News

Wednesday 05 January 2011

The UK education software and IT services (SITS) supplier landscape has undergone some significant changes in recent years. The highly fragmented, application-led market was disrupted by the Labour Government’s £45 billion+ programme of investment in England’s schools, known as Building Schools for the Future (BSF). BSF promised a significant injection of cash into ICT in schools - some 10% of the total budget – via larger, regional managed services contracts. It attracted a different type of supplier into the market: larger players with managed services expertise were tempted by the bigger deals and the fact that they didn’t now have to sell to hundreds of individual schools.

The UK education software and IT services (SITS) supplier landscape has undergone some significant changes in recent years. The highly fragmented, application-led market was disrupted by the Labour Government’s £45 billion+ programme of investment in England’s schools, known as Building Schools for the Future (BSF). BSF promised a significant injection of cash into ICT in schools - some 10% of the total budget – via larger, regional managed services contracts. It attracted a different type of supplier into the market: larger players with managed services expertise were tempted by the bigger deals and the fact that they didn’t now have to sell to hundreds of individual schools.

That dream didn’t last long. When the UK’s new coalition government took office in 2010 it abruptly moved the goalposts. BSF was curtailed – contracts that had reached financial close would go ahead, and some ‘sample’ schools in projects at preferred bidder stage would continue, but there would be no new BSF contracts after that. Overnight, according to our analysis, suppliers lost up to 44% of the total potential value of contracts that had been let or were at the preferred bidder stage (see Counting the cost of BSF cuts). Moreover, the lost opportunity of future contracts totalled more than £3.5 billion.

The government is still debating how capital investment in schools will be managed in the future, but it has made it clear that the priority will be repairing the schools most in need. There is unlikely to be another national programme of investment in ICT for schools. Things don’t look any brighter in Higher and Further education, which are facing unprecedented cuts to their budgets.

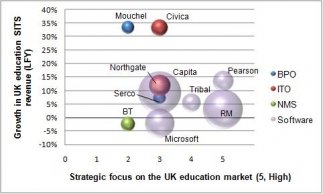

What does all this mean for the SITS suppliers active in the UK education market? How will they adapt their strategies to cope with the aftermath of BSF? You can read our views in our latest report - The UK Education SITS Supplier Landscape 2011 - which reveals the leading SITS suppliers to the UK public sector education market and analyses their strategy in the sector post BSF, as well as highlighting other players to watch in the months ahead. Subscribers to TechMarketView’s public sector research can download the report from today.

Posted by Tola Sargeant at '10:36'

- Tagged:

markettrends

education

« Back to previous page