News

Version 1 has predominantly targeted central government for its application modernisation, cloud engineering and migration, data and analytics, ERP transformation, and managed service offerings. Its presence in UK local government is small in comparison, but it has secured some significant contracts over the last 18 months and has big ambitions in this part of the public sector.

Version 1 has predominantly targeted central government for its application modernisation, cloud engineering and migration, data and analytics, ERP transformation, and managed service offerings. Its presence in UK local government is small in comparison, but it has secured some significant contracts over the last 18 months and has big ambitions in this part of the public sector.

Version 1 has been supporting 12 councils with Oracle ERP implementations for more than a decade, including one of the first Oracle Cloud Financials implementations in the UK at Bournemouth Borough Council. It is still winning Oracle-focused business, for example at Solihull and Walsall; however, its ambitions extend beyond ERP implementation. TechMarketView takes a closer look at Version 1's performance and prospects in local government here...

TechMarketView subscribers, including those signed up to UKHotViewsPremium can read Version 1: an expanding local government footprint now. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Dale Peters at '12:20'

- Tagged:

erp

cloud

data

councils

local+government

digital+transformation

Launching today is TechMarketView’s brand new set of forecasts and trends analysis for the UK Software and IT Services markets to 2024: UK SITS Market Trends and Forecasts 2021.

The report contains detailed data by type of service/software but also for every vertical industry, based on months of research by the TechMarketView team. Analysts have spoken to a wide array of suppliers and buyers to understand their perspectives and experiences and crunched large amounts of data to create what we believe is the most reliable and comprehensive view of the market.

This breadth and depth of analysis is essential because this is a market in the midst of massive change as it moves away from Heritage services. To forecast the nature and pace of this change, TechMarketView has developed a unique model to help clients understand the nature and rate at which each market segment is rotating to the NEW (i.e., Digital, Platform and Cyber).

This time last year, the analyst team painstakingly created two forecast scenarios for the possible impact of the COVID-19 pandemic on UK SITS. By November 2020, our experts had concluded that the impact would be more optimistic than many first feared. In UK SITS Market Trends and Forecasts 2021, we explain our current view and what we believe market evolution will look like in the period to 2024.

Read the report to get to the detail and understand how your organisation should be operating as we emerge from the pandemic into a complex and challenging world.

UK Software and IT Services Market Trends and Forecasts 2021 is only available to subscribers of our Foundation Service research programme. To become a subscriber, please contact Deb Seth.

Posted by UKHotViews Editor at '09:30'

- Tagged:

trends

forecasts

marketmodel

LIVE NOW is TechMarketView’s brand new UK Software and IT Services Supplier Rankings 2021 report, which reveals that TCS has toppled Capita to become the largest SITS vendor in the UK.

Following an impressive period of sustained growth in recent years, TCS successfully moved up from its second-place position in the prior year despite an estimated single digit decline in revenue. TCS saw its performance improve significantly in the second half of 2020 as it successfully navigated its way through the pandemic. Furthermore, the firm is bullish about the continued acceleration of digitisation and its future growth prospects.

After several months of in-depth research and analysis, the TechMarketView analyst team has ‘sliced and diced’ the performance of well over 200 companies operating in the UK Software and IT Services market. Our research shows that the Top 60 players in aggregate achieved very modest revenue growth in 2020. However, this masks a hugely wide-ranging performance by the individual players, some of whom grew way into double digits, and some of whom saw double digits wiped from their top line.

Indeed, Capita - in its new number two position - registered the deepest decline of all the companies in the TechMarketView Top 30 ranking of players. Other significant ‘decliners’ include DXC Technology and IBM - both of whom have large chunks of revenue in slow growth or declining market areas.

In contrast is the performance of the hyperscaler and cloud focused players. Amazon Web Services (AWS) is no longer a ‘new kid on the block’ and is now a very sizeable SITS competitor. Nevertheless, it has maintained a very impressive rate of revenue growth. The same is true of Microsoft’s Azure business, and now both players rank highly as providers of Infrastructure Operations in the UK. While Google Cloud Platform has for many years taken third place in the hyperscaler race, a storming performance in 2020 means it too is now a sizeable - and incredibly fast-growing - SITS ranking player.

Clients of TechMarketView’s Foundation Service can access the report, and its nine ranking tables, here: UK SITS Ranking 2021.

