News

In case you missed them, there were two key TechMarketView reports in 2017 looking at how the progression of the Internet of Things (IoT) might impact IT services suppliers.

Firstly, in Internet of Things: Time for IT services providers to accelerate their strategies?, we investigated what IT services providers could be doing to position themselves for future opportunities as they flow through.  We also examined some of the use cases that have emerged recently and took a look at how some suppliers are positioning themselves for success. This report is available to subscribers of our InfrastructureViews research.

We also examined some of the use cases that have emerged recently and took a look at how some suppliers are positioning themselves for success. This report is available to subscribers of our InfrastructureViews research.

Secondly, in Internet of Things: Network providers push to supplant IT services players, we assessed UK network providers and their strategies for taking a larger slice of IoT revenue. UK network infrastructure is a rare and prized asset that puts connectivity suppliers at the centre, but not necessarily the front, of the expanding IoT service chain. IT services players cannot match those assets and must partner with those same telco, mobile network operators and network service providers to deliver their own IoT platforms whilst simultaneously competing with them to overlay management services and own the customer relationship. This report is available to subscribers of our SecureConnectViews research.

For more information on accessing TechMarketView research, please contact Deb Seth.

Posted by UKHotViews Editor at '06:44'

- Tagged:

networkservices

Last week TechMarketView’s Chief Analyst Georgina O’Toole introduced our research theme for 2018, Breaking the Boundaries; and each of our analysts gazed into their crystal balls providing predictions for the coming year in their respective fields.

If you missed the launch on UKHotViews, you can catch up via the links below:

· TechMarketView Research Theme 2018: Breaking the Boundaries

· Predictions 2018 – Application Services

· Predictions 2018 – Enterprise Software

· Predictions 2018 – Business Process Services

· Predictions 2018 – Infrastructure Services

· Predictions 2018 – Security, Networking & Cloud

· Predictions 2018 – Financial Services

· Predictions 2018 – Public Sector

TechMarketView subscription clients should also log in to read the detail behind the UKHotViews pieces in the Predictions 2018 series of reports, which have now been published within our focused research streams.

2018 Research Agenda

Today, we are building on the launch of our predictions for the year ahead with the publication of Breaking the Boundaries 2018, a document available to all which sets out the key themes running through TechMarketView’s 2018 research agenda. Hear from each of our experts about the market shaping trends impacting their specialist areas and how we’ll be setting out to support our clients in the year ahead.

Download your copy HERE.

Breaking the Boundaries 2018 also introduces our new strapline ‘UK depth, Global trends’, which highlights the fact that TechMarketView analysts blend a deep understanding of the UK tech market and its suppliers – augmented by privileged conversations with CXOs across the industry – with insight into global tech trends.

Breaking the Boundaries 2018 also introduces our new strapline ‘UK depth, Global trends’, which highlights the fact that TechMarketView analysts blend a deep understanding of the UK tech market and its suppliers – augmented by privileged conversations with CXOs across the industry – with insight into global tech trends.

As you read through the document, you’ll see that our research directors are able to help you to navigate change and spot opportunities across a broad spectrum of markets and focus areas from Robotic Process Automation (RPA) through cyber security to cloud transformation; and from the payments market to the police market.

You will also hear from our Managing Partner, Anthony Miller, about our passion for the start-up and scale- up scene in the UK. We are delighted to continue to identify and support innovative SMEs through programmes such as Great British Scaleups and Little British Battlers. Getting close to these innovators also gives us great insight into emerging technologies and future disruptors.

Now more than ever, this makes TechMarketView a natural partner to software, IT services and business process services suppliers in the UK market – indeed, to anyone with an interest in the sector.

We look forward to Breaking the Boundaries together in 2018!

Posted by Tola Sargeant at '08:30'

- Tagged:

trends

Thursday 14 December 2017

In 2018 public sector organisations will not find it easy to operate efficiently and effectively without looking beyond their own four walls. They cannot afford to be insular and will need to look at Breaking the Boundaries if they are going to achieve the necessary reforms to public service delivery.

In 2018 public sector organisations will not find it easy to operate efficiently and effectively without looking beyond their own four walls. They cannot afford to be insular and will need to look at Breaking the Boundaries if they are going to achieve the necessary reforms to public service delivery.

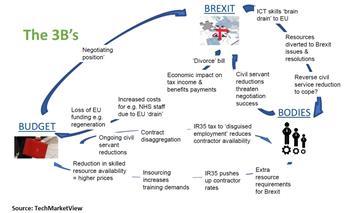

It will be a critical year for the public sector and indeed the United Kingdom as a whole. Brexit will be a looming presence over much that the government does and its impact will filter down to all parts of the public sector. Throw in GDPR, ongoing budgetary pressures, a digital skills shortage and a minority government, and suppliers and their customers will have some challenging waters to navigate. As always, these pressures will create both opportunities and threats.

