In my first monthly share price performance column a fortnight ago, data for April showed tech stock indices taking a hammering that month, with the tech-heavy NASDAQ down 13% month-on-month (MoM).

In my first monthly share price performance column a fortnight ago, data for April showed tech stock indices taking a hammering that month, with the tech-heavy NASDAQ down 13% month-on-month (MoM).

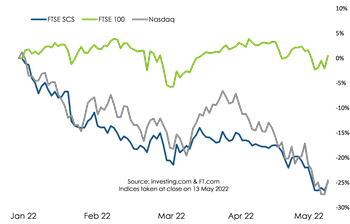

We are two weeks into the month of May and there is no let-up in sight. At close on 13 May, NASDAQ was down a further 4.3% since end April - or a massive 17.0% down since 31 March - with the FTSE Software and Computer Services (SCS) index down 6.4% and 9.8% in those timeframes respectively.

The magnitude of these falls is most easily seen in the chart showing the calendar year-to-date (YTD). Comparing the tech-focused NASDAQ and FTSE SCS to the more diversified FTSE 100 - which is broadly holding steady YTD - neatly illustrates the challenge facing technology stocks.

How did we get here?

The tech sector's misfortunes are being driven by rapidly rising inflation in both the US and the UK. As larger economies emerged from Covid during 2021, there was pent-up demand, particularly for goods. But as the pandemic continued to evolve at different speeds in different countries, it played havoc with logistics, causing bottlenecks in complex global supply chains.

High demand coupled with disrupted supply started to set inflation alarm bells ringing, although the US Federal Reserve and the Bank of England initially took the view that inflation may remain transitory. But in recent months we have seen the geopolitical shock of Russia's invasion of Ukraine and a serious outbreak of Covid in China, both of which have significantly increased supply-side constraints across multiple commodities and product lines.

Central banks have started to raise interest rates in earnest - and with the markets no longer believing inflation is transitory, further rate rises are expected later in the year. And in a climate of rising interest rates, investors are turning away from tech stocks whose valuations more likely depend on discounting future cashflows and towards stocks with relatively lower growth expectations and more certain near-term income streams (hence the more solid performance of the FTSE 100).

And where to now?

The difficulty for tech investors is that whilst central banks increasing interest rates can impact the demand side of the inflation equation, there is not a lot they can do about supply-side factors. And the risk of turning the screw too tight, too soon on inflation via interest rates is that it triggers a recession.

So, the best hope for tech markets is that the issues impacting supply chains start to settle down, which could see inflation coming under control. If that happens - and if the market has already priced in roughly the right level of future interest rate increases - then the bottom for tech stocks may not be too far off. That doesn't necessarily mean a quick recovery to previous valuations however. Interest rates surely won't drop back immediately to pandemic lows and indeed may not do so in the medium term. The best bet for technology companies therefore is to double-down on cost management, recurring revenues and pricing power and (where relevant) articulate to investors the path to profitability.

Of course, tech is not a homogeneous sector and some tech companies are weathering the storm much better than others. There will be more on share price performance of different stocks and the broader macro environment in the May full month round-up, available at the start of June.

Posted by Tania Wilson at '07:29'

- Tagged:

markets

macro