News

The latest stats published yesterday by the Department for Business, Energy & Industrial Strategy (BEIS) on progress with the UK smart meter rollout make, as ever, interesting reading. According to BEIS' own numbers, at current course and speed the legacy meter replacement programme – planned to be done and dusted in just two years' time – will not complete until mid-2026.

The latest stats published yesterday by the Department for Business, Energy & Industrial Strategy (BEIS) on progress with the UK smart meter rollout make, as ever, interesting reading. According to BEIS' own numbers, at current course and speed the legacy meter replacement programme – planned to be done and dusted in just two years' time – will not complete until mid-2026.

Anthony Miller, TechMarketView Managing Partner and self-appointed 'antidote to smart meter hype', takes a harsh look (Ed: surely not!) at the reality of why the Government's misguided, multibillion-pound programme is doomed never to provide the proposed benefits, either for the energy supply industry or for consumers.

Subscribers to any of TechMarketView's research programmes or to UKHotViews Premium can read the whole sorry story here …

Subscribers to any of TechMarketView's research programmes or to UKHotViews Premium can read the whole sorry story here …

Posted by UKHotViews Editor at '07:50'

- Tagged:

smartmeters

I was reading the good news story in today's FT that the European Investment Bank (EIB) has finally given the go-ahead to back a £120m investment fund for the UK North East, run by the North East Local Enterprise Partnership. The funding decision was suspended after the UK triggered Article 50, setting off fears that the European funding tap would be turned off once the UK leaves the EU, and that, in particular, venture funding of UK companies would wither and die (OK, I exaggerate a tad – but that was the mood music in some media).

I was reading the good news story in today's FT that the European Investment Bank (EIB) has finally given the go-ahead to back a £120m investment fund for the UK North East, run by the North East Local Enterprise Partnership. The funding decision was suspended after the UK triggered Article 50, setting off fears that the European funding tap would be turned off once the UK leaves the EU, and that, in particular, venture funding of UK companies would wither and die (OK, I exaggerate a tad – but that was the mood music in some media).

Actually not.

Read more in UKHotViews Extra (but only if you subscribe to any of our research services or UKHotViews Premium!)

Read more in UKHotViews Extra (but only if you subscribe to any of our research services or UKHotViews Premium!)

Posted by Anthony Miller at '15:50'

Avid UKHotViews readers will know that our Chairman Richard Holway MBE is a keen supporter of The Prince’s Trust, as indeed is TechMarketView and a great many of our clients and friends in the tech sector. One of the fundraising events that we enjoy following most is the entrepreneurial competition Million Makers, which over the years has literally raised millions to support the Trust’s fantastic work with young people.

The six-month corporate challenge provides a great learning and development platform for employees to build essential business skills and improves motivation. Teams of employees are challenged to turn an initial investment of £1,500 into at least £10,000 profit.

The competition turns ten this year and The Prince’s Trust is hoping it will be another record-breaker, taking the total raised in its first decade to over £10m. We want to build on the legacy already established, and in particular have some healthy competition amongst the technology sector. Past winners (nationally or regionally) have included Dell EMC, Atos, VMWare and CGI.

It would be fantastic to have a record number of teams from the tech sector taking part in 2018. Million Makers launches in late spring so if you’re interested in taking up the challenge you need to talk to the Trust as soon as possible.

If you would like to find out more please get in touch with Eriko Kobayashi from The Prince’s Trust who manages the competition.

Posted by Tola Sargeant at '09:33'

- Tagged:

Princestrust

‘What on earth is an Otter Trail?’, you may well be asking!

‘What on earth is an Otter Trail?’, you may well be asking!

You can read more about the Otter Wey Trail here or here. Some of you may remember ‘Shaun in the City’, which, in 2015 saw two charity art trails created featuring decorated models of Shaun the Sheep across Bristol and London. The Otter Wey Trail takes a similar form and is being led by Blooming Art, a not-for-profit community interest company (in conjunction with Farnham Town Council, Farnham in Bloom, the Surrey Wildlife Trust and the major sponsor Farnham Lions).

The initiative is a way to celebrate the return of otters to the River Wey near Farnham. Models of otters are being decorated by local schools, charities, community groups, artists and businesses to create a walking trail round Farnham.

TechMarketView is proud to be sponsoring one of the otters. As our Chairman, Richard Holway, told the Farnham Herald, “I learned about the Otter Trail at the Farnham Carol Service and thought this was a really great idea. So, I decided this would be a great way of putting something back, helping a number of local charities – and having some fun too”. The ‘TechMarketView otter’ is being decorated by St Peter's School pupils with the help of local artist, Laura Harrison.

If you want to see the trail it will be running from 20th May to 3rd June, forming part of the Farnham Town Walking Festival. The otters will also be on display at the Farnham Carnival on 30th June and will then be auctioned off, in support of several local charities, later in the year.

Pictured from left to right are Artist, Laura Harrison; TechMarketView Chairman, Richard Holway, Farnham Mayor, Mike Hodge; and Blooming Art’s Jo Aylwin, photographed with children from St. Peters’ Church of England Primary School, Farnham (including – far right - the son of TechMarketView’s Chief Analyst, Georgina O’Toole, who attends the school).

Posted by UKHotViews Editor at '09:40'

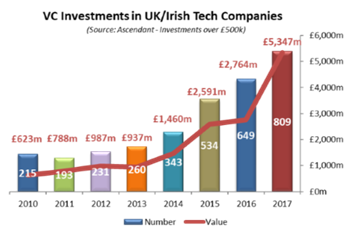

It was another record year for venture capital funding of UK and Irish technology companies in 2017, according to the latest data from corporate finance firm, Ascendant. During 2017, £5.3b was invested in 809 deals of more than £0.5m by 712 investment groups at an average deal size of £6.6m, up from £4.3m in 2016.

It was another record year for venture capital funding of UK and Irish technology companies in 2017, according to the latest data from corporate finance firm, Ascendant. During 2017, £5.3b was invested in 809 deals of more than £0.5m by 712 investment groups at an average deal size of £6.6m, up from £4.3m in 2016.

The latest edition of IndustryViews Venture Capital includes nearly 30 pages summarising significant venture funding in UK tech companies during the quarter, along with summary stats for 2017. Foundation Service subscribers only!

Contact info@techmarketview.com for further information.

Posted by UKHotViews Editor at '07:47'

- Tagged:

funding

Resolving stood out at our recent Great British Scaleup programme event as a fast-growing SME with a genuinely unique offering and inspirational founder.

Resolving stood out at our recent Great British Scaleup programme event as a fast-growing SME with a genuinely unique offering and inspirational founder.

When CEO & founder James Walker’s boiler broke down in 2012 and he was faced with the challenge of claiming compensation from British Gas, he was inspired to found Resolving. Two years later, the Resolver product was launched offering users a fast, simple and fair way to get their issues resolved by connecting consumers and businesses (for more on how they do this or to lodge your own complaint see here).

In 2015, Resolver became the first brand to co-brand with consumer champions MoneySavingExpert – a true endorsement - and it has continued to go from strength to strength. The SME has grown to become the UK’s second largest consumer orientated website and Resolver is now recommended by a broad range of regulators, ombudsmen, charities and government bodies in the UK. It has resolved over £750m of issues over the last three years, all without a marketing budget.

