News

Today the National Audit Office (NAO) published its review of the role and effectiveness of the Government Digital Service (GDS). GDS budget has swollen year-on-year. In 2015-16 the budget stood at £96m; in 2016-17, the budget is peaking at £150m (though an underspend of expected because of lower than expected uptake of centrally provided services). Thus, staff numbers have also expanded rapidly; numbers jumped from 653 FTEs in 2015-16 to 911 in 2016-17. It’s no wonder that there is a desire to ensure the organisation is providing value for money.

Today the National Audit Office (NAO) published its review of the role and effectiveness of the Government Digital Service (GDS). GDS budget has swollen year-on-year. In 2015-16 the budget stood at £96m; in 2016-17, the budget is peaking at £150m (though an underspend of expected because of lower than expected uptake of centrally provided services). Thus, staff numbers have also expanded rapidly; numbers jumped from 653 FTEs in 2015-16 to 911 in 2016-17. It’s no wonder that there is a desire to ensure the organisation is providing value for money.

There is certainly a role for a central organisation like GDS, as Whitehall (and the wider public sector) seeks to reform with the support of digital technologies. However, in this latest UKHotViewsExtra article - GDS: Has it got its priorities right? - PublicSectorViews Research Director, Georgina O'Toole, argues that, GDS must get its priorities in order if it is to have any significant impact on the complex transformation agenda.

If you are not yet a subscriber to TechMarketView - and are, consequently, having problems accessing this latest opinion piece - please get in touch with Deb Seth to sign up!

Posted by Georgina O'Toole at '20:50'

- Tagged:

publicsector

centralgovernment

digital

transformation

Today we are launching The LBB100 report, following our hugely successful LBB100 event last night at the Oxo Tower in London (see Celebrating the 'LBB100').

Today we are launching The LBB100 report, following our hugely successful LBB100 event last night at the Oxo Tower in London (see Celebrating the 'LBB100').

The LBB100 report is to celebrate the fact that more than 100 innovative UK tech SMEs have now taken part in the TechMarketView Little British Battler (LBB) Programme.

We asked all of our LBBs to contribute to an anonymous questionnaire to answer a series of questions about what it takes to make it (or break it) as a UK Tech SME.

This report answers some of the burning questions about the LBBs, as they seek the next stage in their growth:

-

Which sectors are seeing the fastest growth among LBBs?

-

What age do most get acquired or sell up?

-

When do most LBBs seek external investment?

-

Which technologies are going to be most disruptive over the next 5-10 years?

There are some fascinating findings. TechMarketView subscribers can now exclusively read the report here: The LBB100.

If you're not a TechMarketView subscriber, or would like to learn more about The LBB100 report, please contact Deb Seth (dseth@techmarketview.com).

Posted by UKHotViews Editor at '10:18'

- Tagged:

lbb

Very many thanks to the more than 150 clients and friends of TechMarketView who joined us last night at the Oxo Tower to celebrate the success of our Little British Battler Programme. Since its inception five years ago, the LBB programme has seen over 100 innovative UK tech SMEs brought to the attention of the wider market – many going on to greater things!

Very many thanks to the more than 150 clients and friends of TechMarketView who joined us last night at the Oxo Tower to celebrate the success of our Little British Battler Programme. Since its inception five years ago, the LBB programme has seen over 100 innovative UK tech SMEs brought to the attention of the wider market – many going on to greater things!

We were delighted to have with us the Minister for State for Digital and Culture, the Right Honourable Matt Hancock MP. The UK Government has been a keen supporter of our LBB programme pretty much since its launch.

And very special thanks to our sponsor, Oracle NetSuite, without whom the evening would not have been possible, and to Tina and Tina at TX2 Events who, as ever, organised the event to perfection.

We also took the opportunity last night to pre-announce our new SME programme, Great British Scaleups. You will see much more on this when we launch it formally in Monday’s UKHotViews.

We had terrific feedback from our guests, and there was a great sense of excitement about the prospects for the UK tech sector in general – and SMEs in particular. Long may that last!

