News

Tuesday 27 September 2022

If, as is widely accepted, business confidence is a good indication of future performance, the result of TechMarketView's recent survey suggests that the UK software and IT services (SITS) market is set to demonstrate significant resilience in the years ahead.

We asked each of our attendees at our TechMarketView Evening last Thursday – see Oh what a night! – to complete a short online survey once they were sat at their tables for dinner. Considering that, by that time, conversation was flowing, the atmosphere was buzzing, and wine was being consumed, we are delighted that around a quarter of our guests participated (52 respondents).

We asked each of our attendees at our TechMarketView Evening last Thursday – see Oh what a night! – to complete a short online survey once they were sat at their tables for dinner. Considering that, by that time, conversation was flowing, the atmosphere was buzzing, and wine was being consumed, we are delighted that around a quarter of our guests participated (52 respondents).

Our intention was to get a feel for the mood amongst those in the tech industry. Judging by the answers we received, optimism abounds. During the evening, TechMarketView expressed the view that, while “we all drink from the same trough”, and the UK SITS market will not go unscathed during a period of severe economic turbulence, the market would remain resilient. Why? Because digital, data and technology is now so ingrained in the operations of every organisation. And because technology investment has the potential to provide answers to many of the challenges that Government and Corporates are facing.

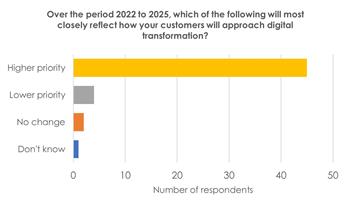

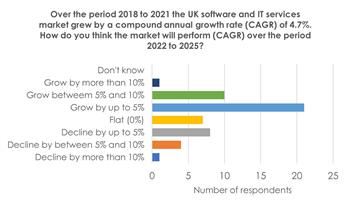

It seems our respondents agreed. In answer to our question, “Over the period 2022 to 2025, which of the following will most closely reflect how your customers will approach digital transformation?”, a staggering 45 respondents (87%) believe that digital transformation is set to become a higher priority for their customers over the next three years. This belief was also reflected in the answer to our question, “Over the period 2018 to 2021 the UK software and IT services market grew by a compound annual growth rate (CAGR) of 4.7%. How do you think the market will perform (CAGR) over the period 2022 to 2025?” The vast majority of respondents believe that the UK SITS market will grow over the next three years (32 respondents, 62%), with only 13 (25%) predicting a CAGR decline over that period.

It seems our respondents agreed. In answer to our question, “Over the period 2022 to 2025, which of the following will most closely reflect how your customers will approach digital transformation?”, a staggering 45 respondents (87%) believe that digital transformation is set to become a higher priority for their customers over the next three years. This belief was also reflected in the answer to our question, “Over the period 2018 to 2021 the UK software and IT services market grew by a compound annual growth rate (CAGR) of 4.7%. How do you think the market will perform (CAGR) over the period 2022 to 2025?” The vast majority of respondents believe that the UK SITS market will grow over the next three years (32 respondents, 62%), with only 13 (25%) predicting a CAGR decline over that period.

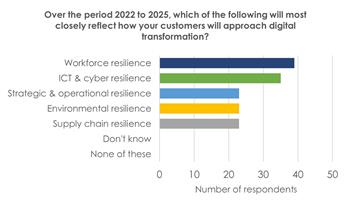

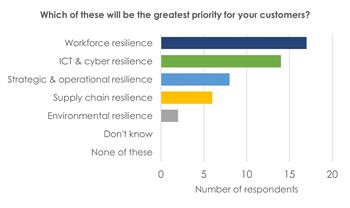

Our Building Resilience theme (launched last November) continues to resonate. All respondents agreed that investment in resilience will be a strong driver of this growth. And, according to the answer to our question, “Over the period 2022 to 2025, which of the following will most closely reflect how your customers will approach digital transformation?”, all types of resilience are set to be pursued (workforce, ICT & cyber, supply chain, strategic & operational). However, the answer to our question, “Which of these will be the greatest priority for your customers?, highlights that workforce resilience and ICT & cyber resilience, are front and centre of many people’s minds.

Our Building Resilience theme (launched last November) continues to resonate. All respondents agreed that investment in resilience will be a strong driver of this growth. And, according to the answer to our question, “Over the period 2022 to 2025, which of the following will most closely reflect how your customers will approach digital transformation?”, all types of resilience are set to be pursued (workforce, ICT & cyber, supply chain, strategic & operational). However, the answer to our question, “Which of these will be the greatest priority for your customers?, highlights that workforce resilience and ICT & cyber resilience, are front and centre of many people’s minds.

Indeed, it’s “workforce resilience” that was a running theme when we gave our respondents free rein to make any other observations, they had about the medium-term future of the UK SITS market. Eight out of ten of those who had more to say on the matter highlighted the skills challenge faced by our industry. Various suggestions were forthcoming – the need for investment and growth in entry level opportunities, the need for greater exploration of offshore options, supplier consolidation (M&A) to optimise skills and resources, a return to impact sourcing (or socially responsible outsourcing), and the use of emerging tech to reduce reliance on human interaction and engagement. This is a topic that we will return to many times in the months ahead.