Key to Resolving’s success is its strong, principled ethos, which is reflected in its ambitious mission statement: “Championing better outcomes for everyone.” The site has no advertising, yet the service is free to consumers and the business vehemently protects its independence ensuring that it has no incentive to increase the number of complaints going through the system. (In fact, businesses that use Resolver find the number of spurious claims decline dramatically, reducing complaints raised by as much as 44%). It’s built a brand that is trusted by both consumers and businesses as a result.

All of this would be admirable purely as a not for profit initiative, but Resolving does make money from its four commercial services. Indeed, revenues have grown six-fold over the last year and are on track to quadruple next FY as the SME expands its services in the UK and embarks on a ‘land grab’ mission in international markets, starting with the US. Little wonder then that Resolving has already attracted the attention of financial backers, raising £3m of Series A financing in 2016 from Draper Esprit and Touchstone Innovations (see Resolver has no complaints about fundraising) and a further £6m earlier this year.

All of this would be admirable purely as a not for profit initiative, but Resolving does make money from its four commercial services. Indeed, revenues have grown six-fold over the last year and are on track to quadruple next FY as the SME expands its services in the UK and embarks on a ‘land grab’ mission in international markets, starting with the US. Little wonder then that Resolving has already attracted the attention of financial backers, raising £3m of Series A financing in 2016 from Draper Esprit and Touchstone Innovations (see Resolver has no complaints about fundraising) and a further £6m earlier this year.

We believe Resolving has the potential to be a true Great British Scaleup, building an independent resolution service internationally, and we look forward to following its progress as it scales in the months and years ahead.

Posted by Tola Sargeant at '09:16'

- Tagged:

fundraising

GreatBritishScaleup

scaleup

We first encountered GBS participant Mvine at our Little British Battler event in April 2014. They have since shown significant tenacity and entrepreneurial zeal, developing proprietary technology and exploring several exciting market opportunities. They are now focused on the crucial question of Federated Identity Management which could transform the company or lead to Mvine being snapped up by a larger business.

We first encountered GBS participant Mvine at our Little British Battler event in April 2014. They have since shown significant tenacity and entrepreneurial zeal, developing proprietary technology and exploring several exciting market opportunities. They are now focused on the crucial question of Federated Identity Management which could transform the company or lead to Mvine being snapped up by a larger business.

Central to Mvine’s strategy is its ability to deliver highly secure collaborative environments, enabling the trusted transfer of information across ecosystems. This has enabled Mvine to build collaboration propositions for trading floors, financial advisors, pay-day lenders and governmental organisations. Sustained success has however been elusive as Mvine lacked the resources to build sufficient momentum in targeted areas and as management avoided commodity-style businesses where vanilla scale-plays (like Microsoft, Box and Google) could overwhelm them.

Central to Mvine’s strategy is its ability to deliver highly secure collaborative environments, enabling the trusted transfer of information across ecosystems. This has enabled Mvine to build collaboration propositions for trading floors, financial advisors, pay-day lenders and governmental organisations. Sustained success has however been elusive as Mvine lacked the resources to build sufficient momentum in targeted areas and as management avoided commodity-style businesses where vanilla scale-plays (like Microsoft, Box and Google) could overwhelm them.

Digital Identity now presents a major opportunity. Building on its secure collaborative environment, Mvine has developed the concept of Federated Identity Management with its technology being able to deal with multiple personas and complex profiles as shown in a three-year contract with the England and Wales Cricket Board (ECB). Mvine is now positioning itself as a trusted provider of Digital Identity hubs and Digital Identity attribute exchanges to commercial organisations. Mvine is leveraging the Gov.UK Verify service as it seeks to be a primary source of identity for a wide range of services. Mvine is also integrating other national identity schemes and working with large telco operators.

Mvine is currently looking to Gov.UK Verify to establish new momentum and be adopted by private sector organisations. The company may also benefit from a change of structure to optimise its approach to this opportunity. As this market evolves, Mvine’s resilience and core capability provide a strong bedrock for it to realise its scale-up potential.

Posted by Peter Roe at '17:57'

- Tagged:

portal

security

identity

collaboration

GreatBritishScaleup

Finovate is a unique event in the Fintech calendar: 70 firms get strictly-policed 7-minute slots to demonstrate an actual product, making it a very valuable opportunity to see what the more innovative tech providers are out there selling into the UK market.

Finovate is a unique event in the Fintech calendar: 70 firms get strictly-policed 7-minute slots to demonstrate an actual product, making it a very valuable opportunity to see what the more innovative tech providers are out there selling into the UK market.

When the London event started in 2011, almost all the demonstrating companies were start-ups, but now some of them have grown into serious SITS providers to multiple leading banks around the world and they are joined on-stage by established players like IBM and Avaloq as well as the latest crop of start-ups.

It’s clear from this year’s event at the Excel earlier this month that FinTech has grown up. It is no longer just clever tech that we see on stage, but integrated solutions which are API-enabled and Open Banking ready.

TechMarketView has been observing the Fintech sector for several years and in our view this is a critical time. A new generation of Fintech providers has evolved, potentially transforming the Software and IT Services Supplier landscape for the Financial Services industry.

TechMarketView has been observing the Fintech sector for several years and in our view this is a critical time. A new generation of Fintech providers has evolved, potentially transforming the Software and IT Services Supplier landscape for the Financial Services industry.

Subscribers can read our latest FintechViews report, analysing this fundamental shift and setting out how SITS providers need to act in order to stay relevant, here.

Non-subscribers can inquire about buying this insightful report here.

Posted by Peter Roe at '08:27'

- Tagged:

legacy

banking

regulation

API

Deep Sky Blue (DSB) [now known as Deep3 - see update below] is a cyber, defence and intelligence software development start-up based in Cheltenham and Daresbury. It currently employs 43 people split between its two sites.

Deep Sky Blue (DSB) [now known as Deep3 - see update below] is a cyber, defence and intelligence software development start-up based in Cheltenham and Daresbury. It currently employs 43 people split between its two sites.

The business was founded by Richard Yorke (CEO), Paul Boardman (COO) and Richard Hensman (CTO) and began trading in 2015. Yorke and Boardman had previously worked together at Atos.

The business was founded by Richard Yorke (CEO), Paul Boardman (COO) and Richard Hensman (CTO) and began trading in 2015. Yorke and Boardman had previously worked together at Atos.

It won its first contract through the Defence Science and Technology Laboratory’s (DSTL) Centre for Defence Enterprise innovation competition. The R&D project, aimed at lightening the cognitive load for cyber analysts, was called Sherpa. Sherpa utilised machine learning and user centred design techniques to suggest appropriate courses of action analysts should take in response to complex cyber events. The project was a success, but since then a number of large security companies have entered this space, so DSB wisely decided not to take development further, focusing instead on their service offerings. In the world that DSB operates it’s hard for organisations to provide referenceable evidence of previous experience, so Sherpa remains useful to the business.

DSB has grown strongly since it was founded, largely through its partnership with Raytheon and customers in the UK cyber and intelligence sector. It has built a Natural Language Processing system that analyses and assesses unstructured text for compliance purposes. It is also developing a secure order processing and fulfilment solution, and a big data platform for UK government clients. In terms of cloud technologies, DSB are also delivering capabilities for their customers based on containerisation and serverless technologies.

