News

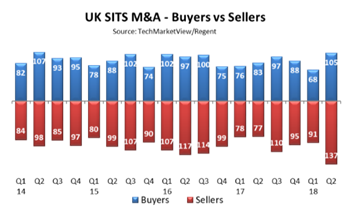

After a relatively quiet first quarter, merger and acquisition activity in the UK software and IT services (SITS) sector bounced back strongly in Q2.

After a relatively quiet first quarter, merger and acquisition activity in the UK software and IT services (SITS) sector bounced back strongly in Q2.

There were 105 UK buyers and 137 UK sellers including 72 domestic deals in Q2, according to data from corporate finance firm, Regent Partners. Demand for IT services companies accounted for 62% of all UK SITS deals, up from 48% in Q1 and resuming the more usual split between the two sectors, with consultancies and SIs representing the largest sector at 32%, and vertical solutions providers with a 14% share. Sector expertise was also in demand in the software sector with vertical software providers accounting for 17% of the deals. Enterprise software accounted for 11% of the UK SITS deals.

Subscribers to the TechMarketView Foundation Service can see the detail and the numbers in our latest quarterly review, IndustryViews Corporate Activity Q2 2018.

Posted by Anthony Miller at '14:43'

- Tagged:

acquisition

The latest edition of the Enterprise Software Supplier Ranking report from the ESASViews research stream is now available.

The latest edition of the Enterprise Software Supplier Ranking report from the ESASViews research stream is now available.

The report confirms the top three suppliers maintained their leading positions and once again Microsoft topped the ranking, despite undergoing a major cloud and AI/Machine Learning transition, but there is a narrow gap to the second placed supplier.

This report assesses the performance of each of the suppliers in the Enterprise Software Top 20 and includes a ranking table showing revenue growth, relative movement over the last 12 months, plus insight into software market accelerators and suppressants and up and coming suppliers. With two new entrants - and a growing number of suppliers clustered just outside the Top 20 - digital disruption is impacting the market.

The report is available for download by TechSectorViews client here: UK Enterprise Software Ranking 2018.

For further information on becoming a client, please contact our Client Services team: dseth@techmarketview.com.

Posted by Angela Eager at '07:03'

- Tagged:

markettrends

cloud

software

rankings

digital

AI

machinelearning

Lower than anticipated market demand last year led to a starker than usual contrast in performance between the winners and losers in the Application Services (AS) world. Within the 2017 list of Top 20 UK AS suppliers, as many companies saw their revenues increase by 9% or more as witnessed their sales decline. The necessity to take market share to achieve top line growth has become the new normal in this increasingly competitive arena.

winners and losers in the Application Services (AS) world. Within the 2017 list of Top 20 UK AS suppliers, as many companies saw their revenues increase by 9% or more as witnessed their sales decline. The necessity to take market share to achieve top line growth has become the new normal in this increasingly competitive arena.

Continuing erosion of legacy services expenditure in 2017 was barely offset by increasing customer investment in “the new”. Moving buyer behaviour on to digital execution at scale remains a key challenge for the supply side. As the boundaries are increasingly broken both between adjacent service towers and into non-traditional, digitally-redefined sectors moreover, so AS suppliers must not only extend the breadth of their capabilities, but also widen the focus of their services to remain market relevant.

Subscribers to TechMarketView's ESASViews can read the full analysis of who's gaining ground and who's falling back, and why, in our new report Application Services Supplier Ranking 2018. If you are not yet an ESASViews subscriber, please contact Deb Seth (dseth@techmarketview.com) to find out how you can access the research.

Posted by Duncan Aitchison at '06:52'

- Tagged:

applications

suppliers

report

Amazon Web Services is clearly making its presence felt in the UK market. However, the speed with which this now sizeable organisation continues to grow might still surprise some.

Amazon Web Services is clearly making its presence felt in the UK market. However, the speed with which this now sizeable organisation continues to grow might still surprise some.

Out today for InfrastructureViews clients is the latest Infrastructure Services Supplier Ranking. This must-read report looks at the performance of AWS and the other leading players in the Top 20 Ranking. It follows several months of research by the TechMarketView analyst team to understand supplier performance in the UK.

