News

Micro Focus tripled in size overnight when it completed the merger with HPE Software, it was catapulted into the ranks of the top 10 enterprise software providers, becoming a very substantial global software supplier. The question now is how influential the expanded and reshaped infrastructure software house will be.

Micro Focus tripled in size overnight when it completed the merger with HPE Software, it was catapulted into the ranks of the top 10 enterprise software providers, becoming a very substantial global software supplier. The question now is how influential the expanded and reshaped infrastructure software house will be.

At the Capital Markets Day in September the Micro Focus management team stressed that its strategy and operating model would remain consistent with how it has operated previously. It has been a successful strategy but there is also a need to drive top line growth and that is part of the job for HPE Software. There was also an awareness that the enlarged Micro Focus has to grow into its new role as one of the largest software providers, with chief executive Chris Hsu commenting that it is too big not to make its views known, so we can expect more communication on market trends and developments and company positioning around them as it works on its ‘influential credentials’. In the latest report from the Enterprise Software & Application Services research stream we look at what we can expect from the ‘new’ Micro Focus.

Subscribers can download the ‘What to expect from the ‘new’ Micro Focus’ report here.

If you do not take a TechMarketView subscription currently, you can contact Deborah Seth for details.

Posted by Angela Eager at '10:01'

- Tagged:

software

analytics

security

merger

DevOps

hybridIT

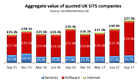

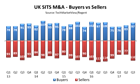

There’s a double helping of research on the UK software and IT services industry today with the publication of our quarterly IndustryViews Quoted Sector (IVQS) and IndustryViews Corporate Activity (IVCA) reports.

IVQS brings you our latest analysis of the UK software and IT services quoted sector scene with comparative share price performance against leading international software and IT services stocks.

IVQS brings you our latest analysis of the UK software and IT services quoted sector scene with comparative share price performance against leading international software and IT services stocks.

IVCA provides a summary of corporate activity in the UK software and IT services market, including trade M&A and private equity deals.

IVCA provides a summary of corporate activity in the UK software and IT services market, including trade M&A and private equity deals.

The third report in the series, IndustryViews Venture Capital (IVVC) will follow soon. IVVC covers significant venture capital investment in UK tech startups and SMEs.

Subscribers to the TechMarketView Foundation Service can download IVQS and IVCA using the links.

For further information, please contact our Client Services team (info@techmarketview.com).

Posted by UKHotViews Editor at '07:49'

Last year saw a lot of change within the Financial Services sector as many large financial services providers moved onto the front foot with respect to growth and change, leading to an acceleration in the rate of Cloud adoption as they sought to address legacy issues and embrace innovation.

Last year saw a lot of change within the Financial Services sector as many large financial services providers moved onto the front foot with respect to growth and change, leading to an acceleration in the rate of Cloud adoption as they sought to address legacy issues and embrace innovation.

In our latest report, “Financial Services Supplier Ranking”, we present our latest view of the top 20 SITS providers active in this dynamic sector. Despite all the changes across the sector, it is probably no surprise to readers that the very top of the table remains largely the same, although the morphing of HPE and CSC into DXC has obviously had an impact. Lower down the table we have seen some more significant movement and also a very wide variance in the growth rates of these major providers. The pressure on the established providers of large computer systems and on software revenues as companies move to cloud-based delivery has meant that some suppliers have reported declines in UK sector revenue, while others have enjoyed better fortunes, boosted by acquisitions and strong performance in system integration.

The Indian Pure-plays continue to feature large within the table, taking five of the top 11 places. A new entrant into the top 20 also shows the growing reliance on the input from advisors and consultants as the sector wrestles with change. The major Business Process Services providers were also able to grow at rates well ahead of overall market levels.

This report is accessible to FinancialServicesViews subscribers, here.

If your company does not yet subscribe to this research stream, please contact our Client Services team on info@techmarketview.com

Posted by Peter Roe at '07:00'

- Tagged:

cloud

financialservices

insurance

legacy

banking

FinTech

It is a fascinating time to be joining TechMarketView. The IT services industry is in the throes of its most profound change and nowhere more so than in Application Services (AS).

