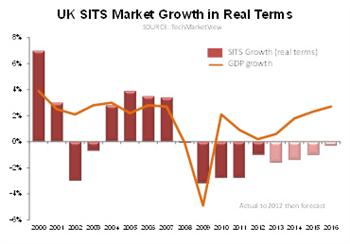

Faced with the longest slump in the last 100 years, technology company managers are facing more obstacles and challenges to hitting growth targets than ever. With the UK Software and IT Services (SITS) market set to have declined by 5% from its 2011 levels by 2016, the competition for the same business is fierce and technology leaders need to be cleverer to maintain and win it.

TechMarketView predicts that, by 2016, the UK Software and IT Services (SITS) market will reach £44.3bn. This will give the SITS market an appearance of 8% growth since 2011 while masking a real terms decline of 5%, says the leading analyst firm focused on the UK software and IT services market.

TechMarketView predicts that, by 2016, the UK Software and IT Services (SITS) market will reach £44.3bn. This will give the SITS market an appearance of 8% growth since 2011 while masking a real terms decline of 5%, says the leading analyst firm focused on the UK software and IT services market.

In its latest report, The UK Software & IT Services Market: Trends and Forecasts, TechMarketView investigates the key trends shaping the UK SITS market, and determines that, despite the difficult market, there is a golden opportunity for SMEs to snatch business from larger players. Performance in this economy is down to the effectiveness of management.

Richard Holway, Chairman of TechMarketView, explains: “A first look at the Market Trends and Forecasts might suggest that the UK SITS market is pretty uninspiring. Ten years of plus or minus 2% growth does seem quite uneventful on the surface.”

“But if you look at its sister report, UK SITS Rankings, there’s another story to tell entirely. The biggest growth companies in the UK SITS market grew by 30% or more. Meanwhile some very established competitors declined by similar amounts. Indeed, some like 2e2 are not even around for us to measure anymore.”

TechMarketView’s UK Software Market Trends and Forecasts 2013 report indicates that the UK SITS market will be worth £42.4bn this year. This is up 1.3% on 2012’s figure of £41.9bn, but disguises a real terms decline of 1.6% excluding inflation.

According to the UK SITS Rankings report, the top 30 companies in the UK SITS market accounted for £30.4bn of the 2012 SITS market, amounting to four% growth, of which half was driven by acquisitions. Despite its own ‘annus horribilis’, HP topped the rankings again even though, according to TechMarketView, its UK software and IT services revenues declined by 5%. HP leads IBM, Capita and BT, which retain their respective second, third and fourth places.

According to the UK SITS Rankings report, the top 30 companies in the UK SITS market accounted for £30.4bn of the 2012 SITS market, amounting to four% growth, of which half was driven by acquisitions. Despite its own ‘annus horribilis’, HP topped the rankings again even though, according to TechMarketView, its UK software and IT services revenues declined by 5%. HP leads IBM, Capita and BT, which retain their respective second, third and fourth places.

Holway added: “I believe that performance relates to execution, which is predominantly the responsibility of management; often boiling down to the character and abilities of solitary leader. Compare, for example, the difference in fortunes between Tim Cook and Steve Jobs, Steve Ballmer and Bill Gates and the impact of individuals such as Mike Lawrie.”

Diversity of performance

Nowhere is the diversity of performance more apparent than in the comparison between the private sector and public sector. While UK public sector SITS spend last year was higher than forecast, it is believed that 2013 will mark the lowest point for the market, with a 1.3% headline decline to £11.2bn, (26% of the UK SITS market). By 2016 TechMarketView estimates that the public sector will return to 2010 values and account for 27% of the market.

Meanwhile, the UK private sector SITS market is expected to continue to grow both in headline terms and in real terms through to 2016. Last year, the UK private sector SITS market was worth £30.6bn, 3.1% higher than in 2011 at the headline level and 2.7% higher in real terms. However, TechMarketView anticipates that growth will fall this year to 2.3% (£31.3bn) will continue downwards to about 1.1%-1.2% in 2015/2016.

Holway commented: “Running an established company during sluggish economic growth at the same time as huge changes in the way that software and IT services are delivered is a huge task. The challenge facing many larger businesses is how to correct course without destroying the core business, which is under pressure due to the economy. The baggage of established businesses makes it a lot harder for them to be agile in today’s market, which presents an enormous opportunity for SMEs and start-ups. Just look at the success of Salesforce.com and many other new businesses that have pulled the rug out from under major suppliers by snatching away their customers.”

TechMarketView Foundation Service subscribers can click on the links to download UK Software & IT Services Market Trends & Forecasts 2013 and UK Software & IT Services Rankings 2013. If you are not among them, please contact Deborah Seth on our client services team.

Posted by UKHotViews Editor at '07:26'