News

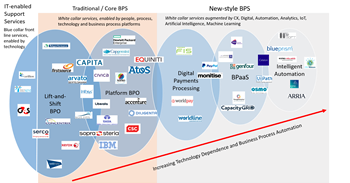

Last year, our UK Business Process Services (BPS) landscape report was all about 'disruption' occurring across the leading suppliers in the market (see UK BPS Supplier Landscape 2015).

Last year, our UK Business Process Services (BPS) landscape report was all about 'disruption' occurring across the leading suppliers in the market (see UK BPS Supplier Landscape 2015).

In 2016, that disruption is now impacting the very top the market—market leader Capita issued its first-ever profits warning in September 2016, due to a ‘perfect storm’ of contract and operational issues hitting at the same time. We now have a new Number Two in digital payments processing firm Worldpay, meanwhile CSC re-entered the Top 10 following its takeover of Xchanging in May. Next year, we expect to have another shake-up as the pending mega-merger between CSC and HPE-Enterprise Services becomes a reality.

Our theme in 2016, ‘Surfing the Waves of Disruption’ therefore couldn’t be more apt, as UK BPS suppliers disrupt their own business models, and transform their legacy operations, in order to embrace Digital and Automation technologies and services.

This is about creating a step change in cost reduction, productivity improvement and customer experience, to remain competitive and relevant to customers embracing digital transformation.

Intelligent Automation is the modus operandi to achieve this, and it is being driven by the growing volume, velocity and variety of data (the three ‘v’s’), which is being created by business process platforms and captured within operations. Suppliers are scrambling to adjust, forcing new partnerships, mergers and restructuring.

Times are changing fast...

Subscribers to TechMarketView’s BusinessProcessViews research service can read about what all this means for BPS suppliers and those looking to disrupt or partner in this sector in our new report here: UK Business Process Services Supplier Landscape 2016.

If you’re not yet a subscriber, please contact Deb Seth (dseth@techmarketview.com) to find out more.

Posted by John O'Brien at '14:17'

The latest edition of the new-look OffshoreViews is now available for download by eligible TechMarketView subscription service clients.

The latest edition of the new-look OffshoreViews is now available for download by eligible TechMarketView subscription service clients.

As usual, we have telling graphics which show just how well the Indian pure-plays (IPPs) are tracking against their increasingly urgent need to ‘break linearity’ (Clue – they’re not!), and what’s happening to growth and margins (guess!).

Plus there’s our graphics-heavy SnapShots for each of the Top Six IPPs, along with summary sections on the mid-tier players and notable IPP corporate activity.

This is essential reading for any IT services firm wherever its HQ.

If you are not a subscriber, contact our Client Services team at info@techmarketview.com for further information.

Posted by UKHotViews Editor at '08:10'

- Tagged:

offshore

We are delighted to announce that the 2017 Evening with TechMarketView will take place on Thursday 5th October (that's a month later than in previous years).

This will be our fifth annual TechMarketView Presentation and Dinner and promises to be another enjoyable evening of analyst insight and quality networking over drinks and dinner. The venue will once again be the magnificent Royal Institute of British Architects (RIBA) in Portland Place, London.

So, mark your calendars now and email tx2 Events to express interest in the event and receive notification when tickets go on sale.

If your organisation would be interested in sponsorship opportunities at the 2017 event please contact Tola Sargeant for further details.

Or to reminisce about the 2016 and 2015 TechMarketView Evenings, check out our Instagram page for a selection of images from the sell-out events.

We look forward to seeing you at RIBA in October 2017!

Posted by UKHotViews Editor at '16:07'

- Tagged:

events

Thursday 24 November 2016

Yesterday, Philip Hammond delivered the Government’s Autumn Statement 2016. For public sector organisations, much uncertainty remains. They are left hanging, wondering how the performance of the UK economy will affect decisions made in a year’s time; contemplating what the outcome of the Efficiency Review will be; and trying to determine how changes in Treasury spending controls will impact them. TechMarketView’s PublicSectorViews’ team has studied the autumn statement and in – UKHotViewsExtra Autumn statement 2016: ICT for productivity – we offer our analysis of what it might all mean for the UK public sector SITS market.

