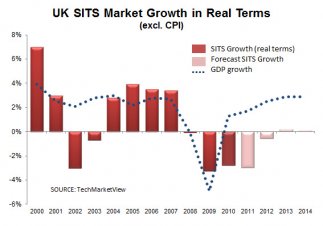

We don’t like to blow our own trumpet too loudly (OK, maybe a little) but we think we read the market pretty well last year. We had forecast that the UK software and IT services (SITS) market would shrink in real terms (i.e. excluding inflation) by 2.5% in 2010. By the time all the numbers were in, we reckoned it was actually down 2.8%. Please forgive us the difference. Headline market growth was up—but only just—at 0.6%, but that was buoyed by unexpectedly high inflation.

We think 2011 could be even slightly worse than 2010. We are now forecasting that the UK SITS market will shrink again in real terms—by 3.0%—although headline growth including inflation will look better than last year’s, at 1.3%. And then one more year of decline in 2012, of just under 1%.

We think 2011 could be even slightly worse than 2010. We are now forecasting that the UK SITS market will shrink again in real terms—by 3.0%—although headline growth including inflation will look better than last year’s, at 1.3%. And then one more year of decline in 2012, of just under 1%.

But it’s the medium term that concerns us.

As you read through our new UK SITS Market Trends & Forecasts report, you will see that we are increasingly of the view that the uptick we saw in the UK SITS market last year was more likely due to the release of pent-up demand, rather than a return to ‘business as usual’. This is why we have reduced our growth forecasts from 2012 onwards.

Our concerns are exacerbated by distinctly moribund GDP growth, which seems to have most economy-watchers downgrading their forecasts. If nothing else, this injects even more uncertainty into capex decision-making. Indeed, very few of the captains of industry we regularly talk to are telling us that IT spending decisions are getting any quicker or any easier. We still belive that we remain in the midst of a 5 year market decline in real terms, with growth remaining below GDP indefinitely!

Disruption rules!

That’s not to say the market is not ‘dynamic’. The disruptive effect of new technologies, especially cloud computing, but also mobile apps, social media, and what is generally referred to as the consumerisation of enterprise IT, is dramatically affecting enterprise buying behaviour. As a result, the diversification of supplier financial performance—a theme we revived when the downturn hit—remains a defining feature of the marketplace. Just look at our recent UK SITS Rankings 2011 report—the winners and the losers are clear for all to see.

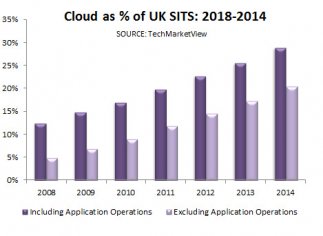

Of these disruptive technologies, undoubtedly cloud computing is having the deepest and most fundamental impact on the UK SITS market. Depending on how you wish to define it (and we have our own views on this, of course), cloud computing could represent nearly 30% of the UK SITS market by 2014. Even using conservative definitions, cloud computing should reach nearly 20% of the UK SITS market over the same period. Whichever way you wish to look at it, cloud is the fastest growing segment of the UK SITS market.

Of these disruptive technologies, undoubtedly cloud computing is having the deepest and most fundamental impact on the UK SITS market. Depending on how you wish to define it (and we have our own views on this, of course), cloud computing could represent nearly 30% of the UK SITS market by 2014. Even using conservative definitions, cloud computing should reach nearly 20% of the UK SITS market over the same period. Whichever way you wish to look at it, cloud is the fastest growing segment of the UK SITS market.

Let us leave you with what we believe to be the crucial ‘take-away’ from this report.

Cloud computing is especially disruptive because it requires both software publishers and IT and business process services suppliers to completely reconstruct their operating and business models. This is why we believe that the ‘winners’ in the cloud computing market—if indeed winners there be—will not necessarily be those suppliers whose cloud ‘proposition’ is the most agile/accessible/elastic/scalable etc. It will be those who are able to adapt their operating model the quickest. Because those that don’t—or can’t—will simply not make money from the cloud!

The UK Software and IT Services market Trends & Forecasts July 2011 report is available for download now – but of course you need to be a TechMarketView subscription service client to see it. Contact our Deborah Seth (dseth@techmarketview.com) when you can resist the temptation no more!

Posted by UKHotViews Editor at '05:00'