News

ERP and business software provider Infor is one of those large suppliers (c$2.8bn annual revenue) who operate under the radar of most organisations, and indeed other software suppliers, but it is emerging as a company competitors should not dismiss.

ERP and business software provider Infor is one of those large suppliers (c$2.8bn annual revenue) who operate under the radar of most organisations, and indeed other software suppliers, but it is emerging as a company competitors should not dismiss.

Having largely acquired its way to its current size (taking in big mid market ERP leaders like Lawson Software, SSA Global and Geac on the way but also dozens of other software suppliers of different types and sizes over the last decade or more), it had demonstrated its mastery of the acquisition process but not necessarily how to add substantial value. That all changed in late 2010 when former Oracle Charles Phillips took over as CEO, began to increase investment in R&D, and worked on a strategy to join its assets together to address the twin market demands of innovation and cloud services.

The Infor of today is different to the pre-2010 version and has undergone enough change that other software suppliers targeting the mid-market should be keeping tabs on it. Infor may not be a major threat yet, but it has assets in place and could catch some competitors unawares over the next few years.

Digital transformation throws everything – and every supplier – up in the air and there are no guarantees on what will land where, so it pays to be aware and reassess the competitive landscape. ESASViews subscribers can read our assessment of Infor in ‘Is Infor a serious threat in the enterprise software market’, which can be downloaded here. As usual, Deborah Seth can introduce you to our research services of you don’t already subscribe.

Posted by Angela Eager at '08:17'

- Tagged:

cloud

software

2015 should be an exciting year for the Financial Services industry and Software and IT Suppliers to the sector should expect to see another year of above market-average growth (notwithstanding potential banana skins provided by the forthcoming election and the effect of the recent slump in the oil price).

2015 should be an exciting year for the Financial Services industry and Software and IT Suppliers to the sector should expect to see another year of above market-average growth (notwithstanding potential banana skins provided by the forthcoming election and the effect of the recent slump in the oil price).

On our estimates, 2014 turned in a fairly good performance, with growth of 3.1%, but this was down on earlier expectations due to lots of planning and little delivery in many larger customers and continued price pressure. We now expect a hike in the growth rate, to 3.8%, spurred on by Cloud Services and a further high level growth rate in Business Process Services, despite Quindell’s recent problems.

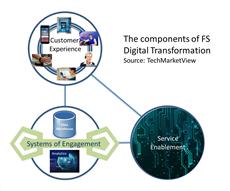

The sector is also particularly interesting as many of the components are in place for a more concerted move by the larger incumbent service providers towards a new operating model, with initiatives to improve customer experience, new Systems of Engagement and faster action in sorting out legacy systems. These companies will have to move more quickly as new competitors will be eager to eat their lunch.

FinancialServicesViews has published its Market Trends and Forecasts report, looking at these trends, giving our detailed forecasts for the years to 2017 and highlighting the main issues by subsector and by SITS activity. This report is available to stream subscribers here. If you are not yet a subscriber and want to know more, please contact Deb Seth of our Client Services team.

You can also access our recent FinancialServicesViews Supplier Landscape here. Happy Holiday reading!

Posted by Peter Roe at '17:05'

- Tagged:

saas

cloud

bpo

software

financialservices

infrastructure

banking

regulation

In 2014, tough battles were fought in the cloud (IaaS and PaaS) market. Frequent price drops and a rapid succession of product releases characterised the approach taken by the hyperscale cloud players. Amazon Web Services, an early mover, has established itself as the biggest large-scale provider of IaaS in the UK – and in other

In 2014, tough battles were fought in the cloud (IaaS and PaaS) market. Frequent price drops and a rapid succession of product releases characterised the approach taken by the hyperscale cloud players. Amazon Web Services, an early mover, has established itself as the biggest large-scale provider of IaaS in the UK – and in other Western country markets besides. However, both the market and the industry are evolving rapidly and change is afoot. Microsoft launched its IaaS offering (which includes Azure Virtual Machines and Azure Virtual Network) via the Azure business in April 2013. It’s already made an impact on the market and this is just the start.

Western country markets besides. However, both the market and the industry are evolving rapidly and change is afoot. Microsoft launched its IaaS offering (which includes Azure Virtual Machines and Azure Virtual Network) via the Azure business in April 2013. It’s already made an impact on the market and this is just the start.

In this new research note we take a look at the ‘size and shape’ of Azure in the UK and its prospects for the enterprise cloud market.

Subscribers to InfrastructureViews can read the note here: Microsoft Azure: Gaining ground in the IaaS battle.

If you do not currently subscribe and would like to, please contact Deb Seth.

Posted by Kate Hanaghan at '08:46'

- Tagged:

iaas

research

infrastructure

Subscribers to the TechMarketView Foundation Service can download the latest edition of IndustryViews Venture Capital, our quarterly round-up of activity in the UK software and IT services venture capital scene.

Subscribers to the TechMarketView Foundation Service can download the latest edition of IndustryViews Venture Capital, our quarterly round-up of activity in the UK software and IT services venture capital scene.

Besides our regular summary of interesting angel, seed and institutional funding transactions, we catch up again with professional investor, Tim de Vere Green, founder of early-stage technology investment firm Origin Capital, to hear about his successes – and, needless to say, disappointments – over the past year.

Posted by UKHotViews Editor at '08:21'

Shares in Atos rose almost 5% following the announcement that it would be acquiring Xerox’s global ITO business for up to $1.1bn.

Shares in Atos rose almost 5% following the announcement that it would be acquiring Xerox’s global ITO business for up to $1.1bn.

It’s clear that this is a good deal for Atos. It expects the business to be immediately accretive to earnings and deliver a 10% margin in the first year. Part of this is going to be achieved by consolidating and integrating the business into Atos’ managed services operations.

Xerox meanwhile has suffered for its 'Services ambitions' for too long (see here and work back), and so a decision to either get bigger or get smaller had to be made.

Subscribers to TechMarketViews research services can read our analysis of the deal here.

Posted by John O'Brien at '16:28'

- Tagged:

bpo

manda

ito

Thursday 18 December 2014

When we published last year’s UK Public Sector SITS Market Trends & Forecasts report, we sought to differentiate between ‘what Government says it is going to do’ (particularly at the Cabinet Office level) and ‘what the purchasing organisations will actually do’. This is still relevant, but less so. Just over a year later, our view is that the actions of the Cabinet Office have changed the way that those across Whitehall think. A new way of procuring and managing ICT services and software is now firmly embedded across central government departments and agencies. Moreover, it has penetrated beyond the walls of Whitehall and into the broader public sector. Certain ways of behaving are now a given.

When we published last year’s UK Public Sector SITS Market Trends & Forecasts report, we sought to differentiate between ‘what Government says it is going to do’ (particularly at the Cabinet Office level) and ‘what the purchasing organisations will actually do’. This is still relevant, but less so. Just over a year later, our view is that the actions of the Cabinet Office have changed the way that those across Whitehall think. A new way of procuring and managing ICT services and software is now firmly embedded across central government departments and agencies. Moreover, it has penetrated beyond the walls of Whitehall and into the broader public sector. Certain ways of behaving are now a given.

Many of the actions taken to change the Government’s approach to ICT procurement and delivery have helped deliver substantial efficiency savings. However, as we highlighted in our analysis of the Autumn Statement (see Autumn Statement: Efficiency through Transformation), the low hanging fruit has been picked, particularly in Whitehall. Further savings will be far harder to achieve. And increasingly we will see organisations compelled to invest in digital technologies, and the associated transformation of their organisations, processes and systems, if they are to continue making savings in the broader budget. We will also see the spotlight increasingly focused on the frontline of public service delivery i.e. in the wider public sector.