We also look more broadly at some of the other funding commitments, related to the National Productivity Investment Fund (NPIF), which could offer significant opportunities to suppliers targeting other sectors. TechMarketView subscribers can read the analysis now. Click here to view. If you cannot access the article, please contact Deb Seth to find out more.

Posted by Georgina O'Toole at '10:11'

- Tagged:

publicsector

budget

Thursday 24 November 2016

We seldom have the opportunity of meeting a company that has a clear lead in a potentially transformational technology, but we are confident that Bristol-based Little British Battler (LBB) Ultrahaptics is one such company.

We seldom have the opportunity of meeting a company that has a clear lead in a potentially transformational technology, but we are confident that Bristol-based Little British Battler (LBB) Ultrahaptics is one such company.

Basically, one of the company’s co-founders Tom Carter has worked out how to use an array of ultrasonic transducers (like the parking sensors on a car) to create a standing sound wave in mid-air that you can actually feel. Then with some fancy algorithms and more clever technology, you can interact with the wave as if you were switching a switch or a rotating a dial to control a device, only without touching the actual device.

The imagination can then run riot as to the potential applications. However, more obvious ones include controls in high-end cars (you don’t have to visually locate the switch) or domestic appliances, non-touch switches in infectious environments or for use in gaming or high-tech theme parks. There’s also massive scope in the growing areas of Virtual and Augmented Reality.

The imagination can then run riot as to the potential applications. However, more obvious ones include controls in high-end cars (you don’t have to visually locate the switch) or domestic appliances, non-touch switches in infectious environments or for use in gaming or high-tech theme parks. There’s also massive scope in the growing areas of Virtual and Augmented Reality.

Ultrahaptics’ evaluation kit is selling like hot cakes, with the vast majority of the world’s car companies working with them. The planned launch of a “Touch” developer kit in January will further expand market reach and help to establish this technology as the global standard. Patents (and physics) will restrict competition. The company is looking at healthy annuity revenues as royalties roll in over the medium term.

Taking this opportunity is not all plain sailing, but experienced and pragmatic CEO Steve Cliffe is leading a capable team to oversee the process of protecting the technology, securing agreements with key suppliers and maintaining the company’s focus and culture. This company could well become a very important, British technology company and we are pleased to welcome them to the Little British Battler programme.

Posted by Peter Roe at '07:13'

- Tagged:

customerexperience

auto

Wednesday 23 November 2016

Little British Battler Wazoku launched onto the UK Tech scene in 2011 bringing its cloud-based idea management software to market. Founder and CEO, Simon Hill, had built up relevant experience in the collaboration software space in a previous role working at Huddle, and spotted a market opportunity with co-founder James King. Since then this digital innovator has gained momentum working with global clients to put co-creation at the heart of business strategy.

Wazoku (meaning “great idea” in Swahili in case you are curious), addresses the problem of how to unlock  innovation collaboration within organisations. Idea Spotlight, its flagship product, enables employees, customers and partners to submit ideas to solve clearly defined business and customer issues. The software facilitates cross functional working to foster innovation in a collaborative way, enabling people to take ownership for their ideas and be rewarded for them, whilst adding real measurable business value along the way.

innovation collaboration within organisations. Idea Spotlight, its flagship product, enables employees, customers and partners to submit ideas to solve clearly defined business and customer issues. The software facilitates cross functional working to foster innovation in a collaborative way, enabling people to take ownership for their ideas and be rewarded for them, whilst adding real measurable business value along the way.

With an impressive client list across multiple verticals including Aviva, Waitrose and the NHS to name just a few, Wazoku has already made its mark in this space. It is also growing a strong partner network, which currently includes Sopra Steria, CGI and Wipro amongst others, which we think offers exciting revenue potential for the future. Its ability to offer deep integration with other enterprise tools, such as Microsoft Office 365 and Yammer, sets it apart and makes it an attractive proposition for those who have already made large investments in social platforms.

Wazoku believes it has a scalable offering and has ambitious plans to target new geographies including the US, Germany and Scandinavia in 2017. If it can leverage its partner network to the full and continue to grow its organic pipeline, we think it is one to watch in this market.