As we highlighted in Enterprise Software and Application Services Market Trends and Forecasts 2017-2020, the overall demand for AS will increase at a CAGR of c.2% to generate a meagre £200m - £300m of additional revenue opportunity each year. This slow rising tide cannot lift the increasing number of boats small and large that sail these vast waters to anywhere near their collective revenue ambitions. Fuel the swell with wave upon wave of technological disruption, add in the maelstrom caused by unparalleled political turbulence and we are now in uncharted, potentially treacherous seas. That’s why I will be focussing on clarifying how demand for AS will evolve, identifying where the opportunities for growth and value creation will be found and evaluating the strategic responses that will be required.

As we highlighted in Enterprise Software and Application Services Market Trends and Forecasts 2017-2020, the overall demand for AS will increase at a CAGR of c.2% to generate a meagre £200m - £300m of additional revenue opportunity each year. This slow rising tide cannot lift the increasing number of boats small and large that sail these vast waters to anywhere near their collective revenue ambitions. Fuel the swell with wave upon wave of technological disruption, add in the maelstrom caused by unparalleled political turbulence and we are now in uncharted, potentially treacherous seas. That’s why I will be focussing on clarifying how demand for AS will evolve, identifying where the opportunities for growth and value creation will be found and evaluating the strategic responses that will be required.

Beneath the surface of this £14bn market much is changing. Customers are struggling with the “how” of unlocking their intelligence and executing real transformational change, at both pace and affordable cost. The boundaries with the other traditional towers – in particular Business Process Services and Infrastructure Services - are also fast eroding.

Success in the AS arena will require much more than the mastery of an ever expanding and developing array of technologies and capabilities. It will demand radical changes to current business models; service portfolios and mixes, skills strategies, supply chains, pricing and contractual constructs and beyond.

I will be taking a closer look at these challenges. Working with my TMV colleagues I’ll be analysing the changes in the AS market, anticipating its future direction and assessing the implications for all who seek their fortune there. It promises to be an exciting voyage of discovery.

For more information on subscribing to our Enterprise Software and Application Services research please contact our Client Services team by emailing info@TechMarketView.com.

Posted by UKHotViews Editor at '08:00'

- Tagged:

applications

Wednesday 18 October 2017

This report updates our view of the major suppliers of Software and IT Services (SITS) into the UK Policing sector. We take a close look at the pressures that are influencing the market, how policing is likely to change and the role that technology might play in that transformation.

This report updates our view of the major suppliers of Software and IT Services (SITS) into the UK Policing sector. We take a close look at the pressures that are influencing the market, how policing is likely to change and the role that technology might play in that transformation.

UK policing has undergone significant change and faces many ongoing challenges, including adapting to new threats at a time of declining resources. The sector has been slow to embrace new technologies, but digital transformation is beginning to accelerate.

Policing is the smallest of the public sector areas that TechMarketView tracks, worth just 4% of the total public sector SITS market. However, with a predicted compound annual growth rate of 7.2% between 2016 and 2020, it will be the fastest growing area of public sector SITS.

Opportunities in the sector will be driven by increasing levels of collaboration between police forces and other agencies. We will also see new business develop through the adoption of cloud and mobile technologies in the sector, as well as the use of data and analytics to predict crime patterns and allocate resources effectively.

In the report we review the Top 10 SITS suppliers in the sector, looking at their performance and prospects for the future, before taking a look at some of the other influential suppliers in policing.

The report, accessible to PublicSectorViews subscribers, is available to download now. If you are not yet a subscriber, or are interested in getting hold of this report please click here.

Posted by Dale Peters at '00:00'

- Tagged:

publicsector

police

research

bluelight

I wanted to use one of my first HotViews posts to outline my initial thoughts on how I plan to develop TechMarketView’s analysis of Business Process Services (BPS), in TechSectorViews.

I wanted to use one of my first HotViews posts to outline my initial thoughts on how I plan to develop TechMarketView’s analysis of Business Process Services (BPS), in TechSectorViews.

This is without doubt an exciting time to be involved with BPS as the sector goes through significant levels of change. Having been a client myself I fundamentally believe TMV’s real value sits in helping clients successfully navigate periods like this.

Helping you prepare for change will see me focus on at least a few key areas.

