News

TechMarketView’s UK CX Tech Challengers and Startups report is now live for our subscribers.

The Customer Experience (CX) arena is one of the most dynamic and significant parts of the Software and IT Services (SITS) market. The scale of demand from this segment, coupled with the widespread opportunities for digital disruption within it, continues to spawn a proliferation of start-ups and scaleups.

This new research is focused on identifying the emerging UK CX Tech suppliers which are marking themselves out as credible challengers in this diverse, rapidly evolving, intensely competitive, largely overseas-HQ’d supplier dominated space. The report contains the profiles of ten companies which by virtue of their growth, customer acquisition achievements, and successes in attracting investment are having a demonstrable impact on the CX SITS world. The document also provides a summary of the overall CX market context, together with an overview of the CX SITS vendor landscape and commentary on the wider dynamics at play in the CX Tech startup and scaleup domain.

as credible challengers in this diverse, rapidly evolving, intensely competitive, largely overseas-HQ’d supplier dominated space. The report contains the profiles of ten companies which by virtue of their growth, customer acquisition achievements, and successes in attracting investment are having a demonstrable impact on the CX SITS world. The document also provides a summary of the overall CX market context, together with an overview of the CX SITS vendor landscape and commentary on the wider dynamics at play in the CX Tech startup and scaleup domain.

If you are a subscriber to TechSectorViews, download the UK CX Tech Challengers and Startups report today. If you don’t have a subscription and would like to gain access the report and our other research and services please contact Deb Seth.

Posted by Duncan Aitchison at '09:43'

- Tagged:

newresearch

customer+experience

It has been just over one and a half years since CANCOM UK&I was acquired by Telefónica Tech, creating the foundation for its UK business. With the Telefónica name more broadly known outside of UK shores, the business has been on a mission to improve its brand recognition and demonstrate the significant range of IT services and expertise it has to offer to UK organisations.

It has been just over one and a half years since CANCOM UK&I was acquired by Telefónica Tech, creating the foundation for its UK business. With the Telefónica name more broadly known outside of UK shores, the business has been on a mission to improve its brand recognition and demonstrate the significant range of IT services and expertise it has to offer to UK organisations.

The company is targeting revenue to grow to £350m in 2026, representing annualised growth of c.20%. Telefónica Tech are aiming to do this through a strategy centred around ‘Secure Digital Enablement’, with 5 main solution areas; Cloud, Data & AI, Enterprise Applications, Modern Workplace and Cybersecurity.

Healthcare is seen as one of the largest target markets for growth, with Financial Services also a strong focus area. The business also has a significant presence elsewhere in the Public sector, with a strong client base in Police and National Security and in Central & Local government, as well as across Manufacturing, Retail and Construction. Customers include Virgin Money, Heathrow airport, Oxford University hospitals and event and travel provider Reed & Mackay.

TechMarketView subscribers, including UKHotViews Premium subscribers, can read our further analysis of Telefónica Tech’s business and growth plans in: Telefónica Tech targets growth through secure digital enablement

If you aren't a subscriber – or aren't sure if your organisation has a corporate subscription – please contact Deb Seth to find out more.

Posted by Simon Baxter at '09:21'

Don't miss your chance to book tickets to An Evening with TechMarketview at a discount - book before the end of April to save money with 'early bird' pricing!

Taking a table or two at An Evening with TechMarketView is a fantastic way to entertain your key clients and prospects; bring your team together in person for some high-quality networking (including with each other!); or reward your rising talent with an enjoyable and informative evening.

A highlight of the UK tech calendar, TechMarketView’s flagship event returns for its ninth year on 21 September 2023. We’re expecting over 200 senior executives to join us at the Royal Institute of British Architects (RIBA) in London, for an evening that combines first-class networking with peers and prospects over drinks and dinner, with an opportunity to absorb insight on the latest tech trends directly from our analyst team and expert guest speakers.