Posted by Rebecca Johnson at '18:30'

- Tagged:

innovation

crowdsourcing

Wednesday 23 November 2016

One of our latest Little British Battlers (LBBs) Metapraxis has carved out an enviable position as a specialist provider of analytics software and services for financial planning & analysis (FP&A) teams, who provide intelligence to support board execs and business management.

One of our latest Little British Battlers (LBBs) Metapraxis has carved out an enviable position as a specialist provider of analytics software and services for financial planning & analysis (FP&A) teams, who provide intelligence to support board execs and business management.

Exec time is precious, so any tools that can give them access to better intelligence, faster and more efficiently, is going to be in high demand. Targeting this opportunity, Metapraxis offers its own Empower analytics software and consulting, to help FP&A teams 'analyse, visualise, report and plan’. The insights are delivered via interactive dashboards for board and management reporting, and to assist with strategic planning, scenario modelling and budgeting and forecasting.

Empower effectively does away with spreadsheets and other DIY tools used by FP&A teams, supplementing this with predictive and prescriptive analytics, to rapidly uncover new trends and insights from the business data. It’s an approach which has had considerable success, growing largely through word of mouth, for big name clients like WPP, Newell Brands, WSP, Thomson Reuters, Unilever and Sainsbury’s Bank.

Metapraxis has been led since 2012 by entrepreneur MD Simon Bittlestone, a chartered accountant, and formerly at Xchanging. He is supported by a large and experienced management team, including recent recruit Xavier Fernandes, who heads up the analytics practice, and has a long background in analysis and M&A at EY and Accenture.

Metapraxis has been led since 2012 by entrepreneur MD Simon Bittlestone, a chartered accountant, and formerly at Xchanging. He is supported by a large and experienced management team, including recent recruit Xavier Fernandes, who heads up the analytics practice, and has a long background in analysis and M&A at EY and Accenture.

Metapraxis has clearly carved out a very nice niche and with access to a growing list of tier one CxO level clients. Unsurprisingly too, it is of growing interest to partners, particularly business process services (BPS) providers, keen to plug in the technology to support their own CxO client’s financial planning needs. We understand a new partnership has recently been agreed with a global BPS player, and would expect further partnerships in the future - good news for Metapraxis looking to exploit the partners' larger scale and client reach.

Posted by John O'Brien at '07:00'

- Tagged:

analytics

lbb

The management team at Little British Battler, Connexica, have already made a success of taking a business from start-up to successful exit. Co-founder of Connexica, Gary Luke, was CEO of Ardentia, a provider of business intelligence solutions to the healthcare market. Co-founder, Richard Lewis had been CTO of Ardentia. While Luke was CEO, Ardentia grew from a business with six employees and £100K of revenue, to one with 60 employees and £5m revenue. Ardentia was acquired by US health SITS company IMS Health (see UKHotViews archive), for an undisclosed sum, in August 2011.

The management team at Little British Battler, Connexica, have already made a success of taking a business from start-up to successful exit. Co-founder of Connexica, Gary Luke, was CEO of Ardentia, a provider of business intelligence solutions to the healthcare market. Co-founder, Richard Lewis had been CTO of Ardentia. While Luke was CEO, Ardentia grew from a business with six employees and £100K of revenue, to one with 60 employees and £5m revenue. Ardentia was acquired by US health SITS company IMS Health (see UKHotViews archive), for an undisclosed sum, in August 2011.

Connexica was originally part of Ardentia; it was spun out as Ardentia Search in September 2006. The name was changed to Connexica in 2009. The company has one product – CXAir – consisting of several modules. CXAir is a business intelligence (BI) tool built on the open source information retrieval and software library, Apache Lucene; its differentiator is that it utilises search engine technology to give end-users fast access to large volumes of data for ad-hoc queries and static reports. The product also offers extensive visualisation functionality, including dashboards, mapping and Venn diagrams. The search engine technology allows indexing and searching of both structured and unstructured data.