Firstly, I am keen to build on the excellent work done to date deepening our knowledge of how digitisation and new technologies are transforming BPS. As such you can expect more intense focus on areas such as Intelligent Automation, Robotic Process Automation, Internet of things, Virtual Assistants and AI (What are the opportunities for Artificial Intelligence in Business Process Services?).

Firstly, I am keen to build on the excellent work done to date deepening our knowledge of how digitisation and new technologies are transforming BPS. As such you can expect more intense focus on areas such as Intelligent Automation, Robotic Process Automation, Internet of things, Virtual Assistants and AI (What are the opportunities for Artificial Intelligence in Business Process Services?).

Secondly, I am particularly keen to capitalise on TMV’s unique knowledge of the local market and identify practical examples of how new BPS technologies are transforming businesses within a variety of UK Industries (RPA - end user insights in retail banking and energy).

My other key area of focus will be to shine a light on the innovation happening in parallel, around the commercial side of BPS as players big and small reshape the way they engage with both their clients and end service users. As such you can expect emphasis placed on understanding how deals are won, contracts structured and the mechanics of the commercials and service delivery.

Ultimately it’s vitally important that the BPS research agenda is useful, relevant and timely and helps our clients address the ‘Exam-Questions’ facing their businesses. As such I look forward to engaging with many of you over coming months to ensure that the research agenda remains shaped by you and your organisation’s needs.

For information on subscribing to our TechSectorViews research please contact our Client Services team by emailing info@TechMarketView.com.

Posted by Marc Hardwick at '08:49'

- Tagged:

automation

AI

RPA

This report updates our view of the major suppliers of Software and IT Services (SITS) into the UK Policing sector. We take a close look at the pressures that are influencing the market, how policing is likely to change and the role that technology might play in that transformation.

This report updates our view of the major suppliers of Software and IT Services (SITS) into the UK Policing sector. We take a close look at the pressures that are influencing the market, how policing is likely to change and the role that technology might play in that transformation.

UK policing has undergone significant change and faces many ongoing challenges, including adapting to new threats at a time of declining resources. The sector has been slow to embrace new technologies, but digital transformation is beginning to accelerate.

Policing is the smallest of the public sector areas that TechMarketView tracks, worth just 4% of the total public sector SITS market. However, with a predicted compound annual growth rate of 7.2% between 2016 and 2020, it will be the fastest growing area of public sector SITS.

Opportunities in the sector will be driven by increasing levels of collaboration between police forces and other agencies. We will also see new business develop through the adoption of cloud and mobile technologies in the sector, as well as the use of data and analytics to predict crime patterns and allocate resources effectively.

In the report we review the Top 10 SITS suppliers in the sector, looking at their performance and prospects for the future, before taking a look at some of the other influential suppliers in policing.

The report is available to download now. If you are not yet a PublicSectorViews subscriber, please contact Deb Seth to find out how you can access the research.

Posted by Dale Peters at '10:00'

- Tagged:

police

research

emergency

bluelight

Announcing the first stage in a big vision project, Sage is creating a unifying cloud platform - Sage Business Cloud - to bring its core products together. As well as providing a platform for Sage’s own business applications, it will also handle apps from the Sage marketplace.

Announcing the first stage in a big vision project, Sage is creating a unifying cloud platform - Sage Business Cloud - to bring its core products together. As well as providing a platform for Sage’s own business applications, it will also handle apps from the Sage marketplace.

In an ideal scenario, Sage Business Cloud would see businesses all through their growth lifecycle – taking them from start up, through scale up and onto global enterprises – via a portfolio of core business products covering accounting and financials, people and payroll, and payments and banking, with industry vertical capability added in too. As the Business Cloud is described as having an ‘AI first” approach with a set of machine intelligence services built in, the platform is intended for the ‘intelligent business’. More….

Posted by Angela Eager at '09:21'

- Tagged:

cloud

software

One of the companies in the news over recent months has been Klarna, with Visa announcing the purchase of a stake (less than 10%, price undisclosed) in June and Permira, the private equity group, taking a 10% stake for a reported US$250m in July - investments which featured in our recent report Why all the M&A in Payments?

