News

Lloyds Banking Group (LBG) has announced a deal to acquire digital wealth management specialist, Embark Group for £390m. The “robo-adviser” platform currently has around 425k retail customers and more than £40bn of assets under administration.

Lloyds Banking Group (LBG) has announced a deal to acquire digital wealth management specialist, Embark Group for £390m. The “robo-adviser” platform currently has around 425k retail customers and more than £40bn of assets under administration.

Embark has enjoyed strong growth since its foundation in 2013 thanks in part to its strategic partnership with wealth management technology provider FNZ. A lot of this growth has been achieved via acquisition, with Embark having added Zurich’s retail wealth platform and the Horizon and Alliance Trust portfolios.

Embark has enjoyed strong growth since its foundation in 2013 thanks in part to its strategic partnership with wealth management technology provider FNZ. A lot of this growth has been achieved via acquisition, with Embark having added Zurich’s retail wealth platform and the Horizon and Alliance Trust portfolios.

The highly competitive UK wealth management sector has seen significant change in recent years, influenced by tight margins and new technology-based approaches and the Embark deal is very much part of that wider trend. My latest UKHotViews Extra Embark deal highlights increasing role of technology in UK wealth management examines the acquisition and explores some of the other activity taking place in the sector, driven by the influence of technology.

TechMarketView clients, including HotViews Premium subscribers, can download this UKHotViewsExtra now. If you do not already have access but are interested in reading this or any other content, please contact Deb Seth for more information.

TechMarketView clients, including HotViews Premium subscribers, can download this UKHotViewsExtra now. If you do not already have access but are interested in reading this or any other content, please contact Deb Seth for more information.

Posted by Jon C Davies at '09:33'

- Tagged:

M&A

Live now is TechMarketView’s latest Infrastructure Operations Supplier Ranking 2021 report. Clients of the TechSectorViews research programme can read it here.

The report highlights the diversity of performance by the largest players in Infrastructure Operations with the Top 20 ranking reflecting the structural changes in the market. Established players have only moved ahead slightly or have declined in terms of revenue performance. Meanwhile, the hyperscalers continue to develop a significant presence. 2020 was a very good year for Amazon Web Services, Microsoft Azure, and Google Cloud Platform, and this reports details both their size and growth in the UK.

During 2020, particularly during the early phase of pandemic, buyers reined in (where they could) spend on Heritage systems. Any upgrades, or expansions to contracts, were paused while organisations went into survival mode. Spend was diverted to services that were crucial to protecting the resiliency of the organisation and/or making serious inroads into digital transformation strategies. The upshot was that players without a significant element of New revenue were vulnerable. But just how bad did things get?

Take a look at UK Infrastructure Operations Supplier Rankings 2021 to understand more about the supplier landscape and competitive scene

Subscribers to TechMarketView's TechSectorViews research programme can download UK Infrastructure Operations Supplier Rankings 2021 now. If you are not yet a subscriber and would like to find out how to gain access to this research and much more besides, please contact Deb Seth.

Posted by UKHotViews Editor at '07:30'

- Tagged:

cloud

automation

digital

AI

infrastructureoperations

An updated alliance with Microsoft around managed voice and cyber security services could help BT reverse the ongoing decline of its Enterprise and Global businesses, which together saw their combined revenue shrink 11.5% year on year in the quarter ending June 2021 according to a trading update.

An updated alliance with Microsoft around managed voice and cyber security services could help BT reverse the ongoing decline of its Enterprise and Global businesses, which together saw their combined revenue shrink 11.5% year on year in the quarter ending June 2021 according to a trading update.

The collaboration sets a firm foundation for the provision of flexible, secure collaborative workspace solutions that for many organisations may become the rule rather than the exception post-pandemic. It may also advance to help both companies expand their presence in the IoT/IIoT space in the future, particularly in verticals like manufacturing and healthcare.

Subscribers to TechSectorViews can read our take on the opportunities the tie-up presents in our research note BT expands Microsoft voice/security partnership to boost collaborative workspace proposition here.  If you don’t have a subscription you can contact Deb Seth for details.

If you don’t have a subscription you can contact Deb Seth for details.

Not a TechMarketView subscription research client? Then why not subscribe to our low-cost UKHotViews Premium service to access all of our UKHotViews and UKHotView Extra posts?

