News

TechMarketView clients who missed our sell-out event on Wednesday can get the merest smidgen of an idea of the content by downloading an ‘edited highlights’ PDF of the slides presented by the TechMarketView team here. Of course, the 200 of you who made it can do so too and wallow in the memory!

TechMarketView clients who missed our sell-out event on Wednesday can get the merest smidgen of an idea of the content by downloading an ‘edited highlights’ PDF of the slides presented by the TechMarketView team here. Of course, the 200 of you who made it can do so too and wallow in the memory!

But pictures without words are like, well, pictures without words. And in the words is the real value. So why not contact us at info@techmarketview.com to find out how you can have a TechMarketView research director present our view on the prospects for the UK software and IT services market at your next management meeting, company ‘rah-rah’ event, or client seminar. You know it makes sense!

Posted by UKHotViews Editor at '07:37'

Last night 200 of our customers and friends attended the first (see note) Intellect TechMarketView Presentation and Dinner at Bafta. It was a SELL OUT event and it was really great to see so many of the CEOs from the UK’s leading players give up an evening to attend.

Last night 200 of our customers and friends attended the first (see note) Intellect TechMarketView Presentation and Dinner at Bafta. It was a SELL OUT event and it was really great to see so many of the CEOs from the UK’s leading players give up an evening to attend.

It was also good to see the whole TMV Team in action. Everyone of our Research Directors gave a session on their ‘specialist areas’. Tola also conducted an interview with Christian Nagele, the CEO of Little British Battler CentraStage. Then Anthony Miller (complete with new shirt/tie combo) ended with his famous Top Twenty Countdown.

gave a session on their ‘specialist areas’. Tola also conducted an interview with Christian Nagele, the CEO of Little British Battler CentraStage. Then Anthony Miller (complete with new shirt/tie combo) ended with his famous Top Twenty Countdown.

I was, I must admit, extremely proud of the TMV Team. Everyone who has ever worked with me in business or the Prince’s Trust knows how much I believe in succession planning. Last night showed that TMV is much more than Anthony & I and that the industry will have its star performers for many years to come!

The evening ended with a really rather good dinner and much heated conversation amongst the attendees on every subject under the tech sun…and beyond if my table was anything to go by.

Yesterday we issued a Press Release on our two new reports - UK Software & IT Services Market Trends & Forecasts 2013, and UK Software & IT Services Rankings 2013 - which made up much of last night’s presentation. Read It’s all down to execution and it’s all down to you. There has already been much press comment too.

See you next year?

Footnote – Although I say this was the ‘First’ Intellect Techmarkview Presentation, the genesis of the evening goes back to 1988 with the first CSA (the forerunner to Intellect) Holway (the forerunner to TMV!) Evening. I well remember carrying my 35mm slide deck up to London on the train. Just like last night, it was organised by Tina Compton.

this was the ‘First’ Intellect Techmarkview Presentation, the genesis of the evening goes back to 1988 with the first CSA (the forerunner to Intellect) Holway (the forerunner to TMV!) Evening. I well remember carrying my 35mm slide deck up to London on the train. Just like last night, it was organised by Tina Compton.

Oh how our industry has changed in those 25 years! For a start 9 out of the Top Ten suppliers of SITS to the UK market in 1988 were UK headquartered. Now only Capita and BT figure in the Top Ten. We also had a buoyant UK IPO market. Now that has all but disappeared too. The two are, of course, connected. Maybe if we get the UK IPOs back we might, in years to come, have more UK HQed SITS companies in the Top Ten too.

UK market in 1988 were UK headquartered. Now only Capita and BT figure in the Top Ten. We also had a buoyant UK IPO market. Now that has all but disappeared too. The two are, of course, connected. Maybe if we get the UK IPOs back we might, in years to come, have more UK HQed SITS companies in the Top Ten too.

The one thing that hasn’t changed is that the top players in the market value top-rate analysis and research. Many tell us that we’ve been the most thought provoking – and the most accurate – analysts throughout that period. We intend to retain that crown into the future.

Posted by Richard Holway at '06:50'

This evening we will be welcoming over 200 of the great and the good in the UK IT industry to the inaugural Evening with TechMarketView presentation and dinner in the magnificent surroundings of BAFTA in London's Piccadilly.

This evening we will be welcoming over 200 of the great and the good in the UK IT industry to the inaugural Evening with TechMarketView presentation and dinner in the magnificent surroundings of BAFTA in London's Piccadilly.

And today we are also launching the two of our most eagerly awaited reports of the year: UK Software & IT Services Market Trends & Forecasts 2013, and UK Software & IT Services Rankings 2013.

Everyone can read a synopsis of these keynote reports here, but only TechMarketView Foundation Service subscribers will be able to read them in full. And if you are not among them, our Deborah Seth will be able to point the way!