Indeed, it’s “workforce resilience” that was a running theme when we gave our respondents free rein to make any other observations, they had about the medium-term future of the UK SITS market. Eight out of ten of those who had more to say on the matter highlighted the skills challenge faced by our industry. Various suggestions were forthcoming – the need for investment and growth in entry level opportunities, the need for greater exploration of offshore options, supplier consolidation (M&A) to optimise skills and resources, a return to impact sourcing (or socially responsible outsourcing), and the use of emerging tech to reduce reliance on human interaction and engagement. This is a topic that we will return to many times in the months ahead.

Many thanks to all those who attended our TechMarketView Evening and who took part in the survey. TechMarketView will be publishing an update to our UK SITS Market Forecasts within the next couple of months.

Posted by Georgina O'Toole at '14:30'

- Tagged:

forecasts

survey

outlook

digital+transformation

buildingresilience

TMVE2022

Tuesday 27 September 2022

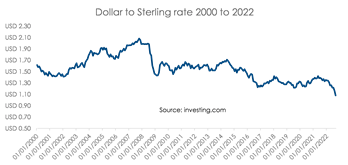

Sterling fell yesterday to a record low against the US dollar, as markets reacted negatively to the new government's tax-cutting 'mini-budget' last Friday. Although it is showing signs of slight recovery in early trading this morning, the direction of travel for the pound is far from certain.

Sterling fell yesterday to a record low against the US dollar, as markets reacted negatively to the new government's tax-cutting 'mini-budget' last Friday. Although it is showing signs of slight recovery in early trading this morning, the direction of travel for the pound is far from certain.

So, what does the currency turmoil mean for UK tech businesses?

The fall in sterling will have short-term benefits for those companies with revenue streams derived in currencies which are currently strong, particularly the US dollar. Their top line will grow relative to the cost base (assuming that is priced in pounds), which should improve short-term competitiveness and profitability.

Indeed we have seen this effect in recent months in the FTSE 100, which has a number of such companies (although admittedly few in the tech space). The FTSE 100 has outperformed most major indices in developed markets, with many of its biggest players exporting in dollars, although of course many of these are commodity-related companies which have seen a spike in demand.

But at some point, the benefit of a weaker sterling will be outweighed by the downsides, namely erosion of consumer and business purchasing power in the domestic market through higher imported inflation and ultimately weaker confidence. A currency is typically strong when risks in that domestic market are perceived to be low, leading to inflows of investment. Regrettably for the UK right now, the converse appears to be true.

For UK software and IT services (SITS) companies in particular, whilst they may benefit from sales in dollars, much of their cost base is labour, which is increasingly expensive due to the shortage of skilled workers who are feeling the pinch from higher inflation. So, any benefit from translation of overseas revenue streams into sterling is being partly offset by wage increases to retain staff. Similarly, tech companies producing a product using components sourced overseas or those who are intensive consumers of energy will face rising input costs.

The Bank of England has indicated it will move to reassure markets if needed. Its next rate setting meeting is not planned until November but there are suggestions it could move earlier, by increasing interest rates before then. This would affect all businesses with variable debt repayments, further squeezing their finances.

Ultimately, no matter how strong their overseas revenues, tech companies will be affected by a domestic downturn. Those first to feel the impact are likely to be those whose product or service is seen as discretionary.

A final observation is the possible impact on UK tech plc as a whole, where we are likely to see an increase in the number of acquisitions of domestic tech companies. We have seen this already with a number of big names subject to takeover discussions in recent months, although a falling currency is not the only factor at play. And fundamental weakness in the economy and the seeming lack of a coherent economic plan are both likely to make shareholders more willing to accept a takeover offer.

These are interesting times for the UK economy but regrettably for all the wrong reasons. Most of us - investors, businesses or consumers - will be hoping that sterling can stage a recovery soon.

Posted by Tania Wilson at '09:46'

- Tagged:

markets

macro

Saturday 17 September 2022

A month ago, it looked as though the worst of the 2022 tech stock rout might be over. US inflation data for July came in below expectations, easing fears of further sharp hikes in US interest rates.

A month ago, it looked as though the worst of the 2022 tech stock rout might be over. US inflation data for July came in below expectations, easing fears of further sharp hikes in US interest rates.

But market relief was short-lived. The Federal Reserve (Fed) made it clear that the fight against inflation was far from finished, in a late August policy speech. Tech growth stocks - particularly vulnerable to rising interest rates due to the need to more heavily discount future earnings - started falling....

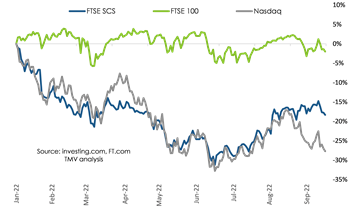

.... and after August inflation data for the US came in higher than predicted last week, they tumbled some more. It is near certain now that we will see a sizeable rate rise at the next Fed monetary policy meeting this coming week. The tech-heavy NASDAQ closed on Friday 27.7% down year-to-date (YTD), wiping out its August rally.

