News

I attended BETT, the education and technology trade event, at the Excel arena last week. The show offers a first glance at some of the more innovating and exciting solutions from ICT suppliers. Subscribers can read my takeaways from BETT 2016 regarding Microsoft, mismatches between technology and teaching styles, competition in the markets for VLEs and MIS systems as well as my views on 3D technologies (here).

I attended BETT, the education and technology trade event, at the Excel arena last week. The show offers a first glance at some of the more innovating and exciting solutions from ICT suppliers. Subscribers can read my takeaways from BETT 2016 regarding Microsoft, mismatches between technology and teaching styles, competition in the markets for VLEs and MIS systems as well as my views on 3D technologies (here).

Posted by Michael Larner at '15:11'

- Tagged:

education

strategy

software

In Part-Two of our report series into Business Process Automation (BPA), we assess what impacts Intelligent Automation will have on the white-collar business process services (BPS) workforce of the future (see Part One – Business Process Automation – what is Intelligent Automation?).

There are lots of dire predictions in the media about the decimation of white-collar jobs over the next decade. But the reality is likely to be very different. We see lots of new and exciting opportunities being created as Intelligent Automation is explored and invested in by suppliers and buyers.

BPS suppliers will need to understand this shifting workforce landscape, and navigate their way through, as they inevitably move out of certain areas impacted by automation, and invest in other potential growth areas enabled by it.

Subscribers to TechMarketView’s BusinessProcessViews research stream can read the analysis of this critical topic in our new report Business Process Automation – the future of white collar BPS.

Posted by John O'Brien at '08:30'

- Tagged:

bps

automation

bpa

Wednesday 27 January 2016

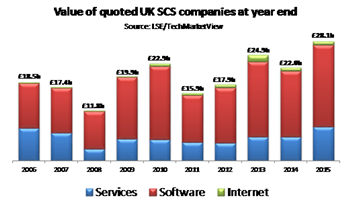

The combined valuation of the 100 UK-headquartered software and IT services (SITS) companies currently listed on the London Stock Exchange Main Market and AIM hit a 15-year high in 2015, at £28.1b, a value not exceeded since the heady days of the internet boom. Back in 2000, the then 168 UK SITS stocks were valued at over £50b, crashing to £21b the following year. Much water has flowed under many bridges since!

The combined valuation of the 100 UK-headquartered software and IT services (SITS) companies currently listed on the London Stock Exchange Main Market and AIM hit a 15-year high in 2015, at £28.1b, a value not exceeded since the heady days of the internet boom. Back in 2000, the then 168 UK SITS stocks were valued at over £50b, crashing to £21b the following year. Much water has flowed under many bridges since!

Indeed, over the past decade aggregate UK SITS company valuations have soared by over 50% - back in 2006 there were 180 listed SITS stocks valued at £18.5b.

TechMarketView Foundation Service subscription clients can take a peak under the covers at the performance of UK SITS stocks in 2015 compared to international peers in our concise annual review of the UK SITS quoted sector in IndustryViews Quoted Sector – 2015 Review out now.

Posted by UKHotViews Editor at '08:20'

We announced the TechMarketView theme for 2016 – Surfing the Waves of Disruption – in December last year, along with a series of provocative predictions from each of our Research Directors on what the future holds for suppliers of software, IT and business process services to the UK market.

We announced the TechMarketView theme for 2016 – Surfing the Waves of Disruption – in December last year, along with a series of provocative predictions from each of our Research Directors on what the future holds for suppliers of software, IT and business process services to the UK market.

Today we launch the TechMarketView Predictions 2016 Compendium, which greatly expands on and consolidates these predictions into a handy 20-page report.

So throw out the tea leaves and put on your board shorts - this report is essential reading for all smart surfers.

Subscribers to the TechMarketView Foundation Service can click the following link to download the TechMarketView Predictions 2016 Compendium report.

But if you find yourself floundering in the surf, just drop an email to our Client Services team and they will show you how to ride the waves safely back to shore.

Posted by UKHotViews Editor at '07:47'

- Tagged:

predictions

EMIS Group (EMIS) is looking to be at the heart of the interconnected health agenda. Having grown from its roots in primary care patient record software, EMIS is now aiming to help deliver a paperless NHS with solutions underpinning how medical information flows between doctors, hospitals, community care providers and pharmacies.

This Company Snapshot provides our view on the company.

Eligible subscribers can access the report (here).