By the way, if you are looking for one of the hottest tickets in town for tonight’s event, we are sold out. But by all means contact Tina Compton at Intellect (020 7331 2011) in case there are any last minute cancellations.

Posted by UKHotViews Editor at '07:41'

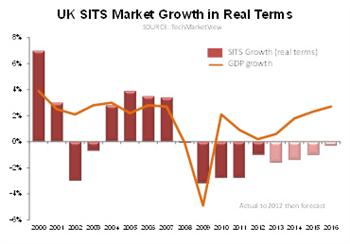

Faced with the longest slump in the last 100 years, technology company managers are facing more obstacles and challenges to hitting growth targets than ever. With the UK Software and IT Services (SITS) market set to have declined by 5% from its 2011 levels by 2016, the competition for the same business is fierce and technology leaders need to be cleverer to maintain and win it.

TechMarketView predicts that, by 2016, the UK Software and IT Services (SITS) market will reach £44.3bn. This will give the SITS market an appearance of 8% growth since 2011 while masking a real terms decline of 5%, says the leading analyst firm focused on the UK software and IT services market.

TechMarketView predicts that, by 2016, the UK Software and IT Services (SITS) market will reach £44.3bn. This will give the SITS market an appearance of 8% growth since 2011 while masking a real terms decline of 5%, says the leading analyst firm focused on the UK software and IT services market.

In its latest report, The UK Software & IT Services Market: Trends and Forecasts, TechMarketView investigates the key trends shaping the UK SITS market, and determines that, despite the difficult market, there is a golden opportunity for SMEs to snatch business from larger players. Performance in this economy is down to the effectiveness of management.

Richard Holway, Chairman of TechMarketView, explains: “A first look at the Market Trends and Forecasts might suggest that the UK SITS market is pretty uninspiring. Ten years of plus or minus 2% growth does seem quite uneventful on the surface.”

“But if you look at its sister report, UK SITS Rankings, there’s another story to tell entirely. The biggest growth companies in the UK SITS market grew by 30% or more. Meanwhile some very established competitors declined by similar amounts. Indeed, some like 2e2 are not even around for us to measure anymore.”

TechMarketView’s UK Software Market Trends and Forecasts 2013 report indicates that the UK SITS market will be worth £42.4bn this year. This is up 1.3% on 2012’s figure of £41.9bn, but disguises a real terms decline of 1.6% excluding inflation.

According to the UK SITS Rankings report, the top 30 companies in the UK SITS market accounted for £30.4bn of the 2012 SITS market, amounting to four% growth, of which half was driven by acquisitions. Despite its own ‘annus horribilis’, HP topped the rankings again even though, according to TechMarketView, its UK software and IT services revenues declined by 5%. HP leads IBM, Capita and BT, which retain their respective second, third and fourth places.

According to the UK SITS Rankings report, the top 30 companies in the UK SITS market accounted for £30.4bn of the 2012 SITS market, amounting to four% growth, of which half was driven by acquisitions. Despite its own ‘annus horribilis’, HP topped the rankings again even though, according to TechMarketView, its UK software and IT services revenues declined by 5%. HP leads IBM, Capita and BT, which retain their respective second, third and fourth places.

Holway added: “I believe that performance relates to execution, which is predominantly the responsibility of management; often boiling down to the character and abilities of solitary leader. Compare, for example, the difference in fortunes between Tim Cook and Steve Jobs, Steve Ballmer and Bill Gates and the impact of individuals such as Mike Lawrie.”

Diversity of performance

Nowhere is the diversity of performance more apparent than in the comparison between the private sector and public sector. While UK public sector SITS spend last year was higher than forecast, it is believed that 2013 will mark the lowest point for the market, with a 1.3% headline decline to £11.2bn, (26% of the UK SITS market). By 2016 TechMarketView estimates that the public sector will return to 2010 values and account for 27% of the market.

Meanwhile, the UK private sector SITS market is expected to continue to grow both in headline terms and in real terms through to 2016. Last year, the UK private sector SITS market was worth £30.6bn, 3.1% higher than in 2011 at the headline level and 2.7% higher in real terms. However, TechMarketView anticipates that growth will fall this year to 2.3% (£31.3bn) will continue downwards to about 1.1%-1.2% in 2015/2016.

Holway commented: “Running an established company during sluggish economic growth at the same time as huge changes in the way that software and IT services are delivered is a huge task. The challenge facing many larger businesses is how to correct course without destroying the core business, which is under pressure due to the economy. The baggage of established businesses makes it a lot harder for them to be agile in today’s market, which presents an enormous opportunity for SMEs and start-ups. Just look at the success of Salesforce.com and many other new businesses that have pulled the rug out from under major suppliers by snatching away their customers.”