Connexica highlights client feedback which points to CXAir being quick to deploy, competitive on price and commercially flexible. The company boasts around 200 clients with most its business in the public sector (and mainly in health). However, as well as selling direct, Connexica is building up a partner network to target multiple sectors. Connexica has had some success starting small with customers – e.g. offering anti-fraud capability - but then broadening the relationship to cover the whole range of business intelligence functionality. As it continues to invest in its product and service range, including the addition of predictive analytics, it will have more opportunities to cross-sell to its existing client base and to open doors to new prospects.

Connexica highlights client feedback which points to CXAir being quick to deploy, competitive on price and commercially flexible. The company boasts around 200 clients with most its business in the public sector (and mainly in health). However, as well as selling direct, Connexica is building up a partner network to target multiple sectors. Connexica has had some success starting small with customers – e.g. offering anti-fraud capability - but then broadening the relationship to cover the whole range of business intelligence functionality. As it continues to invest in its product and service range, including the addition of predictive analytics, it will have more opportunities to cross-sell to its existing client base and to open doors to new prospects.

Posted by Georgina O'Toole at '08:00'

- Tagged:

search

sme

analytics

lbb

BI

Companies looking to move to Cloud Platforms often face the massive task of migrating hugely complex bespoke applications. This is especially the case for established banks which typically have many thousands of applications of various vintages. Fedr8, founded in 2012, enables companies to forensically analyse the source code underlying an application. Mapping out its functions and inter-dependencies then allows key components of the code to be extracted and to be deployed in a more efficient cloud-based environment.

Companies looking to move to Cloud Platforms often face the massive task of migrating hugely complex bespoke applications. This is especially the case for established banks which typically have many thousands of applications of various vintages. Fedr8, founded in 2012, enables companies to forensically analyse the source code underlying an application. Mapping out its functions and inter-dependencies then allows key components of the code to be extracted and to be deployed in a more efficient cloud-based environment.

The proprietary Fedr8 system offers significant advantages over how this work has been attempted before. It uses machine learning techniques to complete the analysis in hours, rather than taking many man-days of effort. The analysis will also get more efficient and accurate as it gains more “experience”. Inefficient code can be eliminated, making the move to cloud even more cost-effective. The customer will then be able to build a clear view of the costs, priorities and the risks of the migration process.

Farnborough-based, 12-man, Fedr8 has until now been running Proofs of Concepts with several prospective customers but we understand that one large bank has now signed a significant contract. The experienced management team, led by CEO Damion Greef and CTO Rhys Sharp, are also actively building partnerships with key System Integrators. These partners will prove to be the most important route to market, extending the reach of the Fedr8 system into global markets.

Farnborough-based, 12-man, Fedr8 has until now been running Proofs of Concepts with several prospective customers but we understand that one large bank has now signed a significant contract. The experienced management team, led by CEO Damion Greef and CTO Rhys Sharp, are also actively building partnerships with key System Integrators. These partners will prove to be the most important route to market, extending the reach of the Fedr8 system into global markets.

Banks are now embracing the move to cloud and the underlying technology is mature enough to support their systems. Crucially, the regulator is now looking favourably upon cloud deployments. Fedr8 supplies an important piece of the jigsaw to enable the sector’s transformation. We expect this Little British Batter to generate substantial, and highly profitable, growth as a result.

Posted by Peter Roe at '07:24'

- Tagged:

cloud

software

legacy

banking

In the two years ANDigital has been trading, it has grown revenue to more than £10m, demonstrating the need within enterprises for experts that can drive forward the digital agenda.

In the two years ANDigital has been trading, it has grown revenue to more than £10m, demonstrating the need within enterprises for experts that can drive forward the digital agenda.

ANDigital employs digital experts that go into the customer and work with product development teams to create/work on digital strategies. Staff at ANDigital are organised into “clubs”, which work together on an ongoing basis and share what they have learned. We like this approach and believe it helps foster the sort of team environment that works well inside the customers’ digital (or technology) teams.

ANDigital plays a complementary role to the digital agencies that its customer might be employing. Its focus is "enterprise digital", meaning it picks up what can be the highly complex challenges around integration and migration, for example.