Subscribers to TechMarketView’s PublicSectorViews stream, can now download UK public sector SITS market trends & forecasts (December 2014). In the report we provide our detailed view of the market trends in all areas of the UK public sector - central government, local government, education, health, police and defence. And we consider how those trends will impact the different areas of the SITS market - from infrastructure services to application services, from business process services to software – through the General Election period and beyond. If you are not yet a subscriber, then... why not? Please contact Deb Seth to find out more.

Posted by Georgina O'Toole at '15:16'

- Tagged:

publicsector

markettrends

forecasts

Thursday 18 December 2014

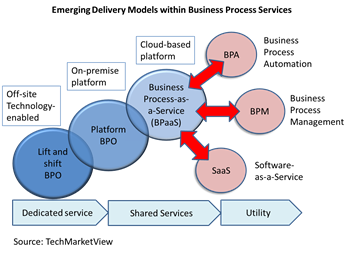

The end of 2014 marks an inflexion point for the UK Business Process Services (BPS) market. Following several years of healthy growth in areas like public sector shared services and insurance, we now see more uncertainties and risks on the horizon.

The end of 2014 marks an inflexion point for the UK Business Process Services (BPS) market. Following several years of healthy growth in areas like public sector shared services and insurance, we now see more uncertainties and risks on the horizon.

The 2015 General Election and recent supplier scandals could impact both public and private sector. There are also deflationary implications from the move to business process automation (BPA) and other tools that shift services from traditional manual to new digital and ‘self-service’ channels.

As a result, we are now taking a slightly more cautious view on growth for the UK BPS market over the next few years, anticipating compound annual growth (CAGR) of 6.4% from 2013 to 2017, when the market will be worth £8.34bn.

Mid-single digit growth is still pretty healthy, and will ensure BPS remains the fastest growing horizontal sector across the UK SITS market (see UK SITS Market Trends and Forecasts 2014). The fundamentals remain sound across public and private sectors seeking help standardising and transforming business processes, re-platforming, and removing cost from operations.

What has changed in 2014 is organisations looking at ways to free up spend to invest in digital technologies and services (social, mobile, analytics and cloud) in what we call the ‘Race for Change’. The needle will move further on this path in 2015 as organisations attempt to ‘Join the Dots’, seeking ways to connect and extract real business value from these new technologies, gadgets and devices.

Within the BPS market ‘Joining the Dots’ is about how you join up these myriad systems and processes; automate low value administrative activities; drive actionable insights out of all the ‘big data’ and support your customers through the journey to digital. There are many outcomes on this journey, but the single biggest one is enabling a step change in the customer experience.

These are big market shaping trends that will create both challenges to suppliers as well as many new opportunities over the coming years. There will be pockets of much stronger growth too in areas like Platform BPO, Business Process Automation, and Business Process as-a-Service (BPaaS) that offer more flexible and cost effective ways of consuming BPS.

Subscribers to TechMarketView’s BusinessProcessViews research stream can read where to place your bets on UK BPS growth in our new report UK Business Process Services Market Trends & Forecasts 2014. The accompanying forecasts data and charts can be found here.

If you’re not yet a subscriber, please contact Deb Seth (deseth@techmarketview.com) who will be happy to help.

Posted by John O'Brien at '11:13'

- Tagged:

bpo

bps

Wednesday 17 December 2014

Many of you know, or might even belong to, the Worshipful Company of Information Technologists – the 100th City Livery Company. I’ve been a Freeman since the 1990s and became a Liveryman a few months back.

Many of you know, or might even belong to, the Worshipful Company of Information Technologists – the 100th City Livery Company. I’ve been a Freeman since the 1990s and became a Liveryman a few months back.

I was therefore delighted to accept an invitation from the new Master – Nic Birtles – to address the next Business Lunch to be held @ 12.15pm on Wednesday 11th Feb 15 at Saddlers Hall – the magnificent mansion house a few yards from St Paul’s Cathedral.

Amazingly this will be for a record-breaking third time that I have addressed a WCIT Business Lunch. The first was in 2000 just after the dot.com bubble had burst. The second was in 2003 when the IT sector in the UK was seriously on its knees and soon after I had given my “IT’s All Over Now?” speech at the inaugural Prince’s Trust ICT Leaders Dinner. Nic has particularly asked speakers to address future trends for the industry and I intend to do that in a Year 2000, Year 2015 and Year 2030 format or “Where we were, Where we are and Where we are going”.

The lunch is open to all and, of course, all the proceeds are to the WCIT. You can see more details and book at Business Lunch Booking

Posted by Richard Holway at '14:53'

Wednesday 17 December 2014

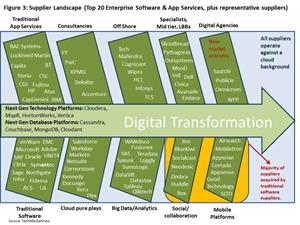

The word tripping off the tongues of most suppliers these days is ‘digital’. It means different things to different people but one thing is clear – supplier activity is driven by the race for change around digital transformation. The latest report from the ESASViews research stream - Enterprise Software & Application Services Supplier Landscape 2014 – assesses the progress of the leading suppliers to the UK market and the critical digital success factors.

Speed, approaches and progress vary widely but there are some common themes. For suppliers, digital progress revolves around the intelligent provision of the technologies and services needed to enable digital transformation. The stakes are being raised however, because it is now also about the convergence of the various technologies (cloud, mobile, big data/analytics and social/collaboration), which is akin to keeping bucking broncos under control. This is driving diversity of performance - not just between suppliers but within suppliers. Another prominent theme is the criticality of providing bridges between legacy and digital environments – which aligns with the TechMarketView theme for 2015: Joining the Dots.

Speed, approaches and progress vary widely but there are some common themes. For suppliers, digital progress revolves around the intelligent provision of the technologies and services needed to enable digital transformation. The stakes are being raised however, because it is now also about the convergence of the various technologies (cloud, mobile, big data/analytics and social/collaboration), which is akin to keeping bucking broncos under control. This is driving diversity of performance - not just between suppliers but within suppliers. Another prominent theme is the criticality of providing bridges between legacy and digital environments – which aligns with the TechMarketView theme for 2015: Joining the Dots.

With traditional ESAS areas in a low/no growth rut, suppliers have to get digital strategies right in order to remain relevant in the market. The challenge is gauging the pace and matching investments, commercial models and the product and service business mix so that revenue continues to flow from traditional business areas, while digital-related revenues ramp up.

Subscribers to ESASViews can download the report here. If you do not take our services and would like to know more about them Deborah Seth will be happy to help.

Posted by Angela Eager at '08:46'

- Tagged:

software

rankings

applications

digital

As 2014 draws to a close, we reveal our analysis on the trends that will impact the UK Infrastructure Services Market over the next three years.

While the “Race for Change” will continue to impact both the market and industry, our theme for next year - “Joining the Dots” - brings the opportunities around digital transformation into focus. In infrastructure services this about how you create better customer and end user services; how you ‘Join the Dots’ between old world legacy systems and new world services; how you bring clouds together; and how you make systems work better together through advanced automation. This is a huge opportunity for suppliers.

In "UK Infrastructure Services Market Trends & Forecasts" (authored by Research Director, Kate Hanaghan), we define and explore the key Market Shaping Trends, namely:

-

The digital “state of mind

-

”IT’s “parallel universes”

-

The end user journey to empowerment

-

The slow-burning cloud

The infrastructure services market is large and accounts for c40% of the total UK Software and IT Services market. However, it is struggling to grow. Our forecast model helps suppliers pinpoint the areas of opportunity to 2017, and understand the areas that are in decline.

Subscribers to our popular InfrastructureViews research stream can read the report in full here: UK Infrastructure Services Market Trends and Forecasts 2014-15.

