News

TechMarketView’s latest “UK Enterprise Cyber Security Market Trends & Forecasts” report is now available to download.

TechMarketView’s latest “UK Enterprise Cyber Security Market Trends & Forecasts” report is now available to download.

Imagine a football team which has restored its manager and players to the starting line up after a season long suspension, but now finds itself kicking a ball about on a muddy field where the touchlines, goalposts and penalty areas are all different sizes and situated in the wrong places.

That gives you some idea of the challenges which face cyber security suppliers in the new era of mass remote and hybrid working that involves UK organisations being much more dependent on cloud-hosted data, applications and services than ever before. Because while the threat from the opposition strikers is still the same, they’ve found new holes in the defence as the centre backs are pulled out of position and tasked with protecting unfamiliar areas of the pitch.

Containing our latest market size and forecast data, the “UK Enterprise Cyber Security Market Trends & Forecasts” report provides a detailed analysis of the threat landscape, commercial dynamics and economic, regulatory and technology trends shaping the UK enterprise cyber security market. It also explains the key challenges facing cyber security suppliers looking to grow their revenue and customer base in the UK and makes recommendations on the strategies we think will best position them for success.

TechMarketView subscribers can access our “UK Enterprise Cyber Security Market Trends & Forecasts” report here. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Martin Courtney at '09:02'

- Tagged:

forecasts

cybersecurity

market+trends

Thursday 24 February 2022

The latest edition of OffshoreViews is now available for download by subscribers to the TechMarketView Foundation Service.

The latest edition of OffshoreViews is now available for download by subscribers to the TechMarketView Foundation Service.

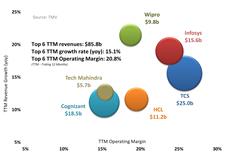

OffshoreViews includes our regular summary of the top-tier and mid-tier Indian SI reporting season, along with insightful charts showing multiyear trends for the Top Tier players and an clickable index to relevant UKHotViews posts.

Posted by UKHotViews Editor at '15:01'

- Tagged:

offshore

Thursday 24 February 2022

Business Process Operations specialist Serco has experienced several years of strong growth. Its latest 2021 full year results, out this morning, outline top line growth for the Group of 14% (10% of which is organic) which takes total revenue for the year to £4,424m (FY 2020 £3,884m). Underlying Trading Profit (UTP) increased by 40% to £229m (FY 2020 £163m) with associated margin increasing from 4.2% to 5.2%. Interestingly, some two-thirds of Serco profits are now coming from outside of the UK.

Business Process Operations specialist Serco has experienced several years of strong growth. Its latest 2021 full year results, out this morning, outline top line growth for the Group of 14% (10% of which is organic) which takes total revenue for the year to £4,424m (FY 2020 £3,884m). Underlying Trading Profit (UTP) increased by 40% to £229m (FY 2020 £163m) with associated margin increasing from 4.2% to 5.2%. Interestingly, some two-thirds of Serco profits are now coming from outside of the UK.

However, Serco has benefited significantly from providing Covid-related services to various governments which will eventually ‘wash through’ this year as things (hopefully!) return to normal. This will have a big impact on 2022 revenue and profit which Serco is now forecasting to decline to between £4.1bn-£4.2bn (-8% organic) and c.£195m respectively. Indeed, Serco has had to become careful not to get addicted to Covid related work which continued longer than expected (see Serco bags £322m COVID test centre extension) and contributed something like £700m to revenue and £60m to UTP in 2021.

Serco’s 2021 order intake was strong with £5.5bn of work won and a book-to-bill ratio of 125%. Serco won 56 contracts worth more than £10m and 5 with a total contract value of more than £200m. Around 60% of this came from the UK and Europe, 25% from the Americas, 10% from Asia Pacific and 5% from the Middle East. Of the order intake, 60% was new business and 40% were rebids and extensions. This is the opposite of the position to the previous FY.

TechMarketView clients, including subscribers to UKHotViewsPremium, can read more by downloading the full review of Serco’s FY results here UKHotViews Extra - Covid cliff edge looms for Serco.

If you are not already a subscriber and but would like to learn more or gain access to this or any other of our content, please contact Deb Seth for more information.

Posted by Marc Hardwick at '08:54'

- Tagged:

results

Wednesday 23 February 2022

There are now just five days left in our #FutureSteps challenge to raise funds for The Prince’s Trust! Throughout February two teams from TechMarketView have been battling it out, attempting to do at least 10k steps a day per person.