One of the companies in the news over recent months has been Klarna, with Visa announcing the purchase of a stake (less than 10%, price undisclosed) in June and Permira, the private equity group, taking a 10% stake for a reported US$250m in July - investments which featured in our recent report Why all the M&A in Payments?

Klarna is one of a rare and endangered species, the European Unicorn, having originated in Sweden along with fellow success stories Skype and Spotify. It is fascinating to see how a business formed to accommodate the particular payment characteristics of some Northern European markets is now viewed as having relevance on a global scale.

Klarna is one of a rare and endangered species, the European Unicorn, having originated in Sweden along with fellow success stories Skype and Spotify. It is fascinating to see how a business formed to accommodate the particular payment characteristics of some Northern European markets is now viewed as having relevance on a global scale.

Subscribers to FinancialServicesViews can access this latest report in our FintechViews service: “Klarna – The European Unicorn Shaking Up Payments”, here.

Posted by Peter Roe at '08:54'

- Tagged:

payments

FinTech

AI

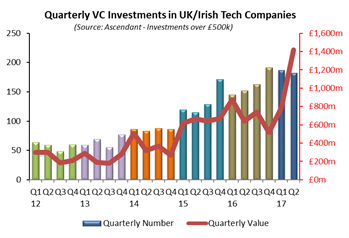

Venture capital funding of UK and Irish technology companies reached new heights in Q2, according to the latest data from corporate finance firm, Ascendant. During Q2, £1.42B was invested in 182 deals of more than £0.5m by 235 investors at an average deal size of £7.8m. This represents a 20% yoy increase in the number of deals and a 122% yoy increase in the total quarterly value which was 62% higher than the previous record high of £873m set in Q1 2016.

Venture capital funding of UK and Irish technology companies reached new heights in Q2, according to the latest data from corporate finance firm, Ascendant. During Q2, £1.42B was invested in 182 deals of more than £0.5m by 235 investors at an average deal size of £7.8m. This represents a 20% yoy increase in the number of deals and a 122% yoy increase in the total quarterly value which was 62% higher than the previous record high of £873m set in Q1 2016.

The latest edition of IndustryViews Venture Capital includes over 30 pages summarising significant venture funding in UK tech companies.

Subscribers to the TechMarketView Foundation Service can download our latest quarterly review of UK software and IT services M&A in the just released report, IndustryViews Venture Capital Q2 2017.

For further information, please contact our Client Services team (info@techmarketview.com).

Posted by UKHotViews Editor at '07:42'

- Tagged:

funding

We are delighted to welcome three new members to the growing TechMarketView team. As those of you that joined us at our ‘Evening with TechMarketView’ last Thursday will already know, Duncan Aitchison, Marc Hardwick and Sarah Robinson have recently joined us - all three are tremendously experienced and we’re excited about the strong contribution they are already making to TechMarketView.

We are delighted to welcome three new members to the growing TechMarketView team. As those of you that joined us at our ‘Evening with TechMarketView’ last Thursday will already know, Duncan Aitchison, Marc Hardwick and Sarah Robinson have recently joined us - all three are tremendously experienced and we’re excited about the strong contribution they are already making to TechMarketView.

Duncan Aitchison joins us from Capgemini as a Research Director for TechSectorViews. A respected industry commentator with more than 30 years’ experience in IT services, he is known for his in-depth knowledge of the outsourcing and SI markets, most notably the application services segment. For the four years before joining TechMarketView, Duncan was an Executive Vice President at Capgemini focused on market and business development in the large-scale applications outsourcing arena. Prior to this, he spent a decade as the European President for ISG, the world’s leading sourcing advisory firm. Here Duncan built a consulting team that advised enterprise clients on many of the largest outsourcing programs in Europe, drove significant geographic expansion in Germany, Switzerland, Scandinavia, Singapore and Japan and became a recognised authority on the EMEA sourcing marketplace.

Duncan Aitchison joins us from Capgemini as a Research Director for TechSectorViews. A respected industry commentator with more than 30 years’ experience in IT services, he is known for his in-depth knowledge of the outsourcing and SI markets, most notably the application services segment. For the four years before joining TechMarketView, Duncan was an Executive Vice President at Capgemini focused on market and business development in the large-scale applications outsourcing arena. Prior to this, he spent a decade as the European President for ISG, the world’s leading sourcing advisory firm. Here Duncan built a consulting team that advised enterprise clients on many of the largest outsourcing programs in Europe, drove significant geographic expansion in Germany, Switzerland, Scandinavia, Singapore and Japan and became a recognised authority on the EMEA sourcing marketplace.