If you would like to become a subscriber, please contact Deb Seth

Posted by UKHotViews Editor at '08:59'

- Tagged:

research

infrastructure

Last week we launched TechMarketView’s theme for 2015, Joining the Dots. This theme reflects our belief that we will see a massive increase in the number things connected to other things and/or the internet. ‘Joining the dots’ will offer significant opportunities to suppliers of software and IT services to the UK market – though financial rewards will not be quite so obvious or swift.

Last week we launched TechMarketView’s theme for 2015, Joining the Dots. This theme reflects our belief that we will see a massive increase in the number things connected to other things and/or the internet. ‘Joining the dots’ will offer significant opportunities to suppliers of software and IT services to the UK market – though financial rewards will not be quite so obvious or swift.

TechMarketView’s research directors have recently presented their predictions for 2015 around this theme for their respective market segments and sectors: Infrastructure Services; Enterprise Software & Application Services; Business Process Services; Public Sector software and IT services; and Financial Services Sector software and IT services. I have extracted the essence of these predictions into some closing thoughts. The highlights are shown below, but subscribers to the TechMarketView Foundation Service can read the full screed here.

‘Mobile’ is a given – think ‘micro-mobile’

Although ‘transforming the customer experience’ through mobile devices has barely got underway, attention is already shifting to micro-mobile devices – basically, sensors – to take this to the next level. The combination of even smaller and ever cheaper technology, faster and more pervasive networks, advanced visualisation software, and massive data repositories and sophisticated analysis tools, will elevate the ‘customer experience’ to something previously only imagined in the realms of science fiction, if not fantasy.

New technology alone cannot join all the dots

Legacy back-end systems developed years (if not decades) ago were never designed to process the volume of transactions – and the ‘richness’ of transactions – initiated from millions of mobile devices let alone billions of micro-mobile devices. No amount of new ‘front-end’ technology will fix this as it is the cause of the problem. Bullets will need to be bitten – sooner, rather than later.

‘Digital’ is a symphony, not a solo

The ‘digital revolution’ has spurred the creation of a new breed of consultancy – the so-called ‘digital media agency’ – which tries to bridge the gap between IT design and marketing advisory. Some are start-ups, purpose built for the role. Many are simply rebrands of existing web design companies and PR agencies.

This mix of skills is generally not found in traditional IT systems integrators or for that matter, in traditional marketing and advertising agencies - no existing player is yet able to go truly ‘solo’ in the digital world. Therefore we are seeing a coming together of old world and new world through commercial partnerships and full-on acquisitions. Both come with risk, especially when the companies involved are of significantly different size and culture.

The more dots you join, the greater the risk of disconnection

The sense of urgency in ‘joining the dots’ – and the inherent complexity in doing so – leaves organisations open to increased risk. We have seen this many times before with legacy, mission-critical systems failing after a ‘routine’ software upgrade (no names, no pack drill). These risks are multiplied exponentially as you interconnect more systems, old and new. Radically different development and testing technologies and processes will need to be established to reduce the risk of system collapse and to make service interruptions all but invisible to its users. This is indeed rocket science.

Switch to automatic

In order to join all the (appropriate) dots without proportionally increasing the number of people involved in joining them, you just have to automate wherever you can. Automation simplifies complexity and eliminates the mundane. But only to a point.

The CIO shall reign forever and ever (Hallelujah!)

The role of the CIO is certainly not dead. Each turn of the technology screw makes the ‘IT ecosystem’ intrinsically more complex, not simpler. Someone has to actually ‘join the dots’ and that’s the CIO. By the way, someone also has to carry the can when it all goes horribly wrong; that’s the CIO too!

Show me the money

Please, do try to make some money out of all of this. Both the software industry and the IT services industry are undergoing transformative changes in commercial engagement models (e.g. ‘pay as you go’, ‘outcome-based’) and product/service delivery models (notably ‘cloud’), with dramatic - in some cases catastrophic - consequences for revenue growth and profitability. By definition there can only be one winner with ‘first mover advantage’. Everybody else needs to stick to business basics and (re)learn how to turn revenue into profit and profit into cash.

Posted by Anthony Miller at '09:58'

- Tagged:

predictions

TechMarketView’s theme for 2015 of Joining the Dots is particularly appropriate for the Financial Services sector where the competitive landscape is being transformed as technology advances, devices proliferate and as more and more data is available.

TechMarketView’s theme for 2015 of Joining the Dots is particularly appropriate for the Financial Services sector where the competitive landscape is being transformed as technology advances, devices proliferate and as more and more data is available.

Established companies need to join up the dots more quickly so that their huge IT investment can provide the type of customer experience and informed decision making that customers increasingly expect. At the same time they must deliver the cost savings, efficiencies and control demanded by the competitive and regulatory environments. In 2015 we expect faster progress– otherwise incumbents will see their markets taken over by nimble newcomers who have joined the dots in new and imaginative ways.

In 2015 FinancialServicesViews will be exploring how suppliers can support sector participants, old and new, as they deploy all this new technology to build, or hold, market positions. We expect to see the following key themes:

- Focus on customer experience: Customers demand seamless, joined-up communications across multiple channels with their FS provider. Getting this right drives higher revenues and lower cost due to channel shifting and straight-through-processing.

- A move to “Systems of Engagement”: Replacing siloed databases and enterprise applications with “joined-up” systems enables the use of Big Data and analytics techniques and improved operational productivity

- Faster rationalisation of system portfolios: Big FS players will improve agility, improve response times and lower cost by further reducing the number of systems (and suppliers) that they use.

- Greater use of cloud: To deliver change and growth, FS players need more agile, flexible and cost-effective infrastructure. Cloud Services are the answer and 2015 will be their year.

- Greater focus on value add by the FS players: This will drive greater use of standardised software and OpenSource, with more and more functions delivered “as-a-Service”, increasingly by third-parties.

Subscribers to FinancialServicesViews and MarketViews can read about these Predictions in full here: Predictions 2015: Financial Services. You can also join the debate on Twitter using #TMVJoiningtheDots or #TMVPredictions2015.

If you do not currently have access to the FinancialServicesViews research stream and would like to, please contact Deb Seth.

Posted by Peter Roe at '08:00'

- Tagged:

outsourcing

cloud

financialservices

predictions

bigdata

Thursday 11 December 2014

Software and IT services (SITS) suppliers have been developing ‘Smart Cities’ propositions for some time. But while some have made progress in Continental Europe, opportunities in the UK have proved elusive. This is not because of lack of interest - the Smart City ‘agenda’ has been on the table for many years in the UK. But a combination of political, economic and technological factors has recently changed the discussions from the hypothetical to the possible.

In this research note we outline the Smart City strategies of three leading SITS suppliers – IBM, HP and Microsoft – and consider when they might start to see ‘Smart Cities’ contracts generating meaningful revenues in the UK.

PublicSectorViews subscribers can download the research - Smart Cities: SITS supplier propositions - here. If you don’t yet subscribe to our PublicSectorViews research stream and you’d like to know more, please contact Deb Seth for details.

Posted by Michael Larner at '16:14'

- Tagged:

publicsector

strategy

digital

smartcities

Thursday 11 December 2014

In the UK public sector, though the General Election will bring uncertainty and interrupt momentum in the early part of 2015, most organisations – whether Whitehall or in the broader public sector – are aware that more radical transformation is required if they are to continue delivering public services while constraining spending. As a result, during 2015, we will see an ‘invest to save’ ICT mentality penetrating more and more public sector organisations. However, this will all be happening in the context of an increasingly complex supplier and technology landscape, exacerbated by the fast introduction of new digital technologies. So, the Government (whoever is in power) will spend 2015 revisiting some of the assumptions put in place over the past few years, particularly in terms of commercial and procurement models.

