You’d have to have been living under a rock not to have picked up on that already. Today’s financial results (for the year ending 31st December 2023) serve to put a bit more meat on the bone (see here in the UKHotViews archive and work back).

In TechMarketView’s latest research note, Chief Analyst, Georgina O’Toole, gives her view on the current situation, given recent developments, and what the future might hold for the French IT services company.

TechMarketView subscribers can access the UKHotViewsExtra article – Atos FY23: uncertainty on multiple fronts – now. If you are not yet a subscriber – or are unsure if your organisation has a corporate subscription – please contact Deb Seth to find out how to access the research and other valuable resources.

Posted by Georgina O'Toole at '10:15'

- Tagged:

results

itservices

corporateactivity

debt

financing

The UK Customer Experience Market 2023 – 2026 report is now available to download. The document contains TMV’s estimates of the sizes and growth rates of the UK CX Software and IT Services (SITS) market and its primary segments, along with insights into the key trends shaping demand. It also identifies the opportunities and challenges that lie ahead for suppliers seeking to prosper in this rapidly evolving space.

Having seen sales surge by almost 37% between 2019 and 2022, demand for CX SITS has cooled significantly in recent times. While investments in CX initiatives have held up comparatively well, they have not been immune to increasingly cautious buyer sentiments. Decision cycles in this space have extended, the scopes of committed expenditure have been trimmed and vendor consolidation has increased.

cooled significantly in recent times. While investments in CX initiatives have held up comparatively well, they have not been immune to increasingly cautious buyer sentiments. Decision cycles in this space have extended, the scopes of committed expenditure have been trimmed and vendor consolidation has increased.

The medium-term prospects for CX SITS, however, are very healthy. The corporate imperatives which it addresses remain high on C-Suite agendas. CX is also set to attract a substantial volume of the burgeoning expenditure on Generative AI. A focus on value and value assurance, however, now dominates CX buying criteria. Enterprise objectives for initiatives in this arena are, and are likely to remain for the foreseeable future, driven more by cost control and efficiency than revenue generation.

If you are a subscriber to TechSectorViews click here to download The UK Customer Experience Market 2023 - 2026 report. If you don’t have a subscription and would like to gain access the report and our other research and services please contact Deb Seth.

Posted by Duncan Aitchison at '07:42'

- Tagged:

forecasts

newresearch

customer+experience

market trends

St Albans-headquartered, Motor Fuel Group (MFG), is the UK’s largest independent forecourt operator. While you might not know the brand, you’re likely to be unknowingly interacting with this multi-billion-pound business frequently.

The firm recently completed the acquisition of 337 Morrisons forecourts, taking the total number of MFG forecourts to over 1200 in the UK. This deal, together with the transfer of 400 parcels of land to develop as EV charging stations, positions MFG as a leading independent forecourt provider in the UK. MFG also partners with well-known retail and fast-food brands, such as Costa, Subway, Greggs and Uber Eats.

This report provides an insight into the acquisitive Motor Fuel Group, which can trace it roots back to 2011. Kate Hanaghan, Chief Research Officer, spoke to IT Director, Paresh Patel, about MFG’s progress with partner, Graphite-backed MSP, Digital Space, to modernise the forecourt experience and improve both resilience and productivity within the Group.

Tech User Programme, TechSectorViews, and Foundation Service customers can read the report here: Motor Fuel Group: Modernising the forecourt experience

Contact Deb Seth to find out if your organisation has access.

Posted by UKHotViews Editor at '09:00'

ESG (Environmental, Social, and Governance) reporting, and the use of sustainability data across the business, are the top use case areas (by activity density) logged by TechMarketView’s Sustainability Technology Activity Index.

ESG (Environmental, Social, and Governance) reporting, and the use of sustainability data across the business, are the top use case areas (by activity density) logged by TechMarketView’s Sustainability Technology Activity Index.

A new case study report: Velo’s ESG journey with Sage Earth – a carbon accounting case study looks at how B2B marketing specialists Velo—in an industry still largely in the early stages of establishing its own sustainability best practices—has used the Sage Earth spend-based decarbonisation tool, not only to accelerate its own net zero ambitions, but also influence the behaviour of its clients and peers through greater transparency.

It's a story about a company at the start of an ESG journey, but one where a ‘work-in-progress-in-public’ approach (with candid transparency about its efforts) is seeking to extend the reach of its influence. Velo is aiming ultimately to make an impact beyond internal operations and direct supply chain partners, out across a wider stakeholder ecosystem—an approach which could be adopted by other tech user organisations, in any and all sectors, in order to achieve a sustainability multiplier effect.

Subscribers to our SustainabilityViews research stream can download Velo’s ESG journey with Sage Earth – a carbon accounting case study now. If you are not yet a subscriber, or would like to learn more about this report, please contact Deb Seth for more information.

