Summary

Richard commented in his 1 April column that "if we weren't all too aware of the troubles facing us - a major war in Europe and the highest cost of living hit in a generation - a glance at the share performance in the last month (March) would not indicate that anything much was wrong".

Richard commented in his 1 April column that "if we weren't all too aware of the troubles facing us - a major war in Europe and the highest cost of living hit in a generation - a glance at the share performance in the last month (March) would not indicate that anything much was wrong".

The markets certainly caught up during April, particularly as far as tech was concerned.

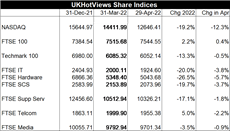

NASDAQ fell 12.3% month-on-month (MoM) and is now down 19.2% year-to-date (YTD), as investors moved away from growth bets on new technologies and back towards "traditional" dividend-paying stocks. In the UK, the flagship FTSE100 index was a beneficiary of this flight to dividends, holding flat during April and managing 2.2% YTD growth.

But in the UK, as in the US, almost everything tech-focused was in negative territory for another month, with the FTSE SCS index (which most closely mirrors the mix of stocks we track) down another 3.7% in April and 19.7% YTD. And interestingly, the FTSE Hardware index - which enjoyed a sustained post-pandemic boom as investment in IT infrastructure ramped up - had the bumpiest ride of the smaller specialist indices, with companies perhaps reducing investment spending amid fears of a recession.

Winners and Losers

Despite the gloom, there were strong performances from Twitter, Corero Network Security, Netcall, THG (The Hut Group), PCI-PAL, 1Spatial and Capita, amongst others, though in some cases it was not enough to reverse share price declines earlier in the year.

The Big Tech group - comprising the FAANGs (Meta/Facebook, Amazon, Apple, Netflix and Alphabet/Google) plus Microsoft - all posted month-on-month (MoM) declines, with Netflix taking the overall Wooden Spoon.

Away from Big Tech, the volatile markets saw many other companies posting MoM declines, including Cazoo, Unisys, Oxford Nanopore, Infosys, Tesla and others.

More detail on the Winners and Losers is available in Share Performance in April 2022 for HotViews Premium readers.

Outlook

UK consumer price inflation (CPI) in the 12 months to March stood at 7%, driven by the ongoing and devastating conflict in Ukraine and Covid lockdowns in China, both of which are causing severe supply chain disruption and price increases across many product lines.

Despite these supply-side pressures on inflation, the UK Treasury pressed ahead with pre-planned tax rises in April, putting further pressure on consumers. The combination of all of the above - and other factors - has led to a drop in consumer sentiment to its lowest level since the 2008 financial crisis.

The Bank of England now has the difficult task of working out when and by how much to further increase interest rates to combat inflation, knowing that doing so could further damage consumer confidence and may make a recession more likely.

Whatever the answer, it is inevitable that rates will rise further. With investors already turning away from growth stocks which performed so well during the pandemic and back towards more cyclical stocks, we can unfortunately expect the bad news to continue for tech for some months to come. All that being said, tech is an embedded part of our lives and our economies now and it is not going away. The question for many tech companies however will be whether they can adapt quickly from being the darlings of the pandemic to something rather less loved, at least for the time being.

Posted by Tania Wilson at '09:30'

- Tagged:

markets

macro