This year, the evening will draw on TechMarketView’s ‘Pursuing Productivity’ research theme, exploring ways in which tech can be used to respond to the UK’s productivity crisis. Hear how leaders across the public and private sectors are already turning to technology to help their organisations get more out of the graft they put in. Understand which technology providers are being the most successful in supporting their customers on that mission. And look to the future with us, as we navigate how technologies, including AI, data analytics and automation, as well as those focused on the evolving world of customer and employee experience, are set to play a crucial role.

This year, the evening will draw on TechMarketView’s ‘Pursuing Productivity’ research theme, exploring ways in which tech can be used to respond to the UK’s productivity crisis. Hear how leaders across the public and private sectors are already turning to technology to help their organisations get more out of the graft they put in. Understand which technology providers are being the most successful in supporting their customers on that mission. And look to the future with us, as we navigate how technologies, including AI, data analytics and automation, as well as those focused on the evolving world of customer and employee experience, are set to play a crucial role.

Discounted early-bird ticket pricing is available until the end of April, with TechMarketView subscription and advertising clients (including our UKHotViews Premium subscribers) benefiting from an extra discount. Prices are held at 2022 rates, so book early to avoid disappointment!

BOOK YOUR TICKETS HERE.

If you’re unsure whether your organisation qualifies for the client price, please contact us to double-check before booking: info@techmarketview.com.

Posted by TechMarketView Team at '16:30'

- Tagged:

event

In our UKHotViews articl e on Mastek’s FY23 and Q423 results (for the period ending 31st March 2023), we highlighted the strength in Mastek’s UK business (see Mastek FY: Q-on-Q improvement but caution remains | TechMarketView). Representing just over 60% of Mastek’s global revenues, the UK business grew revenue by 10% quarter-on-quarter in its Q423.

e on Mastek’s FY23 and Q423 results (for the period ending 31st March 2023), we highlighted the strength in Mastek’s UK business (see Mastek FY: Q-on-Q improvement but caution remains | TechMarketView). Representing just over 60% of Mastek’s global revenues, the UK business grew revenue by 10% quarter-on-quarter in its Q423.

We have since spoken with Abhishek Singh, Mastek’s President UKI & Europe, to understand what is driving UK growth, what we can expect from the UK business in the year ahead, and where the UK executive team will be focusing its efforts.

TechMarketView subscribers – including UKHotViews Premium clients – can read our analysis now in the UKHotViews Extra article, Strength in Mastek's UK business | TechMarketView.

TechMarketView subscribers – including UKHotViews Premium clients – can read our analysis now in the UKHotViews Extra article, Strength in Mastek's UK business | TechMarketView.

If you are not yet a subscriber or are unsure if your company has a corporate-wide subscription, please contact Deb Seth to access this and much insight and analysis besides.

Posted by Georgina O'Toole at '17:08'

- Tagged:

results

offshore

indians

digital

IPP

interview

We are thrilled to announce Aqilla as the first sponsor of our 2023 ‘Evening with TechMarketView’ Presentation and Dinner in September. We are particularly pleased to welcome Aqilla as a sponsor for the evening as it is the fourth year running that they have supported the event.

We are thrilled to announce Aqilla as the first sponsor of our 2023 ‘Evening with TechMarketView’ Presentation and Dinner in September. We are particularly pleased to welcome Aqilla as a sponsor for the evening as it is the fourth year running that they have supported the event.

As you may already know, our ninth annual Evening with TechMarketView event will be held at the magnificent Royal Institute of British Architects (RIBA), in Portland Place London, from 6.30pm on Thursday 21 September and themed around Pursuing Productivity.

Over 200 of UK tech’s ‘great & good’ are expected to attend the evening event which has become a popular fixture in the tech calendar and has been described by attendees as “the best networking event in the industry”.