We see the following factors driving public sector activity during 2018:

Navigating the Brexit challenge. Brexit opportunities will build during 2018. There will be a need for additional consultancy, software, application development and integration services. For some suppliers that will mean being prepared to push their own boundaries by taking on smaller and more consultative contracts than usual to ensure they are in the right place when the panic sets in as 2019 approaches.

Addressing the digital skills shortage. A shortage of people with the right digital skills is inhibiting the digital transformation of the public sector. Businesses can’t wait for clarity to emerge from the fog of Brexit negotiations, so we will see the trend of building resource outside of the UK’s boundaries continue in 2018. The public sector will also need to consider more creative ways to access the requisite digital talent in the UK, including the use of public freelance marketplaces or crowdsourcing.

The benefits of better collaboration. There are several aspects of collaboration that we expect to develop during 2018. Suppliers will look at partnerships to bring in specialist skills such as intelligent automation and we will need to see improvements in joint working between government departments. We will also see more collaboration between and within local and regional agencies, where we expect the devolved authorities to lead the way.

Security, regulation and the value of data. Effective use of data will be complicated by the advent of GDPR and ongoing concerns about cyber security. Most organisations will need to make significant improvements to the way they collect, store and process personal data. The WannaCry ransomware attack acted as a wake-up call across the public sector and we will see a rise in opportunities concerned with countering cyber threats.

A smarter UK public sector. The increasing use of connected devices and appliances will generate huge quantities of data that will need to be collected, stored, analysed and interpreted. This will help encourage public sector organisations to adopt infrastructure and technology beyond their four walls. As digital, data and cloud capabilities mature, we will see further investment in IoT technologies in the public sector, with interest being driven by local government, health and defence.

Public Sector Predictions 2018 provides more detail on these topics and the report is now available to download by PublicSectorViews’ subscribers. If you’re not a current subscriber please contact Deb Seth for details of how to take one out.

Posted by Dale Peters at '09:09'

- Tagged:

skills

government

iot

collaboration

cyber

brexit

GDPR

Thursday 14 December 2017

TechMarketView’s “Breaking the Boundaries” 2018 research theme is particularly relevant to the Financial Services sector as established banks and insurance companies come to terms with the realities of competing in a much more dynamic market. For example, the banking world will be transformed as the move towards Open Banking and the introduction of PSD2 mandates a greater choice for customers in the way their finances are managed. Established providers with extended organisations will have to break down the boundaries between separate business units as they build a more “customer-centric” model, addressing the total needs of a customer in a co-ordinated and joined-up fashion. This will require greater communication between systems, both old and new, and a different approach to the collection, storage and exploitation of customer data.

TechMarketView’s “Breaking the Boundaries” 2018 research theme is particularly relevant to the Financial Services sector as established banks and insurance companies come to terms with the realities of competing in a much more dynamic market. For example, the banking world will be transformed as the move towards Open Banking and the introduction of PSD2 mandates a greater choice for customers in the way their finances are managed. Established providers with extended organisations will have to break down the boundaries between separate business units as they build a more “customer-centric” model, addressing the total needs of a customer in a co-ordinated and joined-up fashion. This will require greater communication between systems, both old and new, and a different approach to the collection, storage and exploitation of customer data.

The boundaries of the financial services providers themselves will also change, not only as the implementation of new ringfencing rules redefine business unit and functional boundaries, but also as they seek out new sources of shareholder value. The competitive boundaries will also be changed dramatically over the coming year as Fintechs attempt to carve out new niches and as the Internet giants leverage their brand and scale to cherry-pick lucrative areas of financial services provision. All this change will drive additional spend on IT infrastructure, innovation and on the recruitment of specialist personnel.

“FinancialServicesViews Predictions 2018” highlights the issues of Brexit, the continued rise of cloud and the drive towards innovation and the use of new technologies as well as the impact of new regulation and the changing competitive environment.

2018 looks like being a very interesting year for the sector and its IT Services suppliers. FinancialServicesViews subscribers can access this report here.

If you don’t yet subscribe to this research stream, please contact our Marketing Director Deb Seth on dseth@techmarketview.com.

Posted by Peter Roe at '07:06'

- Tagged:

cloud

predictions

regulation

blockchain

data

brexit

Wednesday 13 December 2017

The traditional boundaries between enterprise security, networks and the cloud are steadily disintegrating as IT departments combine fundamental infrastructure elements into unified platforms and services which are quick to provision and easy to manage.

Emerging technology is critical to breaking out of those siloes whilst the carrot of establishing strong security defences will be outweighed by the stick in 2018 as data protection regulation forces assessment and changes to existing policies.

We see the major trends in the security, networking and cloud markets next year as:

Data protection regulation looms large. The May 2018 deadline for compliance with the European Union’s Generation Data Protection Regulation (GDPR) is looming, and we think the majority of UK organisations still have much to do.

Data hosting shake up. A broader shake-up of UK information hosting and processing arrangements will cause some turbulence in the cloud services market as public and private sector organisations decide the best architectural and geographical location for their data.

Cyber threats morph and intensify. the specific nature of the threat will change but on a macro level the fight to secure networks, applications and systems against individuals and groups looking to steal data or cause maximum disruption for their own gain will be ongoing and unrelenting in 2018.