If you do not currently take the Foundation Service and want to gain access to this unique view of the players in the UK tech scene, please contact Deb Seth.

Posted by UKHotViews Editor at '09:45'

- Tagged:

cloud

automation

data

DevOps

digitalworkplace

ranking

Servelec has undergone a period of extensive restructuring and divestments in recent years. It has a new leadership team in place and a much clearer focus—connecting communities through digital care.

Servelec has undergone a period of extensive restructuring and divestments in recent years. It has a new leadership team in place and a much clearer focus—connecting communities through digital care.

Sheffield-based Servelec was founded in 1977 with a focus on the design and manufacture of control systems for the local steel industry. It has been through many different guises over its 44-year history, including a significant amount of change since it was taken private in a £224m acquisition funded by Montagu Private Equity in 2018. The sale of its Technologies business in 2019 left Servelec wholly focussed on the public sector markets of health and local government, with the latter spanning social care, education, and youth services.

TechMarketView caught up with CEO Ian Crichton and CFO Simon Belfer about the changes in the business. In this research note we look at the history of Servelec, how it has restructured since it was taken private by Montagu, its strategy and product mix, its financial performance in 2020, and its prospects for the future.

Subscribers to TechMarketView's Foundation Service and PublicSectorViews research streams can download the research note—Servelec: Connecting Communities Through Digital Care—now. If you are not yet a subscriber and would like to find out how to gain access to this research and much more besides, please contact Deb Seth.

Posted by Dale Peters at '09:53'

- Tagged:

software

research

integration

healthcare

local+government

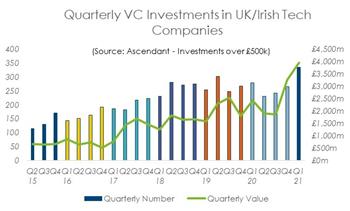

Q1 2021 was the busiest quarter on record for VC investment into tech companies in the UK and Ireland, according to data from Corporate Finance firm Ascendant. Compared to Q1 2020, the volume of deals over £500k was up 20% (to 334) and the value of those deals increased by 62% (to £3,946m).

Q1 2021 was the busiest quarter on record for VC investment into tech companies in the UK and Ireland, according to data from Corporate Finance firm Ascendant. Compared to Q1 2020, the volume of deals over £500k was up 20% (to 334) and the value of those deals increased by 62% (to £3,946m).

The latest edition of IndustryViews Venture Capital has more detail, along with commentary on selected UK tech venture funding deals.

Posted by Tania Wilson at '08:00'

- Tagged:

funding

start-up

The Department for Health and Social Care (DHSC) and NHSX have published a new draft data strategy for health and care. The Data saves lives: reshaping health and social care with data strategy is intended to help unite the health data ecosystem and has important implications for software and IT services suppliers operating across health and local government.

The Department for Health and Social Care (DHSC) and NHSX have published a new draft data strategy for health and care. The Data saves lives: reshaping health and social care with data strategy is intended to help unite the health data ecosystem and has important implications for software and IT services suppliers operating across health and local government.

The strategy is underpinned by three key priorities: 1) to build understanding on how data is used and the potential for data-driven innovation, improving transparency so the public has control over how their data is being used; 2) to make appropriate data sharing the norm and not the exception across health, adult social care and public health, to provide the best care possible to citizens, and to support staff throughout the health and care system; and 3) to build the right foundations—technical, legal, regulatory—to make that possible. More...

TechMarketView subscribers, including those signed up to UKHotViewsPremium can read more about the new draft data strategy here. If you are not yet a subscriber, please contact Deb Seth to find out how to access this and much more.

Posted by Dale Peters at '10:16'

- Tagged:

nhs

strategy

government

healthcare

public+sector

Until recently, it was perhaps true to say that the insurance sector was somewhere around 2 or 3 years behind the curve in terms of digital transformation relative to initiatives occurring in the banking sector. However, driven in part by the pandemic, the pace of change in the insurance sector has accelerated considerably and the gap has closed markedly.

To discuss the recent uptick in transformation initiatives, I caught up with Alec Miloslavsky (pictured), the founder and CEO of SaaS insurance software specialist EIS. Following its rapid growth in the US, the vendor has been attracting attention in the UK, having recently secured a number of high-profile new clients and partners.