With desk-based jobs and no commute, we knew this would be a genuine challenge. But we hadn’t counted on the added complication of bouts of Covid isolation and several days of dangerous storms when we couldn’t leave our houses. We’re a competitive bunch though and haven’t let this stop us stepping - so far, we’ve done an incredible 3.1 million steps between us!

With desk-based jobs and no commute, we knew this would be a genuine challenge. But we hadn’t counted on the added complication of bouts of Covid isolation and several days of dangerous storms when we couldn’t leave our houses. We’re a competitive bunch though and haven’t let this stop us stepping - so far, we’ve done an incredible 3.1 million steps between us!

We’d love those 3m+ steps to raise a bit more for The Prince’s Trust so that the charity can give more young people the opportunity to create a better future through employment, education and enterprise.

We have a target of £250/team – if you can help us with just a few pounds we’d be very grateful, just pick your team and follow the links below:

To show your support for the analyst team – Georgina, Dale, Marc, Kate, Tania & Tola – visit TMV Tramps.

To show your support for the client services team – Emily, Belinda (above with dog Cooper), Helen, Holly & Paula – visit TMV Trekkers.

A huge thank you from all of us!

Posted by TechMarketView Team at '17:52'

Click on the pic and let TechMarketView Managing Partner Anthony Miller tell you more!

DETAILS AND APPLICATION FORM ON OUR WEBSITE HERE

Posted by UKHotViews Editor at '06:00'

Thursday 17 February 2022

There was a time not so very long ago when there was only one store we went to for almost anything we needed for our home: John Lewis. Fantastic selection, ‘guaranteed’ cheapest price on branded goods, great in-store service, and free delivery (in liveried vans).

There was a time not so very long ago when there was only one store we went to for almost anything we needed for our home: John Lewis. Fantastic selection, ‘guaranteed’ cheapest price on branded goods, great in-store service, and free delivery (in liveried vans).

If there was one niggle it was shopping in-store for delivery. First they had to process our payment in their POS system. Then they had to go to a different system to schedule the delivery. There was no link between the two systems so they had to manually key in the sales receipt number into the delivery system and then take our details (which now appear five times in their system).

Roll forwards to today. John Lewis still has an excellent selection. But the price guarantee has gone, in-store service is at best patchy and free delivery is restricted and partly outsourced.

What hasn’t changed is John Lewis’ fulfilment process.

Last week I ordered cutlery, crockery and glassware from the John Lewis website. The cutlery and crockery was ‘in stock’ but not the glassware, for which I was invited to fill in an online form so that one of their stores could call me to see if any was available and arrange delivery.

A few hours later I got a call from John Lewis Westfield White City (our closest store) to say they had the glasses in stock and took payment (plus delivery fee) and details. Yesterday the glassware was delivered by DHL – accompanied by six A4 pages of delivery information – and one broken glass.

So I phoned the John Lewis call centre and explained the problem, only to be told, “they shouldn’t be sending breakable things from the stores as they don’t pack them properly”. And as they had no further stock at White City she would need to check other stores, so could she call me back as she needs to check another system. Which she did not long after, but to no avail. So she arranged a refund, which meant taking my details again as there was no link to their online ecommerce system.

Meanwhile, our crockery and cutlery arrived in perfect condition – by two different carriers on different days.

While competitors have invested in technology, infrastructure and process to support seamless, cost-efficient multi-channel shopping, evidently John Lewis hasn’t.

And you wonder why John Lewis is struggling with profits?

Posted by Anthony Miller at '09:03'

Wednesday 16 February 2022

Over the last couple of years automation has been one of the main beneficiaries of technology investment deployed in response to the pandemic. Technologies such as Robotic Process Automation (RPA) have helped organisations modernise their heritage IT estates and bridge the gap into digital. That said, organisations continue to struggle to scale automation, having often deployed technologies in a fragmented and piecemeal manner, and whilst RPA is good at keeping legacy systems functioning – particularly in the back office – it is not always the best route to genuinely transform digital operations.

The response of the automation industry has been to focus on ‘HyperAutomation’. A quick ‘Google’ and you will find this term across most automation vendor websites. Broadly speaking, HyperAutomation involves taking a more strategic approach to identifying, vetting and automating a wide range of IT and business processes in rapid time. However, and as one might suspect, a lot of HyperAutomation remains more about the hype than the reality.