In the UK public sector, though the General Election will bring uncertainty and interrupt momentum in the early part of 2015, most organisations – whether Whitehall or in the broader public sector – are aware that more radical transformation is required if they are to continue delivering public services while constraining spending. As a result, during 2015, we will see an ‘invest to save’ ICT mentality penetrating more and more public sector organisations. However, this will all be happening in the context of an increasingly complex supplier and technology landscape, exacerbated by the fast introduction of new digital technologies. So, the Government (whoever is in power) will spend 2015 revisiting some of the assumptions put in place over the past few years, particularly in terms of commercial and procurement models.

TechMarketView’s 2015 theme ‘Joining the Dots’ will be extremely relevant in the public sector in 2015. It will be a year defined by public sector organisations trying to seek out the best approaches to enable increased collaboration – ‘joining the dots’ - between public sector organisations, with external organisations (including suppliers and the third sector), and with citizens. Finding ways to enable the sharing of data, as well as opening up Government data, to allow this ‘joining up’ to occur, will be a particular feature of the year. Here we outline what we think will happen.

The General Election & the age of austerity: Austerity continues. Transformation is required across the public sector as budgetary cuts bite harder. But more creativity is required to cut costs while improving public services. The General Election will bring uncertainty; public sector organisations will be reluctant to embark on new initiatives and this will bring more frustration for suppliers. But in the second half of 2015, focus will need to return to the ‘digitisation of government’ and the continuing move to eliminate Government silos through the joining up of people, processes and systems.

The re-rise of the systems integrator: Over the past year, we have witnessed a step change in attitude towards the large systems integrators. From collectively being on the ‘naughty step’, the Cabinet Office has accepted that they require suppliers with deep knowledge of the public sector to guide them on what will be a difficult transformational journey over the next few years. In the world of ‘digital’, systems integrators will be the bolt that holds everything together and helps the public sector ‘Join the Dots’. The large SIs are taking this approach to developing their business outside of Whitehall as well – using their integration skills to, for example, take data analytics capabilities to the table and open up new opportunities.

SMEs as subcontractors: SMEs will still have a significant role to play in the public sector. Indeed, digital transformation requires input from smaller firms with different capability sets. However, as projects scale up, i.e. move on from the pilot or proof-of-concept stages, or require more complex integration with other systems, larger providers will be asked to take SMEs in as subcontractors. This will increase the focus in 2015 on how to ‘join the dots’ between large SITS companies and SMEs and improve their working (and contracting) relationships.

Procurement & commercial models will evolve: The procurement environment in the public sector is renowned for being complex: multiple frameworks, diverse supplier arrangements and various contracting models. Suppliers and customers are often flummoxed by the array of options. Digital technologies – social, mobile, analytics, and cloud – are set to call into question some of the procurement and commercial methods currently in favour. During 2015, we expect public sector organisations to carefully consider the procurement and commercial structures currently in place and start to favour those that fit with the long-term view of the digital transformation journey, while offering the most effective route to ‘joining the dots’ between different technologies and between numerous ICT services providers.

Increased collaboration a necessity, not a luxury: ‘Joining the Dots’ between public sector organisations, even within the same region, has been one of the most problematic issues faced by the Government. Barriers to moving away from the historic silo mentality have been political, cultural and legal, rather than technical. Attempts to implement formal shared service arrangements have suffered from a lack of organisational buy-in and have not progressed as fast as hoped. The one ‘ray of light’ has been the Troubled Families programme, which by focusing on the complex needs of one citizen group, has made considerable strides in a short space of time. There now seems to be acceptance that collaboration initiatives from 2015 onwards need to have specific goals to drive momentum.

Subscribers to PublicSectorViews can read about these Predictions in full here: Predictions 2015: Public Sector SITS. If you do not currently have access to the PublicSectorViews research stream and would like to become a subscriber, please contact Deb Seth.

Posted by Georgina O'Toole at '09:06'

- Tagged:

publicsector

predictions

Thursday 11 December 2014

The staid HR market has been shaken up by bold SaaS HR newcomers and Fairsail is one of those market shakers. Despite its size, it is not afraid of going up against the giants and better-funded competitors.

The staid HR market has been shaken up by bold SaaS HR newcomers and Fairsail is one of those market shakers. Despite its size, it is not afraid of going up against the giants and better-funded competitors.

It is not hard to grow on a rising tide and from a low base but revenue growth of c150% over the last financial year still stands out (recognised revenue not billings or run rate). Reflecting the level of business activity, staffing levels have tripled over the past year and CEO Adam Hale says the company could grow faster but it wants to keep cash under control. Prudent growth is refreshing from a pure SaaS company and bodes well for sustainable, and hopefully profitable, performance.

For LBB’s, financial metrics are only part of the mix. Fairsail has several ingredients in its secret sauce. It is dedicated to HR so can concentrate on usability and depth, and is tightly focussed on the mid market of 500 to 5000 employees. The smart part of its market position is that it brings an affordable solution to multi-national mid-sized companies, an expanding target market that is poorly catered for. Businesses are waking up to the need to manage their workforces strategically. Finding that traditional HR systems are becoming more unfit for purpose, they are turning to the new entrants who take a Systems of Engagement-type approach to HR.

For LBB’s, financial metrics are only part of the mix. Fairsail has several ingredients in its secret sauce. It is dedicated to HR so can concentrate on usability and depth, and is tightly focussed on the mid market of 500 to 5000 employees. The smart part of its market position is that it brings an affordable solution to multi-national mid-sized companies, an expanding target market that is poorly catered for. Businesses are waking up to the need to manage their workforces strategically. Finding that traditional HR systems are becoming more unfit for purpose, they are turning to the new entrants who take a Systems of Engagement-type approach to HR.

Fairsail is a small player in a competitive market so its needs friends. Building on the Salesforce.com Force.com platform puts it within a technology ecosystem but it has also quadrupled its own partner ecosystem over the past year, working with a range of suppliers from specialist cloud integrators such as CloudSense, to larger SI’s. With a gang of SaaS-savy SI friends Fairsail’s opportunities will open up.

Posted by Angela Eager at '08:49'

- Tagged:

software

lbb

Thursday 11 December 2014

We didn’t think we’d get excited about the processing of expenses claims, but that is exactly how we felt after meeting Little British Battler (LBB) Software Europe last month. The team at Software Europe, led by CEO Neil Everatt, are passionate about their five cloud-based products, which each support a traditionally paper-heavy, manual back-office process and transform it into an efficient, smartphone enabled service. That passion is contagious.

We didn’t think we’d get excited about the processing of expenses claims, but that is exactly how we felt after meeting Little British Battler (LBB) Software Europe last month. The team at Software Europe, led by CEO Neil Everatt, are passionate about their five cloud-based products, which each support a traditionally paper-heavy, manual back-office process and transform it into an efficient, smartphone enabled service. That passion is contagious.

Software Europe started life in 1989 reselling other peoples’ software before reinventing itself in 2000 as a ‘cloud technology solution innovator’. Its flagship product, the online expenses platform Expenses, was launched in 2002. But the real breakthrough came when it entered the UK healthcare market in 2009. Today the NHS is Software Europe’s biggest customer. It now has 155 NHS organisations as clients (c65% market share) and derives just over half its revenue from the sector.

The Lincoln-based SME has a good spread of customers in other sectors too, including household names such as Fitness First, Manchester United Football Club and River Island Clothing Co. But it is Software Europe’s work in the healthcare sector - where it’s Expenses software has a bi-directional interface with the NHS’ payroll system the Electronic Staff Record (ESR) - that really sets it apart at the moment. One of Software Europe’s aims for the future is to diversify further into other sectors, including the local government, education and legal markets.