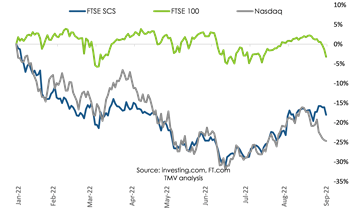

Stock markets globally went into reverse on the gloomy US news. Here in the UK, the FTSE Software and Computer Services (SCS) index, which had been enjoying a mini-revival on the back of takeover discussions for a number of its major players, slid as well. It closed on Friday 18.3% down YTD.

One characteristic of recent economic developments has been the negative outlook on Sterling. Indeed it is now at its lowest point against the US Dollar for 37 years. This is partly because of the perceived resilience of the US economy, partly because the Fed acted faster and more decisively than the Bank of England to tame inflation - and partly because the UK economy is simply seen by investors as weak and lacking direction.

But whatever the causes of sterling's troubles, the broad-based FTSE 100 has been a beneficiary, with revenue streams of many of its players denominated in dollars. But the UK economy is flashing recession warning signs. The latest came on Friday with the announcement of an unexpectedly large fall in August retail sales. And that, combined with US inflation difficulties, sent the FTSE 100 downwards too. It closed 2.0% down YTD.

All in all, the global outlook is miserable. This week has made it clear that what happens in the US impacts markets everywhere in a very significant way. If the US, with its greater resilience to the global energy crisis, cannot bring inflation under control without avoiding a recession, then that is bad news indeed for the rest of us.

All eyes are back on the Fed for their rate-setting announcement. The stakes are high that they make the right call.

Posted by Tania Wilson at '18:15'

- Tagged:

markets

macro

Managed Services Provider, Claranet, recently announced three acquisitions in Europe, all of which support its long-term plan of portfolio expansion and growth.

Managed Services Provider, Claranet, recently announced three acquisitions in Europe, all of which support its long-term plan of portfolio expansion and growth.

In France, it has acquired Pictime Group (annual revenue nearly €27m), which manages critical applications and infrastructure in retail and healthcare. In Germany and Switzerland, Claranet has acquired AddOn AG and AddOn Schweiz AG, which provide strategy, consulting, managed services, and training with a focus on Microsoft, SAP, and AWS. And finally, in Italy the firm has acquired Flowing, a full-stack software development and UX/UI design agency.

Claranet’s managed services span a range of infrastructure and application areas, notably in cyber and cloud, with offerings in workplace and network services too. The firm is ‘playing the long game’ and has been building a multi-country presence over a period of time. Its increased scale has come about via a combination of acquisitions and organic growth, and Founder and CEO, Charles Nasser, believes that the firm’s competitive ability has been considerably improved as a result of its increased scale in recent years. Most recently published figures for the Group put revenue at …. MORE...

Posted by Kate Hanaghan at '10:10'

- Tagged:

acquisition

cloud

cyber

Thursday 15 September 2022

Following the decision by ING to close down the personal finance element of its app-based arm, Yolt, the multinational Dutch bank has this week announced plans to also phase out Yolt’s B2B open banking operations. Following the news that Yolt’s operations are to be sunsetted, it has also been reported that ING is now re-structuring the provision of innovation within the bank.

Following the decision by ING to close down the personal finance element of its app-based arm, Yolt, the multinational Dutch bank has this week announced plans to also phase out Yolt’s B2B open banking operations. Following the news that Yolt’s operations are to be sunsetted, it has also been reported that ING is now re-structuring the provision of innovation within the bank.

Going forward, innovation within ING will no longer be the responsibility of a centralised function but will be handed back to the bank’s individual business units. ING’s dedicated innovation arm, ING Neo, is set to be absorbed into the bank’s corporate strategy function.

Despite the increasingly challenging economic climate, the decision by ING to change its approach to innovation may not soley represent an exercise in belt tightening. The move may also potentially signal the growing maturity of digital transformation and attitudes to innovation and technology modernisation.

TechMarketView clients can learn more via What can we learn from ING about the appetite for innovation? This UKHotViews Extra explores some of the possibly considerations behind ING's decision and the current climate for SITS within financial services.

If you are not already a subscriber and would like access to this or any other of our output, please contact Deb Seth for more information.

Posted by Jon C Davies at '10:35'

Thursday 15 September 2022

Our UK Application Operations Supplier Ranking report for 2022 is now available by clicking here. It features the UK Top 20 UK Application Operations suppliers ranking, by revenue.

The Application Operations (AO) market recovered quickly from the decline in 2020 to post 5.9% yoy growth and lift UK sales above £6.5bn last year. The rotation to the New remained the primary growth engine in the AO segment in 2021 with digital centric services revenues surging by over 20% yoy to account for nearly two fifths of total demand. This was driven largely by a marked increase in expenditure on both applications modernisation and migration services, coupled with the more widespread deployment of digital applications,

UK sales above £6.5bn last year. The rotation to the New remained the primary growth engine in the AO segment in 2021 with digital centric services revenues surging by over 20% yoy to account for nearly two fifths of total demand. This was driven largely by a marked increase in expenditure on both applications modernisation and migration services, coupled with the more widespread deployment of digital applications,

The Top 20 UK AO suppliers as a group significantly outperformed the smaller rivals in 2021 with the combined revenues of this Tier 1 cohort rising more than 50% faster than the sales in the market segment as a whole. The fortunes of the major players, however, varied significantly and there were both big winners and significant losers in the battle for market share in this arena last year. The report both details the variations in performance across the Top 20 AO suppliers and highlights the factors impacting the market during 2022 and beyond.