It is a complex set of market shaping trends that is molding the evolution of the c£14bn Infrastructure Services market, and both buyers and suppliers face many uncertainties. “Transformation” is more than a buzzword, but both the journey and the destination are not well defined. Very few organisations are starting with a ‘clean slate’ and successfully dealing with legacy systems will be an integral part of creating the right strategy going forward.

OUT NOW, Infrastructure Services Supplier Ranking 2018 gives details of how each of the Top 20 players performed in the last financial year, examining the trends around their performance.

Posted by UKHotViews Editor at '18:32'

- Tagged:

cloud

PaaS

infrastructure

AWS

There has been a lot of change at CGI in the UK. A new UK CEO – Tara McGeehan – in place since January this year (see CGI moves quickly: instates new UK President). And, also, some new faces on the UK leadership team.

There has been a lot of change at CGI in the UK. A new UK CEO – Tara McGeehan – in place since January this year (see CGI moves quickly: instates new UK President). And, also, some new faces on the UK leadership team.

We recently met with Michael Herron, who has been the VP leading the UK’s Central Government Business Unit since the beginning of the year. Prior to Herron taking on his new role, the public-sector business – and the central government business in particular - had been lacking in any real direction.

Herron is bringing some clarity back, while aligning CGI’s proposition with the demands of the market. Recent wins and growth in existing clients has returned the central government business to quarter-on-quarter growth. His strategy is not to compete with in-house teams or the Digital Specialist, but to play to CGI’s strengths in four key areas: application management services, application development, next generation infrastructure, and robotic process automation & AI. Herron is also aware that this market approach needs to be backed up with other supporting corporate initiatives.

Herron is bringing some clarity back, while aligning CGI’s proposition with the demands of the market. Recent wins and growth in existing clients has returned the central government business to quarter-on-quarter growth. His strategy is not to compete with in-house teams or the Digital Specialist, but to play to CGI’s strengths in four key areas: application management services, application development, next generation infrastructure, and robotic process automation & AI. Herron is also aware that this market approach needs to be backed up with other supporting corporate initiatives.

CGI has many strengths. Some solid long-term relationships, experience in complex systems engineering of mission critical systems, and backed up with compelling reference sites in space, defence and security. The difficulty will be that at the ‘headline’ level, the range of offerings doesn’t make CGI stand out from the crowd. Like most of the traditional IT services players, the differentiator comes in the detail. In this latest PublicSectorViews research note, subscribers can learn how CGI is making its offering compelling to clients and prospects in order to broaden its Whitehall footprint.

PublicSectorViews subscribers can download the research note - CGI UK: Setting the Whitehall strategy - now. If you are not yet a subscriber, please contact Deb Seth to find out more.

Posted by Georgina O'Toole at '11:35'

- Tagged:

publicsector

centralgovernment

strategy

SI

There has been a lot of movement among the Top 20 providers of Business Process Services (BPS) in the past year, reflecting the disruption taking place within a market continuing its move away from traditional BPO towards technology-enabled services.

The shift in delivery models away from ‘lift and shift’ BPO towards tech-enabled BPS is accelerating with platform-based BPS winning an increasing share of the business and with vendors putting ever greater emphasis on partnering, acquiring, building and ‘uncovering’ IP. The blurring of the boundaries between BPS and enterprise software and application services is continuing whilst the deployment of maturing Intelligent Automation solutions is delivering even greater market disruption.

Subscribers to TechMarketView's BusinessProcessViews research services can read the full analysis of who's hot and who's not, and why, in our new report UK BPS Supplier Ranking 2018.

If you are not yet a BusinessProcessViewssubscriber, please contact Deb Seth (dseth@techmarketview.com) to find out how you can access the research.

Posted by Marc Hardwick at '07:39'

- Tagged:

rankings

suppliers

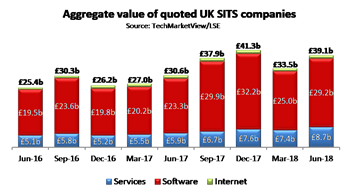

After a poor start to the year, most of the UK tech indices we track (see here) recovered some of the losses during Q2. The FTSE SCS index, a proxy for UK listed software and IT services (SITS) companies and the worst performer in Q1 with a fall of 30%, gained 15% in Q2 but is still 20% down year to date despite strong recoveries from Sophos (up 49% qoq), Aveva (up 41% qoq) and Micro Focus (up 34% qoq).