Picture shows (L to R): Tola Sargeant (TechMarketView Director); David Turner (Senior Director, EMEA Marketing, Oracle – NetSuite); Matt Hancock MP (Minister for State for Digital and Culture); Anthony Miller) (TechMarketView Managing Partner); Richard Holway (TechMarketView Chairman).

Posted by UKHotViews Editor at '08:27'

- Tagged:

lbb

The financial services industry is spending billions of pounds (and euros) on preparations for impending regulatory changes which potentially pave the way for the most radical reshaping of consumer financial services in history.

The financial services industry is spending billions of pounds (and euros) on preparations for impending regulatory changes which potentially pave the way for the most radical reshaping of consumer financial services in history.

The digital revolution means that the historical stranglehold of the banks on financial services provision is both unnecessary and undesirable, and an ‘Uber of banking’ type transformation is a realistic scenario. This doesn’t necessarily mean doom and gloom for the established banks however; there is a bright future for those that can shift from the historic “prison” paradigm (“people can’t go anywhere else”) to become more of a “hotel” (“people choose to come here because we give a great service”).

In this latest report from our Financial Services research stream, Richard Johnson presents his analysis of the current state of PSD2 and the UK’s Open Banking initiatives. Subscribers to FinancialServicesViews can access the report here.

If you or your company do not yet subscribe to this service, please contact Deb Seth of our Client Services team (dseth@techmarketview.com).

Posted by Peter Roe at '10:11'

- Tagged:

financialservices

payments

banking

regulation

We're really looking forward to seeing so many of you for drinks at the OXO Tower a week on Wednesday. As avid HotViews readers will know by now, TechMarketView is celebrating the fact that more than 100 innovative UK tech SMEs have now taken part in our ‘Little British Battler’ (or LBB) Programme with a drinks reception at OXO2 in London on 29 March in association with Oracle NetSuite.

The attendee list already includes more than 150 leaders from the UK tech sector, with our LBBs, our clients and other friends of TechMarketView well represented. It promises to be a fantastic evening of informal networking over drinks and canapes.

It’s an invitation only event and spaces are limited, however we've made available just 25 tickets for sale on a first come, first served basis for £250+VAT each. There are just a few of these tickets left so if you'd like to claim one please click here without delay to book via tx2events, who are managing the event for us.

The details of the event are as follows:

When: Wednesday 29 March, 6.30pm-9pm (approx.)

Where: OXO2, Level Two, Oxo Tower Wharf, Bargehouse Street, South Bank, London, SE19PH

Dress: Business attire

Attendees will also receive a free copy of our LBB100 Report which is being launched on the evening.

Posted by UKHotViews Editor at '10:03'

- Tagged:

events

lbb

The journey to digital business is dominated by core systems and services, from transactional to emerging ‘intelligent’ software and related services, but it is the often-overlooked components that fill the gaps in between that can smooth digital change. If they make the working lives of individuals easier on a day-to-day basis too, resistance to change lowers, increasing the odds of success. Having met with DocuSign recently, we have been exploring e-signatures, a prime example of a ‘fill the gap’ application.

The journey to digital business is dominated by core systems and services, from transactional to emerging ‘intelligent’ software and related services, but it is the often-overlooked components that fill the gaps in between that can smooth digital change. If they make the working lives of individuals easier on a day-to-day basis too, resistance to change lowers, increasing the odds of success. Having met with DocuSign recently, we have been exploring e-signatures, a prime example of a ‘fill the gap’ application.

The progress 13-year old DocuSign has made is proof of the demand for e-signatures in their own right and in the broader context of digital transaction management for tasks such as approvals, contacts and workflows. According to media reports, the company is valued at over $3bn and has secured more than $525m in funding. With more than 250,000 customers and 100m users it has demonstrated the case for volume demand, while customers that include 10 of the top 15 US financial services companies, 12 of the top 15 US insurance carriers attest to its enterprise credentials. It has a growing presence in the UK and is attracting big brand logos as customers, and technology leaders like SAP and Salesforce as partners.

Having ended a 15 month search for a new CEO in January 2017 - Dan Springer, the former CEO of Responsys (one of Oracle's acquisitions) has taken the seat - and had a glimpse into future product directions, we feel there is more to come from DocuSign and the e-signature market as a whole that SITS suppliers need to be aware of.