SDN/NFV moves into virtual security domain. The spread of SDN/NFV will herald be the emergence of more virtualised security services, including firewalls, IDS/IDP systems and denial of service (DoS) protection tools.

Passwords edged out by biometrics. Increased use of two factor authentication for secure access to enterprise networks, systems, devices and applications will open up new opportunities for infrastructure and security product and service suppliers in 2018.

Brexit - IoT opportunity waiting to happen. The Internet of Things (IoT) can play a pivotal role in Brexit, with connected people and devices helping everything from the Irish border checks to frictionless trade/custom controls in UK to EU logistics, distribution and retail operations.

Subscribers can read more in our Security, Networking and Cloud Predictions report here, or contact Deb Seth for further information.

Posted by Martin Courtney at '07:55'

- Tagged:

cloud

predictions

infrastructure

Atos looks set to embark on another substantial acquisition, should its advances to Amsterdam-headquartered Gemalto be accepted. Atos delivered an offer to Gemalto – an all cash offer of €46 per share, valuing the company at c€4.3b – on 28th November, a 42% premium to its prior close. Atos has made clear its willingness to discuss the offer, stating that it is “friendly, compelling, and addresses the interests of all stakeholders”. It is expected that Gemalto will respond by this coming Friday (15th December).

Atos looks set to embark on another substantial acquisition, should its advances to Amsterdam-headquartered Gemalto be accepted. Atos delivered an offer to Gemalto – an all cash offer of €46 per share, valuing the company at c€4.3b – on 28th November, a 42% premium to its prior close. Atos has made clear its willingness to discuss the offer, stating that it is “friendly, compelling, and addresses the interests of all stakeholders”. It is expected that Gemalto will respond by this coming Friday (15th December).

Gemalto does not feature heavily in TechMarketView’s research. While it has global revenues of €3.1b (and 15K employees), according to Companies House, Gemalto UK had turnover of just shy of £100m in FY16 and c300 employees. And very little of that sits in our software and IT services space. In the UK, Gemalto is predominantly known as a card and chip manufacturer, for the personalisation and distribution of smart cards and magnetic stripe cards to the telecoms & banking industries (see Understanding the UK payments market). This footprint also took it, in 2012, into a six-year contract (with extension options) with the UK’s Driver & Vehicle Licensing Agency (DVLA) – see Gemalto beats IBM to driving license contract – for the supply of a range of official permits.

Gemalto does not feature heavily in TechMarketView’s research. While it has global revenues of €3.1b (and 15K employees), according to Companies House, Gemalto UK had turnover of just shy of £100m in FY16 and c300 employees. And very little of that sits in our software and IT services space. In the UK, Gemalto is predominantly known as a card and chip manufacturer, for the personalisation and distribution of smart cards and magnetic stripe cards to the telecoms & banking industries (see Understanding the UK payments market). This footprint also took it, in 2012, into a six-year contract (with extension options) with the UK’s Driver & Vehicle Licensing Agency (DVLA) – see Gemalto beats IBM to driving license contract – for the supply of a range of official permits.

However, worldwide, Gemalto is about more than card manufacturing. Read more…

Posted by Georgina O'Toole at '21:58'

- Tagged:

acquisition

payments

M&A

identity

cyber

Breaking the Boundaries is TechMarketView’s research theme for 2018. In Infrastructure Services this means embracing newer technologies to push the limit of what has been possible to date. It also means rethinking the workforce to ensure new technologies can be fully exploited by the right experts, who are also capable of working in very different ways - DevOps being an obvious case in point.

For all the talk of digital transformation, however, the most important issue for many buyers will continue to be the cost of maintaining the systems they already have. The added layer of complexity is that these systems don’t just have to be able to do what they have always done; they will also become the foundations upon which the business is digitised. There will therefore be no let up in the pressure CIOs put on suppliers to deliver services for less, which is setting the tone for wider discussions: digitisation has got to be affordable.

2018 promises to be an interesting period with many opportunities for suppliers. Below we outline some of the developments we expect to see as the year unfolds.

The skills challenge will deepen, weakening some suppliers

We see suppliers that are not able to address the volume of opportunities in the pipeline because they simply do not have the people to deliver the services. Furthermore, we believe this issue will get worse in 2018 for some service providers as recognised specialists gravitate - and stick - to certain brands.

Risk that buyers become desensitised to co-innovation

Many suppliers now have digital transformation ‘labs’ where they can demonstrate their offerings and work on defining strategies and solutions – together with their clients. However, ‘veteran’ buyers may feel they have been here before, for example when there was a big push to put innovation into outsourcing contracts several years back.

Demand for sub-sector expertise will heighten

In 2018 we expect to see an evolution of demands from buyers. Increasingly they will want to see evidence of expertise and solutions within industries to the sub-sector level (this does not, however, mean they don’t understand the advantages of cross-pollinating ideas between sectors as well).