After a poor start to the year, most of the UK tech indices we track (see here) recovered some of the losses during Q2. The FTSE SCS index, a proxy for UK listed software and IT services (SITS) companies and the worst performer in Q1 with a fall of 30%, gained 15% in Q2 but is still 20% down year to date despite strong recoveries from Sophos (up 49% qoq), Aveva (up 41% qoq) and Micro Focus (up 34% qoq).

Subscribers to the TechMarketView Foundation Service can see the detail and the numbers in our latest quarterly review, IndustryViews Quoted Sector Q2 2018.

Posted by UKHotViews Editor at '15:00'

It's TechMarketView's tenth anniversary year and to celebrate we are announcing a formidable line-up of speakers to enlighten, inspire and surprise you at our annual Evening with TechMarketView. Sponsored by InterSystems, Aqilla and Brands2Life.

It's TechMarketView's tenth anniversary year and to celebrate we are announcing a formidable line-up of speakers to enlighten, inspire and surprise you at our annual Evening with TechMarketView. Sponsored by InterSystems, Aqilla and Brands2Life.

Hosted by TechMarketView Chairman Richard Holway MBE, the evening focuses on TechMarketView's theme for 2018, Breaking the Boundaries, and you will be hearing from:

· Tola Sargeant, TechMarketView Managing Director, who will bring the theme alive and challenge the way you look at the UK tech market by illustrating how buyers and sellers of enterprise technology are breaking their own boundaries to try to keep one step ahead of the pack

· Chief Analyst Georgina O’Toole showcasing brand new TechMarketView analysis that examines the contrasting performances of the ‘legacy’ & the ‘new’ segments of the UK SITS market and ask the question: ‘what needs to happen to return to the halcyon days of double-digit growth?’

· TechMarketView’s Martin Courtney hosting a ‘fireside chat’ with our special guest Andrew Johnson from Shell. One of the world’s largest retailers with a significant UK presence, Shell is three years into its digital transformation journey and Andrew will share his experiences, which touch everything from digital payments to autonomous vehicles

· Kate Hanaghan, Chief Research Officer, who will unveil TechMarketView’s Market Readiness Index to share findings from our new end-user analysis and explore how buyers and suppliers can work better together to Break the Boundaries

· Anthony Miller, TechMarketView Managing Partner, who will be putting his own inimitable slant on the changing fortunes of the leading UK tech suppliers over the past decade and what the future may hold for them over the next.

The event will be held on Thursday 13th September 2018 at the magnificent premises of the Royal Institute of British Architects in London with registration and a networking drinks reception, sponsored by InterSystems, commencing at 6:30 pm. This will be followed by the speaker sessions and a first-class silver service dinner.

The TechMarketView Evening is the only event where over 200 leaders from tech industry giants, mid-market specialist suppliers, aspiring 'Great British Scaleups' and innovative early stage companies, as well as advisors, investors and end-user organisations, get the chance to meet and form new friendships and partnerships – and learn what TechMarketView believes the future may hold!

You can book individual seats for the event, or why not recognise your key clients and partners by booking a table for ten.

For more details and to book your place click here or contact our event management partner, tx2 Events on 020 3137 2541.

Don’t forget that if you are a TechMarketView subscription client, a UKHotViews Premium client, or from one of our Little British Battler, Great British Scaleup or Early Stage Partner programme companies, you qualify for the discounted ticket price.

Posted by UKHotViews Editor at '16:55'

- Tagged:

events

Today, the TechMarketView PublicSectorViews team publishes its annual UK Public Sector SITS: Market Forecast Preview.

Today, the TechMarketView PublicSectorViews team publishes its annual UK Public Sector SITS: Market Forecast Preview.