DSB have developed new partnerships (e.g. with RedHat and Civica) and have a solid pipeline in place, creating good opportunities for the business. It will be moving to new premises in Cheltenham and relocating the Daresbury office to Salford shortly. A name change and related rebrand is also imminent (Sky UK’s lawyers have been busy again…).

As we discussed in Cyber Security Market Trends and Forecasts, the volume, diversity and potency of cyber threats continues to expand. This factor, coupled with increasing interest in AI, data and cloud technologies, suggests that DSB’s services will be in high demand. We will watch its scale-up journey with great interest.

Update: Since taking part in the March 2018 Great British ScaleUps event, the business has completed its name change and rebranding exercise. In April 2018 Deep Sky Blue became Deep3, a name it says reflects the depth of its focus in delivering mission-critical software, engineered to meet the highly complex and secure requirements of its customers.

Posted by Dale Peters at '07:12'

- Tagged:

defence

startup

cyber

intelligence

GreatBritishScaleup

Methods Business & Digital Technology Ltd (BDT) has been in existence far longer than other participants in our third Great British Scaleup event. In fact, it will be celebrating its 28th birthday later this year. It’s also much bigger than the other participants -- in the year ended 30 April 2017 Methods BDT generated revenues of £62.8m. However, it’s never too late to scale-up.

Methods Business & Digital Technology Ltd (BDT) has been in existence far longer than other participants in our third Great British Scaleup event. In fact, it will be celebrating its 28th birthday later this year. It’s also much bigger than the other participants -- in the year ended 30 April 2017 Methods BDT generated revenues of £62.8m. However, it’s never too late to scale-up.

Methods BDT specialises in digital transformation services for the UK public sector. It started life as Methods Application Ltd in 1990. CEO Peter Rowlins and Mark Thompson, strategy director, took control of the business in 2011 and instigated a demerger in 2014 to form six individual companies. To reduce duplication of effort and realise internal efficiencies four of those businesses were remerged in 2017 to form Methods BDT, which now operates alongside its sister companies Methods Analytics and CoreAzure. Although Methods BDT has been around for a long time, it’s only at the beginning of its journey in its current guise.

Methods BDT specialises in digital transformation services for the UK public sector. It started life as Methods Application Ltd in 1990. CEO Peter Rowlins and Mark Thompson, strategy director, took control of the business in 2011 and instigated a demerger in 2014 to form six individual companies. To reduce duplication of effort and realise internal efficiencies four of those businesses were remerged in 2017 to form Methods BDT, which now operates alongside its sister companies Methods Analytics and CoreAzure. Although Methods BDT has been around for a long time, it’s only at the beginning of its journey in its current guise.

Approximately 70% of Method BDT’s revenue comes from central government customers, including the Home Office, Ministry of Justice, and the Department for Education. Thompson is a regular commentator on service redesign in the public sector and has helped to influence the government’s technology procurement strategy. Not surprisingly, Methods BDT has embraced government frameworks and is one of the leading suppliers in terms of Digital Marketplace revenues. It has developed key capabilities in front-end digital service redesign and back-office infrastructure migration and contract disaggregation.

Methods BDT performed well in 2017, improving revenues by 29%, but, like many technology companies in the UK, it is being held back by the digital skills shortage. It’s good to see it taking positive steps to address the issue by establishing an academy to help hone the abilities of recent graduates.

There is still much to be done to improve service delivery in the public sector and organisations will need to embrace digital transformation to navigate challenging financial settlements. There will be plenty of opportunities for Methods BDT to grow its market share and scale-up as it enters the next phase in its history.

Posted by Dale Peters at '06:56'

- Tagged:

government

transformation

GreatBritishScaleup

It was perhaps a fortunate coincidence that Bangalore-based offshore services major, Wipro, chose to hold a briefing for analysts (and later that day, clients) on its cloud strategy the same day that it announced the disposal of its US data centre business (see Wipro divests data centre business to Ensono). Both events made perfect sense.

It was perhaps a fortunate coincidence that Bangalore-based offshore services major, Wipro, chose to hold a briefing for analysts (and later that day, clients) on its cloud strategy the same day that it announced the disposal of its US data centre business (see Wipro divests data centre business to Ensono). Both events made perfect sense.

At the briefing, Wipro paraded a cohort of mostly UK-based management, along with execs from Appirio, the 1,250-employee Indianapolis-headquartered Salesforce.com and Workday consultancy that Wipro acquired for $500m back in 2016 (see Appirio joins TWITCH crew with Wipro). Wipro also fielded a couple of client speakers, one from the global music industry and the other from the Scandinavian utilities sector, both of whom were glowing in praise for Wipro.

But what piqued my interest most were management's comments on the downstream services revenue leverage that the company gets – and might expect to get in future – from transitioning clients to the cloud.

Subscribers to TechMarketView subscription research services, and to our new UKHotViews Premium service, can read more …

Subscribers to TechMarketView subscription research services, and to our new UKHotViews Premium service, can read more …

Posted by Anthony Miller at '09:03'

- Tagged:

offshore

If the US National Security Agency (NSA) can tap Angela Merkel’s secure mobile phone, nobody is safe – unless you have Great British Scale-up Armour Communications on board to stop your mobile calls, messages and file transfers being intercepted by the wrong people.

If the US National Security Agency (NSA) can tap Angela Merkel’s secure mobile phone, nobody is safe – unless you have Great British Scale-up Armour Communications on board to stop your mobile calls, messages and file transfers being intercepted by the wrong people.

Founded in 2014 after a management buyout of Cellcrypt’s EMEA business, Armour currently serves a select number of government clients in the UK, Middle East and Australia which account for around 70% of its revenue.

The certification of its Armour Mobile encryption product against the secure real time communications certification standards of the UK National Cyber Security Centre (NCSC) and NATO, plus the US Federal Information Processing Standard (FIPS), was the key to winning those customers.

The next step is to expand the portfolio by developing encrypted mission critical push to talk (MCPTT) communications tools for standard smartphones aimed at police and emergency services. Those same tools could be embedded in customised communications applications for the financial services industry, strengthening secure customer communications by layering additional identification and authentication features on top. And by utilising its back end infrastructure, Armour also spies an opportunity to encrypt and authenticate desktop PC initiated email in the future.

Jointly owned and run by two senior executives – Dave Holman and Andy Lilly – Armour’s short term aim is to grow its headcount beyond the 24 staff now employed. And with a couple of multi-million pound contracts being finalised, it also needs to boost Armour Mobile’s automated provisioning and resilience capabilities to handle larger numbers of end users.

With the technology now proven against Secure Chorus standards and leapfrogging competitive enterprise and consumer solutions, Armour is now looking to drive further into other verticals with the help of channel partners in Europe, APAC and the US (one European reseller is already rebranding Armour Mobile for its own large customer base).

The company already has a foothold in the financial services industry (which accounts for the other 30% of its revenue), and we look forward to tracking Armour’s expansion beyond its core public sector market.

Posted by Martin Courtney at '07:41'

- Tagged:

communications

cyber

GreatBritishScaleup

encryption

ArmourCommunications

We are very pleased to announce that tickets for the 2018 ‘Evening with TechMarketView’ are now on sale! Secure your place now and book by 1 May for specially discounted early bird rates on tables of ten.

We look forward to welcoming you to this, our sixth annual Presentation and Dinner, at the magnificent Royal Institute of British Architects (RIBA), in Portland Place London, from 6.30pm on Thursday 13th September.