Posted by Michael Larner at '07:39'

- Tagged:

publicsector

strategy

health

TechMarketView’s PublicSectorViews team has just published its review of the software and IT services (SITS) landscape in the UK local government– UK local government SITS supplier landscape 2015-16. Following a detailed analysis of the company performance of the leading suppliers, the report provides our latest ranking of the Top 10 players in local government SITS and reveals how those suppliers have performed compared to their peers and to the market as a whole.

TechMarketView’s PublicSectorViews team has just published its review of the software and IT services (SITS) landscape in the UK local government– UK local government SITS supplier landscape 2015-16. Following a detailed analysis of the company performance of the leading suppliers, the report provides our latest ranking of the Top 10 players in local government SITS and reveals how those suppliers have performed compared to their peers and to the market as a whole.

In the report, we outline the market environment in which the top-ranked suppliers are operating and consider how they match the changing market conditions. Subscribers can access in-depth profiles of the leading 10 suppliers to the market, which include a thorough analysis of the recent performance of those businesses, their UK local government strategies and our view of their prospects.

We also look at some of the ’challengers’ to the market—those that are challenging the status quo and offering a different proposition to the leading suppliers.

Subscribers to TechMarketView’s PublicSectorViews research stream shouldn’t hesitate to download their copy of the report – here. If you are not yet a subscriber and are frustrated that you can’t get hold of this detailed piece of analysis, please contact Deb Seth and she will look to rectify the situation for you.

Posted by Michael Larner at '19:07'

- Tagged:

localgovernment

rankings

suppliers

The aim of the Sopra and Steria tie-up was to create a business that could be a preferred partner for European corporates, offering integrated and end-to-end capability to deliver digital transformation. It looks to us that the UK Financial Services operation of the merged Sopra Steria provides a good example of how combining the two component parts can drive additional value.

The aim of the Sopra and Steria tie-up was to create a business that could be a preferred partner for European corporates, offering integrated and end-to-end capability to deliver digital transformation. It looks to us that the UK Financial Services operation of the merged Sopra Steria provides a good example of how combining the two component parts can drive additional value.

Together the businesses have good relationships with several large financial services customers and a track record in transformation projects (such as the recent work for the Co-operative Group and Royal London) as well as in systems integration and services-led BPO. The company also has a well-established banking software business and is having success with its modular banking solution, selling to newcomer banks as well as helping the incumbents move forward. The company is also actively pushing its utility or shared-infrastructure model. It has also developed a close partnership with SAS which will prove to be of significant value as sector participants look for best-in-class approaches in Big Data.

Together the businesses have good relationships with several large financial services customers and a track record in transformation projects (such as the recent work for the Co-operative Group and Royal London) as well as in systems integration and services-led BPO. The company also has a well-established banking software business and is having success with its modular banking solution, selling to newcomer banks as well as helping the incumbents move forward. The company is also actively pushing its utility or shared-infrastructure model. It has also developed a close partnership with SAS which will prove to be of significant value as sector participants look for best-in-class approaches in Big Data.

The Sopra Steria Group has earmarked the Financial Services sector as a source of significant growth and margin and sees substantial potential in the UK. Consequently, it is investing in additional resources here to provide specialist solutions across the wider banking sector. As the financial services sector tries to accelerate its rate of change, Sopra Steria’s wide portfolio of skills, from transformation management to Big Data implementation and the provision of modular, specialist banking software, should be in a strong position.

Subscribers to FinancialServicesViews or our Foundation Service can access this company report here. If you wish to subscribe to our services, please contact Deb Seth of our Client Services team.

Posted by Peter Roe at '09:54'

- Tagged:

bpo

software

bigdata

banking

In Predictions 2016: Enterprise Software & App Services , we flag up data intelligence and tools such as machine learning, and the early signs of convergence of software and business processes to serve business outcomes, as key themes for 2016. Subsequent catch ups with SAP SuccessFactors and Unit4 provided some compelling examples of how these themes are starting to play out in the enterprise software market. They are also prime examples of one of the waves of disruption suppliers have to surf during 2016.

In Predictions 2016: Enterprise Software & App Services , we flag up data intelligence and tools such as machine learning, and the early signs of convergence of software and business processes to serve business outcomes, as key themes for 2016. Subsequent catch ups with SAP SuccessFactors and Unit4 provided some compelling examples of how these themes are starting to play out in the enterprise software market. They are also prime examples of one of the waves of disruption suppliers have to surf during 2016.

TechMarketView subscribers: click here to find out how SAP and Unit4 are approaching the move to self driving and self learning software.