Posted by Martin Courtney at '16:12'

- Tagged:

voice

telephony

workplace

IIoT

HotViewsPremium

cybersecurity

telecommunications

Our new UK Solutions Supplier Ranking report for 2021 is available for download and contains the Top 20 UK supplier ranking by revenue for the UK Software & IT Services (SITS) Solutions market.

The UK Solutions market contains a diverse range of suppliers, from the very largest Systems Integrators through to multi-service consultants to smaller digital solution specialists. Even the largest and most progressive of Systems Integrators found 2020 challenging.

The UK Solutions market contains a diverse range of suppliers, from the very largest Systems Integrators through to multi-service consultants to smaller digital solution specialists. Even the largest and most progressive of Systems Integrators found 2020 challenging.

Last year proved to be very much a ‘game of two halves’ for the UK Solutions market with reports of organisations implementing three years’ worth of digital transformation in as many months. Overall, once end users had navigated the April/May market pause, the rebound in Solutions expenditure was strong, albeit not quite strong enough to recover all the ground lost during those early months of the pandemic.

This report contains the Top 20 Supplier Ranking (by revenue) for the UK Solutions market. It is part of a series of reports assessing market and supplier performance that includes Solutions Market Trends & Forecasts and Supplier Prospects reports, due for publication later in 2021.

Subscribers to TechMarketView's TechSectorViews research stream can download the research — UK Solutions Supplier Rankings —now. If you are not yet a subscriber and would like to find out how to gain access to this research and much more besides, please contact Deb Seth.

Posted by Marc Hardwick at '17:22'

- Tagged:

suppliers

newresearch

ranking

The financial markets sector currently accounts for around 17% of all SITS spend within UK financial services and in 2020 was worth in excess of £2.2bn. Against this backdrop, technology innovation is increasingly driving change as firms look to improve competitiveness via operational efficiency, ensure regulatory compliance and reduce costs, in particular in respect of post-trade processes.

The financial markets sector currently accounts for around 17% of all SITS spend within UK financial services and in 2020 was worth in excess of £2.2bn. Against this backdrop, technology innovation is increasingly driving change as firms look to improve competitiveness via operational efficiency, ensure regulatory compliance and reduce costs, in particular in respect of post-trade processes.

Cloud, compliance and crypto are three of the major themes that have dominated the financial markets sector from a technology perspective of late. To discuss these topics and others, I caught up with Adrian Ip, the Director of Product & Technology Sales at Aquis Exchange PLC.

The three Cs drving change across financial markets explores the come of the changes that are afoot within the financial markets sector and discusses the key roles being played by the regulators and technology vendors.

Subscribers to FinancialServicesViews can download this UKHotViewsExtra now. If you do not already have access but are interested in reading this or any other content, please contact Deb Seth for more information.

Posted by Jon C Davies at '07:00'

- Tagged:

financialmarkets

The UK public sector is a unique and important market for cyber security products and services. Cyber security is inextricably linked to national security, with most of the public sector coming within the formal definition of critical national infrastructure. It is a key pillar of defence and foreign policy, with cyber attacks considered a ‘tier one’ threat alongside war and natural disasters. The role of the Government and wider public sector in protecting citizens and the economy, and guarding the integrity of critical national infrastructure, make public bodies a target for nation state actors, terrorists and criminal gangs alike.

The UK public sector is a unique and important market for cyber security products and services. Cyber security is inextricably linked to national security, with most of the public sector coming within the formal definition of critical national infrastructure. It is a key pillar of defence and foreign policy, with cyber attacks considered a ‘tier one’ threat alongside war and natural disasters. The role of the Government and wider public sector in protecting citizens and the economy, and guarding the integrity of critical national infrastructure, make public bodies a target for nation state actors, terrorists and criminal gangs alike.

This report analyses the particular threats and vulnerabilities that public bodies must respond to, considering each sub-sector separately, along with current cyber security policy and procurement trends. It provides a list of top suppliers, an estimate of the current market size and recommendations for cyber security suppliers wishing to work with the public sector.

If you are an existing PublicSectorViews or TechSectorViews subscriber, you can read Cyber security in the public sector: challenges and opportunities now. If you’d like to discuss an extension to your existing subscription or would like details of how to subscribe to TechMarketView, please email Deb Seth.