Aqilla have been delivering class-leading cloud-based accounting and business solutions since 2006. The feature rich platform is aimed at delivering cost and efficiency savings to medium-sized businesses and divisions of larger organisations. Designed for Cloud from the start, it runs with ease within any browser on any desktop or mobile device delivering real cost and efficiency benefits across the enterprise. With customers located in some 34 countries and designed to support multi company, multi-currency and even multi-lingual operation, we’re very excited to have them on board!

Early Bird tickets for individuals and tables of 10 went on sale recently and are available at a discounted rate until 1st May. Secure your place now here.

If your organisation is interested in joining Aqilla as an event sponsor, you’ll find more detail on available packages here or Deb Seth (dseth@techmarketview.com) to learn more.

Posted by UKHotViews Editor at '16:42'

- Tagged:

event

Last week I covered the release of the latest Cybersecurity breaches survey 2023 by the Department for Science, Innovation and Technology – See here. The survey gave us some interesting insights into the current actions and priorities from UK organisations surrounding cybersecurity.

Data revealed overall lower volumes of cyber breaches and attacks over the past 12 months, though the figures were likely skewed by underreporting, mainly from micro and small organisations. But the survey goes into greater detail on a range of other topics, which we will explore further in this UKHotViews extra article, available for all TechMarketView subscribers.

In the article you will find a summary and analysis of key findings from the survey across areas such as; supply chain risk, board engagement, incident response plans, cyber training, security outsourcing and accreditations.

TechMarketView subscribers, including UKHotViews Premium subscribers, can read the full analysis Cybersecurity breaches survey 2023: A deeper dive here.

If you aren't a subscriber – or aren't sure if your organisation has a corporate subscription – please contact Deb Seth to find out more.

Posted by Simon Baxter at '08:55'

TechMarketView has kicked off a new research programme focused on understanding the opportunities for tech suppliers in fast-growing markets.

Data Insights looks at some of the most interesting and complex areas of Software and IT Services and provides analysis of the size and growth opportunity. Get up to speed on what’s been published in Q1 with TechMarketView’s unique take on the RPA and CX markets:

-

Data Insights: The Future of Robotic Process Automation: This report looks at how RPA-centric automation is maturing with market forecasts in what is becoming a more complex and diverse landscape. The report is designed to help RPA software and services vendors understand the nature and scale of the opportunity, as well as aiding end users looking to appreciate the market dynamics and challenges faced, when attempting to scale activities.

-

Data Insights: The Customer Experience (CX) Market Opportunity: The UK CX Software and IT Services arena has built up an impressive head of steam over the past decade. Now the focus for over a fifth of all SITS expenditure in this country, the CX segment has become one of the most intensely competitive parts of the market. It is also an arena in which success will require keeping pace with the rapidly evolving changes in buyer expectations, investment priorities, and technology strategies.

Data Insights is available to our TechSectorViews research programme clients.

For more information on becoming a client, speak to Deb Seth.

Posted by UKHotViews Editor at '08:15'

- Tagged:

RPA

CX

marketdata

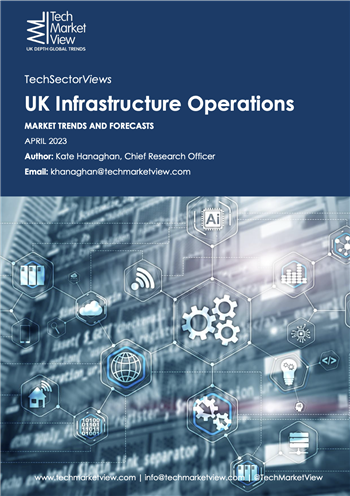

Live now is TechMarketView’s latest analysis of the key trends and dynamics in the UK Infrastructure Operations market.

Authored by Kate Hanaghan, Chief Research Officer, “Infrastructure Operations: Market Trends and Forecasts” explains TechMarketView’s latest market size and growth data and provides expert analysis of the key trends shaping this exciting area of IT Services.