Up to 250 of UK tech’s ‘great & good’ are expected to attend the evening event which has become a popular fixture in the tech calendar and has been described by attendees as “the best networking event in the industry”.

Superb networking coupled with expert insight on tech trends

The evening will begin with an extended welcome drinks reception, supported by InterSystems, giving plenty of time for networking over a glass or two of your favourite tipple.

After a few drinks with your peers, you will be treated to an hour or so of insight on key trends and suppliers shaping the UK tech sector from our leading analysts and guest speakers. In line with our 2018 theme, we will of course be ‘Breaking the Boundaries’ too (more on that in due course) before we sit down to a sumptuous three course dinner.

Book by 1 May for Early-Bird rates

As in previous years, TechMarketView subscription clients and SMEs that have been through our Little British Battler (LBB) and Great British Scaleup (GBS) Programmes benefit from a 20% discount on ticket pricing. Our growing band of UKHotViews Premium subscribers also qualify for this discount (yet another reason to sign up!).

To get the best deal, book before 1 May to secure a table of 10 at the ‘early bird’ price of £3,999 +VAT.

For full details and to book your place click here or contact our event management partners tx2 Events with any queries.

The TechMarketView Evening 2018 Welcome Drinks Reception is proudly supported by:

To express your interest in sponsorship packages related to this or future events – some of which come with sought after speaking slots - please contact TechMarketView’s Tola Sargeant or Sarah Robinson directly.

Posted by UKHotViews Editor at '20:45'

- Tagged:

events

networkservices

insight

Although the Temenos bid for Fidessa took the markets by surprise (see our comment on 20th February, Temenos takes a punt on Fidessa), the management of this Swiss-HQ’d provider of banking software had been planning its route into the Capital Markets business for some time. The £1.4bn deal, now recommended by the Fidessa Board of Directors, opens up the sector which Temenos reckons to be spending some US$14bn on IT. Looking at 2017 revenues, Capital Markets revenue will account for 40% of the enlarged Group.

The Fidessa portfolio sits well with that of Temenos and there is significant potential for cross selling. At the same time the Fidessa operation, which will run as a stand-alone division in the new Group, should benefit from Temenos’s emphasis on R&D, its strong sales focus and its approach to partnership and innovation.

The timing of this deal looks inspired. FinancialServicesViews subscribers can learn more by accessing “Temenos and Fidessa – Building a Full Service Provider”, here.

Posted by Peter Roe at '18:14'

- Tagged:

trading

acquisition

software

financialservices

banking

Hedgehog Lab is a Newcastle based mobile-focused tech consultancy with international growth ambitions. Originally founded by current CEO Sarat Pediredla and Chief Product Officer Mark Forster the company now employs 120 people with offices located in the UK, US, India and Denmark.

Hedgehog Lab is a Newcastle based mobile-focused tech consultancy with international growth ambitions. Originally founded by current CEO Sarat Pediredla and Chief Product Officer Mark Forster the company now employs 120 people with offices located in the UK, US, India and Denmark.

Having worked as developers in other agencies for a number of years Pediredla and Forster took the opportunity to build a company centred around software developers. Originally founded in 2007 as a web agency, Hedgehog Lab pivoted in 2011 to focus on developing multi-platform software for Mobile, Web, VR, AR, Wearables, Connected Platforms and IoT.

Having worked as developers in other agencies for a number of years Pediredla and Forster took the opportunity to build a company centred around software developers. Originally founded in 2007 as a web agency, Hedgehog Lab pivoted in 2011 to focus on developing multi-platform software for Mobile, Web, VR, AR, Wearables, Connected Platforms and IoT.

Hedgehog serves the market need for a small / mid-size technology consultancy that has a combination of strategy, design and technology skills across different platforms. It exploits the fact that many IT companies lack strong design capabilities and that most strategy companies lack the necessary engineering skills, particularly around mobile product development.

With PE investment from Maven Capital Partners now on-board Hedgehog Lab is focusing on differentiating itself by investing in those tech skills that are currently hard to find. Hedgehog got into mobile apps early and has now invested heavily in VR and in establishing an AI practise.

It currently primarily delivers project-based services to a client list that includes the likes of Thales, The Financial Times, Channel 4, Mitsubishi and Microsoft HoloLens and has recently started delivering resource augmentation and outsourced product development as it looks to scale the operation. For many customers Hedgehog Lab’s value is in accelerating product development cycles without having to invest heavily in in-house mobile and digital teams and we look forward to following its scale-up journey as it focuses on landing larger enterprise deals.

Posted by Marc Hardwick at '06:36'

- Tagged:

consulting

mobility

GreatBritishScaleup

In his first Spring Statement, Chancellor Philip Hammond declared himself to be at his “most positively Tigger like”. But with, as expected, no new tax or spending commitments, it leaves us to read between the lines regarding how the Chancellor’s exuberant optimism will translate into spending by public sector organisations.

In his first Spring Statement, Chancellor Philip Hammond declared himself to be at his “most positively Tigger like”. But with, as expected, no new tax or spending commitments, it leaves us to read between the lines regarding how the Chancellor’s exuberant optimism will translate into spending by public sector organisations.

Hammond's positive outlook has been driven by a slightly better than expected economic forecast. But in HotViewsExtra, we question whether the recent positive trend is sustainable. And we look at how the public spending - on ICT in particular - will be impacted should Hammond be blessed with a continuing fiscal improvement.

TechMarketView research subscribers or HotViews Premium subscribers can read our take in HotViewsExtra - Hammond aims for Tigger-like Spring in his Statement. If you are not able to access this opinion piece, please contact Deb Seth to find out how to read this and other behind-the-paywall research from the TechMarketView analyst team.

TechMarketView research subscribers or HotViews Premium subscribers can read our take in HotViewsExtra - Hammond aims for Tigger-like Spring in his Statement. If you are not able to access this opinion piece, please contact Deb Seth to find out how to read this and other behind-the-paywall research from the TechMarketView analyst team.

Posted by Georgina O'Toole at '15:40'

Have you seen our latest report on machine intelligence and AI: ‘Will Machine Intelligence Open Enterprise Doors for Amazon Web Services and Google?’ Make sure you download it here.

Have you seen our latest report on machine intelligence and AI: ‘Will Machine Intelligence Open Enterprise Doors for Amazon Web Services and Google?’ Make sure you download it here.

As AWS and Google look to exploit machine learning and AI and to increase their appeal to enterprise organisations, their activities have a direct impact on the business of traditional software & application services providers. With accessible cloud compute and storage services plus ownership of high value, high volume training data sets, the two have clear advantages when it comes to the provision of these demanding techniques directly to enterprises. Those advantages position them to take hold of budgets that would have automatically gone to traditional suppliers.

It is not a one way street however because the duo lack the industry and business process knowledge CIOs are looking for from their technology providers. And these are precisely the capabilities many of the established providers can provide. Add in the shortage of ML and AI skills in the overall market and the technology-and-services decision matrix quickly becomes complex.

These advanced technologies do open up opportunities for both software & application service providers as well as AWS and Google – provided all parties can agree terms. One thing is very clear: enterprise CIOs and software & application services providers need to understand the AWS and Google propositions, which makes the ‘Will Machine Intelligence Open Enterprise Doors for Amazon Web Services and Google?’ report essential reading.

