Wednesday 13 January 2010

TechMarketView’s main concern is all things that affect IT companies trading in the UK market. But we have a partnership with Pierre Audoin Consultants (PAC), who are acknowledged leaders on the European IT scene, which enables us to have a wider EuropeanView.

TechMarketView’s main concern is all things that affect IT companies trading in the UK market. But we have a partnership with Pierre Audoin Consultants (PAC), who are acknowledged leaders on the European IT scene, which enables us to have a wider EuropeanView.

Of course, the German and UK Top Ten suppliers of SITS are composed of pretty similar companies with IBM, SAP, HP (incl EDS), Microsoft, Accenture, Oracle and Fujitsu Siemens/Fujitsu Services all being common to both. However, T-Systems (#2 in German SITS ranks) and Siemens IT Solutions and Services (#6) are German ‘local heroes’.

Our friend, Christophe Chalons, Chief Analyst at PAC, has recently published a review of the German market. The German SITS market is valued at €48b – only slightly below the UK at €50b; #1 in Europe. France is now somewhat further behind at €35b.

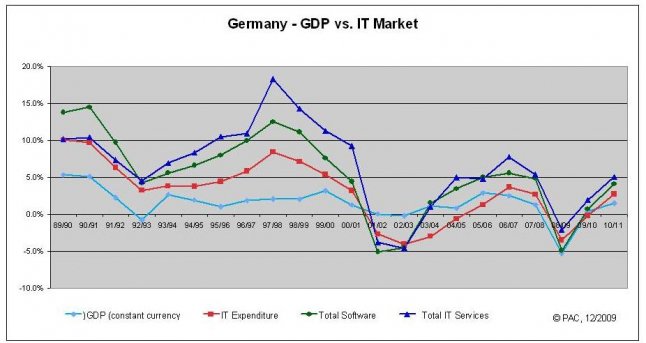

Like the UK, IT-related expenditure in Germany has been hard hit – down 3.6% in 2009. Software was down an even greater 4.9% and even IT services shrank 2.1%. Only marginally better times are forecast for 2010 with a further 0.2% contraction in IT spend – although Software will rise 0.7% and IT services by 1.9%. As all these figures include inflation, real growth is still elusive.

The Manufacturing sector is far more important in Germany than in the UK (Well, they still have one…) The downturn impacted the manufacturing industry severely, in particular automotive, mechanical engineering, chemicals and metal, while pharmaceuticals, food and aerospace & defence have been more resilient. The sector has been hit particularly badly from project cancellations and postponements. Price competition has been intense and PAC also report hardship from “the bankruptcy of outsourcing customers”.

Châlons told us: "Companies are focusing on cutting IT costs, although, outside of the manufacturing industry, they also consider IT as a tool for improving process efficiency and company agility. Additionally, Governance/ Risk Management/ Compliance (GRC) issues continue to generate substantial IT investments. Initiatives for reducing IT costs include consolidation and standardization but also virtualization, IP technology, open source, offshore and outsourcing in its various forms (AM, infrastructure, hosting, SaaS, BPO). In terms of process efficiency and company agility, the key topics are collaboration and workflow, process automation/ process integration/ process harmonization/ process improvement, with a special focus on sales/ CRM/ customer services, and BI/ performance management.”

In comparison, interestingly Banking is doing quite well in Germany for several reasons. Investment banking has not been predominant in Germany; banks have enjoyed substantial government aid and, quite early, the recovery of the stock markets.

As in most countries, the Public Sector is very resilient. But as Martin Barnreiter, responsible for the public & health sector at PAC Munich, told us "On the one hand, federal investment programs tend to support demand and on the other hand, municipalities and regional governments ("Länder") face decreasing tax income."

All this has resulted in a substantial decrease in both Software Products (in particular operating systems, office and ERP; while tools and best-of-breed software are faring better) and the Project Services markets (in particular training and application- & process-related consulting & system integration/ C&SI; while technology-related C&SI is doing better). In the Outsourcing business, big deals have been quite rare; however, Application Management (AM) is booming with numerous medium-sized deals (€10m to €50m contract value).

PAC remains cautious on the outlook as there are still important risks linked with unemployment, credit crunch and resulting bankruptcies. Châlons said: "Even if volumes are expected to recover in 2010, average prices and rates will be lower than in 2009 and will limit the market’s recovery." While most investments topics will remain valid in 2010/2011, several additional topics will gain momentum, such as legacy modernization, transformation outsourcing/ transformation AM; innovation; unified communication and mobility; Cloud and SaaS; sustainability (of IT/ through IT).”

TechMarketView would be delighted to supply you with more details on PAC’s products and services – in particular its European SITSI Research Programme. Contact prajah@techmarketview.com for more details.

Posted by Richard Holway at '16:50'