Infrastructure Platform services continue to expand as a share of the total market, with important implications for hyperscalers and their partner ecosystems. Indeed, such is the position of the hyperscalers, that Ofcom recently said it was “concerned” about Microsoft and Amazon Web Services.

Infrastructure Operations: Market Trends and Forecasts provides recommendations and considerations for how suppliers should approach the market to maximise their success against a backdrop of complexity and opportunity.

Who should read the report?

If you work in strategy or marketing, this is essential reading for you. Check you are in-tune with the market and assess how well you are performing. If you would like a more customised view of your company’s position, please contact the author.

This report is also very useful reading for leaders of Infrastructure Operations businesses, providing an insight into market evolution and advice on strategic moves. Equally, if you are new to the IT Services industry, this report is an accessible guide to the key trends and market developments.

Contact Deb Seth if you are not a subscriber and would like to access the report.

Posted by UKHotViews Editor at '09:30'

- Tagged:

trends

forecasts

infrastructureoperations

TechMarketView’s brand new research on the UK Customer Experience (CX) market is now live for our subscribers. The Customer Experience Market Opportunity report contains data from our experts on the size and growth rates of the Software and IT Services (SITS) CX market and its primary segments. The research also provides insight into the key trends shaping demand and identifies the opportunities and challenges that lie ahead for suppliers seeking to prosper in this rapidly evolving space.

The UK CX Software and IT Services arena has built up an impressive head of steam over the past decade. Now the focus for over a fifth of all SITS expenditure in this country, the CX segment has become one of the most intensely competitive parts of the market. It is also an arena in which success will require keeping pace with the rapidly evolving changes in buyer expectations, investment priorities, and technology strategies.

Annual sales of these offerings have jumped by almost 30% since the start of the decade. Buyer focus has, however, progressively switched from spending to survive to investing to thrive. Despite the increasingly challenging economic outlook, enterprises are continuing to commit substantial funds to CX initiatives in the pursuit of step changes to business performance.

If you are a subscriber to TechSectorViews, download The Customer Experience Market Opportunity report today. If you don’t have a subscription and would like to gain access the report and our other research and services please contact Deb Seth.

Posted by Duncan Aitchison at '08:37'

- Tagged:

newresearch

customer+experience

It has been just over five years since the Competition and Markets Authority (CMA) introduced its open banking reforms in the UK. Reflecting on the impact of these new rules and the vastly changed banking landscape that we see today, it’s safe to say that open banking has been a tremendous success. This is of course true for almost all stakeholders in the ecosystem, except perhaps for the major UK banking organisations whose historical market dominance has been disrupted by the changes.

As open banking has matured, the availability of financial services and ancillary third-party offerings has become increasingly more widespread, facilitated by the provision of API dataflows. The pattern of innovation and adoption that has resulted is giving rise to the further disaggregation of banking services with the ability to embed offerings creating new possibilities.

As open banking has matured, the availability of financial services and ancillary third-party offerings has become increasingly more widespread, facilitated by the provision of API dataflows. The pattern of innovation and adoption that has resulted is giving rise to the further disaggregation of banking services with the ability to embed offerings creating new possibilities.

Subscribers to FinancialServicesViews can learn more by reading a new report in our "Emerging Markets" series: Embedded Finance and Banking as a Service - New Battlegrounds for Banking Supremacy. The research explores two of the emerging technology-led trends set to exert increasing influence on the banking sector and discusses some of the potential market opportunities for SITS vendors and specialist service providers.

If you do not currently have access but would like to learn more about this report or any other of our services please copntact Deb Seth for more information.

Posted by Jon C Davies at '07:00'

- Tagged:

banking

apis

Ross Linnett is a man on a mission. And that mission is to make every website on the planet freely (literally) accessible to the estimated 25% of users who have some form of reading difficulty, such as dyslexia, visual impairment, or have English as a second language.