The response of the automation industry has been to focus on ‘HyperAutomation’. A quick ‘Google’ and you will find this term across most automation vendor websites. Broadly speaking, HyperAutomation involves taking a more strategic approach to identifying, vetting and automating a wide range of IT and business processes in rapid time. However, and as one might suspect, a lot of HyperAutomation remains more about the hype than the reality.

To explore how HyperAutomation can add value ‘on the ground’, be deployed in challenging real time business environments, and how organisations can deal with fragmented automation investment, we spoke recently with industry veteran Chris Lamberton.

Lamberton is currently CEO of TrustPortal, a UK based HyperAutomation scale-up targeting the contact centre and shared services environment. Lamberton has had a diverse career working for many of the usual suspect large Systems Integrators (SIs) and Management Consultancies, including Cap Gemini, PwC and Deloitte. Before joining TrustPortal back in 2018, Lamberton headed up EY’s Financial Services RPA/software robotics centre-of-excellence and practice across Europe.

TechSectorViews’ subscribers can download the research today. If you are not yet a subscriber, or are unsure if your company has a subscription, please contact Deb Seth to find out how you can access the research.

Posted by Marc Hardwick at '12:59'

- Tagged:

automation

RPA

hyperautomation

TechMarketView’s Digital Future Sales 2021 research reveals spend through the three Crown Commercial Service (CCS) frameworks: G-Cloud, Digital Outcomes & Specialists (DOS) and, most recently, Digital Capability for Health (DCFH) was up 28% to £3.7bn in the 2021 calendar year. G-Cloud accounted for 72% of spend during the period, with DOS accounting for 27%—spend via DCFH represented less than 1% of spend.

TechMarketView’s Digital Future Sales 2021 research reveals spend through the three Crown Commercial Service (CCS) frameworks: G-Cloud, Digital Outcomes & Specialists (DOS) and, most recently, Digital Capability for Health (DCFH) was up 28% to £3.7bn in the 2021 calendar year. G-Cloud accounted for 72% of spend during the period, with DOS accounting for 27%—spend via DCFH represented less than 1% of spend.

Spend on G-Cloud was up 32% to £2.7bn, largely as a result of Health expenditure relating to the pandemic, but also through increased digital spend in the Defence and Central Government subsectors.

The challenges of bringing in teams and specialists during the pandemic suppressed spend via the DOS framework in 2020; however, spending picked-up in 2021. Year-on-year spend increased 18% to just over £1.0bn; the first time DOS spend has exceeded £1bn over a calendar year.

The rate of growth in spend with SMEs during the period was faster than that of large companies, with the former up 33% to £1.4bn (2020: £1.0bn) and the latter up 26% to £2.3bn (2020: £1.8bn), resulting in SMEs representing 37% of spend for the year (2020: 36%).

Four companies (AWS, Kainos, Deloitte and Capgemini) broke the £100m barrier for combined G-Cloud and DOS income during the year. Six buyers (Home Office; HMRC; NHS Digital; Department for Work and Pensions; Ministry of Justice; and Department of Health and Social Care) broke the £100m spend barrier—their combined spend represented 38% of combined G-Cloud and DOS spend for the period.

If you are an existing PublicSectorViews subscriber, you can access further analysis and charts now. If you’d like to discuss an extension to your existing subscription or would like details of how to subscribe to TechMarketView, please email Deb Seth.

Posted by Dale Peters at '17:06'

- Tagged:

government

g-cloud

data

dos

public+sector

digital+marketplace

digital+future

ccs

Thursday 10 February 2022

I enjoyed an interesting experience earlier this week, as I entered the metaverse to present at DXC Technology’s 2022 sales conference set in virtual reality (VR). The EMEA-wide event brought together around 1,000 members of DXC’s leadership and business development communities from across three continents, for a two-day programme of insights, collaboration, motivation and strategy.

I enjoyed an interesting experience earlier this week, as I entered the metaverse to present at DXC Technology’s 2022 sales conference set in virtual reality (VR). The EMEA-wide event brought together around 1,000 members of DXC’s leadership and business development communities from across three continents, for a two-day programme of insights, collaboration, motivation and strategy.

In something of a pioneering step, the vendor decided to utilise VR to run the entire conference in its new "DXC Virtual World" an immersive environment designed to enhance workforce collaboration and add a stimulating 3D dimension to virtual meetings.

