News

We have now heard management discuss Serco's H112 results. It is clear the support services and BPS giant is banking on a real improvement in the second half of 2012 after a disappointing first half in which organic revenue fell 2% (see Serco’s disappointing first half).

We have now heard management discuss Serco's H112 results. It is clear the support services and BPS giant is banking on a real improvement in the second half of 2012 after a disappointing first half in which organic revenue fell 2% (see Serco’s disappointing first half).

CE Chris Hyman said he was confident Serco would achieve analyst consensus estimates for 3% organic growth in FY12. To get there Serco would need to achieve organic growth of c8-10% in H212. That would be some turnaround. But is that realistic, and if so, where is that growth coming from?

Subscribers to TechMarketView's BusinessProcessViews service will soon be able to read our new report into IT-enabled support services. In the meantime, Foundation Service subscribers can read the full Serco H1 analysis in UKHotViewsExtra here.

Posted by John O'Brien at '14:19'

- Tagged:

bpo

bps

supportservices

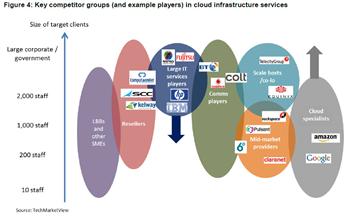

The £14bn UK infrastructure services market is undergoing a number of radical changes due to ‘disruptive’ technologies such as cloud, mobile internet and BYOT. Meanwhile, large outsourcing contracts, a traditional mainstay of a number of top-tier infrastructure players are being split into smaller, shorter lots, making such deals accessible to a much wider range of suppliers – both traditional and non-traditional.

The £14bn UK infrastructure services market is undergoing a number of radical changes due to ‘disruptive’ technologies such as cloud, mobile internet and BYOT. Meanwhile, large outsourcing contracts, a traditional mainstay of a number of top-tier infrastructure players are being split into smaller, shorter lots, making such deals accessible to a much wider range of suppliers – both traditional and non-traditional.

In our latest InfrastructureViews report, UK Infrastructure Services Supplier landscape 2012, we give you the latest picture of the supplier landscape in the UK infrastructure services market. Besides looking at the market leaders, we also highlight other players to look out for in the coming years, as well as key changes and dynamics set to impact the supplier landscape in this large, highly-disrupted part of the UK software and IT services market.

Subscribers to the TechMarketView InfrastructureViews research service can download this report from our website here.

Posted by UKHotViews Editor at '08:25'

Eligible TechMarketView subscription service clients can download the latest edition of OffshoreViews with our regular summary of Indian offshore services suppliers’ performance here.

Posted by UKHotViews Editor at '16:12'

Enterprise mobility is one of the next generation business opportunities for software and services providers but the benefits will only be realised if providers can induce a step change from tactical to strategic deployments within their enterprise customers. The latest report in the ESASViews research stream, Breaking mobile market inhibitors, identifies the dynamics impacting the business applications and application services section of the mobile market, and how the role MEAPs (mobile enterprise application platforms) and the mobile cloud have in shaping the overall market and opening up supply-side opportunities.

Enterprise mobility is one of the next generation business opportunities for software and services providers but the benefits will only be realised if providers can induce a step change from tactical to strategic deployments within their enterprise customers. The latest report in the ESASViews research stream, Breaking mobile market inhibitors, identifies the dynamics impacting the business applications and application services section of the mobile market, and how the role MEAPs (mobile enterprise application platforms) and the mobile cloud have in shaping the overall market and opening up supply-side opportunities.

TechMarketView clients with an ESASViews subscription can access the report here. If you are not already a client and would like access to our research content Deborah Seth (dseth@techmarketview.com) will be more than happy to assist.

Posted by Angela Eager at '16:56'

- Tagged:

cloud

software

mobility

Eligible TechMarketView subscription service clients can download IndustryViews Corporate Activity, our new-look summary of corporate activity in the UK software and IT services market, right here.

Posted by UKHotViews Editor at '17:14'

Over the last year or so we have highlighted the dangers of top-heavy technology stacks as a result of providers continually building out their software stacks, normally via acquisitions. A recent briefing with Colleen Smith, VP of SaaS at application development and deployment provider Progress Software, provided insight into the implications of over-extended portfolios and the value of focusing on core solutions. TechMarketView subscribers can read the analysis here.