TechMarketView subscribers can get feel for the e-signature market and further insight into the DocuSign approach in HotViewsExtra “Extracting the value from e-signatures, which can be accessed here.

Posted by Angela Eager at '17:02'

- Tagged:

software

data

TechMarketView is celebrating the fact that more than 100 innovative UK tech SMEs have now taken part in our ‘Little British Battler’ (or LBB) Programme with a drinks reception at OXO2 in London on 29 March in association with Oracle NetSuite.

TechMarketView is celebrating the fact that more than 100 innovative UK tech SMEs have now taken part in our ‘Little British Battler’ (or LBB) Programme with a drinks reception at OXO2 in London on 29 March in association with Oracle NetSuite.

The attendee list already includes some 150 leaders from the UK tech sector, with our LBBs, our clients and other friends of TechMarketView well represented. It promises to be a fantastic evening of informal networking over drinks and canapes.

It’s an invitation only event and spaces are limited, however we've made available just 25 tickets for sale on a first come, first served basis for £250+VAT each. There are just a few of these tickets left so if you'd like to claim one please click here without delay to book via tx2events, who are managing the event for us.

The details of the event are as follows:

When: Wednesday 29 March, 6.30pm-9pm (approx.)

Where: OXO2, Level Two, Oxo Tower Wharf, Bargehouse Street, South Bank, London, SE19PH

Dress: Business attire

Attendees will also receive a free copy of our LBB100 Report which is being launched on the evening.

Posted by UKHotViews Editor at '11:21'

- Tagged:

events

sme

lbb

Philip Hammond’s Spring Budget contained few surprises. It was a cautious, but forward looking Budget, that put science, technology and industry collaboration at the forefront of the Government’s plans to improve productivity.

Philip Hammond’s Spring Budget contained few surprises. It was a cautious, but forward looking Budget, that put science, technology and industry collaboration at the forefront of the Government’s plans to improve productivity.

Further details were provided on how the National Productivity Investment Fund (NPIF), which was announced at Autumn Statement 2016 (see Autumn statement 2016: ICT for productivity), will be spent. The NPIF will invest £740m in digital infrastructure by 2020-21, including £200m to establish a programme of local projects to help accelerate delivery of full-fibre broadband networks and up to £16m to trial 5G applications. NPIF will also be used to invest £90m to help fund 1,000 PhD placements in areas aligned with the Industrial Strategy and a further £160m will be allocated to help researchers working in these areas.

We already knew about the Industrial Strategy Challenge Fund (ISCF) (see Government technology strategy: first the good news…), but we now have a bit more detail. The first wave of challenges funded by the ISCF will include: 1) batteries for the next generation of electric vehicles; 2) AI and robotics systems for extreme environments; and 3) developing new medicine manufacturing technologies. Greater collaboration between universities and industry is key to much of what NPIF and ISCF are designed to achieve, and we expect to see collaboration increasingly being encouraged through tendering requirements in the future.

In the education sector, the Budget announced further funding for free schools and a continued push towards selective schools. It also took forward the recommendations of Lord Sainsbury’s review of 16-19 education by introducing new T-Levels qualifications. These technical courses will be designed to help ensure that students qualify “work-ready”. Technical training has been neglected for too long, but it is critical component, alongside the apprenticeship agenda, in ensuring that business can access the right skills for the future.

As widely expected, the Chancellor also announced funding to support social care and the NHS in England over the next few years. The government will be providing an additional £2bn to councils in England over the next three years to spend on adult social care services. £1bn of this will be provided in 2017-18 enabling councils to take immediate action to support social care provision and in turn relieve pressure on the NHS. This additional funding will of course be welcomed by councils, but with the social care system under such pressure it’s unlikely much of it will filter through to SITS suppliers.

Self-employed workers were hit the hardest by the Chancellor’s announcements. Hammond said that Class 4 National Insurance contributions for self-employed workers will increase from 9% to 10% in 2018 and to 11% in 2019. The Chancellor also had the self-employed firmly in his sights when he announced that the dividend allowance will be reduced from £5,000 to £2,000 from April next year. The Government says it is acting to reduce the unfairness in the National Insurance contribution system, but it needs to be careful that it doesn’t discourage entrepreneurship in the process.