In just a couple of years, ANDigital has established some household brand names as its customers (e.g. TalkTalk, Aviva, Halfords) under the leadership of founder, Paramjit Uppal. Growth will come from creating more “clubs” to serve more and more customers. Of course, ANDigital won’t be without its challenges, and an obvious one is around retaining its own staff; as those experts become increasingly experienced, they will also become incredibly sought after. Nonetheless, revenue and profit targets are ambitious with the company looking to double revenue in the next year.

Posted by Kate Hanaghan at '10:02'

- Tagged:

digital

Little British Battler AltViz is an innovative product development company focused on intelligent applications. Founded in 2013 by Richie Barter and James Billot, AltViz specialises in using machine learning, data mining and artificial intelligence techniques to develop business data analysis products for commercial enterprises. The AltViz team provides ‘off-site innovation’ for Fortune 500 organisations across various verticals and is already punching above its weight.

Little British Battler AltViz is an innovative product development company focused on intelligent applications. Founded in 2013 by Richie Barter and James Billot, AltViz specialises in using machine learning, data mining and artificial intelligence techniques to develop business data analysis products for commercial enterprises. The AltViz team provides ‘off-site innovation’ for Fortune 500 organisations across various verticals and is already punching above its weight.

AltViz’s goal is to develop intelligent apps that will deliver incremental revenue growth for the customer and then productise them, offering monetisation opportunities to the initial product sponsor/customer. It’s early days, but AltViz has already had demonstrable success in this regard. The start-up has just launched its first product, ListSmart, with eBay and has tripled revenues over the last year as a result. ListSmart is an intelligent application for professional eBay retailers. It monitors the performance of a seller’s product listings; identifies and prioritises changes to those listings that will increase visibility and drive revenue growth; and learns from the changes that are implemented so that future recommendations become more effective.

AltViz’s goal is to develop intelligent apps that will deliver incremental revenue growth for the customer and then productise them, offering monetisation opportunities to the initial product sponsor/customer. It’s early days, but AltViz has already had demonstrable success in this regard. The start-up has just launched its first product, ListSmart, with eBay and has tripled revenues over the last year as a result. ListSmart is an intelligent application for professional eBay retailers. It monitors the performance of a seller’s product listings; identifies and prioritises changes to those listings that will increase visibility and drive revenue growth; and learns from the changes that are implemented so that future recommendations become more effective.

AltViz is not short of opportunities to grow revenue from ListSmart. Over the next year, for example, we can expect it to move beyond its initial target market (eBay merchants in the UK), rolling the product out to Europe and targeting related organisations such as middleware providers and other e-commerce marketplaces where eBay retailers store their data. Indeed, we think the LBB’s biggest near-term challenge will be retaining a focus on its AltViz roots and having the time to devote to other customers and potential products. If all goes to plan, however, AltViz will be a step closer to its ambition – to become the “go-to global leader for developing intelligent applications for Enterprise”.

Posted by Tola Sargeant at '08:00'

- Tagged:

software

AI

machinelearning

Fear, uncertainty and doubt (FUD) have dominated the ongoing data sovereignty debate concerning the storage of data in accordance with national and international regulation over the last five years.

The recent emergence of the EU US Privacy Shield and Microsoft’s victory over the US Department of Justice appear to have added a little more clarity on where the confidential personal data of UK and EU citizens held by US software and IT services (SITS) providers can be safely stored, or at least provided more transparency over what happens if US authorities request access to it.

In this report TechMarketView cuts through the legal jargon to decipher what that means for SITS suppliers offering cloud and hosting services to UK customers, and chronicles Microsoft’s steady rise to prominence as a serious contender in the cloud services market.

Subscribers can access the report here. If you don’t yet subscribe to SecureConnectViews and you'd like details of our subscription packages please contact Deb Seth of our Client Services team.

Posted by Martin Courtney at '06:15'

- Tagged:

cloud

datacentres

security

TechMarketView attended the Black Hat information security conference in London earlier this month to find out how companies are responding to the growing tide of cyber attacks being directed against them and how UK SITS suppliers are revamping product and service portfolios to help them do it.

TechMarketView attended the Black Hat information security conference in London earlier this month to find out how companies are responding to the growing tide of cyber attacks being directed against them and how UK SITS suppliers are revamping product and service portfolios to help them do it.

