Wednesday 01 September 2021

Summary

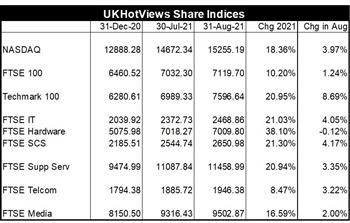

August 21 will be remembered by many for its harrowing scenes from Kabul. Elsewhere C-19 infections and resulting hospitalisations and deaths seem to be increasing in the US and elsewhere – even Australia and New Zealand. Inflation has reared its ugly head again and could well lead to increased interest rates which would severely affect both government and household budgets. But you would never suspect this glancing at the Share Index Tables for August

August 21 will be remembered by many for its harrowing scenes from Kabul. Elsewhere C-19 infections and resulting hospitalisations and deaths seem to be increasing in the US and elsewhere – even Australia and New Zealand. Inflation has reared its ugly head again and could well lead to increased interest rates which would severely affect both government and household budgets. But you would never suspect this glancing at the Share Index Tables for August

NASDAQ has powered to an all-time high of 15255. That an 18.4% increase YTD and a 30% increase yoy/since end Aug 20. NASDAQ is now up an amazing 491% in 10 years since end Aug 11. This compares to a ‘mere’ 32% rise in the FTSE100 in the same 10 year period. So Tech – and Big Tech in particular – has clearly been ‘The Place to Be’.

The FTSE SCS Index – which most closely tracks the UK-HQed software and IT services stock that we track – was up 4.2% in Aug and 21.3% YTD. For the record the FTSE SCS Index is up 235% in the 10 years since end Aug 11. Although that’s impressive, the growth is half that of NASDAQ in the same period.

But even that pales when compared to some the share price rises for other individual stocks. As I said in my post of 25th Aug 21, Amazon has risen a massive 1700% in the last ten years and investments in Apple (up >1000%) and Microsoft (up c1000%) would have comfortably beaten the NASDAQ Index. Indeed, Allianz Technology Trust #ATT, where I was a NED between 2007 and 2019, is up over 800% in the last 10 years.

Outlook

I can give you a long list of risks facing both the UK and the global economies. Everything from an upsurge in terrorism post Afghanistan, inflation, stock shortages (in particular microchips), new C-19 variants that could render vaccines impotent etc. But, there again, savings are at an all time high, confidence is returning both to businesses and consumers, BREXIT is seen more and more as an ‘opportunity’ for the UK etc.

What is certain is that tech is now so ubiquitous that it is an integral part of the economy. The only thing that will now knock it is a global recession or depression. Nobody currently is predicting either.

You want all the detail?

You want all the detail?

All the detail and comment on the Winners and Laggards in our Review of Share Performance in August 21 on HotViews Extra available to all subscribers including HotViews Premium. Why not join them for just £395pa? For more details CLICK HERE

Posted by Richard Holway at '16:01'