Posted by Angela Eager at '19:51'

- Tagged:

software

analytics

We first met Little British Battler (LBB), Carrenza, back in November 2013. The Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) provider was one of the twelve companies selected as part of our third LBB event.

We first met Little British Battler (LBB), Carrenza, back in November 2013. The Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) provider was one of the twelve companies selected as part of our third LBB event.

You can read more about our thoughts on the company at the time of Carrenza’s LBB involvement, including its focus on automating its IaaS offering, in the report: Little British Battlers: the Third Wave.

Carrenza offers IaaS/PaaS services from its Carrenza ‘Community Cloud’, which offers the benefits and security of a private cloud “with benefits inherent in public cloud”. More recently the company has formed partnerships with a range of public cloud providers enabling it to service clients’ hybrid cloud requirements.

Two years ago Founder Dan Sutherland was CEO, while Matt McGrory held the Sales Director role. However, last year, Matt took on the role of UK MD. We recently met with Matt to better understand his new role and responsibilities and to learn more about recent corporate developments. In Matt’s words, “Dan sets the vision; I am responsible for making that vision a reality”.

Two years ago Founder Dan Sutherland was CEO, while Matt McGrory held the Sales Director role. However, last year, Matt took on the role of UK MD. We recently met with Matt to better understand his new role and responsibilities and to learn more about recent corporate developments. In Matt’s words, “Dan sets the vision; I am responsible for making that vision a reality”.

In UKHotViewsExtra, following our meeting with Matt, subscribers can read more about Carrenza's recent progress, including investment in new initiatives - see LBB Carrenza: Continuing to innovate.

Posted by Georgina O'Toole at '15:36'

- Tagged:

publicsector

centralgovernment

cloud

iaas

g-cloud

On the surface it looks like a simple investment but Infor’s $25m stake in cloud pure play retail analytics software Predictix, which bought it a minority interest in the company, is another sign of the awakening of this business software giant, which we previously highlighted in Is Infor a serious threat in the Enterprise Software market?

On the surface it looks like a simple investment but Infor’s $25m stake in cloud pure play retail analytics software Predictix, which bought it a minority interest in the company, is another sign of the awakening of this business software giant, which we previously highlighted in Is Infor a serious threat in the Enterprise Software market?

Access to predictive and prescriptive analytics appropriate to the retail market is a significant gain for Infor but there is more to the investment because it is part of its concerted effort to crack the market for cloud applications applied to mission critical back office areas. How is is approaching the challenge is notable too. Infor is not alone in trying to open up the mid market cloud back office sector - suppliers as diverse as SAP, Unit4, NetSuite, Advanced Computer Software, Access Group, K3 Business Technologies and Sage for example, have it in their sights, melding cloud and vertical capabilities in various ways, but Infor is building an increasingly dedicated and credible offering. Subscribers can read our analysis in HotViewExtra here.

Posted by Angela Eager at '19:14'

- Tagged:

cloud

investment

analytics

retail

This week Six Degrees announced that its new owner, Charlesbank Capital Partners, would be contributing a further £12m to support the company’s organic growth plans. Charlesbank is a US private equity firm with offices in Boston and New York and more than $3bn in assets. The company bought Six Degrees from previous (and much smaller) backer, Penta Capital, in June 2015. At the time, we estimated the deal was worth in the order of £160m+ (based on average deal val

This week Six Degrees announced that its new owner, Charlesbank Capital Partners, would be contributing a further £12m to support the company’s organic growth plans. Charlesbank is a US private equity firm with offices in Boston and New York and more than $3bn in assets. The company bought Six Degrees from previous (and much smaller) backer, Penta Capital, in June 2015. At the time, we estimated the deal was worth in the order of £160m+ (based on average deal val uations of 2x revenue), delivering returns of 2.7x to the Penta team.

uations of 2x revenue), delivering returns of 2.7x to the Penta team.

The new funds will be used to employ over 50 new people in the coming 3-4 years in roles such as sales (including pre-sales experts), marketing and customer services (technical/support roles). One of the objectives is to bulk out the number of experts who can put together and support the more complex technology solutions – the driver of both margin and differentiation. Six Degrees wants to do an increasing amount of work ‘up the stack’ – i.e. services supporting the delivery of customer applications. Importantly, this does not mean moving into application development. Six Degrees will partner with ISVs who do the ‘heavy lifting’ application development work, but will deepen its skills around hosting applications (e.g. running websites and production IT environments) or providing managed security and compliance services, for example. In the first instance, the company will develop more skills around the Microsoft stack – where it already does quite a bit of work. Over time it might consider partnerships with ISVs in the SAP and Oracle space.