The event saw a marked emphasis on the dangers presented by ransomware (Check Point, Cybereason, Palo Alto Networks), but also the benefits that a new generation of security products and services can deliver through proactive threat hunting (Carbon Black, Raytheon, Splunk).

Subscribers can access our report here. If you don’t yet subscribe to SecureConnectViews and you'd like details of our subscription packages please contact Deb Seth of our Client Services team.

Posted by Martin Courtney at '06:04'

Today, top teams from the twelve companies selected to participate in our ninth Little British Battler Day (see here) are coming to London to meet the TechMarketView team and senior partners from our sponsors, MXC Capital, to discuss their aspirations, opportunities and challenges in taking their business to the next level.

Today, top teams from the twelve companies selected to participate in our ninth Little British Battler Day (see here) are coming to London to meet the TechMarketView team and senior partners from our sponsors, MXC Capital, to discuss their aspirations, opportunities and challenges in taking their business to the next level.

They join over 90 other UK tech SME business leaders whose companies have joined the Little British Battler ranks since we started the programme in 2012.

You will be able to read highlights of the companies here in UKHotViews shortly. Subscription clients of the TechMarketView Foundation Service will be able to find more detail on the companies in the next Little British Battler Report to be published in a few weeks’ time.

Because today’s event sees the entire TechMarketView research team out from the crack of dawn, there will be a limited UKHotViews service this morning. But fear not – we will be back tomorrow as usual talking about the things that really matter in the UK tech scene.

Posted by UKHotViews Editor at '06:00'

- Tagged:

lbb

Thursday 03 November 2016

Please note that due to website maintenance the UKHotViews email will drop into your inboxes later than usual tomorrow. However our commentary will be posted on the website as usual.

Posted by UKHotViews Editor at '12:12'

Thursday 03 November 2016

TechMarketView is continuing its study of the Fintech market, with an insight into what is now the premier Fintech event, the Money 2020 show in Las Vegas.

TechMarketView is continuing its study of the Fintech market, with an insight into what is now the premier Fintech event, the Money 2020 show in Las Vegas.

In the past few months, as well as providing a greater coverage of the Fintech world, we have set out a framework for understanding the key Fintech Battlegrounds; the battle for customer engagement, the battle for technology and platforms, and the battle for the payment rails.

In amongst all the bustle and noise at Money2020 last week we were able to build some really valuable – even profound - insights into the current state of these battles and how the next phases are likely to unfold. These will have serious repercussions for the global Fintech industry and implications for the SITS provider community as they endeavour to serve the Financial Services and Retail sectors.

In this report we examine the problems in the US retail markets as they get to grips with more modern payment cards and the developing peer-to-peer payments business as well as the evolution of eCommerce competition. We also highlight a major change to the competitive framework of the banking sector and look at some interesting areas of innovation that could further transform this dynamic sector.

Subscribers can access these insights here. If you don’t yet subscribe to FinancialServicesViews and you'd like details of our subscription packages please contact Deb Seth of our Client Services team.

Posted by UKHotViews Editor at '09:24'

- Tagged:

payments

Wednesday 02 November 2016

We are delighted to announce the companies selected to participate in our ninth TechMarketView Little British Battler Day, to be held in London on 15th November.

We are delighted to announce the companies selected to participate in our ninth TechMarketView Little British Battler Day, to be held in London on 15th November.

They are (in alphabetical order):

-

AI Corporation

-

AltViz

-

ANDigital

-

Connexica

-

EvaluAgent

-

Fedr8

-

Metapraxis

-

Nexor Ltd

-

StorageOS

-

Streamwire

-

Ultrahaptics

-

Wazoku

The leadership teams from the companies will spend an hour in closed session with TechMarketView Research Directors and senior partners from our sponsors, technology merchant bank MXC Capital, to share their business plans and get valuable feedback on market opportunity, competitive positioning, and financing.

The companies will also be featured in UKHotViews and profiled in a forthcoming report, which will be available to eligible TechMarketView subscription service clients.

This event will bring the number of notable UK tech SMEs wearing the ‘LBB badge’ to over one hundred. Many of the prior participants have since gone on to greater things.