If you’d like information about our subscription services, marketing director Deb Seth will be happy to help.

Posted by Angela Eager at '08:30'

- Tagged:

infrastructure

digital

machinelearning

After a few quiet years in the UK Life and Pensions outsourcing market, activity has been increasing as Financial Institutions increasingly look for enhanced value from service providers.

After a few quiet years in the UK Life and Pensions outsourcing market, activity has been increasing as Financial Institutions increasingly look for enhanced value from service providers.

Our latest BusinessProcessViews report - ‘Life & Pensions BPS: Strategies for Success’ - looks at the journey on which the Life and Pensions sector is embarking as third generation BPS deals materialise with new commercial and operating models. It also considers what the future service must look like if BPS providers are to remain relevant and be successful.

Business process services and specifically third-party administration started off in Life and Pensions as a way of fixing costs and transferring risk onto the balance sheet of a BPO player. Whilst efficiencies and improving the bottom line remain as important as ever, there is a pressing need to improve the customer experience in a sector that lags behind many others in putting the customer first.

Many of the first and second generation outsourcing arrangements are contracts that were signed many years ago and have a long way to go on the journey to digital. These L&P providers are returning to the market looking for genuine transformational partnerships with aligned objectives that can improve both their top and bottom lines. They also want to enhance the customer experience for the policy holder whose own expectations have been increased by what’s been done in other sectors such as retail or travel. BPS players consequently have an opportunity to deploy new platforms and intelligent automation to transform Life providers’ cost bases and deliver on the self-service demands from policy holders.

BusinessProcessViews' subscribers can download ‘Life & Pensions BPS: Strategies for Success’ now. If you are not yet a subscriber, please contact Deb Seth to find out more.

Posted by Marc Hardwick at '14:53'

- Tagged:

lifeandpensions

digital

customerexperience

We called out Screendragon as a Little British Battler in November 2014 (see LBB Screendragon adding structure and process to marketing and Little British Battlers: The Fifth Dimension) and since then it has grown steadily, now claiming its place as a Great British Scaleup. Since we last met Screendragon, employee numbers are up by a third to 44. Clients now total >50, including big names like Kellogg, Kimberley Clark, and BP; the biggest success story is in exporting to the US (accounting for 80% of turnover). Most new client wins to date have been via referrals, painting a strong picture of the company’s existing client relationships. Compounded annual revenue growth has been 31% over the last 2 years (despite the currency headwind of a 13% dollar fall last year). And, crucially, Screendragon is an incredibly well-managed business, which, to date, has been entirely self-funded.

We called out Screendragon as a Little British Battler in November 2014 (see LBB Screendragon adding structure and process to marketing and Little British Battlers: The Fifth Dimension) and since then it has grown steadily, now claiming its place as a Great British Scaleup. Since we last met Screendragon, employee numbers are up by a third to 44. Clients now total >50, including big names like Kellogg, Kimberley Clark, and BP; the biggest success story is in exporting to the US (accounting for 80% of turnover). Most new client wins to date have been via referrals, painting a strong picture of the company’s existing client relationships. Compounded annual revenue growth has been 31% over the last 2 years (despite the currency headwind of a 13% dollar fall last year). And, crucially, Screendragon is an incredibly well-managed business, which, to date, has been entirely self-funded.

The company’s raison d'être remains. Screendragon’s software solutions are focused on meeting the needs of marketing and professional services teams. Clients include Marketing Enterprise Teams and Advertising & Communications Agencies. Over the last five years, the product has evolved, adding new processes along the way, so that it now offers a “holistic” cloud-based project, resource and workflow management software solution. Screendragon’s target market is attracted by the prospect of eliminating the increasing complexities, and hence, inefficiencies involved in modern marketing. And hence, boosting performance and profitability.

The next year and beyond will be all about scaling. Screendragon’s ambition is to be “the #1 agency operations software globally and a top 5 global leader in the MRM category”. It has already proven it can win against peers who are, sometimes, ten-times Screendragon’s size. Accelerating growth will require a step-change in efforts around sales & marketing to realise market potential. There is a big cross-sell/up-sell opportunity within the existing client base. But, there is also an opportunity to add more clients by showing Screendragon’s ability to disrupt a broken Agency business model; agencies are struggling to manage multiple channels and multiple partners, while developing campaigns in quicker time. Moreover, within Enterprise Accounts – where Screendragon now boasts some of its biggest deals – the market potential is substantial; just this week Proctor & Gamble said it would take more of its marketing back in-house. There is also the possibility of broadening the software’s use cases to target additional verticals.

Watch out for more news on Screendragon a we follow its scale-up journey.

We'll be profiling other Great British Scaleups soon.

Posted by Georgina O'Toole at '10:56'

- Tagged:

software

marketing

workflow

GreatBritishScaleup

Compliance with the European Union’s General Data Protection Regulation (GDPR) requires some fundamental changes in the way that UK software and services (SITS) suppliers obtain consent to store and process citizens’ data and report data breaches to relevant supervising authorities.

Compliance with the European Union’s General Data Protection Regulation (GDPR) requires some fundamental changes in the way that UK software and services (SITS) suppliers obtain consent to store and process citizens’ data and report data breaches to relevant supervising authorities.

Ensuring compliance ahead of the May 25th deadline can be complex, time consuming and expensive. But the new rules are not just an administrative burden designed to make life difficult for all concerned – the GDPR also offers significant benefits to any organisation engaged in the large scale processing of people’s data, especially where business operations span multiple EU countries.

And because the regulation applies to pretty much everyone (regardless of Brexit), the GDPR also presents a wealth of opportunities to SITS suppliers able to help their public and private sector customers meet its requirements whilst simultaneously beefing up data protection frameworks and cyber security defences.

Our latest report - ‘GDPR: Opportunities and Recommendations for UK SITS Suppliers’ - sets out where TechMarketView thinks those opportunities lie, summarises the primary areas of attention for establishing GDPR compliance amongst SITS suppliers themselves, and offers recommendations on the best way to proceed.

Subscribers to our SecureConnectViews research stream can access the ‘GDPR: Opportunities and Recommendations for UK SITS Suppliers’ report here.

Not a subscriber to SecureConnectViews? No problem, this report is available as a one-off purchase HERE. Alternatively, if you're interested in a subscription to our SecureConnectViews stream, please contact our Marketing Director, Deb Seth at dseth@techmarketview.com.

Posted by Martin Courtney at '08:14'

- Tagged:

compliance

regulation

cyber

data

GDPR

When I wrote about Engage Technology Partners a few weeks ago (see Recruitment startups chase the impossible dream), I thought it was just another run-of-the-mill recruitment software startup trying to make a mark in a well-established market. A few days later I was invited to meet Engage's very engaging founding CEO, Howard Hughes, and was surprised to find that run-of-the-mill they are certainly not, so I almost insisted he applied for a place on our Great British Scaleup programme.

When I wrote about Engage Technology Partners a few weeks ago (see Recruitment startups chase the impossible dream), I thought it was just another run-of-the-mill recruitment software startup trying to make a mark in a well-established market. A few days later I was invited to meet Engage's very engaging founding CEO, Howard Hughes, and was surprised to find that run-of-the-mill they are certainly not, so I almost insisted he applied for a place on our Great British Scaleup programme.