TechMarketView Foundation Service subscribers can click on the links to download UK Software & IT Services Market Trends & Forecasts 2013 and UK Software & IT Services Rankings 2013. If you are not among them, please contact Deborah Seth on our client services team.

Posted by UKHotViews Editor at '07:26'

We said you’d need to move fast to secure one of the last seats at next Wednesday's inaugural Evening with TechMarketView (see here) – and we're now completely sold out!

We said you’d need to move fast to secure one of the last seats at next Wednesday's inaugural Evening with TechMarketView (see here) – and we're now completely sold out!

But you can still put your name down on the waiting list in case a seat comes free. Just let Tina Compton at Intellect know you're interested and she'll put you on the list.

Posted by UKHotViews Editor at '08:02'

Watching the House of Commons Public Accounts Committee (PAC) hearing on the programme formerly known as NPfIT (the National Programme for IT in the NHS) last week, you could be forgiven for thinking you were having a ‘Ground Hog Day-style’ experience (see ‘Nicholson put through the wringer over NPfIT’).

Watching the House of Commons Public Accounts Committee (PAC) hearing on the programme formerly known as NPfIT (the National Programme for IT in the NHS) last week, you could be forgiven for thinking you were having a ‘Ground Hog Day-style’ experience (see ‘Nicholson put through the wringer over NPfIT’).

In many respects, the NPfIT soap opera has moved on very little since the last PAC report into the Programme was published in August 2011 (see ‘NHS IT: PAC report piles pressure on CSC (and BT)). The key contracts are still ongoing despite the Coalition Government’s plans to ‘scrap’ NPfIT, which were announced with such political fanfare in September 2011 (see ‘NPfT: What does ‘accelerated dismantling’ really mean?’). The Department of Health is still in contract negotiations with CSC, the prime contractor tasked with providing electronic patient record (EPR) systems in the North, Midlands and East of England. CSC still hasn’t delivered its Lorenzo EPR system at scale with the functionality originally promised by the end of 2005. And the NHS is still locked in a legal dispute with former NPfIT supplier Fujitsu over the £896m contract terminated in 2008. It is little wonder that Public Accounts Committee members let their frustration show.

In other respects, however, things have changed in the NHS IT market in the two years since the last PAC report into the controversial programme. In our latest PublicSectorViews research note - NHS IT: Plus ça change...? - we take the opportunity to highlight some of the key facts to come out of the latest PAC hearing; debate whether or not the NHS IT market has moved on and consider the implications for suppliers.

PublicSectorViews subscribers can download this research from today. If you don't yet subscribe to our public sector research stream and you'd like to know more please email Deborah Seth for details.

Posted by Tola Sargeant at '14:06'

- Tagged:

publicsector

health

research

If you haven't secured your seat yet for the inaugural Evening with TechMarketView on Wednesday 26th June, then you'd better get your skates on.

If you haven't secured your seat yet for the inaugural Evening with TechMarketView on Wednesday 26th June, then you'd better get your skates on.

We have only five tickets left for the event, which will see the great and the good from the UK IT scene gather to hear the TechMarketView team expound on who will be the 'makers' and who will be the 'breakers' in 2013. And yes we do name names!

'Topped' by Richard Holway and 'tailed' by Anthony Miller, it's a unique chance to hear all of TechMarketView's research directors set out their expectations for how the UK software and IT services market will play out over the next 3 years and what this will mean for the suppliers.

Plus we have a guest interview with the CEO of one of our 'Little British Battler' companies which is sure to be of huge relevance to all SMEs.

And rumour has it Miller may well end the proceedings with his notorious Top 20 Countdown of the leading players in the UK market – no one gets spared his acerbic comments! (Ed's note: Miller says "acerbic, moi?")

Oh – and there's a sumptuous dinner afterwards, of course.

Make or Break – An Evening with TechMarketView will start at 6:00pm on Wednesday 26th June in the magnificent surroundings of BAFTA in London's Piccadilly. Stragglers and reprobates will be forcibly ejected at 11:00pm.

Contact Intellect's stalwart event organiser, Tina Compton, this very minute else all you'll be able to do is read about it on the Thursday!

Posted by UKHotViews Editor at '09:39'

- Tagged:

events

Having recently met with a number of start ups and new entrants in the emerging space of business process automation (BPA), (see Is Blue Prism a game changer in the making?) we are convinced BPA is going to create serious disruptive change to the UK BPO/BPS sector over the next few years.

Automation has revolutionised manufacturing processes over the last ten or so years—robots now commonly perform many of the previously manual tasks in factories. Likewise, in business process ‘factories’ where repetitive rules-based tasks are commonplace, software robots and virtual assistants are now starting to appear to take over some of the heavy manual work.

Incumbent BPO/BPS providers should see automation as an opportunity, but also as a significant threat, as their core business functions compete against cheaper, quicker and more accurate automated alternatives.