The Lincoln-based SME has a good spread of customers in other sectors too, including household names such as Fitness First, Manchester United Football Club and River Island Clothing Co. But it is Software Europe’s work in the healthcare sector - where it’s Expenses software has a bi-directional interface with the NHS’ payroll system the Electronic Staff Record (ESR) - that really sets it apart at the moment. One of Software Europe’s aims for the future is to diversify further into other sectors, including the local government, education and legal markets.

Indeed, one thing that Software Europe is not short of is ambition. It is, for example, building on work it already does for Friends Life by launching a new business process service, Expedite, which will see it take on the expenses claims process from the scanning of paper receipts through to the payment of claims. It’s also on the lookout for acquisitions, investment and channel partners as it continues on its quest for further growth with the ultimate aim of becoming ‘a global provider of cloud technologies’.

Posted by Tola Sargeant at '07:30'

- Tagged:

software

health

lbb

Wednesday 10 December 2014

At TechMarketView, we see 2015 being all about ‘Joining the Dots’ across the UK SITS market, as suppliers grapple to make sense of, and monetize, investments in an ever expanding number of devices, data and gadgets in use in the consumer and business worlds.

At TechMarketView, we see 2015 being all about ‘Joining the Dots’ across the UK SITS market, as suppliers grapple to make sense of, and monetize, investments in an ever expanding number of devices, data and gadgets in use in the consumer and business worlds.

Within the UK business process services (BPS) market ‘Joining the Dots’ is also about the joining up of people and processes with all things digital: business process platforms (BPPs); Business Process-as-a-Service (BPaaS); Business Process Automation (BPA) and Software-as-a-Service (SaaS), all enabled by the cloud, that help drive better customer engagement and new business opportunities.

Suppliers need to adapt, but there are big challenges in doing so as they move from a back office view of the world to one leading from the front, focused on the overall customer experience.

In 2015, we expect to see the following:

-

Customer experience will be a key value driver

End customers will demand their BPS suppliers offer them the same or better customer experience they get in the consumer world when using social media, mobile, analytics and cloud (SMAC) technologies.

-

Business Process Automation (BPA) will be a 'must-have'

A growing number of the leading BPS providers will adopt BPA tools and services. Failure to do so will leave many at risk of losing out on new outsourcing opportunities, or contract renewals.

-

More SaaS partnerships for ‘out-of-the-box’ BPaaS

Business Process-as-a-Service (BPaaS) is coming of age as the number of tie-ups between leading BPS players and enterprise Software-as-a-Service (SaaS) leaders increases. This will accelerate further in 2015.

-

BPS ‘Internet of Things’ (IoT) trials will emerge

Although we are some way off a truly autonomous IoT-enabled world, things are moving forwards at a fast rate, and we expect 2015 to be the year BPS providers dip their toes in the water.

-

The General Election will make life harder in UK Public Sector

There will be a marked slowdown in public sector BPS deals as the General Election causes a hiatus in decision making, impacting Government-focused suppliers.

Subscribers to BusinessProcessViews can read about these Predictions in full here: Predictions 2015: Business Process Services

If you do not currently have access to the BusinessProcessViews research stream and would like to, please contact Deb Seth.

Posted by John O'Brien at '07:15'

- Tagged:

bps

predictions

Wednesday 10 December 2014

LBB Quickheart is one of the smallest ‘battlers’ we have met. Founded in 2000 and led by CEO Mark Sinclair, it has just seven employees. However, it was recently reinvented. The Company started life as a design consultancy for the financial services industry. But in 2009, Quickheart had its own ‘annus horribilis’, hit by the sudden death of its founder and CEO and by the Credit Crunch. 85% of the company’s revenues were for design consultancy in banks; the tap was suddenly turned off.

LBB Quickheart is one of the smallest ‘battlers’ we have met. Founded in 2000 and led by CEO Mark Sinclair, it has just seven employees. However, it was recently reinvented. The Company started life as a design consultancy for the financial services industry. But in 2009, Quickheart had its own ‘annus horribilis’, hit by the sudden death of its founder and CEO and by the Credit Crunch. 85% of the company’s revenues were for design consultancy in banks; the tap was suddenly turned off.

With some quick decisions to make, the management team focused on the company’s core strength: its IPR in transformational customer journeys. The decision was taken to try and leverage that IPR in a sector that was turning to ‘self serve’ (i.e. channel shifting) and where Quickheart could establish a ‘create once; sell many times’ solution. They identified the NHS & Social Care market in the knowledge that the Government’s personalisation agenda, and in particular the Care Act (due to come into force in April 2015), would have a big impact on local authorities.

The last five years have been all about developing a suite of products that will go live next year. The solution is based on the premise that local authorities will be faced with huge additional demands (many more social care assessments, additional auditing of care account expenditure). Quickheart’s self-service solution will relieve some of that pressure. Impressively, the £3.5m development costs have been funded entirely from partnerships with visionary authorities, including Birmingham City Council. The next part of the journey for Quickheart will be to scale up and increase its customer base. That’s where partners like Agilisys (see Agilisys adds string to digital platform bow), Atos and Capita come in. They could well help start Quickheart’s revenue pulse racing.

The last five years have been all about developing a suite of products that will go live next year. The solution is based on the premise that local authorities will be faced with huge additional demands (many more social care assessments, additional auditing of care account expenditure). Quickheart’s self-service solution will relieve some of that pressure. Impressively, the £3.5m development costs have been funded entirely from partnerships with visionary authorities, including Birmingham City Council. The next part of the journey for Quickheart will be to scale up and increase its customer base. That’s where partners like Agilisys (see Agilisys adds string to digital platform bow), Atos and Capita come in. They could well help start Quickheart’s revenue pulse racing.

More to follow for subscribers in our Little British Battlers report out in a few weeks’ time.

Posted by Georgina O'Toole at '07:10'

- Tagged:

localgovernment

software

socialcare

Wednesday 10 December 2014

This is the bold tag-line of business process automation (BPA) player Rimilia, whose technology is used by household names like Britivic, Veolia and Securitas to speed up the collection of cash into their business.

This is the bold tag-line of business process automation (BPA) player Rimilia, whose technology is used by household names like Britivic, Veolia and Securitas to speed up the collection of cash into their business.

What we liked about Rimilia is its laser-like focus on cash allocation, an important, and yet often overlooked part of finance. Rimilia claims a world class rate of automation, helped by ‘self-learning’ technology that works to continuously improve the process.

Launched in 2008 by former utilities services managers, Chris McGibbon (CEO) and Steve Richardson (Commercial Director), they saw first-hand the problems businesses have allocating cash from invoices and payments. These are often small sums, from small suppliers, that can get misallocated or lost within the accounts department, and cause a huge headache for the accounts receivable (AR) and control and compliance teams.

Rimilia’s technology works by taking a data feed from the sales ledger of most ERPs, to match cash receipts to outstanding invoices, with or without a remittance advice. It can also reconcile the cash with any bank using standard protocols. It employs ex-games developers to give its software an edge in customer user experience - an increasingly important driver for enterprise adoption.

Rimilia isn’t short of ambition. Its SaaS technology appeals to clients with a global footprint and already serves customers in Europe and the US. Its vision is to create a ‘paradigm shift’ in the way the finance process operates. Predictive analytics is going to play an important role helping customers predict who pays on time, who takes longer, and who is likely to not pay at all.

serves customers in Europe and the US. Its vision is to create a ‘paradigm shift’ in the way the finance process operates. Predictive analytics is going to play an important role helping customers predict who pays on time, who takes longer, and who is likely to not pay at all.

This is about Rimilia helping its customers manage their exposure to risk. But just as importantly, it’s about developing customer insights and new business opportunities. Rimilia should really benefit aligning its solutions to these customer outcome drivers.

More to follow for subscribers in our Little British Battlers report out in a few weeks’ time.