Marc Hardwick has joined the TechMarketView team as a Research Director for TechSectorViews. Marc has over twenty years’ experience in research and analysis including an eight-year stint as Director of Business Intelligence at BPS market leader Capita. Marc led Capita’s corporate research and intelligence activities across all markets and was responsible for successfully helping put insight at the heart of Capita’s sales and delivery process. Marc’s insight also helped underpin Capita’s business development and acquisition activities. Immediately prior to joining TechMarketView, Marc was a member of the senior management team at specialist research consultancy ComRes. He is also an experienced analyst having begun his career in the technology space with Datamonitor, focused initially on industrial and process control technologies and then as a consultant working on bespoke research for the large IT providers.

Marc Hardwick has joined the TechMarketView team as a Research Director for TechSectorViews. Marc has over twenty years’ experience in research and analysis including an eight-year stint as Director of Business Intelligence at BPS market leader Capita. Marc led Capita’s corporate research and intelligence activities across all markets and was responsible for successfully helping put insight at the heart of Capita’s sales and delivery process. Marc’s insight also helped underpin Capita’s business development and acquisition activities. Immediately prior to joining TechMarketView, Marc was a member of the senior management team at specialist research consultancy ComRes. He is also an experienced analyst having begun his career in the technology space with Datamonitor, focused initially on industrial and process control technologies and then as a consultant working on bespoke research for the large IT providers.

Sarah Robinson joined our Client Services team last month to lead our Advertising and Digital Marketing. Sarah is a veteran of techUK, where she was project manager for the UK Trade and Investment Contract and Trade and Export Programme. Prior to that, Sarah lived in Australia and was national account manager for a research and consulting house in Sydney focused on Government ICT contracts and for a consulting and training organisation in the IT services sector.

Duncan, Marc and Sarah will be introducing themselves to our clients over the coming weeks and you can expect to read more on Duncan and Marc’s plans for their research areas in UKHotViews very shortly.

Posted by Tola Sargeant at '08:54'

- Tagged:

people

TMV

I t was wonderful to be able to present the future vision of the younger generation – as part of our ‘one night only’ KidsViews section at the TechMarketView Annual Presentation & Dinner (Oh what a night!). Huge thanks go to Weydon School in Farnham for giving us access to their Year 7s. The 12-year olds came up with some fantastically creative visions of 2035, involving many robots, some exciting transport and travel options, and lots of use cases for technology implants!

t was wonderful to be able to present the future vision of the younger generation – as part of our ‘one night only’ KidsViews section at the TechMarketView Annual Presentation & Dinner (Oh what a night!). Huge thanks go to Weydon School in Farnham for giving us access to their Year 7s. The 12-year olds came up with some fantastically creative visions of 2035, involving many robots, some exciting transport and travel options, and lots of use cases for technology implants!

In this latest research note from TechMarketView – Future 2035: Preparing for change - we further explore the children’s view of how technology can support their life expectations, discuss what is driving their thinking, and talk about the likelihood of their, sometimes seemingly far-fetched ideas, becoming reality. We also explore how far barriers to the adoption of such technologies are being slowly knocked down. And ask what all this means for tech suppliers as they evolve their businesses to align with possible future scenarios.

In this latest research note from TechMarketView – Future 2035: Preparing for change - we further explore the children’s view of how technology can support their life expectations, discuss what is driving their thinking, and talk about the likelihood of their, sometimes seemingly far-fetched ideas, becoming reality. We also explore how far barriers to the adoption of such technologies are being slowly knocked down. And ask what all this means for tech suppliers as they evolve their businesses to align with possible future scenarios.

TechMarketView subscribers can download the report now. Last night’s attendees will also receive a copy. If you are not yet a subscriber and would like to find out more, please contact Deb Seth.