All conference attendees (including John Neal, CEO of Lloyd’s) accessed the event remotely with their presence represented by an interactive avatar. My thirty-minute presentation was delivered by my own (much slimmer) avatar, standing at a virtual podium, in front of a packed virtual auditorium, which was in turn filled with the massed avatars of the other attendees. Behind me, three giant virtual screens allowed me to control my slide deck in real-time as the attendees listened to my live audio.

TechMarketView clients, including subscribers to UKHotViewsPremium, can find out more by downloading UKHotViews Extra - Adventures in the metaverse with DXC Technology In this article I explore the technology platform that DXC selected for the event and discuss the pros and cons of VR conferencing as we prepare for the wholesale lifting of all pandemic restrictions.

TechMarketView clients, including subscribers to UKHotViewsPremium, can find out more by downloading UKHotViews Extra - Adventures in the metaverse with DXC Technology In this article I explore the technology platform that DXC selected for the event and discuss the pros and cons of VR conferencing as we prepare for the wholesale lifting of all pandemic restrictions.

If you are not already a subscriber and but would like to learn more or gain access to this or any other of our content, please contact Deb Seth for more information.

Posted by Jon C Davies at '13:54'

Wednesday 09 February 2022

Third quarter results from Fujitsu showed a “gradual recovery in demand” at the global level, but the worldwide chip shortage continues to impact the business. The latter is leading to both postponed revenue and higher costs.

Third quarter results from Fujitsu showed a “gradual recovery in demand” at the global level, but the worldwide chip shortage continues to impact the business. The latter is leading to both postponed revenue and higher costs.

Revenue for the quarter came in at 880.5bn Yen, down 1% from the comparable period in the prior year. For the year to date (i.e., the nine months to the end of December 2021), revenue was +0.7% to 2543.5bn Yen. For the full financial year (FY21), the firm is forecasting growth of 1.1% to 3630bn Yen.

The business continued its strategic growth investments in two areas in particular. Firstly, the expansion of its Global Delivery Centres and developing services that are standardised around the world. Secondly, in internal digital (DX, as Fujitsu terms it) investments and its Work Life Shift for its own employees.

Down at the UK level, Fujitsu has been experiencing significant activity in its private sector IT services business. Renewals were sealed and business with existing customers expanded in industries including Financial Services, Retail & Hospitality, and Manufacturing. This will have been helped by Fujitsu’s investments in innovation through technologies such as AI and its digital annealer. MORE….

Posted by Kate Hanaghan at '10:00'

- Tagged:

results

hybridIT

quantum

trust

Wednesday 09 February 2022

Regulation has been a key driver of the significant change occurring within the financial markets sector. This in turn has fuelled increased competition and tighter margins. Meanwhile, a surge in interest around crypto and digital assets has been coupled with significant levels of funding for innovation.

Regulation has been a key driver of the significant change occurring within the financial markets sector. This in turn has fuelled increased competition and tighter margins. Meanwhile, a surge in interest around crypto and digital assets has been coupled with significant levels of funding for innovation.

TechMarketView’s Financial Markets Update 2022 explores how market participants are modernising thier technology estates in response to the many challenges of the operating environment, and how new approaches are helping to accelerate processes, reduce costs and improve service consistency.

Subscribers to FinancialServicesViews can discover more by downloading Financial Markets Update 2022 now. If you do not currently have access to this report and are interested in learning about this, or any other of our services, please contact Deb Seth for more information.

Posted by Jon C Davies at '08:26'

- Tagged:

financialmarkets

2022 marks growing digital consultancy and service provider FSP’s (formerly Foundation SP) tenth anniversary. At the beginning of February, FSP moved into brand new offices right next door to Microsoft in Reading’s Thames Valley Park, where we recently caught up with Simon Grosse, FSP’s CEO, and Tim Ebenezer, COO.

2022 marks growing digital consultancy and service provider FSP’s (formerly Foundation SP) tenth anniversary. At the beginning of February, FSP moved into brand new offices right next door to Microsoft in Reading’s Thames Valley Park, where we recently caught up with Simon Grosse, FSP’s CEO, and Tim Ebenezer, COO.

