News

Improving the customer experience is the key battleground for the UK's retail banks. Despite a longstanding recognition of this challenge, problems with customer onboarding have still not been resolved satisfactorily by the high street banks.

The failings of the "Big 4" banks in particular, have been badly exposed of late by the impact of the coronavirus pandemic and lockdown. An inability to service prospective new customers effectively will have inevitably seen those affected lose out to their rivals in respect of valuable new business opportunities.

The failings of the "Big 4" banks in particular, have been badly exposed of late by the impact of the coronavirus pandemic and lockdown. An inability to service prospective new customers effectively will have inevitably seen those affected lose out to their rivals in respect of valuable new business opportunities.

Subscribers to FinancialServicesViews can download Customer Onboarding in Retail Banking "Pandemic exposes enduring challenges" to learn more.

If you are not currently a subscriber and would like to gain access please contact Deb Seth.

Posted by Jon C Davies at '07:00'

- Tagged:

financialservices

banking

fintechs

.svg_13.png;140;45) Over the last few years, we have seen the Business Process Service (BPS) market increasingly migrate away from heritage “lift and shift” style operations towards new platform/technology enabled services and Business Process-as-a-service (BPaaS) type operations - COVID-19 has only helped accelerate this trend.

Over the last few years, we have seen the Business Process Service (BPS) market increasingly migrate away from heritage “lift and shift” style operations towards new platform/technology enabled services and Business Process-as-a-service (BPaaS) type operations - COVID-19 has only helped accelerate this trend.

When Capita CEO Jon Lewis took over the reins at the UK SITS market leader three years ago, he committed the firm to developing “Digital BPO” offerings. A new strategy for the firm soon followed, specifically referencing a move away from developing “one off”/bespoke solutions towards a more reusable platform-based approach. Capita’s ambition is for technology-led solutions to be developed and deployed across multiple clients looking to address similar market needs. Reducing the need to invest in infrastructure and tie up other fixed costs, delivery of entire business processes is increasingly offered as-a-Service (BPaaS) leveraging digital technologies.

A tangible example of where Capita is making significant progress here is in the field of Digital Grant Management, as Capita refers to it, where the firm’s Government Services business has developed a Grant Management platform called GrantIS, now live with its first client, the Department for International Trade (DIT).

A tangible example of where Capita is making significant progress here is in the field of Digital Grant Management, as Capita refers to it, where the firm’s Government Services business has developed a Grant Management platform called GrantIS, now live with its first client, the Department for International Trade (DIT).

I caught up recently with Markus J Becker, Digital Growth Director for Capita Government Services to understand the progress made in digital BPO but also specifically what the business is trying to achieve in the Grant Management space.

TechMarketView subscribers, including UKHotViewsPremium clients, can learn more about digital BPO and Grant Management and read our perspective on GrantIS via *UKHotViewsExtra* Pivoting to digital BPO – Capita’s new Grant Management platform GrantIS

If you are not yet a subscriber and would like to find out what we have to say, please contact Deb Seth to enquire about access.

If you are not yet a subscriber and would like to find out what we have to say, please contact Deb Seth to enquire about access.

Posted by Marc Hardwick at '13:39'

- Tagged:

bpaas

bps

Grants

TechMarketView is helping InterSystems, one of the world’s most trusted data management platform providers, find Fintech partners in the UK and Republic of Ireland.

TechMarketView is helping InterSystems, one of the world’s most trusted data management platform providers, find Fintech partners in the UK and Republic of Ireland.

Apply today for an outstanding opportunity to offer your solutions and services to financial services organisations that might otherwise be out of your reach and range.

Click here and let TechMarketView Managing Partner Anthony Miller explain how.

Or click here and go directly to the application form.

Entries close Friday 12th February 2021

Don’t miss out!!

Posted by UKHotViews Editor at '00:01'

- Tagged:

tipp

Wednesday 20 January 2021

2020 was a year that turned our lives upside down, but 2021 (all 20 days of it) is offering hope. As the UK continues to live through a gruelling and essential lockdown, TechMarketView’s Predictions for tech and market trends seek to explain what could be on the horizon and how we can all leverage these for the best.

to live through a gruelling and essential lockdown, TechMarketView’s Predictions for tech and market trends seek to explain what could be on the horizon and how we can all leverage these for the best.