Subscribers to TechMarketView's TechSectorViews research stream can download the UK Application Operations Supplier Ranking research now. If you are not yet a subscriber and would like to find out how to gain access to this research and much more besides, please contact Deb Seth.

Posted by Duncan Aitchison at '08:08'

- Tagged:

rankings

applications

suppliers

newresearch

operations

Wednesday 14 September 2022

There is just over a week to go until the TechMarketView Evening returns to the Royal Institute of British Architects (RIBA) building in London on 22 September.

In a period of unprecedented change, our ‘Building Resilience’ theme seems all the more appropriate, and we are looking forward to spending the evening with some 200 leaders from across UK tech.

During the evening we’ll be sharing our analysts’ latest views on the outlook for the sector and debating the opportunities and threats posed by the need to build resilience across the workforce, cyber, supply chain and more.

During the evening we’ll be sharing our analysts’ latest views on the outlook for the sector and debating the opportunities and threats posed by the need to build resilience across the workforce, cyber, supply chain and more.

We are particularly looking forward to hearing from guest speakers Melissa McBride, co-founder and CEO of metaverse edtech Sophia Technologies; David Moran from Arup Digital UK who has led the digital visualisation of the UK’s railways; and Dr Andrew Rogoyski, from Surrey University’s Surrey Institute for People-Centred AI.

As the analyst team put the finishing touches to their presentations, our guest speakers consider how they'll answer those tricky questions on the panel, and we begin to think about the table plans for dinner - we'd like to take another opportunity to thank both our incredible sponsors & all of our lovely guests set to attend on the night.

Particular thanks to InterSystems for supporting the Welcome Drinks Reception again this year, as well as our partners University of Surrey, Computacenter, Aqilla & ScaleUp Group.

There are a few tickets remaining if you are in London on the 22nd and can join us for what is always a great event you'll find more details and a booking link on our website.

See you there!

Posted by TechMarketView Team at '08:41'

Tuesday 13 September 2022

We are in a time of unprecedented uncertainty. UK tech suppliers are faced with operating in an environment that is defined by political and economic turbulence.

We are in a time of unprecedented uncertainty. UK tech suppliers are faced with operating in an environment that is defined by political and economic turbulence.

Even in the relatively short time since we inked our forecasts for the UK software and IT services (SITS) market in June (see here), the situation has become noticeably more worrying. There appears to be no end to the war in Ukraine, the inflation rate continues to rise, the cost of living is taking its toll on households, businesses are facing skills shortages and spiralling costs, and the UK Government is set to take on a larger debt burden.

It's not surprising that we are being asked how this is impacting our outlook for the UK tech market. The truth is that our view is evolving as we see more evidence of recent company performance, as we learn more about the plans of Liz Truss’ Government, and as economic forecasts are updated. We will publish a revised set of forecasts in the next couple of months.

In the meantime, our latest report - UK SITS Market 2022-2025: Impact of economic turbulence | TechMarketView – provides our current view on how the backdrop is likely to impact the performance of the UK SITS market between 2022 and 2025. Few (if any) would be able to find a sensible argument to suggest it won’t be impacted at all. Technology is so integrated into our businesses and our lives that the market will, inevitably, feel the effects of a recession.

The big question is: how much will it be affected? In line with TechMarketView’s 2022 Research Theme "Building Resilience", how resilient will our sector be to the strong headwinds? TechMarketView subscribers can find out now by downloading our research note.

If you are not yet a subscriber or want to find out if your company subscribes, please contact Deb Seth.

Posted by Georgina O'Toole at '21:33'

- Tagged:

forecasts

growth

SITSmarket

economy

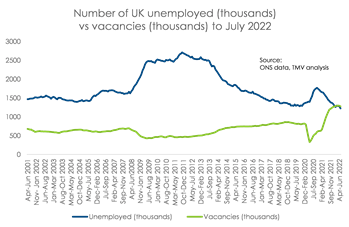

The UK economy simply doesn't have enough workers.

Businesses across all sectors have struggled to recruit in recent months. Now that we are facing a downturn, we will see vacancies reducing and unemployment rising. But once the economic recovery begins, the workforce shortages experienced recently will return.

Businesses across all sectors have struggled to recruit in recent months. Now that we are facing a downturn, we will see vacancies reducing and unemployment rising. But once the economic recovery begins, the workforce shortages experienced recently will return.

I strongly believe the labour shortage represents a significant opportunity for the UK tech sector - because the only way to address it is for companies to invest in the people they do have to work smarter. This means equipping them with technology and training them in how to use it. As I argued in my recent article, the health of the economy depends on digitisation.