FSP wrapped up its financial year at the end of December ahead of plans, having delivered more than £11.7m in revenue and £3.5m in EBITDA (FY 2020 saw revenue of £8.7m and EBITDA £2.5m). Headcount wise FSP hired 50 people last year, from grads right through to senior hires, and now employs a team of some 120 people. FSP traded with 64 customers for its services last year, with no one client representing more than 20% of revenues, and the top 10 clients representing about 80% of turnover. Some 44% of revenue is committed on an annuity basis, whilst sector-wise the business remains split 50% Private sector, 30% from Central Government and 20% from Defence.

The business model remains focused on two complementary sets of services. Strategy consultancy and business change accounts for around a quarter of the company’s revenue with the remaining three quarters coming from digital technology solutions and delivery, which in turn splits down as follows:-

-

Business productivity applications - including modern workplace solutions, business process improvement and optimisationon Microsoft platforms accounts for 30%;

-

Cloud applications and cloud engineering - typically on Azure but with growing referenceability on AWS - accounts for another 30%;

-

Data and AI - built on top of cloud platforms is 10%;

-

A new Cyber practice launched in May helps clients at the most senior level understand and address security risks within their organisation, and already contributes about 5% of revenue having signed up 10 clients from a standing start.

TechMarketView subscribers can read more here in UKHotViewExtra…

Posted by Marc Hardwick at '09:03'

- Tagged:

digital

cyber

Yesterday’s third quarter results set a pattern for BT’s financial year, with the telco continuing to balance consistent revenue declines against EBITDA improvements driven by its ongoing transformation and cost reduction strategy. The Q3 numbers now point to a 2% year on year drop in turnover for the full financial year.

Yesterday’s third quarter results set a pattern for BT’s financial year, with the telco continuing to balance consistent revenue declines against EBITDA improvements driven by its ongoing transformation and cost reduction strategy. The Q3 numbers now point to a 2% year on year drop in turnover for the full financial year.

All eyes are on BT’s long term plan which predicts an extra £1.5bn of normalised free cash flow by the end of the decade, derived solely from lower capex and operating costs enabled by its move to an all fibre, all IP network. But should the telco fail to simultaneously halt (and ideally reverse) the continuing revenue shrinkage in its Global and Enterprise divisions, those improvements could ultimately be academic.

TechMarketView subscribers, including those signed up to UKHotViewsPremium, can read more detailed analysis of BT’s Q3 performance and its prospects for future growth in our HotViewsExtra “BT Q3 sets pattern for FY22” here. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Martin Courtney at '06:52'

- Tagged:

results

cloud

iot

cybersecurity

telecommunications

Q322

Thursday 03 February 2022

2021 looks set to have delivered the largest ever volume of annual growth in the UK SITS market. TechMarketView’s latest analysis indicates that demand increased by almost 9% last year as buyers in the UK spent approaching an additional £5bn on Software and IT Services (SITS). Click here to download the Market Outlook Update: Trends and Forecasts 2021-2024 report for the full details.

Published last June, our UK IT Services Market Trends & Forecasts 2021 was compiled in the weeks immediately following the third national lockdown. While the SITS supplier performance data covering the first quarter of last year was broadly encouraging, the lack of clarity about what the continued impact of the pandemic might be both domestically and globally prompted our team to adopt a cautiously optimistic view of demand outlook.

However, as analysts continued to track quarterly results and buyer sentiment/action during the second half of 2021 it became obvious the market was expanding at an exceptional pace. Indeed, growth was at a velocity not seen since the hay days of Y2K/Dotcom when the SITS sector was barely half its current size.

The revised data in the Market Outlook Update covers the SITS market as a whole, alongside the constituent lines of business and industry verticals. It shows not only a trebling of the previously anticipated growth in demand last year from the Public, Financial Services and Manufacturing sectors, but also a marked acceleration in the pace of digital transformation across all segments.

If you are an existing Foundation Services subscriber, please access the report here: Market Outlook Update: Trends and Forecasts 2021-2024.

If you’d like to discuss an extension to your existing subscription or would like details of how to subscribe to TechMarketView, please email Deb Seth.

Posted by Duncan Aitchison at '07:27'

- Tagged:

newresearch

MarketForecasts

market+trends

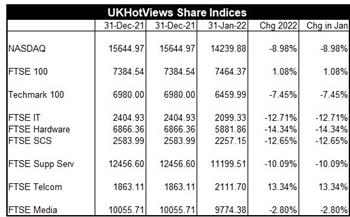

A ‘Volatile’ month – to say the least!