It does exactly what it says on the tin, giving PublicSectorViews subscribers an early view of our detailed forecasts for the UK public sector SITS market through to 2021, including by vertical subsector (central government, local government, education, health, police and defence). Subscribers can find out the extent of the decline in public sector SITS in 2017, find out which sectors suffered the most, and investigate where we expect a recovery over our forecast period.

We will be publishing a thorough analysis of the drivers and trends in each of those subsectors in a subsequent report. PublicSectorViews’ subscribers can download the preview report – UK Public Sector SITS: Market Forecast Preview 2016-2020 - now.

If you are not yet a subscriber and would like to find out more, please contact Deb Seth, who would be more than pleased to help.

Posted by Georgina O'Toole at '06:32'

- Tagged:

publicsector

markettrends

At its Technology Days event in Paris this week, Atos placed artificial intelligence at the centre of its digital transformation agenda. Announcing the launch of the Codex AI software suite, Chairman and CEO Thierry Breton presented an organisation now as equally committed to the development and marketing of core technologies as it is to the provision of the IT services which will embrace them.

At its Technology Days event in Paris this week, Atos placed artificial intelligence at the centre of its digital transformation agenda. Announcing the launch of the Codex AI software suite, Chairman and CEO Thierry Breton presented an organisation now as equally committed to the development and marketing of core technologies as it is to the provision of the IT services which will embrace them.

The new tool set, which Atos claims to be the most comprehensive artificial intelligence software suite available on the market, is aimed primarily at helping the data scientist community to accelerate commercial AI adoption. Codex AI comprises four main components; Studio, a UI for cognitive applications development self-service, Forge, an evolving set of ready-made components, blue prints, data sets, algorithms and frameworks, a Deep Learning Engine, and an Orchestrator to enable fast deployment across multiple environments.

While confident about the market potential for AI-centric solutions, Atos is also aware of the nearer term constraints that have so far stifled its widespread implementation (see our UK AI/Machine Learning report for more details on this). The company believes, however, that it is strongly positioned to help lower the current barriers progress.

Several AI based projects were showcased at the event to demonstrate the breadth of potential application for deep learning technologies. These included the recent end-to end IoT services contract award by the Coca-Cola Hellenic Bottling Company. This will see the Atos Codex Connected Cooler solution rolled-out across the customer’s estate of 1.6 million coolers in 28 countries. The first 300,000 units will be connected by the end of this year. The programme aims to delivery actionable insights into consumer behaviour and retail performance while helping to both improve operational efficiency and increase sales.

Perhaps the most eye-catching presentations, however, related to Atos’ endeavours in High Performance Computing, Enterprise Computing and Edge Computing.

Subscribers to TechMarketView subscription research services, and our new UKHotViews Premium service can read more…

Posted by Duncan Aitchison at '09:12'

- Tagged:

AI

supercomputing

The latest edition of TechMarketView’s UK SITS Supplier Rankings report is now available. These rankings have been compiled through a detailed analysis of the UK SITS revenues of over 200 publicly quoted and privately held companies. We can now reveal, despite its annus horribilis, Capita holds on to the top spot in the rankings for the fifth year in a row.

The latest edition of TechMarketView’s UK SITS Supplier Rankings report is now available. These rankings have been compiled through a detailed analysis of the UK SITS revenues of over 200 publicly quoted and privately held companies. We can now reveal, despite its annus horribilis, Capita holds on to the top spot in the rankings for the fifth year in a row.

The report reviews the performance and prospects of each of the suppliers in the Top 30. It also provides ranking tables for the Top 60 UK SITS suppliers, the reasons why aggregate revenue for these leading suppliers grew more slowly in 2017 compared to the previous year, and the names of the three new entrants into the Top 60 this year.

The report is available for download by Foundation Service clients only, here: UK SITS Supplier Rankings 2018.

For further information on becoming a client, please contact our Client Services team: dseth@techmarketview.com.

Posted by UKHotViews Editor at '09:52'

Preparations are now well underway for the annual TechMarketView Presentation & Dinner on 13 September 2018, to which we look forward to welcoming some 250 of UK tech’s ‘great and good’ for an evening of analyst insight and quality networking.