Yes, Engage is a recruitment sector platform, but it differs significantly from rest of the crowd. Firstly, rather than addressing white-collar recruitment, the traditional stomping ground for many software vendors, Engage focuses on the blue-collar contingent staffing market – some 7m workers in the UK alone, who work on contracts from a few hours to several months and typically get paid weekly.

Secondly, rather than being a 'point' solution for just one part of the recruitment process, Engage is in effect an end-to-end supply-chain management platform covering all key aspects of the recruitment cycle, including hiring, time-recording, billing and payment. And if they need, clients can plug in their own 'point solutions' from popular third-party vendors.

Thirdly, and perhaps most significantly, Engage is designed for use by all parties involved in the recruitment process; the companies that need the workers; the agencies they use to find them; and the workers themselves. This 'one-stop shop' approach eliminates error-prone manual data transfer between the multiple parties in the process and vastly reduces the need for back-office staff.

Hughes and his co-founders are not newbies in this game. Before launching Engage, they built and spun out a construction firm, a recruitment agency and a payroll business, so they know the market from all angles.

Hughes' biggest challenge is the best one to have – managing explosive demand. I can't reveal the numbers but I can say that triple-digit growth is involved.

Watch out for more news on Engage as we follow its scale-up journey.

We'll be profiling other Great British Scaleups soon.

Posted by Anthony Miller at '07:25'

- Tagged:

GreatBritishScaleup

SMEs play such an important part in the UK economy and its overall prosperity: at the start of 2016 they represented over 99% of UK businesses. That’s 5.5m companies with a combined annual turnover of £1.8tn according to the Nesta foundation/Sage Group report ‘The State of Small Business’. And they provided 60% of total UK private sector employment. Furthermore, as a group they punch above their weight when it comes to private sector job creation having created 73% of new private sector jobs since 2010 despite accounting for just 60% of private sector employment.

SMEs play such an important part in the UK economy and its overall prosperity: at the start of 2016 they represented over 99% of UK businesses. That’s 5.5m companies with a combined annual turnover of £1.8tn according to the Nesta foundation/Sage Group report ‘The State of Small Business’. And they provided 60% of total UK private sector employment. Furthermore, as a group they punch above their weight when it comes to private sector job creation having created 73% of new private sector jobs since 2010 despite accounting for just 60% of private sector employment.

As a software provider who has long championed the SME community, Sage Group understands their needs and challenges and is also able to represent the position of UK businesses in dialog with UK government. A FTSE 100 organisation and one of the UK’s largest technology companies, it is also an influential tech sector participant. With that background in mind, we spoke to Alan Laing, MD of Sage UK & Ireland, to get his views on Sage’s progress as it continues to adjust to changing market conditions and technology developments, acts as a conduit between government and SMEs, addresses the productivity challenge and works on key partnerships.

As a software provider who has long championed the SME community, Sage Group understands their needs and challenges and is also able to represent the position of UK businesses in dialog with UK government. A FTSE 100 organisation and one of the UK’s largest technology companies, it is also an influential tech sector participant. With that background in mind, we spoke to Alan Laing, MD of Sage UK & Ireland, to get his views on Sage’s progress as it continues to adjust to changing market conditions and technology developments, acts as a conduit between government and SMEs, addresses the productivity challenge and works on key partnerships.

Available as part of our UKHotViewsExtra research stream, ‘Q&A with Sage UK MD Alan Laing’ can be accessed here by TechMarketView subscribers, including those who take our UKHotViews Premium service.

Individuals who subscribe to UKHotViews Premium gain access to the more than 15,000 UKHotViews articles in our online library as well as the more in-depth UKHotViewsExtra analysis from our analyst team. For more details or to sign up to UKHotViews Premium today please click here.

Individuals who subscribe to UKHotViews Premium gain access to the more than 15,000 UKHotViews articles in our online library as well as the more in-depth UKHotViewsExtra analysis from our analyst team. For more details or to sign up to UKHotViews Premium today please click here.

Posted by Angela Eager at '09:03'

- Tagged:

cloud

software

digital

The first few weeks of 2018 have flown by and over the period the growing TechMarketView analyst team has published more than thirty pieces of in-depth research for our subscription clients. (Of course this doesn’t include the more than 400 UKHotViews articles that we’ve also published so far this year!).

The first few weeks of 2018 have flown by and over the period the growing TechMarketView analyst team has published more than thirty pieces of in-depth research for our subscription clients. (Of course this doesn’t include the more than 400 UKHotViews articles that we’ve also published so far this year!).

Here are some highlights from the published reports in case you missed them:

Our FinancialServicesViews team, led by Research Director Peter Roe, has just published the eagerly anticipated Financial Services IT Market Trends & Forecasts 2018-2020 report, a must-read for anyone with an interest in the financial services tech sector. This should be digested alongside Financial Services Supplier Prospects 2018 & Beyond, a report which was published at the beginning of the year.

If you have an interest in cyber security, don’t miss the core Cyber Security Market Trends & Forecasts 2017-2020 and Cyber Security Supplier Prospects 2018 reports published by Martin Courtney who leads our SecureConnectViews research stream.

Those active in the public sector should be sure to read the in-depth UK Public Sector Supplier Prospects 2018 analysis from our PublicSectorViews team, our data-driven report on the Digital Marketplace in 2017, and our Chief Analyst Georgina O’Toole’s views on the impact that Brexit is having on Whitehall in Brexit preparation snapshot: Whitehall progress & supplier opportunities.

Those active in the public sector should be sure to read the in-depth UK Public Sector Supplier Prospects 2018 analysis from our PublicSectorViews team, our data-driven report on the Digital Marketplace in 2017, and our Chief Analyst Georgina O’Toole’s views on the impact that Brexit is having on Whitehall in Brexit preparation snapshot: Whitehall progress & supplier opportunities.

Subscribers to our popular Enterprise Software & Application Services research (ESASViews) can enjoy the latest report from Duncan Aitchison on the opportunities in application management, The legacy opportunity: Strategies for success, and benefit from Angela Eager’s insight into the rapidly changing world of machine intelligence in Will machine intelligence open enterprise doors for AWS & Google?.

BusinessProcessViews Research Director Marc Hardwick examines the disruption facing the business process services market in Prospering beyond the mega-deal – Transforming BPS commercial & operating models and the very well-received Business Process Services Supplier Prospects 2018 report.

In infrastructure services, our InfrastructureViews research team led by Chief Research Officer Kate Hanaghan, analyses an important emerging trend in Containers & Serverless Computing: Opportunities and use cases and puts the leading players in the sector under the microscope in Cloud & Infrastructure Services Supplier Prospects 2018.

And last but by no means least, subscribers to our Foundation Service research are spoilt for choice with recent reports analysing 2017 merger & acquisition activity, Quoted Sector performance and Venture Capital activity, as well as providing consolidated commentary on the SMEs that took part in the first two phases of our Great British Scaleup Programme.

Subscribers to the research streams listed above can login and download the research highlighted – and much more - at any time (if you need to reset your password you can do that here.)

If your organisation doesn’t yet subscribe to our core research and analysis and you’d like details of our 2018 subscription packages please don’t hesitate to contact our Client Services team who will be only too pleased to help.

