News

Wednesday 21 December 2016

It’s here! TechMarketView’s annual review of the software and IT services (SITS) supplier landscape in the UK public sector (UK public sector SITS supplier landscape 2016-17). The 60-page report is heaving with valuable insight. As usual, you will find the Top 20 UK public sector SITS rankings and our commentary on the ups and downs. But you will also find further analysis of supplier performance by subsector, including the Top 10 rankings for central government, local government, education, police and defence.

It’s here! TechMarketView’s annual review of the software and IT services (SITS) supplier landscape in the UK public sector (UK public sector SITS supplier landscape 2016-17). The 60-page report is heaving with valuable insight. As usual, you will find the Top 20 UK public sector SITS rankings and our commentary on the ups and downs. But you will also find further analysis of supplier performance by subsector, including the Top 10 rankings for central government, local government, education, police and defence.

And crucially, you will find an in-depth analysis of the performance and prospects for every one of the Top 20 suppliers. This time, we have included more analysis in the forms of tables and charts to make the key data and information more digestible. And we haven’t forgotten the ‘up and comings’… who are the suppliers knocking on the door of the Top 20 or significantly outperforming the leading players?

It’s been a tough couple of years for the leading suppliers. Overall the Top 20 watched their total revenues decline by just over 1%. But this disguises a huge diversity of performance; the fastest growing of the leading suppliers managing growth of 17%, while the biggest revenue decline was -26%. To find out the reasons for these massive ups and downs and insight into what the future holds, PublicSectorViews’ subscribers should download the report now. If you are not a subscriber, and would like to find out how to access the research, please contact Deb Seth to find out more.

Posted by Georgina O'Toole at '09:19'

- Tagged:

publicsector

centralgovernment

localgovernment

defence

education

police

health

suppliers

Each end user organisation is following a cloud journey as unique as the organisation itself. For example, the mix of cloud services, the level of investment to date, and the pace of transition. Suppliers must ‘tune in’ to the specific business requirements of each customer, being cognizant of where and how they should flex their approaches and likewise where they should lead and take buyers safely out of their ‘comfort zone’.

Each end user organisation is following a cloud journey as unique as the organisation itself. For example, the mix of cloud services, the level of investment to date, and the pace of transition. Suppliers must ‘tune in’ to the specific business requirements of each customer, being cognizant of where and how they should flex their approaches and likewise where they should lead and take buyers safely out of their ‘comfort zone’.

In this research note, we take a look at end user organisation, Mortgage Brain. The company has been operating in the UK market - in one form or another - for 30 years and is owned by six of the big mortgage lenders (Barclays, Lloyds Banking Group, Nationwide, Royal Bank of Scotland, Santander and Virgin Money). It provides software that contains mortgage product data and that manages the application process by brokers. This is a highly regulated industry and one that has moved slowly in terms of technology advancement. However, as Mortgage Brain (a Navisite customer) demonstrates, cloud delivered services have an important role to play in improving both customer experience and compliancy.

Subscribers to InfrastructureViews and FinancialServicesViews can read the note by Kate Hanaghan, Research Director, here: End User Insight: Mortgage Brain.

Posted by UKHotViews Editor at '09:25'

- Tagged:

cloud

financialservices

colocation

hosting

Last Monday, TechMarketView ran a roundtable discussion on the important topic of whether the digital strategies of the banks are being successful, either in introducing transformation to the larger banks or in building new banks and banking propositions.

Last Monday, TechMarketView ran a roundtable discussion on the important topic of whether the digital strategies of the banks are being successful, either in introducing transformation to the larger banks or in building new banks and banking propositions.

The event was sponsored by CAST Software and turned out to be a very informative and enjoyable evening for all concerned.

Under the Chatham House Rule, we cannot identify the specific companies and individuals in attendance, but we can say that senior digital and innovation representatives from 2 major banks (retail and corporate arms), a challenger bank and a specialist investment bank shared details of their digital strategies.

There was an exceptionally wide-ranging discussion, with many interesting ideas and opinions discussed in the context of the four banks represented giving some clear guidance as to how Software and IT Services suppliers can support their banking customers. In the briefing we produced following the roundtable we have drawn out the key themes of the discussion.