Posted by John O'Brien at '07:10'

- Tagged:

saas

bpa

Wednesday 10 December 2014

We recently presented at NGA HR’s annual customer conference, speaking to c400 mid-sized UK HR and payroll software and services customers on the trends and opportunities within their market.

We recently presented at NGA HR’s annual customer conference, speaking to c400 mid-sized UK HR and payroll software and services customers on the trends and opportunities within their market.

The move to ‘the cloud’ was high on the agenda at the event, as was the shift to digital technologies that can better enable the business. HR itself is going through major changes as a result of demographic shifts, the growing skills shortage and tech savvy ‘millennials’ entering the workplace. This is all driving innovation within HR technology, and investment in areas like talent management, training, and analytics.

Our presentation explored these disruptive themes and the implications for both HR professionals and suppliers of HR software and services. Subscribers to TechMarketView's BusinessProcessViews research service can read the analysis and insights in HR Services - avoiding the traps and pitfalls in the digital world.

If you're not yet a subscriber, please contact Deb Seth (dseth@techmarketview.com) who will be happy to help.

Posted by John O'Brien at '07:00'

- Tagged:

saas

bpaas

hr

bps

Did you know you can now embed a Sponsored Post directly within the main body of the UKHotViews e-newsletter and have it appear on TechMarketView’s website for seven days, as well as in our Twitter feed?

UKHotViews is arguably the UK’s most respected, authoritative newsletter for informed opinion and analysis on what’s happening in the UK Software and IT Services (SITS) market.

Considered a must read for anyone with ‘skin in the SITS game’, UKHotViews enjoys a high calibre readership of some 20,000 decision makers in UK tech. It reaches a broad spectrum of companies from the largest SITS players to emerging SMEs; as well as key players from the investment community, press, government and CIOs.

Engage with our audience...

Now you can insert your article – 250 words provided by you along with images and links – into UKHotViews to get your message across to our audience.

A Sponsored Post is an ideal way to raise your profile and brand awareness; attract customers, partners or investment; promote white papers and events, or recruit the best calibre applicants.

If you'd like further details on Sponsored Posts, or to request an advertising brochure, contact Helen McTeer in our client services team. If you're quick there's still time to take advantage of our 2014 Special Offer on Sponsored Posts too!

Posted by UKHotViews Editor at '09:04'

Our theme for 2015 - Joining the Dots - resonates deeply throughout Enterprise Software & Application Services (ESAS). Enterprises are becoming overwhelmed with distributed applications, digital processes and events, and by the multitude of devices and sensors proliferating under the IoT banner. As standalone assets, their value is limited - but join them together and the scope to do business differently and better explodes. The opportunity for suppliers in 2015 is dealing with the resulting complexity on behalf of overwhelmed enterprises and joining these many disparate assets to release their potential and deliver digital transformation.

Our theme for 2015 - Joining the Dots - resonates deeply throughout Enterprise Software & Application Services (ESAS). Enterprises are becoming overwhelmed with distributed applications, digital processes and events, and by the multitude of devices and sensors proliferating under the IoT banner. As standalone assets, their value is limited - but join them together and the scope to do business differently and better explodes. The opportunity for suppliers in 2015 is dealing with the resulting complexity on behalf of overwhelmed enterprises and joining these many disparate assets to release their potential and deliver digital transformation.

In 2015 we expect to see to activity in the following areas:

Digital silos will drive demand for bridging capabilities

Enterprises will look to ESAS suppliers for the bridges to join the silos of digital technologies that have already proliferated.

Interaction bridges will break the barrier between Systems of Record and Systems of Engagement

Legacy SoR and modern SoE are mutually dependent so smart suppliers will concentrate on interaction bridges. Holding the interaction bridge creates a positon of strength.

Suppliers have to consider ‘mobile first’ and even ‘mobile only’ scenarios

‘Cloud first’ starts to cede ground to ‘mobile first’ or even ‘mobile only’. ‘Mobile first’ highlights the need for different types of experiences - but that requires a design approach which is a world away from traditional enterprise applications.

Analytics-as-a-Service, Self-service BI, and conversational analytics become core business tools

Business users have been given tantalizing glimpses of what could be but the data fog keeps closing over. We see a doubling down on extracting value and ease of consumption.

Suppliers will differentiate themselves by offering alternative commercial models

Commercial models have failed to keep pace with technology and delivery methods so suppliers will need to design innovative commercial models to create a point of differentiation.

Enterprises and suppliers turn to DevOps to meet aggressive delivery timelines

DevOps will command more thought time because its role in efficiency and faster application development-to-operation cycles fits well with the realities of digital transformation.

Subscribers to ESASViews can read these Predictions in full in Predictions 2015: ESASViews.

If you do not currently have access to the ESASViews research stream and would like to, please contact Deb Seth.

Posted by Angela Eager at '08:01'

- Tagged:

software

predictions

applications

emapsite has already survived adverse conditions, having launched its online geospatial data service during the dot com implosion. The combination of the launch of its geographic web services and the establishment of the core of the current management team in 2004-6 provided the foundations for subsequent growth. Over the past 5 years, growth has averaged 15% per year, all organic.

emapsite has already survived adverse conditions, having launched its online geospatial data service during the dot com implosion. The combination of the launch of its geographic web services and the establishment of the core of the current management team in 2004-6 provided the foundations for subsequent growth. Over the past 5 years, growth has averaged 15% per year, all organic.

The company hosts and provides location data through an enterprise-grade cloud platform managing data from over 30 different sources, including Ordnance Survey and open data, enabling on-demand access to location content. Customers combine geospatial data with other data sources to assist for example urban planning, site location (for a wind farm) or resource management. Geographic data is a valuable component within asset management, monitoring and maintenance, and risk assessment. With risk, for example, developers, asset owners and insurers can evaluate properties or sites in relation to flood and other perils, providing insight for investment decisions, risk pricing and options for mitigation.

Managing and maintaining geospatial data is challenging, which makes emapsite’s promise of up-to date data, continuous availability, ISO certification and licence management appealing for organisations looking for input to improve analysis and decision making.

Managing and maintaining geospatial data is challenging, which makes emapsite’s promise of up-to date data, continuous availability, ISO certification and licence management appealing for organisations looking for input to improve analysis and decision making.

Much of emapsite’s revenue comes from the land and property and asset management markets but it also has a footprint in other large, data hungry sectors including energy and infrastructure, public sector, financial services and insurance. Although geospatial data is a niche market, there is plenty of growth opportunity.

In today’s environment where data-informed decision making is increasingly valued, we are seeing more data-driven start-ups looking to monetise data assets - but emapsite is already an established provider. With enterprises recognising the value of data in all its many forms, the prospects are opening up for this Little British Battler.

Posted by Angela Eager at '08:00'

- Tagged:

software

CommonTime is punching above its weight in the world of mobile app development. One of our ‘Fifth Dimension’ of Little British Battlers (LBBs), CommonTime impressed us with its ‘code free’ mobile app development platform, mDesign; rapid revenue growth and high quality customer base.

CommonTime is punching above its weight in the world of mobile app development. One of our ‘Fifth Dimension’ of Little British Battlers (LBBs), CommonTime impressed us with its ‘code free’ mobile app development platform, mDesign; rapid revenue growth and high quality customer base.

Founded in 1995, CommonTime has come a long way from its roots in Lotus Notes email. Today the Derby-based SME and its c50 employees are known for their ability to take complex business workflows and turn them into feature-rich, cross platform mobile apps quickly and simply. mDesign’s rich data reporting capability and ease of integration with existing systems is also helping it to win business against much larger rivals, including US HQ’d Kony.