Over the last year or so we have highlighted the dangers of top-heavy technology stacks as a result of providers continually building out their software stacks, normally via acquisitions. A recent briefing with Colleen Smith, VP of SaaS at application development and deployment provider Progress Software, provided insight into the implications of over-extended portfolios and the value of focusing on core solutions. TechMarketView subscribers can read the analysis here.

Posted by Angela Eager at '09:53'

- Tagged:

cloud

software

.jpg;149;38) Having commented on the half time numbers (see Capita - matching the words with the music), we have now pored over the detail and heard from management on Capita's performance and prospects.

Having commented on the half time numbers (see Capita - matching the words with the music), we have now pored over the detail and heard from management on Capita's performance and prospects.

CE Paul Pindar talked about ‘real momentum’ having returned to the UK BPS market following 2011, which he admitted was one of the most challenging years in Capita’s history. Top line revenue steamed ahead—up 15% in the first half, thanks to the recent spate of acquisitions. And Pindar is confident that Capita will deliver 3% organic growth in the full year, accelerating from its flat performance in the first half.

But we think problems in key areas like general insurance, property consultancy, life and pensions and IT services are holding the UK BPS market leader back, and putting pressure on margins. Subscribers to TechMarketView's BusinessProcessViews service can read the analysis and implications here.

Posted by John O'Brien at '17:46'

- Tagged:

offshore

bpo

bps

The UK market is in transition as services revenue from mature areas like management and support, and application operations stagnates or declines, while demand for services around the disruptor technology areas of mobility, big data analytics and social media, which are all underpinned by cloud computing, is poised to expand. The cross over period is a nervous time for suppliers and it is happening now. Services providers should already have their transition plans well under way or risk losing market share as the disruptor technologies live up to their name. In a recent briefing with TCS VP and CTO K Ananth Krishnan, we explored how TCS was approaching the change. TechMarketView subscribers can see what we think in HotViewsExtra, TCS: taming disruptive technologies.

The UK market is in transition as services revenue from mature areas like management and support, and application operations stagnates or declines, while demand for services around the disruptor technology areas of mobility, big data analytics and social media, which are all underpinned by cloud computing, is poised to expand. The cross over period is a nervous time for suppliers and it is happening now. Services providers should already have their transition plans well under way or risk losing market share as the disruptor technologies live up to their name. In a recent briefing with TCS VP and CTO K Ananth Krishnan, we explored how TCS was approaching the change. TechMarketView subscribers can see what we think in HotViewsExtra, TCS: taming disruptive technologies.

Posted by Angela Eager at '08:25'

- Tagged:

services

Eligible TechMarketView subscription service clients can download the latest edition of IndustryViews Quoted Sector here to see our latest analysis of how the stock performance of UK software and IT services companies listed on the London Stock Exchange compares with their international peers.

Posted by UKHotViews Editor at '08:18'

With growth of 0.7% during 2011, the UK application services market just scraped into positive territory. Yet as our just-published Application Services Market Trends & Forecasts - 2012 report shows, this is as good as it will get until the end of our forecast period in 2015.

With growth of 0.7% during 2011, the UK application services market just scraped into positive territory. Yet as our just-published Application Services Market Trends & Forecasts - 2012 report shows, this is as good as it will get until the end of our forecast period in 2015.

Deflationary forces such as cloud computing, lower price contract renewals, austerity and public sector cuts are changing the shape and threatening to leach revenue out of the application services market. Long held assumptions about what constitutes software and supporting application services, and how they are priced and provisioned are being questioned as new technology and business models reshape the market. Suppliers are in for a difficult time, under pressure to anticipate and quickly act on emerging services opportunities around disruptor technologies like the cloud, big data and mobile, in order to compensate for declines in traditional areas such as application operations, and support and management.

The latest report in the ESAS research stream provides in-depth analysis of the five factors that are driving the changes – Smart interactions, Smart solutions, Lifecycle engagement, Just-in-Time skill management and Supply-side cost management. The combination of these factors and our invaluable TechMarketView market trends and forecast data for the sector, which are also included in the report, provides suppliers with valuable insight into how to manage the changes and where and when to look for opportunities.

Subscribers to ESASViews can access the Application Services Market Trends & Forecasts – 2012 report here.

Posted by Angela Eager at '11:22'

- Tagged:

applications

« Back to previous page