Subscribers to FinancialServicesViews can access this report here.

Posted by Peter Roe at '09:21'

- Tagged:

cloud

security

legacy

banking

digital

data

Thursday 15 December 2016

The UK’s decision to leave the EU on 23rd June 2016, astonished the market, creating shockwaves of uncertainty that have been felt across the tech sector and beyond. Large enterprises have made their voices heard – but what about the SMEs?

In October 2016, 33 UK tech SMEs completed a self-selective TechMarketView questionnaire as part of the application process to join our Little British Battler programme. We saw this as a great opportunity to ask them about their company’s experience following the Brexit vote and how they see the future outside the EU.

The respondents varied by revenue, number of employees, how long the business had been established, focus area and vertical coverage, but they were all UK-headquartered SMEs operating in the tech sector.

So, what did we discover? Overall it was very reassuring to see a bullish attitude amongst SMEs who see change as an opportunity, and are showing a determination to make Brexit work favorably for them. 55% reported that there had been no impact on their business since the vote, with over half reporting that they expected no impact in the future. 12% reported that their business had been negatively affected by the vote, whilst 15% predicted that leaving the EU will deliver a positive opportunity for their business in the future.

In this report, we drill down behind the headline figures to discuss the big areas of concern for tech SMEs, both now and after the UK leaves the EU. We consider the impact for SMEs comparing levels of revenue generated outside the UK, and the knock on this may have to their future geographical focus. We also analyse the responses based on the primary revenue source of the companies.

This is essential reading for those in the process of drawing up their own Brexit battle plans! TechMarketView research clients can download a copy here. If you are not an existing research client but would like to find out more, please contact Deb Seth in our Client Services team.

Posted by Rebecca Johnson at '16:30'

- Tagged:

brexit

Wednesday 14 December 2016

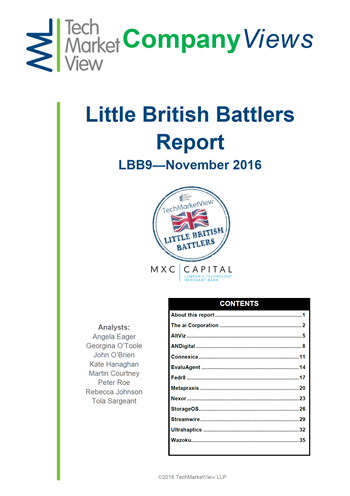

TechMarketView, in association with technology merchant bank, MXC Capital, is delighted to announce the publication of the ninth Little British Battler Report in the series.

TechMarketView, in association with technology merchant bank, MXC Capital, is delighted to announce the publication of the ninth Little British Battler Report in the series.

This report profiles the 12 companies that participated in our Little British Battler Day in November 2016:

-

ai Corporation

-

AltViz

-

ANDigital

-

Connexica

-

EvaluAgent

-

Fedr8

-

Metapraxis

-

Nexor Ltd

-

StorageOS

-

Streamwire

-

Ultrahaptics

-

Wazoku

These companies typify the highly innovative, UK-headquartered tech SMEs vying for attention in the local – and global – market.

Each company has been assessed by the TechMarketView team on its business fundamentals and market proposition, supplemented by an insightful SWOT analysis.

Subscribers to the TechMarketView Foundation Service can download Little British Battler Report – LBB9 report by clicking the link. For further information, please contact our Client Services team.

Posted by UKHotViews Editor at '06:00'

- Tagged:

lbb

Customer demand for lower cost infrastructure services is putting pressure on HCL’s profit margins whilst competitors are getting better at matching it on price. After meeting executives and big spending customers including Volvo, Unilever and Greater Manchester Police at HCL’s recent analyst event, TechMarketView assesses the company’s plan for differentiation and details how its portfolio is being re-engineered to generate more revenue from application development and the Internet of Things (IoT) whilst using automation to cut opex and improve the customer experience.

Subscribers to our InfrastructureViews or SecureConnectViews research streams can access the report here.