However, the tech sector is particularly vulnerable to this labour shortage, with skilled tech practitioners proving particularly hard to recruit. And so, to capitalise on this growth opportunity, tech companies must focus on the resilience of their workforce by investing significantly in training and retention.

The omens are not good. Data shows companies tend to cut back on training in times of economic uncertainty. And the economy is doing a woeful job of hanging onto the most experience segment of its labour force.

The omens are not good. Data shows companies tend to cut back on training in times of economic uncertainty. And the economy is doing a woeful job of hanging onto the most experience segment of its labour force.

My latest HotViewsExtra article explores why tech firms need to be brave and buck the trend, by investing heavily in their people, even in the face of a downturn. Those that do will be rewarded with loyalty, resilience and increased productivity.

HotViewsExtra subscribers can read the full article here. And if you would like to discuss subscription options, please contact Deb Seth.

Posted by Tania Wilson at '11:29'

- Tagged:

skills

employment

productivity

resilience

macro

Wednesday 07 September 2022

With the summer holiday season drawing to a close, the countdown to the 2022 TechMarketView Evening on 22 September has kicked into top gear!

As the analyst team put the finishing touches to their presentations, our guest speakers consider how they'll answer those tricky questions on the panel, and we begin to think about the table plans for dinner - we'd like to take the opportunity to thank both our incredible sponsors & all of our lovely guests set to attend on the night.

Particular thanks to InterSystems for supporting the Welcome Drinks Reception again this year, as well as our partners University of Surrey, Computacenter, Aqilla & ScaleUp Group.

After a two year gap, we can't wait to see you all again for an evening of drinks, dinner, debate, networking & analyst insight.

There are a few tickets remaining if you are in London on the 22nd and can join us for what is always a great event you'll find more details and a booking link on our website.

See you there!

Posted by TechMarketView Team at '00:00'

- Tagged:

event

Tuesday 06 September 2022

July saw London play host to two consecutive rounds of the ABB FIA Formula E World Championship. For the uninitiated, or indeed, non-motorsports fans, think fully electric ‘Formula one-type cars’ racing around an indoor and outdoor track in London’s Docklands. It’s high-speed motor racing but without the emissions and the noise. As well as the inevitable interest in Formula E from motor sports, automotive and engineering companies, SITS companies are also getting involved. Initiatives like Formula E are all about pushing the boundaries of current technologies – not just around aerodynamics, battery life and charging speed but also the application of data and analytics in a highly competitive sporting environment.

Formula E showcases the very best of high-performance engineering in a low carbon environment and UK SITS market leader TCS has been the title sponsor of the Jaguar Formula E Racing Team, now branded Jaguar TCS Racing, since last November (see TCS announces Jaguar Formula E partnership). Whilst initiatives such as sports sponsorship are of course crucial in brand positioning and in raising awareness, TCS’s tie-up with Jaguar is much more than this, and is feeding the development of the SITS provider’s sustainability portfolio, something that is becoming an increasingly important and high-profile component of TCS’s growth plans. In particular, TCS is using its Formula E tie-up as an incubator and test bed for new technologies and services feeding its smart mobility and sustainable transport proposition. Think about what a “game changer” for mass adoption being able to charge your electric road car in under 5 minutes would be, or what a battery range in excess of 500 miles might do to current levels of “range anxiety”, and you can see why so much investment is being committed.

Formula E showcases the very best of high-performance engineering in a low carbon environment and UK SITS market leader TCS has been the title sponsor of the Jaguar Formula E Racing Team, now branded Jaguar TCS Racing, since last November (see TCS announces Jaguar Formula E partnership). Whilst initiatives such as sports sponsorship are of course crucial in brand positioning and in raising awareness, TCS’s tie-up with Jaguar is much more than this, and is feeding the development of the SITS provider’s sustainability portfolio, something that is becoming an increasingly important and high-profile component of TCS’s growth plans. In particular, TCS is using its Formula E tie-up as an incubator and test bed for new technologies and services feeding its smart mobility and sustainable transport proposition. Think about what a “game changer” for mass adoption being able to charge your electric road car in under 5 minutes would be, or what a battery range in excess of 500 miles might do to current levels of “range anxiety”, and you can see why so much investment is being committed.

Recent conversations with several of the UK TCS team have revealed anecdotally that, sustainability has already become one of the top themes clients want to discuss regarding solutions development and improving their operations. Recent rises in energy pricing have only made the issue more pertinent. With sustainability driving an increasing proportion of TCS’s client and brand positioning activity, I caught up recently with Preeti Gandhi, Global Head of Sustainability Marketing at the firm, to understand how they are looking to grow sustainable business.

To read more eligible TechMarketViews subscribers can download our new report Sustainability to the fore at TCS today.

If you are not a subscriber to our services and would like to find out more, please contact Deb Seth.

Posted by Marc Hardwick at '15:19'

There were two stories running through the month of August for tech stocks.