We explore topics such as how COVID has impacted the Digital Chaos experienced by so many organisations, and which specific tech trends will emerge. Life will of course look very different for office workers and customers in the months to come, but what approach should organisations take to ensure safety and success?

Sector by sector, the pathways vary. In Public Sector, for example, we can expect to see step changes in operating models. And in Financial Services, COVID has added significant impetus to the transformation agenda, meaning TechMarketView’s “Reset & Reimagine” research theme is an extremely apt choice this year.

TechMarketView’s ‘compendium’ of Predictions brings together our analysis across Public Sector, the Financial Services sector and the market more broadly. It is accessible to every TechMarketView subscriber.

Read it here: Predictions Compendium 2021.

For more information about becoming a TechMarketView client, please contact Deb Seth.

Posted by Kate Hanaghan at '09:20'

- Tagged:

cloud

AI

data

workplace

2021

Edge computing implementations are starting to gain momentum though the majority of organisations are still looking to identify potential use cases and better understand how the architectural approach can improve their application delivery, data processing and workflow automation. Some companies are already testing the water with small scale pilot projects before applying the technology elsewhere, particularly when it comes to supporting workloads with high performance requirements that use artificial intelligence (AI) and machine learning (ML) technology.

Edge computing implementations are starting to gain momentum though the majority of organisations are still looking to identify potential use cases and better understand how the architectural approach can improve their application delivery, data processing and workflow automation. Some companies are already testing the water with small scale pilot projects before applying the technology elsewhere, particularly when it comes to supporting workloads with high performance requirements that use artificial intelligence (AI) and machine learning (ML) technology.

The larger and more complex the AI/ML data set involved, the harder applications have to work to ingest, process and analyse the information. That puts considerable strain on the underlying network, storage and server architecture which shifts data from one place to another for analysis, a situation that often creates latency and bandwidth bottlenecks that can both undermine application performance and compromise security and regulatory compliance policies.

TechMarketView’s latest Edge AI: Pushing Workload Boundaries research discusses how and where edge compute architectures and approaches can help to solve those performance issues by processing data in distributed locations rather than centralised data centres.

Subscribers to TechSectorViews can read more detail in our Edge AI: Pushing Workload Boundaries report here. If you don’t have a subscription and would like to know more about how to access our services, please email Deb Seth for more information.

Posted by Martin Courtney at '09:36'

- Tagged:

AI

ML

EdgeComputing

networkinfrastructure

I am saddened to report that Geoff Shingles CBE died aged 81 on 14TH Jan 21.

I am saddened to report that Geoff Shingles CBE died aged 81 on 14TH Jan 21.

Geoff was one of the pivotal people in the UK IT sector in its early days but went on to assist many other UK tech companies until very recently.

He started in the early 1960s as an apprentice at the Mullard Radio Valve Company before moving in 1963 to Elliott Brothers working on an early ‘shoe box’ computer.

But it was his time at DEC (I was always rebuked for calling them DEC as founder Ken Olsen had insisted they be referred to as the Digital Equipment Corporation) where he is best remembered by me and many others. He joined DEC in 1965 as employee #4 in the UK. After just 3 years, Geoff was appointed UK MD.

The DEC PDP-11 and, later, the DEC VAX, were the first real distributed or mini computers rivalling the mainframe power of IBM and ‘the BUNCH’. These computers were hugely influential in bringing the benefits of computing to businesses of all sizes. DEC pioneered the OEM market whereby software providers produced solutions which were then sold as ‘turnkey’ systems to users.

That’s where I really became involved with DEC and Geoff when I was at Hoskyns. When I told Geoff Unwin, CEO of Hoskyns and latterly Capgemini, the news he said ‘Geoff’s passing is very sad, he was extremely personable and straightforward to do business with. In Hoskyns at the time we saw the power of the DEC mini-computers and their cost effectiveness. ... It became an era of explosive growth, and Geoff did a phenomenal job of holding on to this tiger and encouraging a new breed of OEMs to accelerate ever more applications and hence growth. One of THE characters of those pioneering times.”