Posted by UKHotViews Editor at '09:08'

- Tagged:

research

government

cyber

public+sector

Banking software specialist, Temenos, has published an impressive set of H1 results, highlighting excellent performance YTD amid improving market conditions. The Swiss vendor reported total global revenue of $445.4m, up 11.1% YTD (+9% in Q2), meanwhile profit YTD rose by 48% to $68.1m

Banking software specialist, Temenos, has published an impressive set of H1 results, highlighting excellent performance YTD amid improving market conditions. The Swiss vendor reported total global revenue of $445.4m, up 11.1% YTD (+9% in Q2), meanwhile profit YTD rose by 48% to $68.1m

Temenos revealed that software licence revenue was up by 20.3% YTD to $110.2m, whilst SaaS and subscription revenue rose by 54.2% to $57.5m. Overall software revenue increased by 11.1% in the first half of the fiscal to $167.7m. Maintenance revenue also showed a healthy increase, rising by 9.3% YTD to $195.8m whilst services revenue was more or less flat at $82m.

The excellent performance delivered by Temenos has been founded on the company’s sustained investment in R&D and its commitment to cloud-based, open-architecture, that has now become the ultimate goal for many in the industry. This approach has enabled the vendor to capitalise on opportunites amongst neo-bank "challengers" and established institutions alike.

The excellent performance delivered by Temenos has been founded on the company’s sustained investment in R&D and its commitment to cloud-based, open-architecture, that has now become the ultimate goal for many in the industry. This approach has enabled the vendor to capitalise on opportunites amongst neo-bank "challengers" and established institutions alike.

Momentum builds for Temenos as banking market accelerates explores the factors behind Temenos' current success and examines the changes in the market for banking technology and how vendors in this sector might respond.

Subscribers to FinancialServicesViews can download this UKHotViewsExtra now. If you do not already have access but are interested in reading this or any other content, please contact Deb Seth for more information.

Posted by Jon C Davies at '09:40'

UK insurance software vendor and broker market specialist, SSP, has taken another key step on its recovery journey with the appointment of a new CEO. Colin Greenhill took office on 12 July, following the departure of his predecessor, Steve Lathrope, in the wake of the company’s recent acquisition by North American software vendor, Constellation Software (via its Volaris subsidiary).

UK insurance software vendor and broker market specialist, SSP, has taken another key step on its recovery journey with the appointment of a new CEO. Colin Greenhill took office on 12 July, following the departure of his predecessor, Steve Lathrope, in the wake of the company’s recent acquisition by North American software vendor, Constellation Software (via its Volaris subsidiary).

The SSP story is an intriguing one. For around 15 years, the Halifax based vendor enjoyed strong growth and became recognised as one of the success stories of the UK insurance technology sector. However, following an MBO in 2015, a series of damaging system outages occurred in 2016, denting the company’s fortunes and impairing its reputation amongst its clients and prospects.

SSP was originally co-founded in 2000 by David Rasche, the entrepreneurial former MD for UK Financial Services of DXC’s antecedent, CSC. The SSP business was itself formed from elements of CSC’s pre-existing European insurance operations, originally acquired by the US vendor from insurer RSA.

SSP was originally co-founded in 2000 by David Rasche, the entrepreneurial former MD for UK Financial Services of DXC’s antecedent, CSC. The SSP business was itself formed from elements of CSC’s pre-existing European insurance operations, originally acquired by the US vendor from insurer RSA.

My latest UKHotViews Extra “Recently acquired SSP’s new CEO takes the helm” takes a look at the SSP story and discusses some of the vendor's key milestones and future challenges, as the UK insurance sector continues to evolve.

Subscribers to FinancialServicesViews can download this UKHotViews Extra now. If you do not already have access but are interested in reading this or any other content, please contact Deb Seth for more information.

Subscribers to FinancialServicesViews can download this UKHotViews Extra now. If you do not already have access but are interested in reading this or any other content, please contact Deb Seth for more information.

Posted by Jon C Davies at '07:00'

- Tagged:

insurance

M&A

We last wrote about Foundation SP in December after it secured funding from LDC (see Foundation SP secures "multimillion-pound" investment) to support its bold organic growth strategy. With LDC’s backing, the aim is to expand its client base, add to its suite of digital software and services, and consider complementary acquisitions.