The first was the eagerly-awaited meeting of global monetary policy leaders in late August in the US. This was a chance for the Federal Reserve (Fed) to communicate its position in relation to inflation. After a positive month in July and a strong start to August, investors began to get nervous even in the weeks before the meeting convened. Then comments by the Fed at the meeting, emphasising their resolve to increase interest rates further as needed, sent stocks tumbling.

The first was the eagerly-awaited meeting of global monetary policy leaders in late August in the US. This was a chance for the Federal Reserve (Fed) to communicate its position in relation to inflation. After a positive month in July and a strong start to August, investors began to get nervous even in the weeks before the meeting convened. Then comments by the Fed at the meeting, emphasising their resolve to increase interest rates further as needed, sent stocks tumbling.

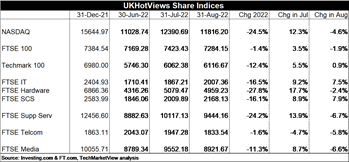

Of course, tech growth stock valuations are particularly vulnerable to rising interest rates because so much of that value is in future earnings and higher interest rates mean a heavier discount on those earnings. The tech-focused NASDAQ finished 4.6% down month-on-month (MoM), or 24.5% down year-to-date (YTD) - not its worst month in 2022 by any means but disappointing after a strong showing in July.

The second story concerns UK tech. We can see how UK tech markets are impacted by news in the US by observing how closely the UK FTSE Software and Computer Services (SCS) index has tracked the NASDAQ in 2022 so far.

The second story concerns UK tech. We can see how UK tech markets are impacted by news in the US by observing how closely the UK FTSE Software and Computer Services (SCS) index has tracked the NASDAQ in 2022 so far.

But there is another story unfolding here in the UK, with news of prospective takeovers of several of the largest UK tech players: Avast, Micro Focus, Darktrace and AVEVA. Market reaction to the news of takeover discussions was enough to tip the FTSE SCS upwards for the month, diverging from the NASDAQ and bucking the trend across other indices.

The broad-based FTSE 100 finished the month 1.9% down MoM, or 1.4% down YTD. The slide of sterling against the dollar is benefitting many of the FTSE 100 constituents, making it one of the standout indices in developed markets.

Winners and Losers

In July, around 100 of the 150 or so stocks we track for this column posted a gain. In August, the trend was reversed and we saw over 100 suffering a loss.

Amongst those to see their share price increase were the companies which are the subject of takeover talks: Micro Focus, Avast, Darktrace and AVEVA. Away from takeover speculation, several others enjoyed a strong month, including used car retailer Cazoo, analytics-as-a-service provider Rosslyn Data Technologies and asset finance software specialist Alfa Financial Services.

After the expectation attached to their quarterly results season in late July, August was a relatively calm month for the US Big Tech stocks. Of the traditional Big Five, Apple, Amazon, Google/Alphabet and Microsoft posted modest losses, with only Facebook/Meta posting a small gain. Netflix held steady, with both Twitter and Tesla down.

Some of those losing more heavily from the continued turmoil on the tech markets included edtech specialist RM, US multinationals Unisys and DXC Technology, SaaS bellwether Salesforce and digital learning specialist Learning Technologies Group.

Some of those losing more heavily from the continued turmoil on the tech markets included edtech specialist RM, US multinationals Unisys and DXC Technology, SaaS bellwether Salesforce and digital learning specialist Learning Technologies Group.

More details on the winners and losers is available in Share Performance in August 2022, for HotViews Premium readers.

Outlook

US monetary policy decisions, driven mainly by US macroeconomic data, will continue to dominate the fortunes of tech stocks. And amid signs that US inflation could be peaking, the Fed may slow the pace of rate rises and perhaps even engineer a so-called soft landing for the US economy, avoiding a deep downturn. All of this would be good news for tech - perhaps lifting share prices again in the short-term - and the global economy more generally.

But a possible uptick in tech stock prices may all come too late for the listed UK companies which are at various stages of exploring overseas takeover bids. If AVEVA is taken fully private and the merger of Avast with NortonLifeLock goes ahead, the FTSE 100 will be left with just one software and IT services company, accounting software provider Sage.

A dearth of major UK tech players is not good news for the UK economy. Looking beyond the current inflation crisis, we know this country must improve its productivity if we are to improve our living standards. Tech is surely a huge part of that productivity debate and (as I argued in my recent article) demand for technology solutions can only grow.

So it is an own-goal to fail to nurture the tech sector. In the end, if we don't support tech here in the UK, then other countries surely will and we will continue to see a steady stream of tech companies departing these shores.

Posted by Tania Wilson at '07:33'

- Tagged:

markets

macro

There's only a few weeks to go before An Evening with TechMarketView returns to London’s Royal Institute of British Architects (RIBA) from 6.30pm on 22 September and we can't wait to see so many of you together in person at the event after a two-year hiatus.

If you haven’t booked your ticket yet, it’s not too late. There are a few spaces left for those of you who like to leave things until the last minute, but we’d recommend you don’t leave it any longer!

The informal event is an excellent opportunity to network with CXOs from across the UK tech sector with both the Welcome Drinks Reception, supported by InterSystems, and the lovely three course dinner, providing ample time to catch up with peers and make new connections amongst the 200+ leaders attending.