Automation of Infrastructure Services will step up a gear

Supplier openness to funding – and their desire to invest at speed and scale – means we will see many more end user organisations gain access to, and benefit from, automation technologies in 2018.

From help desk to customer service: AI makes it mark

Do we think 2018 will see the emergence of the perfect service desk? No – we are a way off that. However, as suppliers refine their technological approaches we expect to see incremental improvements that will help nibble away at what is a complex and widespread issue.

Infrastructure Services Predictions 2018 provides a deeper dive into these topics and the report is now available for download by eligible subscribers. If you’re not a current subscriber please contact Deb Seth for details of how to take one out.

Posted by Kate Hanaghan at '20:58'

Accelerating the pace of digital adoption at scale must be the priority to re-ignite sluggish Enterprise Software & Application Services market growth.

Accelerating the pace of digital adoption at scale must be the priority to re-ignite sluggish Enterprise Software & Application Services market growth.

Click here to download the Enterprise Software & Application Services Supplier Prospects 2018 report for insight into how the top suppliers in the UK tech market are tackling this challenge.

While there have been encouraging signs that the newer digital enabling technologies are maturing and moving into ‘operations’ mode, buyers remain nervous and skeptical about the business value achievable which is a real give away that the tipping point has not yet been reached. The question then, is ‘what action can suppliers take?’.

That's the market context for the latest research from the ESASViews stream. The ESAS Supplier Prospects 2018 report provides insight and analysis into the challenges facing suppliers over the coming year, what they need to do to be successful and highlights ways to win in the longer term. The report also includes profiles of the top 10 ESAS suppliers to the UK market.

If you are an existing ESASViews subscriber you’ll know you can access the report by clicking the link above. If you’d like to discuss an extension to your existing subscription or would like details of how to subscribe to TechMarketView, please email Deb Seth.

Posted by Angela Eager at '17:57'

- Tagged:

software

trends

rankings

applications

The TechMarketView 2018 research theme of Breaking the Boundaries reflects the need for drastic change by enterprise software suppliers if they are to meet the needs of their customers who want straightforward ways to derive the insight needed to move their businesses forward. However, many customers are trapped within the confines of traditional applications where functional silos, hierarchical architectures and hard coded approaches to processes reinforce rigid business operating models.

The TechMarketView 2018 research theme of Breaking the Boundaries reflects the need for drastic change by enterprise software suppliers if they are to meet the needs of their customers who want straightforward ways to derive the insight needed to move their businesses forward. However, many customers are trapped within the confines of traditional applications where functional silos, hierarchical architectures and hard coded approaches to processes reinforce rigid business operating models.

Breaking customers out of this restrictive architecture and patterns of behaviour (while retaining much of the value of existing investments) is the task facing software suppliers. That task is made more difficult because although enterprises intuitively understand the need to invest to take their place in the data and event driven digital business world, many struggle to find a pathway, quantify the value of large scale digital investments and imagine new possibilities.

We see the following factors driving enterprise software activity during 2018:

Machine intelligence makeover to boost mainstream adoption. Machine intelligence already needs a makeover if it is to generate substantial revenue through mainstream adoption because its presentation to market has been technically focussed and lacking sufficient proof points about the business benefits achievable when properly understood and implemented. We anticipate a maturity leap in 2018 and beyond as software suppliers apply themselves to the usability and business use cases of machine intelligence via intelligent applications.

Intelligent features will progress towards intelligent applications. Currently, we have intelligent features rather than intelligent applications (IAs). Chatbots and digital assistants are a long way from complete IAs but they are important in breaking open machine intelligence revenue streams, providing a non-threatening entry point into IA and machine intelligence for enterprises and individuals, while hinting at what could be achieved. What is particularly significant is that they will start to demonstrate how machine intelligence can augment individuals’ activities, showing how people and bots can operate as co-workers, while also serving as ‘land and expand’ opportunities for software suppliers.

Increased focus on distributing and monitising algorithms. Algorithms underpin intelligent applications, providing the capability to unlock the value from data. Understanding and deploying them is one thing, monetising them is another. Suppliers also have the opportunity to think about new value propositions and strategies around the creation and distribution of algorithms and other services and related delivery models such as Machine Learning-as-a-Service.

Commitment to convergence, collaboration and trusted chains. Operating successfully in the digital world requires organisations to look outside their four walls and take part in a highly networked, converging and collaborative ecosystem where is it critical to trust and be trusted. It also means exploring different types of collaboration such as swarm AI and hive minds.

Bringing on a new class of ‘super professionals’. Future skill requirements are one of the ‘known unknowns’ of digital transformation so fostering continual learning among employee bases to keep up to date with rapidly moving developments will be imperative. Organisations need ‘super professionals’ – individuals adept in the art of change who have the ability to repeatedly adapt to the evolving unknown in terms of skills and job functions. These super professionals need to be identified and nurtured now.

Enterprise Software Predictions 2018 provides a deeper dive into these topics and the report is now available for download by eligible subscribers. If you’re not a current subscriber please contact Deb Seth for details of how to take one out.