We last wrote about Foundation SP in December after it secured funding from LDC (see Foundation SP secures "multimillion-pound" investment) to support its bold organic growth strategy. With LDC’s backing, the aim is to expand its client base, add to its suite of digital software and services, and consider complementary acquisitions.

Half a year on, we caught up with Simon Grosse, Foundation SP’s CEO, and Tim Ebenezer, COO. Foundation SP’s last financial year completed at the end of December 2020 and accounts have just been published. Revenues for the year were up 49% to £8.8m and adjusted EBITDA grew 92% to £2.5m. During the year, on average, the number of people employed was 71.

Within its digital transformation services portfolio, the company has three key business areas… Read more in UKHotViewExtra…

Posted by Georgina O'Toole at '06:55'

- Tagged:

digital

Is your organisation looking to raise its profile in UK tech? If so, why not sponsor a TechMarketView breakfast webinar? We have a series of four webinars running weekly from 23 September 2021.

There are sponsorship packages available for each event with benefits including the opportunity to increase visibility in the UK tech arena, to be associated with a leading research analyst firm in the UK and to network with peers and potential customers at an exclusive, invitation-only drinks reception planned for 2022.

Through early engagement, sponsor organisations will achieve maximum exposure with continuous promotion in UKHotViews and on social media in the months leading up to the webinars, as well as attractive advertising benefits.

In case you missed it, we were delighted to announce our first sponsor – our friends over at Aqilla (https://www.techmarketview.com/news/archive/2021/05/27/www.techmarketview.com ).

The breakfast webinars will be shining a light on:

· Delivering Social Value – Implications for Public Sector Technology Suppliers

· Hackers & Defenders – How greater use of public cloud is changing the cyber security landscape

· Clarity of Purpose – How the pandemic helped financial services to focus on what really matters

· Making Green from Green – Is there revenue from the sustainability agenda?

Get in touch for a copy of our sponsorship pack and the opportunity to talk to us about becoming a sponsor.

Please email Paula from our Client Services team pmilesmathewson@techmarketview.com.

Posted by UKHotViews Editor at '00:00'

- Tagged:

events

For over ten years we’ve has been helping UK startups and scaleups get a leg-up in the market, first with our Little British Battlers programme, then with Great British Scaleups, and, most recently, with the TechMarketView Innovation Partner Programme, TIPP.

For over ten years we’ve has been helping UK startups and scaleups get a leg-up in the market, first with our Little British Battlers programme, then with Great British Scaleups, and, most recently, with the TechMarketView Innovation Partner Programme, TIPP.

We’re now launching TIPP for Scaleups, specifically designed to help growth companies expand their partner channel and dramatically increase their market visibility.

TIPP for Scaleups leverages the extraordinary reach and reputation of the TechMarketView brand to attract potential partners to register for a 30-minute ‘get to know you’ meeting so that both parties can quickly size up the partnership fit.

Here’s why TIPP for Scaleups is such an effective way for growth companies to find new partners.

-

You’ll have the backing of TechMarketView, one of the most respected names in the UK tech sector. Even if potential partners aren’t familiar with your brand, knowing that TechMarketView is working with you will give them the confidence to engage.

-

We’ll help you build a compelling partnership proposition that is most likely to attract the best-fit candidates.

-

We can bring candidates right to your (virtual) door. You know how tedious it can be researching the market, and how frustrating it is when companies you approach don’t reply to your emails or return your calls. We save you the pain!

-

Our search campaign will put your brand firmly on the map, not just with potential partners, but in the wider industry too.

-

It really works. We’ve been running our Innovation Partner programme for over three years, and we have never failed to find credible partnership candidates for our clients.

You can find out more about TIPP for Scaleups on our website here or contact TechMarketView Managing Partner Anthony Miller to discuss further.

Posted by UKHotViews Editor at '06:00'

- Tagged:

scaleup

tipp

Over two days of Atos Technology Days we learnt of the next evolution in Atos’ strategy. In line with TechMarketView’s ‘Reset & Reimagine’ research theme, the company is drawing on its years of investment in cloud, digital, security, and decarbonisation, and turning its attention to ‘digital platforms’. The move answers end user demands for an accelerated journey to digital, more easily consumable products and services, and the desire to leverage the value of data across their ecosystems to respond to heightened customer expectations. It also aims to further enhance the company’s strategic positioning as a leader in secure, decarbonised, digital.