Posted by Georgina O'Toole at '09:32'

- Tagged:

markettrends

transport

predictions

iot

robotics

Thank you so much to everybody who joined us at RIBA last night for the fifth annual Evening with TechMarketView, we hope you enjoyed ‘Unlocking the Intelligence’ as much as we did. We’d particularly like to express our thanks once again to our sponsors Sage, without whom the event wouldn’t have been possible, and to tx2 Events for their flawless event management.

Thank you so much to everybody who joined us at RIBA last night for the fifth annual Evening with TechMarketView, we hope you enjoyed ‘Unlocking the Intelligence’ as much as we did. We’d particularly like to express our thanks once again to our sponsors Sage, without whom the event wouldn’t have been possible, and to tx2 Events for their flawless event management.

After a warm welcome from TechMarketView’s Managing Director Tola Sargeant, we heard inspiring words from Alan Laing, Sage’s Managing Director UK & Ireland, and were treated to KidsViews – a look ahead to 2035 through the eyes of today’s 12 year-olds - by TechMarketView Chief Analyst Georgina O’Toole.

After a warm welcome from TechMarketView’s Managing Director Tola Sargeant, we heard inspiring words from Alan Laing, Sage’s Managing Director UK & Ireland, and were treated to KidsViews – a look ahead to 2035 through the eyes of today’s 12 year-olds - by TechMarketView Chief Analyst Georgina O’Toole.

Then it was down to business with Kate Hanaghan, Chief Research Officer, and Angela Eager, Research Director for Enterprise Software & Application Services, analysing trends in the sector and warning traditional SITS suppliers that complacency could be fatal. This was followed by TechMarketView’s public sector expert Dale Peters and financial services guru Peter Roe debating the trends in these key verticals, notably their success or otherwise at Unlocking the Intelligence.

We also heard two contrasting stories of SME success as our very own Martin Courtney interviewed Christian Nagele, now at Autotask but formerly CEO of erstwhile Little British Battler (LBB) CentraStage, and Paul Evans, CEO and co-founder at Great British Scaleup Redstor, about their respective experiences of ‘selling out’ and ‘scaling up’.

We also heard two contrasting stories of SME success as our very own Martin Courtney interviewed Christian Nagele, now at Autotask but formerly CEO of erstwhile Little British Battler (LBB) CentraStage, and Paul Evans, CEO and co-founder at Great British Scaleup Redstor, about their respective experiences of ‘selling out’ and ‘scaling up’.

And finally, TechMarketView Chairman Richard Holway MBE closed the show with his take on what the future holds – we can look forward to an abundance of AI, transportTech and Missions to Mars amongst other things!

…and finally

If you attended the event last night you should receive an email with a link to download your copy of the slides later today. TechMarketView subscription clients can download the slides

Posted by UKHotViews Editor at '08:02'

We’re looking forward to welcoming some 200 leaders from the world of UK tech to the fifth annual Evening with TechMarketView tonight. We’ll be gathering from 6.30pm this evening at the Royal Institute of British Architects (RIBA) at 66 Portland Place, London, W1B 1AD.

This year the event, run in association with Sage, is themed Unlocking the Intelligence. We have an exciting evening of future-gazing planned, covering a vast spectrum of trends and issues that we believe will fundamentally determine the prospects for the UK tech market over the next several years.

If you’re free this evening and would like to come, it would be worth contacting our event coordinator, Tina Compton (tina.compton@tx2events.com, 020 3137 2541), to see whether any spaces have become available at the last minute. Tickets cost £425 for TechMarketView research subscription clients and Little British Battlers (£525 for everyone else). There are more details on the event here or see the booking page here.

For those of you that are coming, a reminder that the dress code is business attire and we kick off with a drinks reception at 6.30pm followed by the analyst presentations from 7pm. See you then!

Posted by UKHotViews Editor at '09:31'

- Tagged:

events

Wednesday 04 October 2017

Applications for the second TechMarketView Great British Scaleup event, to be held in London on 7-8 November, CLOSE 6PM TODAY.

Applications for the second TechMarketView Great British Scaleup event, to be held in London on 7-8 November, CLOSE 6PM TODAY.