Ross Linnett is a man on a mission. And that mission is to make every website on the planet freely (literally) accessible to the estimated 25% of users who have some form of reading difficulty, such as dyslexia, visual impairment, or have English as a second language.

Prompted to develop Recite Me because of his own dyslexia, Linnett struggled to get corporates to engage with him on his ‘mission’. He hoped that the UK government’s Disability: Equality Act, which became law in 2010, would be a wake-up call for corporates to formally address ‘Disability & Inclusion’ in the workplace, and therefore more receptive to Recite Me.

But it has turned out to be a long, hard slog: “Corporates are very cautious,” he told me when we spoke recently. “They don’t like to be first movers”.

I wrote about Recite Me’s recent funding round a couple of weeks ago (see BGF assists Recite Me spread the word about assistive technology). TechMarketView subscription service clients can read more – and discover the mystery as to who is ‘Helen Linnett’ – in UKHotViews Extra.

Posted by Anthony Miller at '16:19'

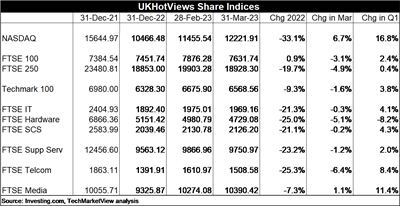

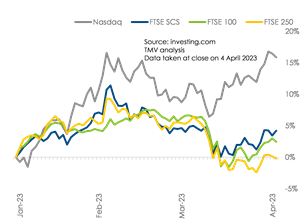

We are now a quarter of the way into what is turning out to be another volatile year for equities, albeit one that is so far favouring the dominant tech players.

We are now a quarter of the way into what is turning out to be another volatile year for equities, albeit one that is so far favouring the dominant tech players.

In fact, the US tech-focused Nasdaq Composite index gained almost 17% quarter-on-quarter (QoQ) to 31 March, its strongest QoQ performance since the bounce-back from the early stages of the Covid pandemic in Q2 2020.

Strong performers included Intel (up 31.0% month-on-month (MoM) and 23.6% QoQ), Microsoft (up 15.6% MoM and 20.2% QoQ), Apple (up 11.9% MoM and 26.9% QoQ) and Amazon (up 9.6% MoM and 23.0% QoQ).

After a bright January, UK tech indices and the more general FTSE 100 and 250 have stuttered however. The FTSE Software and Computer Services (SCS) index closed up 4.3% QoQ, whilst the broader FTSE 100 managed 2.4% QoQ and the FTSE 250 mid-cap just about broke even.

After a bright January, UK tech indices and the more general FTSE 100 and 250 have stuttered however. The FTSE Software and Computer Services (SCS) index closed up 4.3% QoQ, whilst the broader FTSE 100 managed 2.4% QoQ and the FTSE 250 mid-cap just about broke even.

Indeed of the 140 or so tech stocks that we track across several markets, around half posted a share price decline in the month of March.

Why is the Nasdaq outperforming so strongly? Is this the start of another tech boom, so soon after the 2022 tech crash? And can it last?

UKHotViews Premium readers can read more on how 2023 is shaping up to be another volatile year and what may yet be in store in Larger tech stocks benefit from banking turmoil.

UKHotViews Premium readers can read more on how 2023 is shaping up to be another volatile year and what may yet be in store in Larger tech stocks benefit from banking turmoil.

And if you would like to discuss subscription options, please contact Deb Seth.

Posted by Tania Wilson at '13:21'

- Tagged:

markets

macro

Live now is TechMarketView’s latest analysis of the key trends and dynamics in the UK Infrastructure Operations market.

Authored by Kate Hanaghan, Chief Research Officer, “Infrastructure Operations: Market Trends and Forecasts” explains TechMarketView’s latest market size and growth data and provides expert analysis of the key trends shaping this exciting area of IT Services.