Posted by Angela Eager at '09:57'

- Tagged:

software

predictions

machinelearning

Breaking the Boundaries is TechMarketView’s research theme for 2018 and goes to the core of what we will be seeing in Application Services (AS) during 2018.

Breaking the Boundaries is TechMarketView’s research theme for 2018 and goes to the core of what we will be seeing in Application Services (AS) during 2018.

Longer-term, survival and success for today’s Application Services (AS) providers will demand radical changes to current business models, service portfolios and mixes, skills strategies, delivery models, supply chains, pricing and contractual constructs and beyond. Driven by both rapidly developing technological possibilities and ever heightening customer expectations, traditional service tower boundaries are breaking quickly and convergence is accelerating fast in this domain.

In 2018, we expect to see the following major factors at play:

Self-cannibalisation accelerates as the full impact of resistance is felt. With competitive renewals now regularly resulting in 40% price cuts, vendors will increasingly choose to get ahead and seek to both best ameliorate the short-term pain while positioning to maximise for longer term returns. Observing Steve Jobs’ maxim of “If you don't cannibalize yourself, someone else will," will become mainstream practice.

Convergence and hyper-specialisation are the new the watchwords. The AS paradigm is shifting to one of mass micro manufacturing – hyper-specialisation based approaches capable of offering bespoke customisation of platform based services at (or below) ‘apps store’ prices. This in turn is both challenging fundamentally the de facto delivery model that forms the core of most established AS suppliers and breaking down the boundaries between traditionally adjacent service towers.

Commercial ‘creativity’ comes to the fore. Suppliers will increasingly leverage their balance sheets and those of their ecosystem partners to offer buyers substantial co-investment incentives and bring forward anticipated longer-term benefits. Attitudes towards risk will also embolden, with outcomes of enterprise-wide digital transformation programmes underwritten in efforts to both loosen customer purse strings and land elusive bigger deals.

AS suppliers break into BPS. The new world of Business Process Services (BPS) is developing apace. It is also becoming a key battleground between AS suppliers seeking additional sources of revenue through product extension and established BPO players looking to reinvent themselves for the Business 4.0 age.

Acquisitions regain their mojo. Having fallen back significantly this year from record breaking levels of acquisitive activity in 2016, AS suppliers will be back out in the market and shopping with gusto as we head through 2018 and beyond as they seek alternative sources of improved top-line performance and to build out the capabilities now demanded for success.

More detail on these predictions can be found in Application Services Predictions 2018. Readers who don’t have a subscription can contact Deb Seth for details.

Posted by Duncan Aitchison at '09:08'

- Tagged:

predictions

applications

We are delighted to announce the third TechMarketView Great British Scaleup Event will be held in London on Tuesday 6th and Wednesday 7th March 2018.

We are delighted to announce the third TechMarketView Great British Scaleup Event will be held in London on Tuesday 6th and Wednesday 7th March 2018.

The Great British Scaleup programme is already helping UK tech SMEs achieve a step-change in growth, through a closed-door, 90-minute workshop session with TechMarketView analysts and executive advisors from ScaleUp Group, the team of successful tech entrepreneurs that have been responsible for accelerating growth and achieving over £4b in successful exits at many well-known tech companies.

The workshop will assess your company’s potential and scalability using the ScaleUp Growth Index®, a proprietary scorecard which identifies areas of your business that might be an inhibitor to achieving extraordinary growth. Unlike traditional company scorecards which measure past financial performance, the ScaleUp Growth Index® assesses your company’s future scale-up potential. The ScaleUp Growth Index® gets you better prepared to undertake the next stage of your scale-up journey. You can use the Index to compare yourself with peers and track your progress as you implement your plans.

The workshop will assess your company’s potential and scalability using the ScaleUp Growth Index®, a proprietary scorecard which identifies areas of your business that might be an inhibitor to achieving extraordinary growth. Unlike traditional company scorecards which measure past financial performance, the ScaleUp Growth Index® assesses your company’s future scale-up potential. The ScaleUp Growth Index® gets you better prepared to undertake the next stage of your scale-up journey. You can use the Index to compare yourself with peers and track your progress as you implement your plans.

In addition, every applicant will be entitled to an optional initial infrastructure assessment at no charge and with no obligation by managed cloud and infrastructure services firm Cogeco Peer 1, the Enterprise Cloud & Infrastructure Services Technology Partner for the Great British Scaleup programme.

In addition, every applicant will be entitled to an optional initial infrastructure assessment at no charge and with no obligation by managed cloud and infrastructure services firm Cogeco Peer 1, the Enterprise Cloud & Infrastructure Services Technology Partner for the Great British Scaleup programme.

There are 4 workshop slots available on each day. To nominate yourself or a company you know, just fill in the Nomination Form on the TechMarketView website here by Wednesday 31st January 2018. There is no charge to participate, nor any obligation to follow through on the outcomes.

If you have any queries about the Great British Scaleup programme, please drop an email to gbs@techmarketview.com.

Posted by UKHotViews Editor at '06:00'

TechMarketViews’s theme for 2018 is “Breaking the Boundaries” which fits neatly with what we expect to see in UK Business Process Services (BPS) next year.