The Great British Scaleup programme helps UK tech SMEs develop plans to achieve a step-change in growth in a closed-door, 90-minute workshop-style session with TechMarketView analysts and advisors from ScaleUp Group, the team of successful tech entrepreneurs and experienced executives that have been responsible for accelerating growth and achieving successful exits at many well-known tech companies.

The Great British Scaleup programme helps UK tech SMEs develop plans to achieve a step-change in growth in a closed-door, 90-minute workshop-style session with TechMarketView analysts and advisors from ScaleUp Group, the team of successful tech entrepreneurs and experienced executives that have been responsible for accelerating growth and achieving successful exits at many well-known tech companies.

The workshop will measure your company’s scale-up potential using the ScaleUp Index, a proprietary scorecard which identifies areas of your business that might be an inhibitor to achieving your growth objectives. It gives you an independent insight of your company’s scale-up potential relative to your peer group, and will help you feel better prepared to undertake the next stage of your scale-up journey. You can then use the Index to track your progress as you implement your plans.

The Great British Scaleup programme offers a unique opportunity to tap into the market knowledge of TechMarketView analysts and the success of ScaleUp Group advisors to understand what it could take to accelerate your company’s growth. There is no charge to participate, nor any obligation to follow through on the outcomes.

In addition, every applicant will be entitled to an optional initial infrastructure assessment at no charge and with no obligation by managed cloud and infrastructure services firm Cogeco Peer 1, the Enterprise Cloud & Infrastructure Services Technology Partner for the Great British Scaleup programme.

In addition, every applicant will be entitled to an optional initial infrastructure assessment at no charge and with no obligation by managed cloud and infrastructure services firm Cogeco Peer 1, the Enterprise Cloud & Infrastructure Services Technology Partner for the Great British Scaleup programme.

There are 4 workshop slots available on each of Wednesday 7th and Thursday 8th November. To apply, just fill in the Pre-Qualification Form on the TechMarketView website here by 6pm today. We will let you know by 18th October whether your company has been selected.

If you have any queries about the Great British Scaleup programme, please give TechMarketView Managing Partner Anthony Miller a call (020 3002 8463) or drop him a line (amiller@techmarketview.com).

Posted by UKHotViews Editor at '06:00'

- Tagged:

GreatBritishScaleup

Computacenter, which has an excellent track record of retaining staff and succession planning, has appointed Neil Hall as the company’s new UK lead. Hall was TUPE’d into Computacenter from GE Capital in 2001 and was most recently Director of Group Managed Services. He knows the UK business intimately so will hit the ground running.

Computacenter, which has an excellent track record of retaining staff and succession planning, has appointed Neil Hall as the company’s new UK lead. Hall was TUPE’d into Computacenter from GE Capital in 2001 and was most recently Director of Group Managed Services. He knows the UK business intimately so will hit the ground running.

Hall will be taking over from Kevin James who is moving up to a Group role (Chief Commercial Officer). James joined Computacenter in 1990 so is well-placed to work at the Group level, particularly in managing the key vendor relationships, which include all the biggies such as HPE, VMware, Cisco, Microsoft, Dell EMC and IBM.

We applaud Computacenter for being able to retain and grow talent, but just as important is bringing in ‘new blood’ from the outside. To that end, the appointment of Andy Stafford (ex-Unisys and Accenture) to the role of COO (replacing Chris Webb who is leaving after nearly 30 years) is important. Among other things, Stafford will be helping to develop offerings and improve service quality. Computacenter also has a strong graduate/apprentice recruitment programme, which is helping to create a flow of new and young talent into the company. More...

Posted by Kate Hanaghan at '09:30'

- Tagged:

skills

people

infrastructure

leadership

Today our expert analyst team is busy rehearsing for An Evening with TechMarketView on Thursday 5 October and the sommelier and chef at RIBA are preparing to welcome some 200 of our guests - leaders from across the UK tech sector - to the drinks receptions and dinner.

If you haven't yet managed to secure your place at our flagship annual event we may still be able to squeeze you in. You can try to book your place via the website or contact our event coordinator Tina Compton (tina.compton@tx2events.com) directly to secure your ticket.

More details on the event are to be found here. We look forward to seeing many of you there!

The TechMarketView Evening 2017 is proudly sponsored by

Posted by UKHotViews Editor at '08:21'

- Tagged:

events

« Back to previous page