If you haven’t booked your place yet don’t delay, the event has been a sell-out for the last five years and tickets are already selling like those proverbial hot cakes! Click here to book.

The evening, which will once again be held at RIBA in London, will begin with an extended drinks reception sponsored by InterSystems, giving you plenty of time to mingle with your peers and make new connections over a glass or two of your preferred tipple.

The evening, which will once again be held at RIBA in London, will begin with an extended drinks reception sponsored by InterSystems, giving you plenty of time to mingle with your peers and make new connections over a glass or two of your preferred tipple.

We then retire to the auditorium, where TechMarketView experts and guest speakers will spend 90 minutes sharing their insight on the trends and suppliers that are shaping the UK tech market. In keeping with our 2018 research theme, we’ll be focusing on what both suppliers and buyers need to do to ‘Break the Boundaries’ and position themselves for success both now and well into the future.

During the course of the evening, the audience will hear from TechMarketView’s Chairman Richard Holway MBE, Managing Director Tola Sargeant, Chief Analyst Georgina O’Toole and Chief Research Officer Kate Hanaghan as well as guest speakers from our industry community. By popular demand, our Managing Partner Anthony Miller will once again close the show in style.

We then all sit down to enjoy a fabulous three-course dinner and more enjoyable conversation with leaders from across the UK IT market.

Who should attend:

-

Execs from UK software, IT services and business process services companies

-

CXOs from UK tech start-ups and scale-ups (those that have been through our Little British Battler, Great British Scaleup and Early Stage Partner Programmes qualify for a discount on ticket price)

-

CTO/CIOs from end-user organisations, public or private sector

-

VCs, private equity and other advisors with an interest in the UK tech sector.

For more details and to book your place click here or contact Tina Compton at our event management partners tx2 Events.

Proudly supported by:

Posted by UKHotViews Editor at '15:10'

TechMarketView’s Foundation Service clients can now access our annual review of the UK Software and IT Services market: UK SITS Market Trends & Forecasts 2018.

TechMarketView’s Foundation Service clients can now access our annual review of the UK Software and IT Services market: UK SITS Market Trends & Forecasts 2018.

Suppliers are faced with a fast-moving market, defined by rapidly-evolving client requirements and an acceleration in technological advancements. However, we see increasing evidence that many are struggling to make the changes necessary to compete in the ‘digital world’.

In this latest report, you will read market analysis from each of TechMarketView’s Research Directors across all research areas.

TechMarketView had predicted a worsening of UK SITS market performance in 2017; however, it was even more pronounced than we had expected with legacy revenue streams under immense pressure. The market is changing shape and this year was the first year that ALL growth was driven by cloud computing.

To make sure you are prepared to respond to the new world, download UK SITS Market Trends & Forecasts 2018 now.

If you are not yet a subscriber, please contact dseth@techmarketview.com for more information.

Posted by UKHotViews Editor at '08:09'

As the NHS celebrates its 70th birthday, it - or at least its PR machine - has been looking to the future and making plans to ‘unleash the power of technology to transform everyday life for patients’. Health and Social Care Secretary Jeremy Hunt today announced both a new NHS app for England and a £215m package of funding for medical research that it’s hoped will transform the lives of millions of people who are living with a range of conditions, including life-long illnesses, mental health issues and obesity.

As the NHS celebrates its 70th birthday, it - or at least its PR machine - has been looking to the future and making plans to ‘unleash the power of technology to transform everyday life for patients’. Health and Social Care Secretary Jeremy Hunt today announced both a new NHS app for England and a £215m package of funding for medical research that it’s hoped will transform the lives of millions of people who are living with a range of conditions, including life-long illnesses, mental health issues and obesity.

In today’s UKHotViewsExtra article, NHS to get app & £215m research fund for its birthday, Tola Sargeant analyses both developments and asks whether we need another NHS app?

In today’s UKHotViewsExtra article, NHS to get app & £215m research fund for its birthday, Tola Sargeant analyses both developments and asks whether we need another NHS app?

UKHotViews Premium and TechMarketView corporate subscription clients can read the article here. If you don’t yet subscribe to either, you’ll find more detail and the sign-up form for UKHotViews Premium here, or contact Deborah Seth for details of our corporate subscription packages.