TechMarketViews’s theme for 2018 is “Breaking the Boundaries” which fits neatly with what we expect to see in UK Business Process Services (BPS) next year.

IP led services of BPaaS and platform based BPS are already breaking down barriers between BPS providers and enterprise software and application services players. Partnering is becoming an ever-common feature with suppliers and buyers increasingly moving away from a traditional outsourced relationship towards one based on shared risk and reward, pursuing mutually agreed outcomes. Consulting and automation technologies are breaking the boundaries of the front, middle and back offices, allowing processes to be redesigned and integrated throughout an organisation.

We see specifically the following factors playing out in 2018:

Brexit - A ‘glass half-full’ for BPS? - At a very minimum the Government will need new services dealing with immigration, customs, trade and agriculture. These services will need to be scoped and procured very quickly and will lean heavily on SITS providers to make this happen. This provides the opportunity for suppliers to bring ‘ideas to the table’ and contribute to solving some of these challenges.

Partnering replaces outsourcing - the move to strategic BPS - Relationships between suppliers and buyers continue to evolve with new commercial and operating models becoming prevalent. Relationships are less about outsourcing and more about creating genuinely transformational partnerships.

The maturing of Intelligent Automation - Consulting companies and BPS players are partnering with and acquiring capability across a range of technologies to develop Intelligent Automation ecosystems. As the technology matures you can expect to see greater consolidation and integration between consulting capability, RPA and AI. An integrated approach offers a genuinely transformational environment.

‘Virtual BPO’ - a game changer for UK BPS - Combining strategic consulting expertise and intelligent automation technologies will lead to the creation of ‘virtual BPO’ players – a potential game changer for BPS. ‘Virtual BPO’ has no legacy of labour intensive operating models with which to contend and can offer those clients who are ready for it a ‘blank sheet of paper’ for process redesign and delivery.

Moving beyond the ‘mega deal’ with commodity services - Mega-deals within the UK BPS market will continue to remain in short supply and a marketplace moving towards smaller opportunities, with shorter contracts and greater flexibility, will require a more productised approach. This is already causing an increased focus on suppliers developing replicable propositions that are fast to deploy, technically simple, commercially easy to understand and deliver clients quick value.

GDPR – the risk and the reward - Some organisations have made good progress and have been gearing up for years but there remain many that are not fully prepared. With many of the issues and permissions already automated and integrated within existing business processes there is huge opportunity for BPS providers to help.

More detail on these predictions can be found in the research note Business Process Services Predictions 2018. Readers who don’t have a subscription can contact Deb Seth for details.

Posted by Marc Hardwick at '09:06'

- Tagged:

bps

predictions

Every year TechMarketView chooses a theme that we believe sets the tone for the key trends that will determine the shape of the UK tech market and the fortunes of its players for the year and beyond.

Every year TechMarketView chooses a theme that we believe sets the tone for the key trends that will determine the shape of the UK tech market and the fortunes of its players for the year and beyond.

In 2016, we were all ‘Surfing the Waves of Disruption’ as competition—especially from new market entrants—forced the pace of digitalisation in traditional business enterprises, including the technology industry itself. Then in 2017, we were ‘Unlocking the Intelligence’; this theme acknowledged the complexity of true digitisation, involving the need to extract value from vast swathes of data created by both legacy and ‘change the business applications’.

In 2018, TechMarketView’s research focus remains on digital transformation, as we watch the story further evolve. Our theme – Breaking the Boundaries – emphasises that, as organisations progress with their digital transformation agendas, they can no longer be insular. They must look beyond their organisational boundaries in ways that they never have before. To fully embrace the possibilities presented by digitalisation, enterprises and government organisations – and the ICT suppliers supporting them - must throw off the shackles limiting progression. They must look beyond their own four walls when it comes to skills & resources, to data, to technology, and to innovation.

With digital skills & resources scarce, creative ways to pull in digital talent must be considered. As well as traditional routes such as partnering (which need to become more innovative), that might also include the use of public freelance marketplaces or crowdsourcing. Such an approach will also allow the flexibility and agility to respond to rapidly changing digital requirements.

In a digital world, organisations are increasingly harnessing the power of data for competitive advantage. So, drawing on data from external sources – particularly if it is difficult for others to access – that can be exploited to advance organisational aims, is highly valuable. Those sources might be public, but they might also come from forming innovative – even exclusive - partnerships with data owners.

Gone are the days when all technology assets sat within internal datacentres. As organisations increasingly adopt as-a-service models, there is an increasing reliance on technology in the cloud. The internet-of-things adds another dimension. Now, the source of more and more data is the raft of sensors sitting on everything from shipping containers to street lights. As organisations adapt their modus operandi to take advantage of the data collected, they become increasingly reliant on third party technology sitting in far harsher, and less secure, environments than a server room. The supplier ecosystem within which ICT suppliers reside will become increasingly complex – with more potential points of failure.