Over two days of Atos Technology Days we learnt of the next evolution in Atos’ strategy. In line with TechMarketView’s ‘Reset & Reimagine’ research theme, the company is drawing on its years of investment in cloud, digital, security, and decarbonisation, and turning its attention to ‘digital platforms’. The move answers end user demands for an accelerated journey to digital, more easily consumable products and services, and the desire to leverage the value of data across their ecosystems to respond to heightened customer expectations. It also aims to further enhance the company’s strategic positioning as a leader in secure, decarbonised, digital.

Core the new strategy is the Atos Digital Hub, described as an “accelerator for the building of ecosystem platforms”.... Read more in UKHotViewsExtra.

If you do not know how to access this research - and want to find out more about the Atos Digital Hub and how Atos is taking it to market, please contact Deb Seth to find out how to become a subscriber.

Posted by Georgina O'Toole at '10:25'

- Tagged:

digital

data

platforms

The pandemic response has been good for several areas of technology and immersive is one of them. Necessity has been the mother of invention, ushering in or extending the use of immersive tech across a broad swath of public and private sector areas including health and social care, training and education, remote support and maintenance, manufacturing and industrial control, retail operations and leisure and tourism.

The pandemic response has been good for several areas of technology and immersive is one of them. Necessity has been the mother of invention, ushering in or extending the use of immersive tech across a broad swath of public and private sector areas including health and social care, training and education, remote support and maintenance, manufacturing and industrial control, retail operations and leisure and tourism.

Our report: “Spotlight on Emerging Tech: Are you ready to release the Immersive Tech genie?” outlines immersive tech infiltration, key challenges and four tests for immersive readiness.

The technology provides a spectrum of experiences capable of addressing use cases ranging from the empathetic, to the informative, to hands on practical guidance and simulations - as is appropriate. That is important because different functions and different audiences require different immersive approaches. As organisations rethink working practices, product and service delivery and consumption models across all sectors, public and private, the immersive tech that was considered something for the future is rapidly becoming a technology of the now.

Eligible subscribers can download the report now; if you’d like to know more about TechMarketView’s research and related services please drop an email to Deb Seth.

Posted by Angela Eager at '17:23'

- Tagged:

software

AR

VR

immersivetechnologies

Last week, TechMarketView launched UK SITS Market Trends and Forecas ts 2021, our annual report on the trends and forecasts in the UK Software and IT Services market.

ts 2021, our annual report on the trends and forecasts in the UK Software and IT Services market.

We’re already hearing from many clients about how useful the report is and, in partcular, how much they appreciate the level of detail it provides.

To accompany the report, we have also published a spreadsheet containing our market model (see UK SITS Market Forecasts 2021 (Excel)) and a document describing in detail how we define the market segments (see Market models descriptions and definitions). Both documents are incredibly useful for fully understanding the shape and evolution of the market.

Consulting all three documents will give readers the best understanding of the UK Software and IT Services market. In addition, some clients are choosing to bring in one of our market specialists to discuss the trends, forecasts and players in greater depth, and how they apply to their organisations.

UK SITS Market Trends and Forecasts 2021, UK SITS Market Forecasts 2021 (Excel) and Market models descriptions and definitions are only available to TechMarketView’s Foundation Service clients.

To become a client or to engage with an analyst, please contact Deb Seth.

Posted by UKHotViews Editor at '09:30'

- Tagged:

markettrends

forecasts

Artificial Intelligence and Augmented Intelligence – what’s the difference and why does it matter? The bottom line is that on a technical basis there is little between the two - the meaningful difference lies in intent and usage. This is what will help drive further adoption of both types of 'intelligence', especially now that the 'future of work' discussions that are already high on the agenda are garnering even more attention with the prospective removal of most COVID restrictions on 19 July 2021.