CommonTime’s sweet spot is mid-sized to large enterprises with more than 50 app users. Its 55 customers range from small housing associations to large corporates and it’s particularly strong in the construction and healthcare sectors. Notable clients include Carrillion, TK Maxx, and Calderdale & Huddersfield NHS Trust, which is using mDesign to mobilise a range of processes within the Trust.

This high quality customer base is underpinning CommonTime’s growth. Revenue from mDesign grew by more than 100% in 2013 and the SME is on track to grow revenue by a similar amount in 2014. Around two-thirds of its revenue comes from software licenses with the rest from custom development services, so it also enjoys a high percentage of recurring revenue.

This high quality customer base is underpinning CommonTime’s growth. Revenue from mDesign grew by more than 100% in 2013 and the SME is on track to grow revenue by a similar amount in 2014. Around two-thirds of its revenue comes from software licenses with the rest from custom development services, so it also enjoys a high percentage of recurring revenue.

Looking ahead, CommonTime sees huge potential in the healthcare sector over the next couple of years and is excited by developments such as the Internet of Things and BYOD, which are also driving demand. In common with other of our LBBs, the main challenges will be finding the required funds and scaling up quickly in order to address those opportunities.

More to follow for subscribers in our Little British Battlers report out in a few weeks’ time.

Posted by Tola Sargeant at '07:30'

- Tagged:

mobility

lbb

In 2008, LBB Surevine’s founders - Stuart Murdoch (now CEO) and John Atherton (now CTO) - were working as independent consultants for a UK central government client. With their expertise in secure software engineering, they recognised a business problem. How do you encourage collaboration on sensitive information about security threats in a highly bureaucratic environment? Surevine was born. They took the principles of social technology into an organisation with the most demanding security requirements. At the time, former UK Government CIO, Ian Watmore praised the solution as “the best example of intelligent use of social technology for internal collaboration across the whole of government”.

In 2008, LBB Surevine’s founders - Stuart Murdoch (now CEO) and John Atherton (now CTO) - were working as independent consultants for a UK central government client. With their expertise in secure software engineering, they recognised a business problem. How do you encourage collaboration on sensitive information about security threats in a highly bureaucratic environment? Surevine was born. They took the principles of social technology into an organisation with the most demanding security requirements. At the time, former UK Government CIO, Ian Watmore praised the solution as “the best example of intelligent use of social technology for internal collaboration across the whole of government”.

Off the back of this initial success, Surevine won business from other departments with top-level information sensitivities. It now designs, builds and supports secure collaboration environments for a number of other UK central government clients. Their solutions enable a real-time response to cyber threats and incidents. Surevine has since attracted further praise, this time from the Prime Minister, who described Surevine as “stopping the bad stuff, while allowing the good stuff”. One of the company’s biggest references is CISP (Cyber Information Security partnership), which it developed alongside the Cabinet Office (and was described by the Financial Times as Secure Facebook for Cyber Threats).

The secret of Surevine’s success appears to be providing an intuitive and engaging User Experience which actively promotes participation and enables strong cyber threat situational awareness. One of Surevine’s ‘tricks’ has been to ensure an even balance of employees; for every one recruit with a strong central government/defence/intelligence background, it makes sure it recruits one with a web development mindset. There’s still room to grow in the central government market. But Surevine has also identified opportunities in other verticals and geographies. Already there is interest from blue light organisations, the finance sector (another industry where certain types of sharing have to be controlled), and Five Eyes countries (defence information sharing). There’s much to play for.

The secret of Surevine’s success appears to be providing an intuitive and engaging User Experience which actively promotes participation and enables strong cyber threat situational awareness. One of Surevine’s ‘tricks’ has been to ensure an even balance of employees; for every one recruit with a strong central government/defence/intelligence background, it makes sure it recruits one with a web development mindset. There’s still room to grow in the central government market. But Surevine has also identified opportunities in other verticals and geographies. Already there is interest from blue light organisations, the finance sector (another industry where certain types of sharing have to be controlled), and Five Eyes countries (defence information sharing). There’s much to play for.

More to follow for subscribers in our Little British Battlers report out in a few weeks’ time.

Posted by Georgina O'Toole at '09:05'

- Tagged:

socialmedia

lbb

security

OSMO gets its name from ‘osmosis’ - an analogy for the company who’s technology helps to move financial data seamlessly from one organisations’ accounting system to another. One of our ‘Fifth Dimension’ of Little British Battlers (see here), OSMO impressed us with its innovative approach to a long-standing problem among finance departments - how to efficiently access relevant financial data on customers and partners.

OSMO gets its name from ‘osmosis’ - an analogy for the company who’s technology helps to move financial data seamlessly from one organisations’ accounting system to another. One of our ‘Fifth Dimension’ of Little British Battlers (see here), OSMO impressed us with its innovative approach to a long-standing problem among finance departments - how to efficiently access relevant financial data on customers and partners.

Led by CEO and founder Oliver Chadwick, with a background in insurance and credit risk, Chadwick saw the problem first hand, that to get this information both supplier and customer were bogged down by form filling, rekeying data, e-mail attachments and printing off documents. This led to huge inefficiency, frustration and cost for both sides.

'OSMOs' are the solution Chadwick came up with. These system connectors work with over 240 accounting packages and are installed in minutes. They non-invasively trawl through the customers’ accounting system, collect the relevant financial data and transfer it to the suppliers’ financial system. OSMOs are able to do this by making use of open database connectivity (ODBC) within accounting systems, allowing it to collect any sales ledger, purchase ledger or management accounts data securely and confidentially.

Since gaining Close Brothers as its first customer in 2005, OSMO has added other high-quality clients like Experian, Credit Safe, Lloyds Banking Group and most recently one of the world’s largest e-invoicing networks. We’re told other big names are on the cards for 2015.

Like other players in the business process automation (BPA) space, OSMO has huge potential to expand its reach, targeting specific business outcomes for its customers. OSMOs help to reduce risk through supply chain assurance and fraud prevention. It increases the speed of cash collection within the business and helps financial institutions improve their commercial banking services, particularly to SMEs.

More to follow for subscribers in our Little British Battlers report out in a few weeks’ time.

Posted by John O'Brien at '09:04'

- Tagged:

lbb

bpa

TechMarketView’s theme for 2015 is Joining the Dots. In our view, there is a huge opportunity for suppliers to help organisations make sense of the vast array of data, devices, connectors, and sensors that is out there, bringing them together to create new possibilities for both businesses and consumers. It’s more than just an “Internet of Things”; it’s about fully exploring and exploiting this highly complex blend of technology, processes and people.

TechMarketView’s theme for 2015 is Joining the Dots. In our view, there is a huge opportunity for suppliers to help organisations make sense of the vast array of data, devices, connectors, and sensors that is out there, bringing them together to create new possibilities for both businesses and consumers. It’s more than just an “Internet of Things”; it’s about fully exploring and exploiting this highly complex blend of technology, processes and people.

In Infrastructure Services specifically, Joining the Dots is also about how you create better customer and end user services; how you ‘Join the Dots’ between old world legacy systems and new world services; how you bring clouds together; and how you make systems work better together through advanced automation. There are many other examples besides, and throughout 2015 we will be exploring these in the InfrastructureViews research stream.

In 2015, we expect to see the following:

- Cloud management will become more established: As enterprises increasingly adopt cloud, the need for these to be better managed will rise, and we think 2015 will be an important year in the evolution of supplier capabilities.

- Hyperscale cloud players will penetrate the enterprise further: AWS, Azure and Google will all move

deeper into enterprise accounts.

This will be pay off for some of

the activities they have

undertaken in 2014.

- There’ll be more pressure on suppliers to up their automation game: We expect suppliers to come under greater pressure to increase investment in technology to automate infrastructure services. The outcome is not just cheaper but better infrastructure services.

- Demand will rise for better quality workforce support: Suppliers will be increasingly called upon to ‘Join the Dots’ between technology, processes and culture to provide more workforce-led end user support services.