And when it comes to organisations ensuring that their use of technology is advancing at an appropriate pace, innovation can also come from ‘outside’. For suppliers and end user organisations alike, drawing on ideas from academia, hackathons, or innovation hubs to keep ahead of the competition is increasingly common and will grow in popularity.

Crucially, to cope with these changes, our view is that traditional organisations – both end users and technology firms - must push their own boundaries culturally, and adopt an entirely different mindset. ‘Breaking the Boundaries’ has wide implications and the theme will be picked up in each of our research streams throughout the year ahead.

Over the next few days, TechMarketView’s Research Directors will be publishing the 2018 Predictions for their research focus areas: Enterprise Software, Infrastructure Services, Application Services, Business Process Services and in the verticals, Public Sector and Financial Services. They will each explain how our 2018 - Breaking the Boundaries - research theme applies to their area of the market. Today, we start with insight from our BusinessProcessViews Research Director, Marc Hardwick: see Predictions 2018: Business Process Services.

Posted by Georgina O'Toole at '09:00'

- Tagged:

predictions

We are delighted to announce that the 2018 Evening with TechMarketView will take place on Thursday 13th September 2018.

We are delighted to announce that the 2018 Evening with TechMarketView will take place on Thursday 13th September 2018.

This will be our sixth annual TechMarketView Presentation and Dinner and in line with our 2018 theme we will of course be ‘Breaking the Boundaries’.

It promises to be another enjoyable evening of analyst insight and quality networking over drinks and dinner. The venue will once again be the magnificent Royal Institute of British Architects (RIBA) in Portland Place, London.

So, mark your calendars now and email tx2events to book your tickets.

If your organisation would be interested in sponsorship opportunities at the 2018 event please contact Tola Sargeant for further details of the various packages available.

We look forward to seeing you at RIBA in September 2018!

Posted by UKHotViews Editor at '08:48'

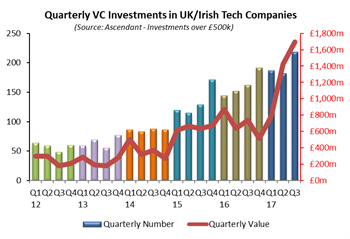

The steady increase in venture capital funding of UK and Irish technology companies continued in Q3 to set a new record, according to the latest data from corporate finance firm, Ascendant. During Q3, £1.69b was invested in 217 deals of more than £0.5m by 268 investors at an average deal size of £7.8m. This represents a 34% yoy increase in the number of deals and a 130% yoy increase in the total quarterly value.

The steady increase in venture capital funding of UK and Irish technology companies continued in Q3 to set a new record, according to the latest data from corporate finance firm, Ascendant. During Q3, £1.69b was invested in 217 deals of more than £0.5m by 268 investors at an average deal size of £7.8m. This represents a 34% yoy increase in the number of deals and a 130% yoy increase in the total quarterly value.

The latest edition of IndustryViews Venture Capital includes nearly 30 pages summarising significant venture funding in UK tech companies during the quarter.

Subscribers to the TechMarketView Foundation Service can download our latest quarterly review of UK software and IT services M&A in the just released report, IndustryViews Venture Capital Q3 2017.

For further information, please contact our Client Services team at info@techmarketview.com.

Posted by UKHotViews Editor at '07:40'

- Tagged:

funding

Wednesday 06 December 2017

Did you miss it? Last week, TechMarketView’s PublicSectorViews team published its annual review of the key trends impacting the UK public sector software and IT services market. The report gives our detailed analysis of how those trends will impact each of the subsectors – central government, local government, health, education, police and defence – through to the end of the decade.

Did you miss it? Last week, TechMarketView’s PublicSectorViews team published its annual review of the key trends impacting the UK public sector software and IT services market. The report gives our detailed analysis of how those trends will impact each of the subsectors – central government, local government, health, education, police and defence – through to the end of the decade.

We highlight a push-pull scenario. On the one hand, public sector organisations know they must control budgets in the short-term, as well as dealing with all sorts of uncertainty (accentuated by Brexit). On the other hand, they are conscious of the need to invest to attain increased efficiency and productivity for the longer-term. The impact will vary between subsectors, between service lines, and between suppliers. And with diversity of performance a continuing feature, the ‘winners’ in the market will be those that judge the market correctly, make sure they are in the right place at the right time, and offer the right mix of products and services for a sector’s needs.

UK Public Sector SITS Market Trends & Forecasts to 2020 is available for download by PublicSectorViews subscription clients now. If you are not sure if your organisation has a subscription or you would like to sign up, please contact dseth@techmarketview.com to find out more.

Posted by Georgina O'Toole at '22:36'

- Tagged:

publicsector

centralgovernment

localgovernment

markettrends

defence

education

police

health

forecasts

Wednesday 06 December 2017

For the most comprehensive understanding of the UK’s Business Process Services supplier landscape for next year and beyond, read BPS Supplier Prospects 2018.

The report looks at the leading players in the UK BPS market, and assesses what they will need to do to be successful from 2018 onwards. We also provide our view on the likely hurdles that will prevent suppliers reaching their potential in the short and mid-term.