Posted by Craig Wentworth at '09:37'

- Tagged:

carbon accounting

reporting

Case Study

TechMarketView recently sat down with Netcompany’s Richard Davies (UK Country Managing Partner) and Matthew Rowe (Principal) to talk about the company’s momentum in the public sector, and particularly how the Danish-founded company’s focus on outcomes and principles of re-use are seeing it build on successes across Europe with new wins in the UK.

TechMarketView recently sat down with Netcompany’s Richard Davies (UK Country Managing Partner) and Matthew Rowe (Principal) to talk about the company’s momentum in the public sector, and particularly how the Danish-founded company’s focus on outcomes and principles of re-use are seeing it build on successes across Europe with new wins in the UK.

Netcompany talks of the need for an “Agile 2.0” mindset, where concepts of re-use aren’t restricted to code dev; they’re applied upstream in a strategic way too—where use case transferability (from sector to sector) drives discussions about requirements definition and refinement.

In our UKHotViewsExtra article Re-use and re-imagination—Netcompany’s Public Sector growth, subscribers to TechMarketView research services can learn more about Netcompany’s vision for modernisation of the public sector’s “Cinderella Systems”, and how its PULSE and AMPLIO platforms are being applied—both across continental Europe, and in UK regional government.

If you are a TechMarketView subscriber you can access the research now UKHotViewsExtra – Re-use and re-imagination—Netcompany’s Public Sector growth. If you are not yet a subscriber, or are unsure if your organisation has a corporate subscription, please contact Deb Seth to find out more.

Posted by Craig Wentworth at '09:29'

- Tagged:

re-use

regional government

Artificial Intelligence (AI) may be the hot topic grabbing all the headlines, but it is not the only technology that has the potential to accelerate digital transformation, disrupt how we leverage data, and deliver significant productivity gains.

Artificial Intelligence (AI) may be the hot topic grabbing all the headlines, but it is not the only technology that has the potential to accelerate digital transformation, disrupt how we leverage data, and deliver significant productivity gains.

One such technology is Quantum computing, a rapidly developing field that many organisations are currently underestimating and unprepared to fully leverage. The development of more sophisticated quantum solutions will enable compute speeds to eclipse even the most powerful supercomputers, and while practical quantum applications at scale are still a few years off, a select few organisations are already piloting the technology. Use cases for quantum extend across multiple industries including; Financial Services (e.g. risk scoring and investment modelling), Pharmaceuticals (e.g. drug discovery), Manufacturing (e.g. Battery design & aerodynamics) and Transportation (e.g. route optimisation)

The UK in particular has been a hotbed for quantum computing development, with notable UK HQ’ed suppliers including; Oxford Quantum circuits, Oxford Ionics and Orca computing, whilst many of the larger SITS managed services providers such as Fujitsu, Eviden and IBM have also invested significantly into developing quantum solutions.

In this new report we will explore the latest developments in the field of quantum computing, the growing supplier landscape, practical examples of getting value from quantum solutions, and the potential impact of the convergence of quantum computing with AI, a prospect that may be closer than you think.

TechMarketView has also partnered with the Surrey Institute for People-Centred Artificial Intelligence to bring a unique perspective from academia, with Dr Andrew Rogoyski sharing his views on the skills we will need in the future and how to cultivate the right talent.

TechMarketView has also partnered with the Surrey Institute for People-Centred Artificial Intelligence to bring a unique perspective from academia, with Dr Andrew Rogoyski sharing his views on the skills we will need in the future and how to cultivate the right talent.

If you are a subscriber to TechSectorViews you can access the Quantum acceleration is on the horizon report today. If you don’t have a subscription and would like to gain access the report and our other research and services please contact Deb Seth.

Posted by Simon Baxter at '23:16'

- Tagged:

quantum

quantumcomputing

The TechMarketView analyst team has been all over the Spring Budget 2024 announcement to bring our subscribers a range of insightful analysis, all available within UKHotViewsExtra.

The TechMarketView analyst team has been all over the Spring Budget 2024 announcement to bring our subscribers a range of insightful analysis, all available within UKHotViewsExtra.

In a pre-General Election Budget, the Chancellor Jeremy Hunt, was keen to highlight that the plan for the UK’s finances is on track and to set out a path to accelerated progress. But what does it all mean for the tech sector and its suppliers?