As well as spending some of that £12m on new people, Six Degrees will also invest in the further development of its tools – which is essential for continuous improvement of customer experience. In particular, Six Degrees wants to do more transformative work with customers, and already has c30 people working in its programme and systems group on complex projects to “transform the customer experience in a digital world”.

All in all, we think Six Degrees is being realistic about where it should focus its investments and how long those investments will take to come to fruition.

More analysis is available to TechMarketView clients in this HotViewsExtra piece. To become a subscriber, please contact Deb Seth.

Posted by Kate Hanaghan at '09:08'

- Tagged:

cloud

funding

hosting

mid-market

convergence

Wednesday 06 January 2016

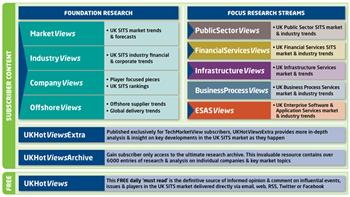

With all the frenetic activity of the festive season, you may have missed some of the research & analysis published by the TechMarketView team in the latter half of December.

With all the frenetic activity of the festive season, you may have missed some of the research & analysis published by the TechMarketView team in the latter half of December.

The analyst team finished 2015 with a flourish. Of course, a highlight was the synopsis of our 2016 Predictions published on UKHotViews (see TechMarketView’s theme for 2016: Surfing the Waves of Disruption), the full version of which will published this month. But, there was plenty more besides.

As 2015 drew to a close, PublicSectorViews Research Director, Georgina O’Toole, published an in depth analysis of the Comprehensive Spending Review & Autumn Statement. The report (see Comprehensive Spending Review 2015: Delving the detail for SITS opportunities) delves into the finer detail of the Government’s plans, separates the spin from the reality, and identifies potential opportunities for SITS suppliers.

Meanwhile, in FinancialServicesViews, Research Director Peter Roe, published his 2nd Payments Bulletin (see Payments Bulletin December 2015). In it he looks at two disruptors to payments in 2016, which are at very different stages of development: Blockchain and the Smartphone.

From the InfrastructureViews team, we were treated to research into the impact of Software Defined Networking (SDN) and Network Function Virtualisation (NFV), highlighting some of the early commercial uses of the technology and how it can be applied to improve the margins of cloud delivered services. In addition, the research lays out some of the challenges faces by suppliers as they move into this market (see SDN/NFV to boost cloud services profit margins).

And in ESASViews, Research Director, Angela Eager, published ‘Developments shaping the fast-flowing security market’. The report looks at the fundamentals of emerging security models and provides a snapshot of the security market in terms of key developments, opportunities and the overall supplier landscape.

We will have much more in January and beyond. In the meantime, if any of the above whets your appetite for our research and you don’t have access to the research stream in question; please don’t hesitate to contact Deb Seth who can talk you through your options.

Posted by UKHotViews Editor at '09:49'

- Tagged:

research

Wednesday 06 January 2016

Are you looking to raise your company’s profile within the UK tech scene in 2016? Or perhaps promote an event or whitepaper, or recruit a senior executive?

Are you looking to raise your company’s profile within the UK tech scene in 2016? Or perhaps promote an event or whitepaper, or recruit a senior executive?

Why not do this by embedding a Sponsored Post directly within the main body of the UKHotViews e-newsletter? These articles, written by you, also appear on TechMarketView’s website for seven days, as well as in our Twitter feed.

UKHotViews is arguably the UK’s most respected, authoritative newsletter for informed opinion and analysis on what’s happening in the UK Software and IT Services (SITS) and Business Process Services markets.

Considered a must read for anyone with ‘skin in the SITS game’, UKHotViews enjoys a high calibre readership of more than 20,000 decision makers in UK tech. It reaches a broad spectrum of companies from the largest SITS players to emerging SMEs; as well as key players from the investment community, press, government and CIOs.

Engage with our audience to get your message across

Now you can insert your article – 250 words provided by you along with images and links – into UKHotViews to get your message across to our audience.

A Sponsored Post is an ideal way to raise your profile and brand awareness; attract customers, partners or investment; promote white papers and events, or recruit the best calibre applicants.

If you'd like further details on Sponsored Posts, or to request an advertising brochure, contact Helen McTeer in our Client Services team.

Posted by UKHotViews Editor at '09:26'

« Back to previous page