- Infrastructure will become an early beneficiary of digital transformation: Infrastructure services firms will find themselves at the forefront of some of the initial investments as organisations assess to what degree their existing infrastructure can support digital plans (e.g.Computacenter wins Post Office modernisation deal).

Subscribers to InfrastructureViews can read about these Predictions in full here Predictions 2015: Infrastructure Services.

If you do not currently have access to the InfrastructureViews research stream and would like to, please contact Deb Seth.

Posted by Kate Hanaghan at '07:51'

- Tagged:

cloud

predictions

infrastructure

Homes across the UK need to be assessed for their energy efficiency whenever they are sold or let and since early 2013 energy suppliers are required to deliver energy efficiency measures to domestic customers. Consequently, there are armies of assessors visiting properties around the country to see what work is required and what grants can be provided. To support these assessors by providing location-aware data on-site and enabling reports to be prepared without additional re-work, Little British Battler eTech, has developed a cloud-based system running on iPads.

Homes across the UK need to be assessed for their energy efficiency whenever they are sold or let and since early 2013 energy suppliers are required to deliver energy efficiency measures to domestic customers. Consequently, there are armies of assessors visiting properties around the country to see what work is required and what grants can be provided. To support these assessors by providing location-aware data on-site and enabling reports to be prepared without additional re-work, Little British Battler eTech, has developed a cloud-based system running on iPads.

Solihull-based, 130-strong eTech’s systems are currently used by c.8000 assessors, and five of the six leading energy suppliers. Customers generally pay on a per assessment basis for the SaaS system and eTech has strictly maintained the standardisation of its core system to leverage scale benefits across its user base. eTech has also built significant expertise in the focused market of energy assessment, where it currently generates around 90% of its revenue.

Jim and David Driver, the CEO and CCO of eTech are now taking their disciplined approach into the mortgage valuation and residential surveying sectors, supplementing management with domain experts and building a system to enable chartered surveyors to access additional data and appropriate comparisons to produce more accurate valuations. This market offers substantial potential, particularly as large valuation firms look to renew their infrastructure and improve productivity.

Jim and David Driver, the CEO and CCO of eTech are now taking their disciplined approach into the mortgage valuation and residential surveying sectors, supplementing management with domain experts and building a system to enable chartered surveyors to access additional data and appropriate comparisons to produce more accurate valuations. This market offers substantial potential, particularly as large valuation firms look to renew their infrastructure and improve productivity.

With rapid growth in energy assessment volumes, eTech more than doubled revenue to nearly £6m in the year to March 2014, producing double-digit pre-tax margins. With the opportunity in mortgage valuations the company looks capable of continuing to deliver high rates of growth and profitability. The clear focus on specific opportunities, with domain expertise and a disciplined approach to the service portfolio looks like a winning formula for eTech.

Posted by Peter Roe at '07:37'

- Tagged:

cloud

mobility

lbb

bigdata

Last December we revealed that the TechMarketView Theme for 2014 would be Race for Change. It proved to be very apposite. Indeed the Pace of Change is even faster now as almost every HotViews post testifies. If you are not up there with the winners in that Race for Change, your future is in serious doubt. Just like our many other themes over the years, we will continue to use it as they all seem to become even more relevant with time.

Last December we revealed that the TechMarketView Theme for 2014 would be Race for Change. It proved to be very apposite. Indeed the Pace of Change is even faster now as almost every HotViews post testifies. If you are not up there with the winners in that Race for Change, your future is in serious doubt. Just like our many other themes over the years, we will continue to use it as they all seem to become even more relevant with time.

TechMarketView’s Theme for 2015 is Joining the Dots.

There has been a proliferation of new terms and buzz words. SMAC, Internet of Things (IoT), Wearables, Big Data, Connected World, “Cloud first, Mobile first” (to quote Microsoft), Smart this/Smart that. What is clear is that in the future we will see a massive increase in the number things connected to other things and/or the internet – they will range from the ubiquitous mobile phone (now >7billion is use – exceeding the world’s population) through smart watches/health bands, cars, meters, heating controls, fridges etal…and maybe even pills. Nobody really knows how many ‘things’ we might be talking about in the fullness of time but we are talking hundreds of billions.

Then we look at all the data that we – and all the things we use - are creating. The vast majority of this is currently local, certainly in silos and little used. But the future potential of using that data in a ‘joined up’ manner is so huge as to be game-changing. For example, the collection of personal health data on a continuous basis could not only help to alert us all to health issues whilst they are still treatable but, collectively, could help us understand how to prevent them happening in the first place.

Whether in the Public or Private Sectors, making systems work together is an established, albeit early, trend. Renewing your car road tax is a good example of joining individuals, vehicles, insurance, MOTs, banking etc together in a seamless (and to give the DVLA credit) efficient experience.

Of course, all this creates massive challenges too. Not least of these are privacy, confidentiality, security, cyber terrorism, availability (both by geography and ensuring that the poorest also have access) and the stability/suitability of legacy systems often crafted decades ago.

But, as ever, there are massive opportunities too. TechMarketView’s research clients are predominately involved in Software and IT Services. The ‘things’, the datasets, the systems all need to be joined together. What a huge opportunity our clients will have in Joining the Dots!

Over the next week the Research Directors of each of TechMarketView’s streams will be presenting their Predictions for 2015 and how Joining the Dots will affect their sectors - starting with Kate Hanaghan's Predictions for Infrastructure Services. In the New Year, we will announce how the theme will be incorporated into our research Programme for 2015. And throughout 2015, including at our TechMarketView Conference in Sept 15, you will be hearing much more about Joining the Dots

Posted by Richard Holway at '00:00'

Wednesday 03 December 2014

In the Budget 2014 (see Budget 2014: shift from Whitehall cuts to local reform), it was revealed that the Chief Secretary to the Treasury has asked the Minister for the Cabinet Office to set out “an ambitious new efficiency programme to deliver savings from 2016-17 and across the next Parliament, in time for the Autumn Statement 2014.” Very little was said in George Osborne’s lunchtime statement on public sector efficiency savings, apart from the fact that more would be sought via continued control of public spending. However, dig into the supporting documentation and the supplementary publication from the Cabinet Office, ‘Efficiency & Reform in the next Parliament’ (also published today), and there’s a little more to get your teeth into.

In the Budget 2014 (see Budget 2014: shift from Whitehall cuts to local reform), it was revealed that the Chief Secretary to the Treasury has asked the Minister for the Cabinet Office to set out “an ambitious new efficiency programme to deliver savings from 2016-17 and across the next Parliament, in time for the Autumn Statement 2014.” Very little was said in George Osborne’s lunchtime statement on public sector efficiency savings, apart from the fact that more would be sought via continued control of public spending. However, dig into the supporting documentation and the supplementary publication from the Cabinet Office, ‘Efficiency & Reform in the next Parliament’ (also published today), and there’s a little more to get your teeth into.

‘Efficiency & Reform in the next Parliament’ outlines the Governmnent's efficiency savings targets through to 2020. There are some ambitious targets and, with the low-hanging fruit picked, Government will now be increasingly reliant on its ability to drive forward radical transformation. Moreover, that transformation will involve organisations across central government and the wider public sector. ‘Digital’ government (more specifically Government-as-a-Platform) remains at the heart of the Cabinet Office’s transformation agenda. In this research note, TechMarketView Director, Georgina O’Toole, takes a look at the proposals and the implications for software and IT services suppliers. PublicSectorViews subscribers can download the research here - Autumn Statement 2014: efficiency through transformation. If you are not yet a subscriber, please contact Deb Seth to find out more.

Posted by Georgina O'Toole at '17:44'

- Tagged:

publicsector

centralgovernment

localgovernment

education