To discuss the recent uptick in transformation initiatives, I caught up with Alec Miloslavsky (pictured), the founder and CEO of SaaS insurance software specialist EIS. Following its rapid growth in the US, the vendor has been attracting attention in the UK, having recently secured a number of high-profile new clients and partners.

Alec is a technology entrepreneur with an impressive record of success. Alec co-founded Genesys Telecommunications Laboratories, a company he helped lead through a successful IPO and subsequent sale to Alcatel for $1.9bn at a 30x premium. Prior to EIS, Alec was Chairman and CEO of Return on Intelligence, a company he also helped found and that has since grown to an enterprise with revenue exceeding $70m.

TechMarketView clients including subscribers to FinancialServicesViews and UKHotViews Premium can learn more via UKHotViewsExtra (see: EIS discovers an industry eager to change).

TechMarketView clients including subscribers to FinancialServicesViews and UKHotViews Premium can learn more via UKHotViewsExtra (see: EIS discovers an industry eager to change).

If you are not already a subscriber but would like access to this content, please contact Deb Seth for more information.

Posted by Jon C Davies at '08:42'

- Tagged:

financialservices

insurance

EIS

The use of artificial intelligence in health and care in the UK got another boost this week as Health and Social Care Secretary Matt Hancock announced the winners of the second wave of NHS AI Lab’s AI in Health and Care Award. In this phase, 38 innovative projects will share £36m in funding and, importantly, be supported to test and deploy their solutions in the NHS.

The use of artificial intelligence in health and care in the UK got another boost this week as Health and Social Care Secretary Matt Hancock announced the winners of the second wave of NHS AI Lab’s AI in Health and Care Award. In this phase, 38 innovative projects will share £36m in funding and, importantly, be supported to test and deploy their solutions in the NHS.

The advantages of using AI in healthcare are increasingly well understood, and as the NHS comes through the pandemic, rather than return to old ways, the emphasis from the centre is – to quote Sir Simon Stevens, CE of the NHS - on “supercharging a more innovative future.” More….

Posted by Tola Sargeant at '10:56'

- Tagged:

nhs

funding

AI

healthcare

Another sizeable wedge of BT has found its way into European hands after Altice gained a 12.1% stake in the UK company.

Another sizeable wedge of BT has found its way into European hands after Altice gained a 12.1% stake in the UK company.

France’s second largest telco stressed it would not make a takeover bid and fully supports BT’s current strategy - particularly when it comes to meeting government targets for the mass rollout of high speed fibre broadband which may ultimately prove extremely lucrative for both BT and its shareholders.

Subscribers to TechSectorViews can read our HotViewsExtra analysis of the Altice BT investment here. If you don’t have a subscription please contact Deb Seth for details or access our UKHotViews Premium service for more details.

Posted by Martin Courtney at '10:14'

- Tagged:

investment

broadband

fibre

telecommunications

Recent times have seen Micro Focus release a H1 trading update pointing to positive progress from its recovery programme, and deliver its Universe customer conference where it had an opportunity to position its strategy and products in the context of market trends and customer needs. Following some tough years that included work on the troublesome HPE Software integration programme, now is a good time to look at what the company stands for and what it can offer partners and customers.

Recent times have seen Micro Focus release a H1 trading update pointing to positive progress from its recovery programme, and deliver its Universe customer conference where it had an opportunity to position its strategy and products in the context of market trends and customer needs. Following some tough years that included work on the troublesome HPE Software integration programme, now is a good time to look at what the company stands for and what it can offer partners and customers.

It is on a growth quest to reverse revenue decline through a focus on ‘high tech, low drama’ transformation practicalities, initiatives to line its broad portfolio up behind key business outcomes and leverage key IP like Vertica across the portfolio. In addition, security has now been elevated to the CyberRes line of business but integration with the rest of the Micro Focus applications remains key which creates opportunities around secure applications.

Micro Focus’ positioning is still emerging but it does have more of a connected story to tell that addresses the issue of its relevance to digital transformation agendas.

TechMarketView clients, including UKHotViews Premium subscribers, can read the latest analysis here: Micro Focus: direction, imperatives and relevance.

TechMarketView clients, including UKHotViews Premium subscribers, can read the latest analysis here: Micro Focus: direction, imperatives and relevance.

If you’d like access to this and our extensive body of research and related services, please contact Deb Seth.