Shingles stayed and progressed with DEC extending his responsibilities outside of the UK to Northern Europe. He left after nearly 30 years with DEC in 1993.

But this was just the beginning of Geoff’s contribution to the UK tech sector. In 1994 he joined Imagination Technologies –becoming Chairman in 1995 – and served until 2015. CEO Sir Hussein Yassie said “Geoff was very much one of the key UK pioneers in global tech. Geoff was a very wise and supportive pillar for me in my efforts to develop and grow the company from very small beginnings to a global tech powerhouse supplying billions of technology products to leading global brands and iconic devices. That journey was a tough but amazing period which also made us very close friends. He totally shared my views of wanting the UK to have its rightful place on the world technology stage.”

On a personal note, I’ve spent all my career trying to support that aim.

Geoff was the Senior NED at Interregnum from 1994-2006 where he supported Sir Kenneth Olisa who said. ‘I was deeply honoured that a founding father of the UK IT industry was prepared to invest his skills and reputation - and characteristically pithy wit - to support me to build a company from the ground up. They don’t make them like Geoff anymore’.

Geoff loved working with start-ups. In many he invested alongside Mel Morris (best known for his backing of King the creators of Candy Crush) in many businesses– like Prevx and uDate -over almost 30 years. Mel said, “He had vast experience and an incredible talent for focussing on what REALLY was important. He had a presence that oozed integrity and stature and earned instant respect. A truly humble giant of a man in every way”

In an interview with Archives of IT, Geoff said that his major achievement was ‘making no enemies’. Indeed, in the emails I have received since his death became known, Geoff was universally liked and admired. One of many emails was from Alan Laing, MD IFS. ‘Geoff was a legend of our industry as well as being a gent and all-round lovely guy. He inspired so many people. Me especially as he was my first boss in IT’.

On a more personal basis, Geoff put this down to ‘surrounding himself with others he believed were smarter than him’. I have often quoted that myself and am still amazed at how few so-called managers don’t adopt that same principle.

Our condolences to Geoff’s wife Frances, his children Emma, James and Jonny and many grandchildren.

Posted by Richard Holway at '07:00'

TechMarketView is helping InterSystems, one of the world’s most trusted data management platform providers, find Fintech partners in the UK and Republic of Ireland.

TechMarketView is helping InterSystems, one of the world’s most trusted data management platform providers, find Fintech partners in the UK and Republic of Ireland.

InterSystems is looking to expand its partner community in the UK and ROI to offer reliable, innovative and scalable data technology solutions to the financial services industry and position itself as an innovator and disruptor within the Financial Services sector.

Apply today for an incredible opportunity to work with InterSystems to take your solutions and services into financial services institutions that might otherwise be out of your reach.

Virtual pitch sessions

We will be running virtual pitch sessions during week beginning 15th March 2021 to identify companies that are the best fit for a strategic partnership with InterSystems.

Your company

You must be an established solutions provider to the financial services sector headquartered in the UK or the Republic of Ireland, ideally serving international markets.

Partnership options

-

Applications Solutions Partners: Independent software vendors that can sell applications or solutions built with InterSystems technology to financial services organisations.

-

Technology Alliance Partners: Hybrid cloud professional and managed service organisations that can deliver a solution to financial services customers based on InterSystems technology.

Why partner with InterSystems?

-

Market access: InterSystems has an enviable client base including the world’s leading financial institutions as well as major healthcare providers and government institutions.

-

Business growth: InterSystems will help you build your pipeline, using its global scale to open up opportunities for your business with large clients.

-

Partner ecosystem: Over 1,200 partner organisations already work with InterSystems creating value together not just for a few years, but for decades.

-

Partner accreditation: The InterSystems partner program provides partners the opportunity to differentiate their offerings to win market recognition, customer trust and loyalty.

-

Proven technology: InterSystems IRIS makes it easier to build high-performance, machine learning-enabled applications that connect data and application silos.