Infrastructure Platform services continue to expand as a share of the total market, with important implications for hyperscalers and their partner ecosystems. Indeed, such is the position of the hyperscalers, that yesterday Ofcom said it was “concerned” about Microsoft and Amazon Web Services.

Infrastructure Operations: Market Trends and Forecasts provides recommendations and considerations for how suppliers should approach the market to maximise their success against a backdrop of complexity and opportunity.

Who should read the report?

If you work in strategy or marketing, this is essential reading for you. Check you are in-tune with the market and assess how well you are performing. If you would like a more customised view of your company’s position, please contact the author.

This report is also very useful reading for leaders of Infrastructure Operations businesses, providing an insight into market evolution and advice on strategic moves. Equally, if you are new to the IT Services industry, this report is an accessible guide to the key trends and market developments.

Contact Deb Seth if you are not a subscriber and would like to access the report.

Posted by UKHotViews Editor at '09:30'

- Tagged:

cloud

hybridcloud

infrastructureoperations

On Tuesday I attended the first day of UK CyberWeek, an event for security suppliers, industry experts and end users to come together and share their latest experiences and knowledge on the cybersecurity market.

On Tuesday I attended the first day of UK CyberWeek, an event for security suppliers, industry experts and end users to come together and share their latest experiences and knowledge on the cybersecurity market.

There were a multitude of talks across 6 stages, so my own experiences are limited to but a few of those, with the event also continuing for a further second day yesterday. For those of you who didn’t get a chance to attend you can at least experience some of it through my own highlights in this UKHotViewsExtra article.

The highlights include:

-

The confessions of hacker #FYRA, who a bit like a James Bond villain has undertaken a range of security attacks, through subterfuge and taking advantage of human weaknesses.

-

The changing security landscape according to Stuart Wiggins, Strategic Threat Advisor at Crowdstrike.

-

A brief foray into North Korean hackers by Investigative journalist Geoff White, author of the book and podcast The Lazarus Heist, followed by a live Phishing attack demo by ethical hacker Glenn Wilkinson.

-

An amusing and interesting talk on the theft of the Crown Jewels in 1671 by Graham Cluely, host of the Smashing Security podcast (a personal favourite of mine). Of course, with links back to cybersecurity best practises.

TechMarketView subscribers, including UKHotViews Premium subscribers, can read the full highlights in the HVX: UK CyberWeek: Hackers, Phishing and the Crown Jewels

If you aren't a subscriber – or aren't sure if your organisation has a corporate subscription – please contact Deb Seth to find out more.

Posted by Simon Baxter at '09:12'

TechMarketView's Public Sector Software and IT Services (SITS) Supplier Prospects 2023 report is now available.

TechMarketView's Public Sector Software and IT Services (SITS) Supplier Prospects 2023 report is now available.

In this publication we look at the Top 20 suppliers in the UK public sector SITS market based on their 2021 performance. We review their progress over 2022 and assess what they need to do to maximise their potential in 2023 and beyond.

Suppliers profiled in this report:

Accenture - Amazon Web Services - Atos - BAE Systems - BT Group - Capgemini - Capita - CGI - Civica - Deloitte - DXC - Fujitsu - IBM - Kainos - Leidos - Microsoft - Oracle - OSUK - Serco - Sopra Steria

This report should be read alongside our UK Public Sector Software & IT Services: Suppliers, Trends & Forecasts 2022-2025 report, our recent UK Public Sector Software & IT Services: Market Outlook Update & Predictions, and individual subsector reports on the Central Government, Defence, Local & Regional Government, Health, Police, and Education SITS markets.

If you are an existing PublicSectorViews subscriber, you can read the report now. If you’d like to discuss an extension to your existing subscription or would like details of how to subscribe to TechMarketView, please email Deb Seth.

Posted by Dale Peters at '08:18'

- Tagged:

defence

education

police

health

prospects

local+government

public+sector

central+government

« Back to previous page