Posted by Angela Eager at '09:15'

- Tagged:

software

analytics

digital

cyber

TechMarketView’s Digital Marketplace Review 2020-21 research reveals spend through the two Crown Commercial Service (CCS) frameworks: G-Cloud and Digital Outcomes & Specialists (DOS) was up 29% to £3.2bn, with G-Cloud accounting for 72% and DOS the remaining 28%. Spend on G-Cloud was up 40% year-on-year to £2.4bn, but the performance of the DOS framework was more subdued—up 8% to £895m.

TechMarketView’s Digital Marketplace Review 2020-21 research reveals spend through the two Crown Commercial Service (CCS) frameworks: G-Cloud and Digital Outcomes & Specialists (DOS) was up 29% to £3.2bn, with G-Cloud accounting for 72% and DOS the remaining 28%. Spend on G-Cloud was up 40% year-on-year to £2.4bn, but the performance of the DOS framework was more subdued—up 8% to £895m.

The impact of the pandemic on spending is clear to see, with Health spend across both frameworks up 97% year-on-year to £542.7m (2019-20: £275.9m). The largest increases in spend were seen at NHS Digital and the Department for Health and Social Care (DHSC). This performance was driven by G-Cloud spend, where Health spending was up by 135% to £427.2m.

The rate of growth in spend with SMEs outpaced that of large companies, but large companies still attracted the majority of spend, accounting for 64% by value. Three companies (Kainos, Capgemini and Deloitte) broke the £100m barrier for Digital Marketplace income during the year.

It’s hard to overestimate the impact the pandemic had on the procurement of digital services and solutions in the public sector. In this report we take a closer look at the associated trends and explore who the leading suppliers and buyers were in the Digital Marketplace in 2020-21.

If you are an existing PublicSectorViews subscriber, you can access further analysis and charts now. If you’d like to discuss an extension to your existing subscription or would like details of how to subscribe to TechMarketView, please email Deb Seth.

Posted by Dale Peters at '08:53'

- Tagged:

research

g-cloud

dos

digital+marketplace

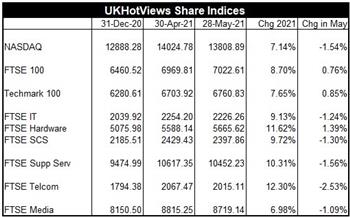

Share Performance in May 21

It is a rare month when every index we follow only moves by +2% to -2%. Indeed, even most of the individual share price movements were within modest parameters.

It is a rare month when every index we follow only moves by +2% to -2%. Indeed, even most of the individual share price movements were within modest parameters.

After the events of the last 12+ months it might be ‘good’ to put this down to an uneventful month for UK and global news. But that is not the case. C-19 seems to be getting worse in many parts of the word – in particular India. Tensions are rising in many areas what with ‘hijacked’ airplanes and mounting tensions with China. Here in the UK we had the Dominic Cummings circus.

From an economic viewpoint, there is little doubt that the UK and US are roaring back to life. Indeed staff (or should I say ‘skills’) shortages are common place. But, to counter this, there are fears that inflation will raise its ugly head again. Indeed are talking of ‘1970s-type’ inflation. As I lived through double digit inflation – and interest rates – I really wouldn’t wish that only anyone. Indeed, people under the age of 40 have been used to low inflation and interest rates for all of their working lives.

Worth pointing out however that all the major indices we follow – NASDAQ, FTSE100 and the FTSE IT Index -are all up between 7%-9% in 2021 YTD. Rather better than inflation at 1.5% and much better than the 0.1% you can get on an instant access account!

Outlook

I’d like to think that life might get back to something closer to normal in the next month. Indeed I’ve already had my first hotel holiday in 15 months and several meals out. There is certainly a pent -up demand for these things in the Holway household – and I suspect in the households of many HotViews readers too. That can only be good for the economy and, in turn, for the tech companies supplying services to those customers.

The problem is that one cannot be totally certain about anything – in particular the detrimental effects of a further mutant C-19 strain.

The problem is that one cannot be totally certain about anything – in particular the detrimental effects of a further mutant C-19 strain.

Subscribe to HotViews Premium for just £395+VAT pa

All the detail and comment on this month's Winners and Laggards in our Review of Share Performance in May 21 on HotViews Extra available to all subscribers including HotViews Premium.

Why not join them for just £395pa. For more details CLICK HERE

Posted by Richard Holway at '06:53'

« Back to previous page