And don’t forget that individuals can now also subscribe to our UKHotViews Premium service to gain access to the more than 15,000 UKHotViews articles in our online library as well as the more in-depth UKHotViews Extra analysis from our analyst team, which we haven’t had space to mention above! For more details or to sign up to UKHotViews Premium today please click here.

And don’t forget that individuals can now also subscribe to our UKHotViews Premium service to gain access to the more than 15,000 UKHotViews articles in our online library as well as the more in-depth UKHotViews Extra analysis from our analyst team, which we haven’t had space to mention above! For more details or to sign up to UKHotViews Premium today please click here.

Posted by UKHotViews Editor at '12:30'

How privileged we were to support eight aspiring UK tech SME scale-ups on their journey! TechMarketView research directors and ScaleUp Group advisors helped the top teams of these companies assess the scale-up opportunities and challenges in their business plans at the third Great British Scaleup event held in London over the past two days.

How privileged we were to support eight aspiring UK tech SME scale-ups on their journey! TechMarketView research directors and ScaleUp Group advisors helped the top teams of these companies assess the scale-up opportunities and challenges in their business plans at the third Great British Scaleup event held in London over the past two days.

The companies participating in GBS3 were:

-

Armour Communications

-

Deep Sky Blue Solutions

-

Engage Technology Partners

-

hedgehog lab

-

Methods Business & Digital Technologies

-

Mvine

-

Resolving

-

Screendragon

We'll be writing more about these companies on UKHotViews soon and will be following their progress with interest.

Don't worry if you missed out this time. Great British Scaleups: The Fourth Generation is scheduled for June, and Great British Scaleups: The Fifth Dimension in September. We will announce details in UKHotViews in coming weeks. Contact gbs@techmarketview.com for further information.

The TechMarketView Great British Scaleup programme is proudly sponsored and supported by:

Posted by UKHotViews Editor at '08:38'

- Tagged:

GreatBritishScaleup

In FinancialServicesViews we have written long and often about how banks need to address their legacy issues urgently if they are to remain competitive against agile, cloud-native digital businesses and to meet ever-increasing customer expectations. The resulting Bank transformation programmes have multi-billion dollar budgets (see for example Lloyds Banking Group to spend an extra £3bn on IT), and much of this spend will be directed at third-party Software and IT Services providers.

In FinancialServicesViews we have written long and often about how banks need to address their legacy issues urgently if they are to remain competitive against agile, cloud-native digital businesses and to meet ever-increasing customer expectations. The resulting Bank transformation programmes have multi-billion dollar budgets (see for example Lloyds Banking Group to spend an extra £3bn on IT), and much of this spend will be directed at third-party Software and IT Services providers.

As we highlighted in our recent Financial Services Market Trends and Forecasts report, there is an unprecedented period of opportunity for SITS providers. However, we believe that a critical success factor for vendors to win a share of the banks’ expenditure will be the ability to demonstrate an understanding of the wide range of interconnected and complex legacy issues.

But what exactly are these legacy issues, how did they arise and specifically what sort of opportunities do they provide for vendors? To answer these questions and more, FinancialServicesViews clients can access our new report “Understanding the Legacy Issues facing Banks” here.

If you are interested in buying this fascinating report on a one-off basis, please follow this link.

Posted by Peter Roe at '17:06'

- Tagged:

legacy

banking

regulation

We are excited to announce the second group of fast-growing UK tech SMEs companies participating on Day 2 of our third Great British Scaleup Event today in London.

We are excited to announce the second group of fast-growing UK tech SMEs companies participating on Day 2 of our third Great British Scaleup Event today in London.

They are:

-

Armour Communications

-

Deep Sky Blue Solutions

-

Methods Business & Digital Technologies

-

Mvine

Top executives of these companies will be joining a team of TechMarketView research directors and ScaleUp Group advisors in individual, intensive 90-minute workshops to assess their scale-up potential.

The companies will be rated using the ScaleUp Growth Index®, a proprietary scorecard which identifies areas of the business that might be an inhibitor to achieving management’s growth objectives. It gives an independent insight of the company’s scale-up potential relative to its peer group, and helps management feel better prepared to undertake the next stage of the scale-up journey and track progress.

We announced the first group companies participating in Day 1 in yesterday's UKHotViews, and we will be telling you more about all these companies in future UKHotViews posts.

Don't worry if you missed out this time. Great British Scaleups: The Fourth Generation is scheduled for June, and Great British Scaleups: The Fifth Dimension in September. We will announce details in UKHotViews in coming weeks. Contact gbs@techmarketview.com for further information.

The TechMarketView Great British Scaleup programme is proudly sponsored and supported by:

Posted by UKHotViews Editor at '06:00'

The Financial Services sector is still a cauldron of change as new competitors emerge, regulations change and customers get more demanding. The large, established players have to change their business models and cost structures radically if they are to succeed. This will mean substantial changes in the way they interact with their Software and IT Services suppliers.

The Financial Services sector is still a cauldron of change as new competitors emerge, regulations change and customers get more demanding. The large, established players have to change their business models and cost structures radically if they are to succeed. This will mean substantial changes in the way they interact with their Software and IT Services suppliers.

The ubiquitous digital transformation agenda, together with the need to prop up legacy systems, will mean that IT spend will remain strong, growing faster than the overall market. However, we expect that the chronic uncertainty over Brexit will continue to delay decisions and shift IT investment onto the Continent as London-based operations hedge their bets. An annual growth rate of 2.3% is forecast for the next 3 years, well down on pre-Brexit expectations.

As companies look to improve customer experience and service quality, major changes are necessary to ensure that they can efficiently access the relevant data, particularly from within their own organisations. Success here will enable real progress through the application of automation and analytics technologies.

With the advent of cloud, larger companies see the opportunity for lower costs, but they also realise that their rate of innovation is woefully insufficient. Many aim to work with the new breed of Fintech players, but in our opinion, doing this effectively requires a partnership with the larger SITS suppliers.

Tectonic shifts are occurring in all the major segments of the UK SITS market and throughout the worlds of Banking, Insurance and Capital Markets. This annual review highlights the underlying issues and discusses the implications and opportunities for the SITS supplier community. Subscribers to FinancialServicesViews can access the report, here.

If you don’t yet subscribe, please contact our Marketing Director, Deb Seth at dseth@techmarketview.com .

Posted by Peter Roe at '12:52'

- Tagged:

cloud

financialservices

analytics

automation

FinTech

data

We are excited to announce the first group of fast-growing UK tech SMEs companies participating on Day 1 of our third Great British Scaleup Event today in London.

We are excited to announce the first group of fast-growing UK tech SMEs companies participating on Day 1 of our third Great British Scaleup Event today in London.

They are:

-

Engage Technology Partners

-

hedgehog lab

-

Resolving

-

Screendragon

Top executives of these companies will be joining a team of TechMarketView research directors and ScaleUp Group advisors in individual, intensive 90-minute workshops to assess their scale-up potential.

The companies will be rated using the ScaleUp Growth Index®, a proprietary scorecard which identifies areas of the business that might be an inhibitor to achieving management’s growth objectives. It gives an independent insight of the company’s scale-up potential relative to its peer group, and helps management feel better prepared to undertake the next stage of the scale-up journey and track progress.

We will announce the second group of companies participating on Day 2 in tomorrow’s UKHotViews, and we will be telling you more about all these companies in future UKHotViews posts.