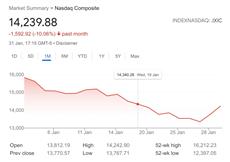

If you have been reading HotViews regularly in January (and if not, why not?) you will already know that NASDAQ entered ‘Correction’ territory on 20th Jan 22 when the index had fallen 10% from its Nov 21st 21 high. It then continued to fall recording some of the most volatile trading days I can remember. Sometimes losing 5% intraday and recovering all those losses by the close. See NASDAQ’s volatile trading day on 24th Jan 22.

If you have been reading HotViews regularly in January (and if not, why not?) you will already know that NASDAQ entered ‘Correction’ territory on 20th Jan 22 when the index had fallen 10% from its Nov 21st 21 high. It then continued to fall recording some of the most volatile trading days I can remember. Sometimes losing 5% intraday and recovering all those losses by the close. See NASDAQ’s volatile trading day on 24th Jan 22.

The volatility continued yesterday – the last trading day of January. NASDAQ put on a pretty amazing 5% gain and therefore ended January down ‘just’ 9% - it could have been a lot, lot worse.

The other indices we follow were all over the place. TechMark100 followed NASDAQ with a 7.5% decline in January. But the flight from ‘growth’ to ‘value’ pushed the banking and energy-heavy FTSE100 UP 1%.

The UKHQed quoted software and computing services companies we cover had an even more torrid month – the FTSE SCS Index falling 12.7%.

The UKHQed quoted software and computing services companies we cover had an even more torrid month – the FTSE SCS Index falling 12.7%.

But the FTSE Telecomm Index was up an impressive 13.3%. The Index is dominated by two companies – BT Group whose share price rose 15.3% as it will either ‘get its act together’ with its current transformation programme or be subject to a bid. Vodafone rose by 15.8% as the epitome of the ‘value’ stock consistently paying high dividends. Neither of these companies could remotely be labelled ‘growth’ companies but both have stable and reliable revenue streams. Something that is highly prized in these unertain times.

Leaders and Laggards

The two main UK winners in Jan 22 were Triad and Micro Focus. Conversely the two main losers were Trustpilot and The Hut Group (#THG)

BIG TECH had a range of good and bad performances with Apple leading the pack. But we still await all important Q4 results from Meta/Facebook, Alphabet/Google and Amazon later this week.

Outlook

A ‘Correction’ was long anticipated. A ‘Bear market’ is defined as a 20% fall from a recent high. We are not there yet although nobody should rule that out.

There are just too many negative factors and risks at the moment. Inflation is clearly the #1 issue which could accelerate a move away from ‘growth’/tech stocks. Then we have a squeeze in consumer spend occasioned by increases in energy and taxes. On top of that we have global unrest in Ukraine and, of course, political unrest in the UK.

All that points to a continuation of the current volatility the stock markets.

You want more?

You want more?

Detailed comment on all the Winners and Losers in the Share Performance Stakes in Jan 22 as a whole in HotViews Extra. See Share performance in Jan 22 available free for all our main research subscribers or for just £395pa for HotViews Premium subscribers . For more details CLICK HERE.

Posted by Richard Holway at '09:54'

Today marks the first day of TechMarketView’s #FutureSteps challenge in support of The Prince’s Trust. From today and throughout February, we’re joining teams from across the tech sector on a quest to do 10,000 steps a day each. Even with a dog to walk, I’ve realised that is harder than you think with a desk-based job and no commute – it is going to be a genuine challenge.

Today marks the first day of TechMarketView’s #FutureSteps challenge in support of The Prince’s Trust. From today and throughout February, we’re joining teams from across the tech sector on a quest to do 10,000 steps a day each. Even with a dog to walk, I’ve realised that is harder than you think with a desk-based job and no commute – it is going to be a genuine challenge.

Our two teams represent the analysts – team ‘TMV Tramps’, Georgina, Tola, Marc, Dale, Tania and Kate – and our wonderful client services team – ‘TMV Trekkers’, Emily, Belinda, Helen, Paula and Holly.

We’re hoping to (literally) take steps to improve our physical and mental health as a team, whilst also raising funds to help the most vulnerable young people in the UK take the next step to transform their lives with support from The Prince’s Trust.

You can follow our progress and show your support at the teams’ Just Giving pages: TMV Tramps and TMV Trekkers. Right, time to get moving….

Posted by Tola Sargeant at '08:34'

- Tagged:

charity

« Back to previous page