-

Cloud first: InterSystems IRIS is a complete, cloud-first, unified data platform that enables organizations to rapidly develop, deploy, and maintain real-time, data-rich solutions.

How to apply

Application form: http://bit.ly/3hRXWb0

Applications close on Friday 12th February 2021

Further information is available on the TechMarketView website HERE or contact TechMarketView Managing Partner Anthony Miller

Posted by UKHotViews Editor at '00:01'

In November, it was announced that London headquartered, ECS, had been acquired by US player, GlobalLogic.

We can see why GlobalLogic was attracted to ECS, which gives it a great entry point into the UK market. ECS has numerous FTSE 100 customers, in Financial Services and other highly regulated sectors. ECS has built a track record as an Amazon Web Services partner and is a certified Advanced Consulting Partner, Managed Services Partner, and one of only three EMEA Amazon Connect Service Delivery Partners. It is also one of a small number of UK-headquartered businesses to be awarded the DevOps competency partner status by AWS.

It is of course not the only AWS partner to have been scooped up by a larger player in recent times. For example, we've seen Cognizant acquire Contino (which was most latterly backed by Columbia Capital) and Inawisdom (the Ipswich-based artificial intelligence and data analytics consultancy).

As ever, the risk with acquisitions is that the people so critical to the success of the business jump ship in due course. Or, that the IP that is acquired is not leveraged in a way that means the acquirer fully capitalises upon it.

Given where ECS and GlobalLogic are in their own evolution, the transaction makes good sense. This research note, available for TechMarketView clients only, takes a look at some of the implications of the acquisition for both the companies and their customers.

Download the report here: ECS acquisition by GlobalLogic oozes logic.

Posted by Kate Hanaghan at '09:45'

- Tagged:

acquisition

cloud

automation

ML

Wednesday 13 January 2021

The motivating factors behind the estimated $10bn bid for DXC Technology by Atos are intriguing. Equally so is the likely impact of any merger on the SITS market both here in the UK and farther afield. In the UK, the estimated revenue of Atos, when combined with the larger DXC, is likely to exceed £3.5bn per annum. This would make the merged company the largest SITS vendor in the UK, ahead of the likes of Capita, TCS and IBM.

The motivating factors behind the estimated $10bn bid for DXC Technology by Atos are intriguing. Equally so is the likely impact of any merger on the SITS market both here in the UK and farther afield. In the UK, the estimated revenue of Atos, when combined with the larger DXC, is likely to exceed £3.5bn per annum. This would make the merged company the largest SITS vendor in the UK, ahead of the likes of Capita, TCS and IBM.

TechMarketView subscribers, including UKHotViewsPremium clients, can learn more about the various considerations surrounding any merger and read our perspective on the proposed deal via UKHotViewsExtra "Running the rule over Atos and DXC".

TechMarketView subscribers, including UKHotViewsPremium clients, can learn more about the various considerations surrounding any merger and read our perspective on the proposed deal via UKHotViewsExtra "Running the rule over Atos and DXC".

If you are not yet a subscriber and would like to find out what we have to say, please contact Deb Seth to enquire about access.

Posted by Jon C Davies at '09:52'

- Tagged:

M&A

Atos

DXC

Wednesday 13 January 2021

Often, digital-related announcements in Government have left me unexcited and unconvinced that anything will change. Yesterday’s announcement by Alex Chisholm, COO for the Civil Service and Permanent Secretary for the Cabinet Office, feels different.

The big news is the establishment of the Central Digital and Data Office (CDDO) for Government – a new strategic centre for Digital, Data and Technology (DDaT), which will be launched in early February, with significant appointments supporting its creation.

The big news is the establishment of the Central Digital and Data Office (CDDO) for Government – a new strategic centre for Digital, Data and Technology (DDaT), which will be launched in early February, with significant appointments supporting its creation.

TechMarketView subscribers – including UKHotViewsPremium clients – can read our reaction to the announcements in UKHotViewsExtra: New Government Central Digital & Data Office. If you are not yet a subscriber and would like to find out what we have to say, please contact Deb Seth to enquire about access.