Don't worry if you missed out this time. Great British Scaleups: The Fourth Generation is scheduled for June, and Great British Scaleups: The Fifth Dimension in September. We will announce details in UKHotViews in coming weeks. Contact gbs@techmarketview.com for further information.

The TechMarketView Great British Scaleup programme is proudly sponsored and supported by:

Posted by UKHotViews Editor at '06:00'

TechMarketView has just launched “Containers and Serverless computing: Opportunities and use cases”, a new research note to help you understand the context of these technologies alongside the use cases.

Software containers continue to generate a great deal of interest among organisations of all sectors and sizes, and represent an important emerging trend. This is largely because containers have become associated with a shift in the way that IT services and applications are operated and delivered, but also new approaches to developing those services that emphasise agility and continuous improvement instead of the stepwise progression of traditional approaches.

In this report we take a reality check to assess use cases, the challenges with container usage, the impact of containers on PaaS platforms, and what adoption of the technology looks like right now.

Subscribers to InfrastructureViews can download the report here: Containers and Serverless computing: Opportunities and use cases.

To become a subscriber, please speak to Deb Seth.

Posted by UKHotViews Editor at '09:51'

- Tagged:

cloud

servers

containers

Microservices

Among the traditional supplier community AWS is one of the companies that keeps execs awake at night. From an end user enterprise perspective, it is one of the companies CIOs are leaning towards. As for AWS itself, it is looking to increase its footprint within large enterprises and secure a greater share of wallet. One of its execution strategies is to use machine intelligence (machine learning and AI). Google is also looking to machine intelligence to attract larger enterprise customers and improve its standing within them.

Among the traditional supplier community AWS is one of the companies that keeps execs awake at night. From an end user enterprise perspective, it is one of the companies CIOs are leaning towards. As for AWS itself, it is looking to increase its footprint within large enterprises and secure a greater share of wallet. One of its execution strategies is to use machine intelligence (machine learning and AI). Google is also looking to machine intelligence to attract larger enterprise customers and improve its standing within them.

With their machine intelligence infused ambitions both hyperscale cloud providers are looking to break boundaries so in the latest report from the ESASViews research stream ‘Will Machine Intelligence Open Enterprise Doors for AWS and Google?’ we look at how this is impacting their services, partnerships and customer relationships.

Simply having machine intelligence capability is not a guarantee of future success but we can be fairly confident that those who don’t will lose out competitively to those who do. Running alongside that we have a situation where despite rising need, relevant skills are scarce in the market. AWS and Google’s response is to make technologies readily available and accessible, and address the skills issue by providing ‘as-a-Service’ pre-configured and guided solutions. While providing a pathway for customers, it also helps the cloud suppliers as they become gravitational force for machine learning experts and organisations looking to use the technologies for business improvement. That’s a potentially powerful position.

To understand more about their machine intelligence approaches and offerings, eligible TechMarketView subscribers should click to download Will Machine Intelligence Open Enterprise Doors for AWS and Google?’.

To find out how to access our services if you are not a subscriber, please contact Deb Seth.

Posted by Angela Eager at '10:17'

- Tagged:

cloud

software

infrastructure

AI

machinelearning

As a keen UKHotViews reader you will understand the value of TechMarketView’s daily, opinionated coverage of key developments in UK tech. And it won’t come as any surprise to you that over the last ten years, this daily insight has built into a hugely valuable digital library of more than 15,000 articles that creates an unparalleled resource on the UK IT market.

As a keen UKHotViews reader you will understand the value of TechMarketView’s daily, opinionated coverage of key developments in UK tech. And it won’t come as any surprise to you that over the last ten years, this daily insight has built into a hugely valuable digital library of more than 15,000 articles that creates an unparalleled resource on the UK IT market.

You might also have been frustrated by the inability to click through to our analyst team’s longer, more considered articles and thought pieces that are only published under the banner UKHotViewsExtra. Today, for example, we've published two UKHotViewsExtra articles. Our Business Process Services Research Director Marc Hardwick shares his views on Conduent a year after it separated from Xerox in Conduent a digital interactions company and our esteemed Chairman Richard Holway publishes his end of month share price analysis for February.

Sign up to UKHotViews Premium

Until now, this invaluable resource – the combination of our searchable UKHotViews archive and our more in-depth UKHotViewsExtra analysis - was only available to our corporate subscribers as part of a subscription to one or more of our focused research streams. But we recognise that there are many individuals that would benefit from access to this rich, searchable source of insight too, so we’ve launching a new service, UKHotViews Premium, especially for you.

Until now, this invaluable resource – the combination of our searchable UKHotViews archive and our more in-depth UKHotViewsExtra analysis - was only available to our corporate subscribers as part of a subscription to one or more of our focused research streams. But we recognise that there are many individuals that would benefit from access to this rich, searchable source of insight too, so we’ve launching a new service, UKHotViews Premium, especially for you.

Sign up to UKHotViews Premium for twelve months for just £395 (+VAT) and you’ll be able to interrogate TechMarketView’s repository of 15,000+ UKHotViews and subscriber-only UKHotViewsExtra articles for news and views on suppliers, market and industry trends. Browse the analysis online or, if you wish, select multiple articles to print or PDF on demand. Quickly build up an informed picture of a supplier of interest; spot trends in share prices over time; identify start-ups you should be talking to; or mine the archive for insight on areas of opportunity in the UK public sector IT market.

Added benefits

UKHotViews Premium subscribers will also be eligible for discounted client rates on tickets to TechMarketView events throughout the year - including the flagship ‘Evening with TechMarketView’ held every autumn - and be able to claim a 50% discount off the price of one TechMarketView report during the subscription period.

For more details or to sign up to UKHotViews Premium today please click here.

Posted by UKHotViews Editor at '10:15'

Against the backdrop of accelerating market decline, a fundamental redefinition of the role, scope and focus of Applications Management (AM) services is now essential if this trend is to be stemmed and reversed. Time is very much of the essence.

Against the backdrop of accelerating market decline, a fundamental redefinition of the role, scope and focus of Applications Management (AM) services is now essential if this trend is to be stemmed and reversed. Time is very much of the essence.

Click here to download The Legacy Opportunity: Strategies for Success for insights into how both the dynamics of the AM market are changing and suppliers must respond.

For the last two decades, the support, maintenance and management of legacy applications has been a key source of revenue and stability for the majority of SI’s and Offshore players. A dramatic downward drop in market pricing, coupled with both a step-change up in customer service expectations and stringent cuts in legacy investments have combined to create a market inflection. The viability of this traditional bulwark of the AS world is under threat as never before.

Tectonic market shifts demand radical, rapid responses. Simply attempting to deliver today’s services better and cheaper through both more extreme off-shoring and the automation of current processes is not the answer. It will generate neither sufficient value nor the quality improvements necessary to satisfy the collective needs of either buyers and sellers.

This is the market context for the latest research from the ESASViews stream. The Legacy Opportunity: Strategies for Success report provides insight and analysis into the challenges facing suppliers over the coming years, what they need to do to be successful and highlights ways to win in the longer term.

If you are an existing ESASViews subscriber you’ll know you can access the report by clicking the link above. If you’d like to discuss an extension to your existing subscription or would like details of how to subscribe to TechMarketView, please email Deb Seth.

Posted by Duncan Aitchison at '08:15'

- Tagged:

applications

« Back to previous page