Between drinks and dinner, you’ll spend an hour hearing from TechMarketView’s expert analysts and our guest speakers. The agenda includes a series of short presentations from TechMarketView research directors; a fireside chat with Dr Andrew Rogoyski, Surrey Institute for People-Centred AI; and a panel debate themed around Building Resilience and featuring guest appearances from Melissa McBride, CEO, Sophia Technologies and David Moran, Digital Strategy & Transformation, Arup Digital UK.

Between drinks and dinner, you’ll spend an hour hearing from TechMarketView’s expert analysts and our guest speakers. The agenda includes a series of short presentations from TechMarketView research directors; a fireside chat with Dr Andrew Rogoyski, Surrey Institute for People-Centred AI; and a panel debate themed around Building Resilience and featuring guest appearances from Melissa McBride, CEO, Sophia Technologies and David Moran, Digital Strategy & Transformation, Arup Digital UK.

See our website for more details of the event and book your place via our event management partners tx2events before it’s too late.

(Don’t forget, if you’re a TechMarketView subscription client, or subscribe to UKHotViews Premium, you qualify for the discounted ticket price.)

With grateful thanks to our sponsors - InterSystems, Computacenter, University of Surrey, Aqilla and ScaleUp Group.

Posted by TechMarketView Team at '07:30'

Thursday 01 September 2022

Electric vehicles (EV) continue to see high demand and increasing investment, reshaping the automotive industry, as well as national infrastructure. EV’s certainly seem to be the future but how far are we from that future becoming mainstream?

Electric vehicles (EV) continue to see high demand and increasing investment, reshaping the automotive industry, as well as national infrastructure. EV’s certainly seem to be the future but how far are we from that future becoming mainstream?

Well maybe it is getting that bit closer with the UK government unveiling a £20m plan to upgrade the UK’s electric vehicle (EV) infrastructure that will see 1,000 charge points installed across nine UK locations including Dorset, Durham, North Yorkshire, Nottingham and Suffolk.

The funding is part of the £20m Local EV Infrastructure (LEVI) pilot scheme which builds on the success of the On-Street Residential Chargepoint Scheme (ORCS) which has seen nearly 2,900 chargepoints installed so far.

While the number of EV’s vehicles on our roads continues to increase, challenges for adoption remain, especially around the current price of newer EV models, the need for accessible charging infrastructure and possible mileage distances. But there are also opportunities both for existing auto manufacturers and new entrants like Tesla, as well as for tech providers like chip manufacturer Nvidia who is quickly growing revenue providing chips for in-car systems and cloud platforms to test AI models. Retailers are also set to benefit from EV adoption by driver higher footfall with EV charging stations installed and personalised offers for EV drivers.

TechMarketView subscription service clients and UKHotViews Premium subscribers can read more details around the current state of EV’s and how these different challenges are being addressed in our UKHotViews Extra article here.

Posted by Simon Baxter at '15:28'

- Tagged:

autonomousvehicles

EV

Thursday 01 September 2022

Electric vehicles (EV) continue to see high demand and increasing investment, reshaping the automotive industry, as well as national infrastructure. EV’s certainly seem to be the future but how far are we from that future becoming mainstream?

Electric vehicles (EV) continue to see high demand and increasing investment, reshaping the automotive industry, as well as national infrastructure. EV’s certainly seem to be the future but how far are we from that future becoming mainstream?

Well maybe it is getting that bit closer, with the UK government unveiling a £20m plan to upgrade the UK’s electric vehicle (EV) infrastructure, that will see 1,000 charge points installed accross nine locations across the UK including Dorset, Durham, North Yorkshire, Nottingham and Suffolk.

It comes as part of the £20m Local EV Infrastructure (LEVI) pilot scheme, through which local authorities and industry will work together to create new, commercial EV charging infrastructure for residents, from faster on-street chargepoints to larger petrol station-style charging hubs. The fund builds on the success of the On-Street Residential Chargepoint Scheme (ORCS) which has seen nearly 2,900 chargepoints installed so far, with funding provided for around 10,000 additional chargepoints in the future. £20m was already available through ORCS for FY 2020-21 with the scheme extended as far as 2022/23. It allows local authorities to apply for 75% of the capital costs of installation. The remaining 25% can be funded by councils, or through match-funding by Charge Point Operators (CPO).

According to Zap map at the end of July 2022, there were 33.3k charging points in the UK (not including homes and workplaces), across 20k charging locations, a 35% yoy increase, with over 30% of charging stations in Greater London. As a comparison the UK has around 33m registered vehicles and around 8.4k petrol stations.

The LEVI pilot supports the UK government’s drive to encourage more motorists to go electric ahead of the 2030 ban on new petrol and diesel car sales. The aim is to help residents without private driveways to have better access to EV chargers, as well as grow the charging network across the country, enabling more people to drive and charge without fear of being caught short, no matter where they are. Getting robust and widespread charging infrastructure in place is going to be critical to sustaining the growth of EV adoption.

