News

Today TechMarketView launches “Mid-market Data Centre Services: Competitors and Opportunities”, part of the InfrastructureViews research programme.

Today TechMarketView launches “Mid-market Data Centre Services: Competitors and Opportunities”, part of the InfrastructureViews research programme.

The mid-market (100-1000 employees) is often referred to as if it is a single market sector, such as financial services or manufacturing. It is not. There is not, for example, a single set of regulatory challenges that will drive data centre services investment. There is not a collective pattern for margin or cash flow performance. This is a highly fragmented market consisting of a large number of enterprises with different business and technology challenges.

The opportunities for suppliers of data centre services to the mid-market vary considerably. Some of the best opportunities are amongst firms that have an overstretched IT function and have acknowledged they must invest to prevent a total meltdown. Or, alternatively, firms where technology is central to the business model - for example, sectors that are data centric, seasonally driven and/or that have a high reliance on IT. As one data centre services supplier put it: “The biggest customers are not necessarily the largest corporations. The big spenders are the more innovative companies, such as online firms.”

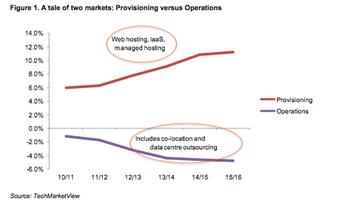

The strongest growing data centre services in the UK are the cloud and hosting markets (Provisioning market), which will be worth £1.7bn in 2013 and will grow (CAGR) 9% to 2016. While that represents an undoubted opportunity, suppliers to the mid-market must be aware that tier one – and even tier two – vendors are often considered to be too expensive by mid-sized buyers. The perception is that larger suppliers are more inclined to help their big accounts when something goes wrong or requires immediate attention.

However, as cloud services become more prevalent in the market, the question is whether the resultant contracts and delivery/payment models will make larger suppliers more attractive to these buyers. Will larger suppliers be able to deliver cloud services at a price point that is more attractive to smaller buyers than their traditional IT services? Or, will cloud and hosting services prove to be the making of some of the UK’s burgeoning mid-sized suppliers? This report provides particular focus on the latter: the emerging set of mid-sized managed hosting and cloud suppliers.

“Mid-market Data Centre Services: Opportunities and Competitors” is available to subscribers of our ever-popular InfrastructureViews research stream. Please contact Deb Seth if you would like to join the stream.

Posted by Kate Hanaghan at '09:08'

- Tagged:

datacentres

research

infrastructure

« Back to previous page