Posted by Georgina O'Toole at '09:41'

- Tagged:

publicsector

centralgovernment

government

digital

leadership

data

Have you read TechMarketView's recently published supplier rankings report?  Don’t miss out on finding out who ranks where in our Top 60 and delving into the supplier profiles of the Top 30 players. The rankings reflect the changes in the market, and in particular how the long-standing suppliers are managing the swing from heritage Software and IT/Business Process Services to new propositions.

Don’t miss out on finding out who ranks where in our Top 60 and delving into the supplier profiles of the Top 30 players. The rankings reflect the changes in the market, and in particular how the long-standing suppliers are managing the swing from heritage Software and IT/Business Process Services to new propositions.

Top 20 ranking tables are also provided for key horizontal market areas as defined by TechMarketView’s Digital Evolution Model (DEM): Enterprise Software, Consulting, Solutions, and Operations (across Business Process, Applications and Infrastructure) giving readers unparalleled depth and breadth of analysis.

The much anticipated, and highly comprehensive, Supplier Rankings report is available for our Foundation Service clients here: UK SITS Supplier Rankings 2020.

If you are not a client of the Foundation Service, or indeed of TechMarketView, contact info@techmarketview.com today to find out how to get your copy.

Posted by UKHotViews Editor at '00:00'

- Tagged:

rankings

suppliers

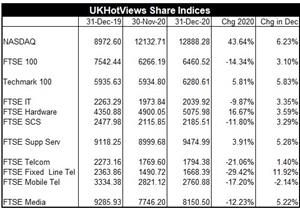

Share Price performance in December and 2020 as a whole

NASDAQ continued its Bull run rising another 6.2% in December making it a massive 43.6% gain in 2020. Set this against the FTSE100 which, although rising 3.1% in December as a BREXIT deal was finally agreed and two C-19 vaccines approved, still registered a 14.3% fall in 2020 as a whole.

NASDAQ continued its Bull run rising another 6.2% in December making it a massive 43.6% gain in 2020. Set this against the FTSE100 which, although rising 3.1% in December as a BREXIT deal was finally agreed and two C-19 vaccines approved, still registered a 14.3% fall in 2020 as a whole.

The FTSE SCS Index, which most closely tracks the Software & IT Services companies on the LSE that we follow, also rose 3.3% in December. But is also down 11.8% in 2020.

So the place to be in 2020 was in US Big Tech!

Outlook?

Let’s be honest, at the start of January 2020 I (and practically everyone else) hadn’t a clue that we would be hit by a pandemic like C-19. This eclipsed all other issues – including BREXIT, Trump etc.

I was actually quite optimistic for the outlook for tech stocks. Fortunately one prediction I got (massively) correct – but for mainly the wrong reasons!

I’m still optimistic for 2021. Although I am not a BREXIT supporter, I am pleased that a deal has finally been done and, hopefully, we can move forward. If Britain sets it mind to it, it can succeed. We have so many talents. On top of that various C-19 vaccines will be rolled out. So, later in 2021, our lives might eventually return to something more normal. Some reports suggest that £400b has been ‘saved’ by UK consumers who are awaiting an opportunity to spend on holidays, eating out, new clothes etc. Some are predicting a new ROARING TWENTIES. With interest rates set to continue at their current historic lows, more people with turn to equities.

C-19 has hastened the importance of tech. Indeed many are saying that ‘nine years of digital transformation has been achieved in the nine months since C-19 hit’. I really can’t see us reversing that transformation. Online shopping, WFH, ‘Zooming’ etc are the new norms.

But even given that, it would however be a brave (or foolish..) person who forecast that NASDAQ would repeat its 44% rise again in 2021.

Wishing you all a Happy, Successful and, above all, Healthy 2021.

For a detailed and extensive review of Share Performance in Dec 20 and 2020 as a whole see HotViews Extra. Available to all our paying subscribers including HotViews Premium . IT COULD BE YOU! Sign up for just £395+VAT pa. CLICK HERE!

Posted by Richard Holway at '12:34'

« Back to previous page