The BPS market is going through a period of unprecedented change and all the major suppliers are having to adapt to the conditions. New greenfield and ‘big-ticket’ opportunities are in short supply at a time when intelligent automation is shaking up existing business models. Buyers are looking for partners who can deliver greater flexibility and demonstrate faster results.

If you are either a BPS provider looking to understand how the competition is gearing up for 2018, or a buyer of business services looking to evaluate potential suppliers, then this is the report for you.

If you would like to access the report (which is authored by Research Director, Marc Hardwick) and are not currently a subscriber to our Business Process Services research, please contact Deb Seth.

Posted by UKHotViews Editor at '20:00'

- Tagged:

RPA

Following the announcement of Castleton Technology’s H1 results earlier in November (see Castleton H1 revenue up 11%) and the more recent acquisition of Kinetic Information Systems Pty (see Castleton buys and builds down under), we took the opportunity to catch up with the company’s CEO, Dean Dickinson, and CFO, Haywood Chapman.

Following the announcement of Castleton Technology’s H1 results earlier in November (see Castleton H1 revenue up 11%) and the more recent acquisition of Kinetic Information Systems Pty (see Castleton buys and builds down under), we took the opportunity to catch up with the company’s CEO, Dean Dickinson, and CFO, Haywood Chapman.

The H1 results were strong but there is much more to come from the provider of software and managed services to the public and not-for-profit sectors (predominantly the social housing sector).

PublicSectorViews' subscribers can learn more about Castleton's current business, its future investmnet focus and its prospects in the latest resaerch note from TechMarketView's PublicSectorViews team - Castleton Technology: The post integration journey. If you are not yet a PublicSectorViews subscriber, or would like to find out if your organisation has access to the research, please contact Deb Seth.

Posted by Georgina O'Toole at '16:32'

- Tagged:

publicsector

localgovernment

software

managedservices

housing

There’s no shortage of discussion around the ‘why’ of digital enablement but given the limited revenue suppliers are generating from all things digital there is definitely a question about the ‘how’. At TechMarketView we hear time and again that one of the inhibitors of digital change is converting digital strategy into digital execution.

There’s no shortage of discussion around the ‘why’ of digital enablement but given the limited revenue suppliers are generating from all things digital there is definitely a question about the ‘how’. At TechMarketView we hear time and again that one of the inhibitors of digital change is converting digital strategy into digital execution.

The latest report from the ESASViews research stream, ‘Enabling digital: services shift execution and intelligent PSA’ examines the role of professional services automation in the 'how' of digital change. If you are a subscriber you can download the report here; if not Deborah Seth will happily provide you with subscription details.

Why is PSA software important? As more and more companies pivot towards services provision to improve customer engagement and open up growth potential via new business models as part of their digital change plans, they need the tools to help run those services-oriented operations. This means the addressable market for PSA is expanding beyond pure services organisations like technology and management consultancies, embracing the growing number of ‘services second’ companies. And as automation ought to go hand in hand with intelligence, PSA software is starting to embed machine intelligence capabilities, providing tangible business uses for these techniques.

The report provides insight into the high growth, expanding PSA market, how some of the notable PSA providers - Kimble Applications, Unit4, FinancialForce, NetSuite – are tackling it alongside dark horses like Atlassian, and how PSA has a role in delivering services-oriened digital change.

Posted by Angela Eager at '13:15'

- Tagged:

software

digital

machinelearning

During the summer, we gave subscribers to TechMarketView’s PublicSectorViews service sight of our UK public sector SITS market forecasts through to 2020. As always, we included a full breakdown of the numbers by vertical subsector (central government, local government, education, health, police and defence) and by SITS activity (infrastructure services, application services, business process services and software).

During the summer, we gave subscribers to TechMarketView’s PublicSectorViews service sight of our UK public sector SITS market forecasts through to 2020. As always, we included a full breakdown of the numbers by vertical subsector (central government, local government, education, health, police and defence) and by SITS activity (infrastructure services, application services, business process services and software).

Yesterday, we published our up-to-date, in-depth, analysis of the drivers and trends in each of those sectors. Importantly, we also give our view on how those trends are impacting the market. And how suppliers can best position themselves to take advantage of related opportunities.

So, from approaches to encouraging accelerated take up of emerging technologies, to trends in contract disaggregation, to the race for digital skills, you’ll find it all in UK public sector SITS Market Trends & Forecasts 2017… that’s if you are a PublicSectorViews subscriber, of course! You can also download a spreadsheet with all the market forecasts included.

If you would like to find out if your organisation has a subscription or talk about getting access, please contact Deb Seth to find out more. Deb would also be happy to discuss TechMarketView ‘Engagements’ – hearing from the analysts in person, gives you the opportunity to pick their brains and talk about how the trends in the market will affect your organisation in the year(s) ahead.

Posted by Georgina O'Toole at '09:34'

- Tagged:

publicsector

centralgovernment

localgovernment

defence

education

police

health

« Back to previous page