It’s good to see science and technology investment and industry collaboration at the forefront of the Budget. It was a Budget designed to prepare the country for a post-Brexit future. We get another Budget later this year, as we move to a single fiscal event to take place in the autumn. It remains to be seen how different things look once Article 50 has been triggered.

Subscription service clients can read our full report on Spring Budget 2017 here. If you’re not a subscriber please contact Deb Seth in the Client Services team for more information.

Posted by Dale Peters at '09:23'

- Tagged:

budget

spring

2017

In any two horse race, backing the second favourite is always a good bet and UK wholesale fibre specialist CityFibre is now poised to become a credible competitor to BT Openreach.

In any two horse race, backing the second favourite is always a good bet and UK wholesale fibre specialist CityFibre is now poised to become a credible competitor to BT Openreach.

The company grew its revenue 134% last year after buying network assets from KCOM and Redcentric, and continues to capitalise on the political and financial stimulus behind improving the UK’s digital infrastructure coupled with pent-up demand for high speed fibre broadband from businesses and consumers.

Subscribers to SecureConnectViews can download our assessment of CityFibre’s activity, plans and business strategy here. If you’re not a subscriber please contact Deb Seth in the Client Services team for more information.

Posted by Martin Courtney at '09:04'

- Tagged:

infrastructure

broadband

CityFibre

fibre

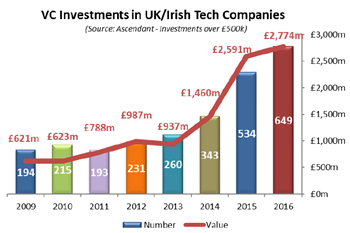

Despite all the fears about Brexit, venture capital funding of UK and Irish tech companies increased in 2016 according to the latest data from corporate finance firm, Ascendant. During Q4, £516m was invested in 191 deals of more than £0.5m. This brought the total for 2016 to £2,774m invested in 649 deals by 538 investors, an increase of 7% in value and 22% in volume over the previous year. There were considerably fewer deals involving US based investors in Q4 reflecting a general drop in VC investment in the US since Q2 2015. However, Ascendant recorded the largest number of monthly UK/Irish tech deals for 20 years in October, with 77 companies receiving finance.

Despite all the fears about Brexit, venture capital funding of UK and Irish tech companies increased in 2016 according to the latest data from corporate finance firm, Ascendant. During Q4, £516m was invested in 191 deals of more than £0.5m. This brought the total for 2016 to £2,774m invested in 649 deals by 538 investors, an increase of 7% in value and 22% in volume over the previous year. There were considerably fewer deals involving US based investors in Q4 reflecting a general drop in VC investment in the US since Q2 2015. However, Ascendant recorded the largest number of monthly UK/Irish tech deals for 20 years in October, with 77 companies receiving finance.

Subscribers to TechMarketView's Foundation Service can read our analysis, along with commentary on selected UK tech VC deals, in our latest IndustryViews report, IndustryViews Venture Capital Q4 2016, which is available for download here.

Posted by UKHotViews Editor at '07:29'

- Tagged:

funding

We’ve been delighted by the large number of comments we’ve received from UK Tech sector suppliers to the publication of the Government’s Digital Strategy (see UK Government’s Digital Strategy Launched). It’s great to see such enthusiasm for what is surely one of the most important opportunities for future Tech sector investment.

We’ve been delighted by the large number of comments we’ve received from UK Tech sector suppliers to the publication of the Government’s Digital Strategy (see UK Government’s Digital Strategy Launched). It’s great to see such enthusiasm for what is surely one of the most important opportunities for future Tech sector investment.

Against the backdrop of Brexit, the implications are now even more important, because UK Tech needs to look more to itself to develop the talent, up-skill the existing workforce and develop the specialist digital skills for the future.

Delivering the Digital Strategy is going to require a lot of hard work, commitment and buy-in from Government, the Tech industry and academia.

In this HotViewsExtra comment we examine the detail and implications for TechMarketView subscribers, here.

Posted by John O'Brien at '07:14'

- Tagged:

bps

digital

robotics

AI

« Back to previous page