There are more EV cars on the road than ever before…

There certainly seem to be a lot more electric cars on the roads today than even a few years ago, and the data support this. According to Zap map, as of the end of July 2022 there were more than 520k battery-electric cars registered in 2022, this is already 31% higher than all EV registrations in 2021 (which itself saw growth of 92% vs 2020). Currently electric vehicles account for around 11% of all new car registrations. There were also around 406k plug-in hybrid vehicles registered in 2022 so far, up around 16% yoy.

Clearly demand is growing but there are still challenges, namely that while electric cars have been around for 10 years or so, the more modern models that have longer ranges, and ability to charge at higher voltages, are still relatively new, and therefore quite expensive. In a time of rising inflation, especially for energy, and already high used car prices, it may not be easy for the majority of people to buy EVs in the near future. That said, running costs can often be cheaper, especially with the current price of fuel. According to Autotrader, a small hatchback Renault Zoe is going for around £18-20k, while a 5-year-old Tesla Model S will set you back about £33k and something like a 3-year-old Audi E-tron will cost around £45k. It will of course take some time for the used car market to catch up, and even then, the technology will have moved on and older models will be lagging behind.

But what about the mileage…

One of the main obstacles for EV adoption, and the main concern for most consumers, is charging time and mileage distance. Filling-up a petrol or diesel car takes a matter of minutes and for your average hatchback can take you 400-500 miles, but even top end electric cars have ranges of half that and charging currently takes much longer. But this is unlikely to be a huge barrier to adoption as the majority of people rarely drive more than a few hundred miles before stopping. So really it all comes down to charging time and availability of infrastructure.

Charging speeds widely differ depending on battery capacity and acceptable voltage, as a rough guide a 3kW slow charger can add 10 miles of range after an hour. Step up to a fast charger with a delivery of 7kW, which is the rate most domestic wallboxes charge at, and after 60 minutes you’ll have added up to 30 miles. A typical electric car (60kWh battery) takes just under 8 hours to charge from empty-to-full with a 7kW charging point. By contrast, a 50kW rapid charger can add around 100 miles in about 35 minutes. Tesla now also offers its Level 3 Superchargers which are able to take a Tesla from 0-170 miles range in just 30 minutes and 80% full in 40 mins, but these are only available for the latest Tesla models.

Most driver’s also top-up charge rather than waiting for their battery to recharge from empty-to-full, in fact most manufacturers advise to only charge an EV to 80% to preserve battery health. While most people will find home charging or at a place of work to be more than sufficient for their needs, there will still be those that require convenient charging for long distance trips and in rural locations, where finding charging hubs can still be very challenging.

The LEVI scheme, along with ORCS, will help in improving charging infrastructure and bring about the EV future many of us are expecting, but we will still need further investment from both government and private organisations if the pace of adoption of electric vehicles is to be maintained.

The impact of EV’s extends far beyond cars sales

While the growth in electric vehicles represents changing demand for automobile manufacturers, and opportunities for new entrants like Tesla, the potential impact extends well beyond car sales. Tech companies like Nvidia are already benefitting from the demand for fast chips for onboard systems and cloud platforms to test AI models. While numerous Lidar* companies like Luminar are benefitting from partnerships with auto manufacturers.

* Lidar is a remote sensing method that uses light in the form of a pulsed lasers to measure distance ranges and a common technology to enable advanced driver assistance systems.

Retail and leisure destinations are also expected to be beneficiaries of increased EV adoption. With the average EV charging likely to be around 30-40 mins, this is plenty of time for consumers to do some additional shopping, even grab a quick meal. According to a report by CACI, retailers can expect increased footfall if they implement electric vehicle (EV) charging points. The research reveals that 66% of people who intend to own an EV will visit retailers and businesses more frequently if they provide the right charging facilities. In addition, 48% of existing EV owners have engaged with charging infrastructure at a public car park and 33% have charged their EV at a supermarket. Retailers can also look to build stronger customer connections by developing loyalty programs that cater to EV drivers.

Autonomous vehicles will be the true disrupter

The topics of EV’s and Autonomous vehicles are often intertwined, but while the future for electric vehicles is pretty clear, we are much further off the more ambitious target of autonomous driving. The technology itself is already very advanced, but the regulatory and cultural changes required are much bigger hurdles. But that has not stopped numerous companies investing in the technology and the UK government announcing it is planning to introduce self-driving vehicles from next year, with full implementation planned for 2025.

Autonomous vehicles will truly disrupt road and network infrastructure, insurance and ownership, and the entire transportation and logistics market. They will also offer numerous opportunities around the usage of data and in-car services, driving forward the demand for 5G, IoT and other technologies like Lidar.

But that is a much broader topic and one for another day. For now, the focus is on the shift to EV’s, it is much more achievable with less hurdles to overcome, though as shown in this article it also has its challenges.

So, what do you think, can the growth in EV’s be sustained? Do you own an Electric vehicle and if so, have you found charging infrastructure to be sufficient? What other pitfalls do you see to wider adoption? Feel free to drop me an email at sbaxter@techmarketview.com with your thoughts.

Posted by Simon Baxter at '15:04'

- Tagged:

autonomousvehicles

EV

« Back to previous page