Many congratulations to these companies, and thanks again to everyone else that applied.

Posted by UKHotViews Editor at '09:56'

- Tagged:

lbb

Wednesday 02 November 2016

UK software firm Advanced is celebrating a landmark contract win in the education sector having signed a three-year deal with the UK’s largest multi academy trust, Academies Enterprise Trust (AET). AET is to use Advanced’s SaaS-based Progresso management information system to support its 66 academies.

UK software firm Advanced is celebrating a landmark contract win in the education sector having signed a three-year deal with the UK’s largest multi academy trust, Academies Enterprise Trust (AET). AET is to use Advanced’s SaaS-based Progresso management information system to support its 66 academies.

The terms of the deal have not been made public, but when it was tendered the estimated value was £5m over three years. And there is no doubt that it’s a significant contract for Advanced. Won against incumbent and market leader Capita, AET should become a useful reference site for the Progresso software, which Advanced has been developing since it was acquired with Serco Learning in December 2012 (see ACS acquires Serco Learning).

As avid UKHotViews readers will recall, Advanced was acquired by Vista Equity Partners in March 2015 (see Vista set to take ACS private) and new CEO Gordon Wilson and his team have spent the last year working to transform the business with the support of its PE backers. According to Wilson, this transformation is now at least 70% complete. The re-brand from Advanced Computer Software Group in April this year was a clear sign of progress and the AET contract is a further welcome indication that Advanced is intent on making waves in the market.

Of course there is still work to do, but other SITS suppliers (not least education market leader Capita) should be keeping a watchful eye on newly invigorated Advanced. Our estimates show Advanced’s revenue from from UK education was c£22m in 2015 putting it comfortably inside the top 10 SITS suppliers to the sector. Today Advanced counts as customers some 650 schools and academies in the UK, plus 420 in Ireland, and views education as an important market that presents some interesting opportunities for the Group.

This article is continued on UKHotViewsExtra. TechMarketView subscription clients can read more in Advanced win in education signals schools' move to cloud.

If your organisation doesn't yet have a subscription to our paid-for research and analysis and you'd like details of our 2016 subscription packages please contact Deborah Seth in our Client Services Team.

Posted by Tola Sargeant at '09:44'

- Tagged:

contract

education

It’s here: the latest UK public sector SITS market trends & forecasts report from TechMarketView’s PublicSectorViews team. If you are already a subscriber to the PublicSectorViews research stream, you will know that this is one of two core reports published every year. It is the ‘bible’ of everything that is going on in the UK public sector SITS market. You will find detailed analysis of all of the subsectors - central government, local government, education, health, police and defence – allowing you to understand the thinking behind our detailed forecasts.

It’s here: the latest UK public sector SITS market trends & forecasts report from TechMarketView’s PublicSectorViews team. If you are already a subscriber to the PublicSectorViews research stream, you will know that this is one of two core reports published every year. It is the ‘bible’ of everything that is going on in the UK public sector SITS market. You will find detailed analysis of all of the subsectors - central government, local government, education, health, police and defence – allowing you to understand the thinking behind our detailed forecasts.

The headline is none-too-exciting: a pretty subdued market throughout our forecast period to 2019. But it’s the detail under the covers that needs to be explored. While three of the subsectors will decline over four years on a compound annual growth basis, the other three will perform pretty strongly. It’s all about understanding which organisations, when faced with tough budgetary pressures and mounting challenges, will bite the bullet and invest to transform… and which will act like rabbits in the headlights.

The political and economic climate means UK public sector organisations are operating in tough times. But the technological pace of change is picking up, offering those organisations solutions that may not have previously been available as they look to 'Surf the Wave of Disruption'. TechMarketView’s subscribers can find out which organisations we think are set to make the biggest investments, within what timescales, and how they are likely to engage with the SITS industry to make things happen. Download the report – UK public sector SITS market trend & forecasts 2016-2017 – now. Or, if you are not yet a subscriber, please contact Deb Seth to find out more.

Posted by Georgina O'Toole at '09:15'

- Tagged:

publicsector

centralgovernment

localgovernment

markettrends

defence

education

police

health

forecasts

« Back to previous page