Subscribers to TechMarketView's BusinessProcessViews research stream can read the analysis and implications here.

Posted by John O'Brien at '08:30'

- Tagged:

bpo

bps

automation

Martin Read (Logica CEO between 1993 and 2007) once had ambitions to make Logica a global brand and return it to the FTSE 100. It turned out to be a pipe dream. Logica simply didn’t have the global footprint. CGI, which acquired Logica in August 2012, makes it clear that it has similar ambitions.

Martin Read (Logica CEO between 1993 and 2007) once had ambitions to make Logica a global brand and return it to the FTSE 100. It turned out to be a pipe dream. Logica simply didn’t have the global footprint. CGI, which acquired Logica in August 2012, makes it clear that it has similar ambitions.

Michael Roach, President and CEO, said at a recent Analyst Event: “The market will consolidate into 5 or 6 global players. We intend to be one of them”.

But while establishing itself as a global leader, more able to compete head to head on worldwide deals with the likes of IBM and Accenture (against whom management says they most regularly compete), CGI is also determined to differentiate by ensuring intimate client relationships based on local proximity. Many have used the term “Think Global, Act Local” but it’s easier said than done. In this latest TechMarketView CompanyViews note, Georgina O'Toole considers the challenges CGI faces in realising its global ambitions. Subscribers can download the analysis here. Everyone else should contact Deb Seth to gain access,

Posted by Georgina O'Toole at '21:56'

- Tagged:

strategy

itservices

With this ‘Make Or Break’ year fast approaching halfway the TechMarketView team of analysts are busy keeping abreast of how things are shaping up, not least in view of our inaugural Presentation & Dinner event later this month, at which we’ll share our latest forecasts and analysis. Incidentally if you still haven’t bought your ticket to this ‘not to be missed’ evening with the TechMarketView team you may still be lucky enough to nab one of just a handful of tickets which remain – for full details see our TechMarketView events page and contact Tina at Intellect as soon as possible to bag a space (tina.compton@intellectuk.org).

With this ‘Make Or Break’ year fast approaching halfway the TechMarketView team of analysts are busy keeping abreast of how things are shaping up, not least in view of our inaugural Presentation & Dinner event later this month, at which we’ll share our latest forecasts and analysis. Incidentally if you still haven’t bought your ticket to this ‘not to be missed’ evening with the TechMarketView team you may still be lucky enough to nab one of just a handful of tickets which remain – for full details see our TechMarketView events page and contact Tina at Intellect as soon as possible to bag a space (tina.compton@intellectuk.org).

As for our current published research, in May BusinessProcessViews research director, John O’Brien, released his key report on Business process services opportunities in UK central government in which he discusses how the UK central government is shaping up to be one of the stand out sectors for growth in the UK BPS market thanks to some big wins over the past year. To find out where we think the next set of opportunities will be, click here and follow the links to the full report if you’re a BusinessProcessViews or PublicSectorViews subscriber.

Earlier in the month, TechMarketView managing partner, Anthony Miller, published our regular review of the Indian offshore services scene, OffshoreViews Q1 2013. This popular report has the all-important quarterly review for Q1 2013, as well as covering changes to US visa protocol, the ‘Bangalore Blues’ and links to our daily commentary on the offshore scene.

Further to the release of BT’s FY12/13 results on 10th May (see BT GS finally creeps over the FY profit line), InfrastructureViews research director, Kate Hanaghan, followed up with a more in-depth report providing further information on how BT Global Services has performed and what the current year holds, see BT Global Services: More profits to follow?

The exit of Xchanging from Xchanging Transaction Bank (XTB), one of its founding joint venture enterprise partnerships (EPs) (see Xchanging exits Deutsche Bank JV), is a sign of progress according to BusinessProcessViews research director, John O’Brien. To read our in depth analysis on how this surprise announcement will effect the company read John’s full report on HotViewsExtra Xchanging exits Deutsche Bank JV (update).

Quindell Portfolio’s FY12 results suggested that it really has got the wind in its sails (see Is Quindell the fastest growing SITS provider?). But John O’Brien takes the opportunity to scrutinise Quindell’s growth in his HotViewsExtra report Quindell's full year raises more questions.

ESASViews research director, Angela Eagar, reported on how HR and payroll specialist NorthgateArinso (NGA) has positioned itself so that it is situated across several points of change and intersection to occupy valuable spaces in market intersections. To find out how these developments will start to converge, click here.

If you’re not yet a fully paid-up TechMarketView subscriber this is just a snapshot of how much you are missing out on. You'll find details of more reports published in the first quarter in our Quarterly Research Summary, which you can download here. If you would like to find out more about our subscription packages, just drop Deborah Seth an email and she'll be happy to help.

Posted by UKHotViews Editor at '08:00'

« Back to previous page