Posted by Tola Sargeant at '18:10'

- Tagged:

nhs

strategy

funding

health

mobility

Investment is gushing towards the new generation of software startups that put Artificial Intelligence/Machine Learning techniques at the centre of their products.

Investment is gushing towards the new generation of software startups that put Artificial Intelligence/Machine Learning techniques at the centre of their products.

Our ‘Funding Trends & Patterns: UK AI/ML Startups’ research note is essential reading for enterprises and suppliers looking to understand how the market is developing and where the money trail is leading.

Heightened expectations exist around AI/ML despite cautious adoption because it’s clear the ability to apply the techniques to data sources can open doors to new revenue and operational models. And as more processes and operations turn digital, relevant data sources are rapidly expanding. Failure to reveal the value hidden in data is as good as disabling a growth lever.

This research explores:

· the UK AI/ML startup funding landscape,

· identifies the sectors attracting the highest levels of funding,

· the types of startups gaining funding and why,

to provide a snapshop of funding activity across a selected group of startups.

You should be reading this research note If you are an established software or services supplier looking to startups for innovation enablement and solution delivery via partnerships or acquisitions. C-level executives looking to understanding what is available and how and to what effect the technology could be used within the business will also find this a valuable resource.

The research is available to eligible TechMarketView subscribers. If you do not currently take a subscription and would like details please contact Deborah Seth.

Posted by Angela Eager at '10:00'

- Tagged:

funding

startup

software

AI

machinelearning

TechMarketView subscription research service clients and UKHotViews Premium clients can read our latest summary of UK share index movements – along with the 'winners' and 'losers' in UKHotViews Extra here.

Posted by UKHotViews Editor at '09:45'

Advanced has acquired healthcare electronic document management specialist Docman for an undisclosed fee. The deal will see Docman’s CEO Ric Thompson take on the role of MD for Health & Care at Advanced when Nick Wilson, who currently holds the position, takes over as CEO at Allocate Software next month (see Allocate appoints Advanced’s Nick Wilson as new CEO).

Advanced has acquired healthcare electronic document management specialist Docman for an undisclosed fee. The deal will see Docman’s CEO Ric Thompson take on the role of MD for Health & Care at Advanced when Nick Wilson, who currently holds the position, takes over as CEO at Allocate Software next month (see Allocate appoints Advanced’s Nick Wilson as new CEO).

The deal is a good fit with Advanced’s strategy under the leadership of CEO Gordon Wilson i.e. acquiring close to its core markets and focusing on cloud-based applications. Advanced has a solid position in urgent and community healthcare settings, but Docman gives Advanced significant reach into primary and acute settings.

More than 5,400 GP practices, 115 NHS Trusts and 178 Clinical Commissioning Groups (CCGs) currently use Docman’s document management and workflow solutions.

This product set is complementary to Advanced’s existing health and care offerings, which include financial management, electronic patient records, e-prescribing and medicines administration, clinical patient management and its clinical decision support solution (CDSS), which also powers the Ask NHS app. We believe there will be significant cross sell opportunities for Advanced’s new look Health & Care business.

This is the fourth acquisition that the UK-based software and services provider has completed in the last twelve months. It follows Science Warehouse and Information Balance in March 2018 and Hudman Solutions in July 2017. We expect to see further M&A activity this year.

Overall, this looks like a sound acquisition by Advanced, The UK healthcare sector is under tremendous pressure as the population ages and demands on the service increase. Technology is a key component in relieving these pressures and remains central to government policy for the sector. This will create opportunities for the business, particularly for products and services that demonstrably improve efficiencies.

Overall, this looks like a sound acquisition by Advanced, The UK healthcare sector is under tremendous pressure as the population ages and demands on the service increase. Technology is a key component in relieving these pressures and remains central to government policy for the sector. This will create opportunities for the business, particularly for products and services that demonstrably improve efficiencies.

Subscribers to TechMarketView’s research services, and our new UKHotViewsPremium service, can read further analysis of this acquisition and what it means for Advanced here.

Posted by Dale Peters at '09:39'

- Tagged:

acquisition

health

« Back to previous page