- In Spring Budget 2024: Challenging Productivity Goals, PublicSectorViews Research Director, Dale Peters, and Chief Analyst, Georgina O’Toole, delve into the detail to determine how tech suppliers to the UK Public Sector will be impacted by budgetary challenges and policy changes within Whitehall and the wider public sector. The Chancellor has sought to avoid increasing taxes, and instead has focused on productivity improvements within the public sector. It will come as little surprise that many of the Spring Budget announcements are previous policies and plans that have now been placed under the Productivity umbrella. Regardless, the biggest challenge is set to be leveraging technology effectively, and with the pace required, to achieve the tough goals set out and enable organisations to work within challenging budgetary constraints.

- Meanwhile, in Further AI investments in Spring budget, Principal Analyst and Lead for TechMarketView’s AI research, Simon Baxter, investigates whether actions taken in the Spring Budget will have any impact on accelerating the pace of AI adoption across the UK. Simon uncovers some noteworthy takeaways that will be welcomed by the tech sector, but also questions, is there more that could be done?

- And, finally, in Spring Budget: Takeaways for the tech sector TechMarketView’s CEO, Tola Sargeant, uses a wider lens to interrogate the Budget and understand how the tech sector will be impacted. Tola looks at measures designed to boost investment in and by UK companies, to improve skills in high demand areas of the economy, and to accelerate regulatory reform to keep pace with the fast-moving AI sector.

The TechMarketView analyst team is always on hand to answer any additional questions our subscribers might have (see Our People | TechMarketView). If you are not yet a TechMarketView subscriber – or are unclear if your organisation has a corporate subscription – please contact Deb Seth to see how to access this analysis and much more besides.

Posted by UKHotViews Editor at '09:43'

- Tagged:

policy

government

AI

budget

public sector

In this new piece of research by Chief Research Officer, Kate Hanaghan, TechMarketView profiles SMB (small and medium sized businesses) buyers to understand whether their tech investments to accelerate digital progression have also led to improved productivity growth.

SMB Productivity: Driving value through modernisation explains that productivity growth is a challenge for firms of all sizes – and has been for some time. Implementing the right technologies in the right way can help, but SMBs face their own set of very specific challenges. They don’t always have dedicated IT expertise, meaning they can be late to adopt – and benefit from – technological advancements. Additionally, it’s difficult for smaller organisations to engage directly with large technology vendors, and a direct partnership between the two is often just too impractical (given the large number of SMBs in the market, their typically small budgets, and the go-to-market model of the large vendors).

SMB Productivity: Driving value through modernisation explains that productivity growth is a challenge for firms of all sizes – and has been for some time. Implementing the right technologies in the right way can help, but SMBs face their own set of very specific challenges. They don’t always have dedicated IT expertise, meaning they can be late to adopt – and benefit from – technological advancements. Additionally, it’s difficult for smaller organisations to engage directly with large technology vendors, and a direct partnership between the two is often just too impractical (given the large number of SMBs in the market, their typically small budgets, and the go-to-market model of the large vendors).

This is where the channel (the ecosystem that enables the supply of products and services from large vendors via distributors and resellers to buyers) becomes an essential piece of the jigsaw. Through Value Added Resellers (VARs) and Managed Service Providers (MSPs), the UK’s SMB community is not only gaining access to new technology (for example cloud-based services and smart workplaces) but it is finding ways to improve productivity levels.

A big thanks to the organisations that took part in this research (National Timber Group, McDermotts, Ascot Services, Franklins Solicitors, and DWA Claims).

The tech providers in this report are all SMBs themselves (Excenta, Croft Communications, inTEC, Digital Origin, KSM Telecom), and when SMBs work with SMBs, the whole local economy benefits. Furthermore, if local firms – such as those in legal and construction – can sufficiently digitise, this in turn improves the range and quality of services they are able to provide, which in turn also benefits the local community.

Read the report: SMB Productivity: Driving value through modernisation

Contact Deb Seth if you would like to join TechMarketView or find out if your organisation already has access to our research and services.

Posted by UKHotViews Editor at '09:55'

- Tagged:

channel

reseller

VAR

SMB

The UK Customer Experience Market 2023 – 2026 report is now available to download. The document contains TMV’s estimates of the sizes and growth rates of the UK CX Software and IT Services (SITS) market and its primary segments, along with insights into the key trends shaping demand. It also identifies the opportunities and challenges that lie ahead for suppliers seeking to prosper in this rapidly evolving space.

Having seen sales surge by almost 37% between 2019 and 2022, demand for CX SITS has cooled significantly in recent times. While investments in CX initiatives have held up comparatively well, they have not been immune to increasingly cautious buyer sentiments. Decision cycles in this space have extended, the scopes of committed expenditure have been trimmed and vendor consolidation has increased.

Decision cycles in this space have extended, the scopes of committed expenditure have been trimmed and vendor consolidation has increased.