Artificial Intelligence and Augmented Intelligence – what’s the difference and why does it matter? The bottom line is that on a technical basis there is little between the two - the meaningful difference lies in intent and usage. This is what will help drive further adoption of both types of 'intelligence', especially now that the 'future of work' discussions that are already high on the agenda are garnering even more attention with the prospective removal of most COVID restrictions on 19 July 2021.

The role of Augmented Intelligence, also known as intelligence amplification (IA) or cognitive augmentation, is specifically to work with and amplify human intelligence, enabling humans to make use of the deluge of data we’re generating. Rather than being designed to operate independently or replace humans, its remit is to complement and enhance human intelligence and knowledge.

Check out our thoughts on the nuanced area of Augmented Intelligence in Emerging Tech Spotlight: Developments in Augmented Intelligence.

TechMarketView subscribers, including those who take the UKHotView Premium service, can access this note. If you’d like to find out more about our range of services you can contact Deb Seth.

Posted by Angela Eager at '09:26'

- Tagged:

software

AI

machinelearning

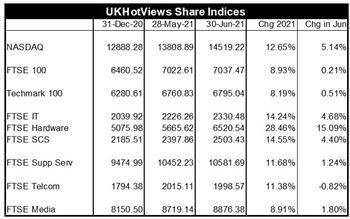

Any fears that tech was in for a ‘correction’ certainly did not come to pass in June 21. NASDAQ had a stonkingly good month – rising another 5.1% making it a 12.7% gain in 2021 YTD. This compared to a flat-lining FTSE100 (up 8.9% YTD)

It wasn’t quite so good for tech here in the UK with Techmark 100 flat-lining (up 8.2% YTD) and the FTSE IT index up 4.7% (14.2% YTD).

It wasn’t quite so good for tech here in the UK with Techmark 100 flat-lining (up 8.2% YTD) and the FTSE IT index up 4.7% (14.2% YTD).

The FTSE Software and Computer Services Index was up 4.4% in June. But YTD is up 14.6% - outpacing NASDAQ (up 12.7% YTD)

Outlook

There is a general feeling of optimism that the US and UK are emerging out of the darkness of C-19. These are countries where a majority of citizens have been vaccinated. The attitude now is that we will have to learn to live with C-19 in much the same way as we ‘live’ with diseases like flu that also cause significant numbers of deaths each year. But this is not the situation in many other parts of the world which remain unvaccinated.

Tech has had a pretty good run. Indeed 2020 was a vintage year as tech emerged as one of the big winners from the pandemic. This upbeat situation has continued into 2021. Throughout that whole 18 months, pundits have been warning of a ‘correction’ which has never come.

The real threat now is from INFLATION. If interest rates rise as a result, investors might move away from high risk tech stocks. Indeed consumer confidence would be knocked again if mortgage interest rates rose, affecting consumer tech sales. But in the enterprise tech world, companies have to up their digital transformation plans which continues to bode well for the tech companies supplying that sector of the market.

The real threat now is from INFLATION. If interest rates rise as a result, investors might move away from high risk tech stocks. Indeed consumer confidence would be knocked again if mortgage interest rates rose, affecting consumer tech sales. But in the enterprise tech world, companies have to up their digital transformation plans which continues to bode well for the tech companies supplying that sector of the market.

All the detail and comment on the Winners and Laggards in our Review of Share Performance in June 21 on HotViews Extra available to all subscribers including HotViews Premium. Why not join them for just £395pa. For more details CLICK HERE

Posted by Richard Holway at '09:33'

The UK wealth management SITS sector has witnessed significant activity over recent months as the impact of the pandemic has added to the existing forces that are already helping to drive change in the market.

The technology choices of firms across the wealth management ecosystem are evolving as a variety of external factors have led to changed business priorities and a challenging operational environment.

The Wealth Management Challenge explores some of the current business priorities impacting firms and examines the major factors influencing decisions around technology investments.

The Wealth Management Challenge explores some of the current business priorities impacting firms and examines the major factors influencing decisions around technology investments.

The commentary also discusses the effect of the coronavirus pandemic and the influence that COVID-19 has had on wealth management, innovation in the sector and the pace of change.

Subscribers to FinancialServicesViews can download this new research now. If you are not already a client and are interested in gaining access, please contact Deb Seth for more information.

Posted by Jon C Davies at '09:03'

- Tagged:

financialservices

wealthmanagement

« Back to previous page