The medium-term prospects for CX SITS, however, are very healthy. The corporate imperatives which it addresses remain high on C-Suite agendas. CX is also set to attract a substantial volume of the burgeoning expenditure on Generative AI. A focus on value and value assurance, however, now dominates CX buying criteria. Enterprise objectives for initiatives in this arena are, and are likely to remain for the foreseeable future, driven more by cost control and efficiency than revenue generation.

If you are a subscriber to TechSectorViews click here to download The UK Customer Experience Market 2023 - 2026 report. If you don’t have a subscription and would like to gain access the report and our other research and services please contact Deb Seth.

Posted by Duncan Aitchison at '08:26'

- Tagged:

forecasts

newresearch

customer+experience

market trends

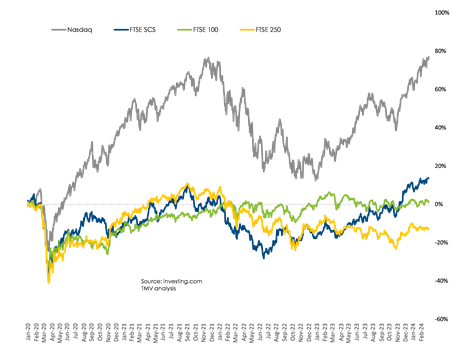

2024 has started in the same vein as 2023 concluded for tech stocks. February ended with the tech-focused NASDAQ up 6.1% month-on-month (MoM) and recording its highest close, as investors keep the faith with the AI investment boom. This is despite US inflation data, released mid-month, which was higher than expected and caused a wobble - before markets surged again.

2024 has started in the same vein as 2023 concluded for tech stocks. February ended with the tech-focused NASDAQ up 6.1% month-on-month (MoM) and recording its highest close, as investors keep the faith with the AI investment boom. This is despite US inflation data, released mid-month, which was higher than expected and caused a wobble - before markets surged again.

And it is belief in the future benefits of artificial intelligence which is the foundation of this market resilience, as investors continue to back the so-called Magnificent Seven (Microsoft, Apple, Nvidia, Amazon, Alphabet/Google, Meta/Facebook and Tesla) in their investment in AI.

UK tech stock prices are on the up as well, with the FTSE Software and Computer Services (SCS) index rising 2.1% since the start of the year, outstripping the flatlining FTSE 100 and FTSE 250.

But is the boom in tech on both sides of the Atlantic built on solid ground? Or will investors be disappointed by challenges in monetising AI?

Research subscribers and UKHotViews Premium readers can read more in Inflation hiccup barely registers as tech stocks top their 2021 peak.

Research subscribers and UKHotViews Premium readers can read more in Inflation hiccup barely registers as tech stocks top their 2021 peak.

If you would like to discuss subscription options, please contact Deb Seth.

Posted by Tania Wilson at '07:55'

- Tagged:

markets

macro

World Wildlife Day (WWD) – celebrated on 3rd March every year – marks the anniversary of the signing of the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) in 1973. Although WWD2024 was officially celebrated yesterday, an event is set to be broadcast from the UN later today (4th March) to raise awareness of this year’s theme: “highlighting how digital conservation technologies and services can drive wildlife conservation, sustainable and legal wildlife trade and human-wildlife coexistence”.

World Wildlife Day (WWD) – celebrated on 3rd March every year – marks the anniversary of the signing of the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) in 1973. Although WWD2024 was officially celebrated yesterday, an event is set to be broadcast from the UN later today (4th March) to raise awareness of this year’s theme: “highlighting how digital conservation technologies and services can drive wildlife conservation, sustainable and legal wildlife trade and human-wildlife coexistence”.

It's a timely moment, therefore, for TechMarketView to release the latest episode in our series of Totally Sust podcasts. In this edition, SustainabilityViews’ lead analyst, Craig Wentworth, interviews Andy Wallace (Head of Client Innovation for Atos UK&I; and one of the company’s project leads on its partnership with WWF, Worldwide Fund for Nature).

The discussion ranges around the use of AI in nature monitoring in general; and about a couple of projects with WWF, specifically, that leverage AI (amongst other technologies). One focuses on the surveillance of Key Biodiversity Areas (KBAs); the other is looking to predict and prevent zoonoses (diseases that jump the species barrier).

An edited (15-minute) version of the podcast (covering just the KBA project) is available to stream for free now on SoundCloud and Spotify (or you can play it in the widget below).

Subscribers to our SustainabilityViews research stream, however, can get access to the full 35-minute episode (which also features insights on the AI-powered Zoonotic Disease Predictor project).

To understand more about how our new SustainabilityViews research stream can help your organisation understand its sustainability obligations, obstacles, and opportunities, please contact Deb Seth.

Posted by Craig Wentworth at '08:41'

- Tagged:

carbon

podcast

biodiversity

habitat

WWF

« Back to previous page