If you’re not yet an InfrastructureViews or SecureConnectViews research stream subscriber, contact Deb Seth for more information.

Posted by Martin Courtney at '09:44'

.jpg;149;38) Confidence in Capita has taken a real hit following its second profits warning in as many months (see Capita downgrades again, plans Asset Services sale), with its shares now off c60% year to date.

Confidence in Capita has taken a real hit following its second profits warning in as many months (see Capita downgrades again, plans Asset Services sale), with its shares now off c60% year to date.

Capita’s CE Andy Parker talked of taking ‘decisive action’, to reduce Capita’s cost base and its improve its operating efficiency.

The UK SITS market leader is now cutting c2,000 jobs, or c3% of its workforce, seeking to dispose of the majority of its highly profitable Asset Services business, and turning to offshoring and automation, to turn things around. Capita said the changes will ‘strengthen management, improve visibility, enhance reporting and sales effectiveness. Leaves Capita more focused and leaner.’

However, this isn't going to be an overnight fix. There's a huge amount of work to be done to restore lost confidence.

Subscribers to TechMarketView's subscription services can read our full analysis in UKHotViewsExtra here.

Posted by John O'Brien at '08:17'

TechMarketView’s 2016 research theme, “Surfing the Waves of Disruption”, couldn’t be more apt. The evolution of the infrastructure services industry has hit a significant milestone with Amazon Web Services (AWS) storming into our Top 20.

TechMarketView’s 2016 research theme, “Surfing the Waves of Disruption”, couldn’t be more apt. The evolution of the infrastructure services industry has hit a significant milestone with Amazon Web Services (AWS) storming into our Top 20.

AWS is certainly a disruptive force to be reckoned with, and one of things that really unnerves traditional suppliers is the unknowns around its full competitive might. AWS has grown to become a substantially sized player over an incredibly short period of time, racking up phenomenal UK growth in FY15 - based on our analysis.

However, the AWS figures hint at an even more disruptive future. If the company continues to grow at such a rate - and if our leading players continue to grow very slowly or not at all - we’re looking at AWS becoming one of the top five infrastructure services players in the UK within just a few years’ time.

To find out exactly where AWS is placed, and to read more analysis on the pure-play cloud provider and its peers, see Infrastructure Services Supplier Landscape 2016-2017, by Kate Hanaghan, Research Director.

Of course, the report also examines other key industry players, moves and trends and is essential reading for those looking to survive as the market shifts into the cloud and towards a Hybrid IT operating model.

If you’re not yet an InfrastructureViews research stream subscriber, contact Deb Seth for more information.

Posted by UKHotViews Editor at '09:33'

- Tagged:

outsourcing

cloud

hosting

AWS

Thursday 01 December 2016

Our annual research theme 'Surfing the Waves of Disruption' has been highly appropriate for Enterprise Software & Application Services (ESAS) suppliers as they faced yet another disruptive wave: preparation for the move to data-led intelligent applications. This is emerging as a particularly fast moving wave as awareness and activity levels ramped up.

Our annual research theme 'Surfing the Waves of Disruption' has been highly appropriate for Enterprise Software & Application Services (ESAS) suppliers as they faced yet another disruptive wave: preparation for the move to data-led intelligent applications. This is emerging as a particularly fast moving wave as awareness and activity levels ramped up.

It is driven by the recognition that in a digital environment, data lies at the heart of value and competitive strength but it needs a new set of enablers to make the most of it - namely machine learning and AI techniques embedded into business applications, This, in turn, is opening the door to new-style intelligent applications.

But it is not just enterprises that are facing disruption and looking to suppliers for help and guidance. These developments are also causing suppliers to reevaluate their own models, software, services and delivery approaches in response to customer demands for rapidity, efficiency and lower priced contracts.

On the competitor front, the rise of data as an agent of change is bringing new competitors into the Enterprise Software & Application Services market as data owners and even data-owning industrial suppliers encroach into the market.

Download the Enterprise Software & Application Services Supplier Landscape 2016 report here to see how these pressures are impacting suppliers and changing the competitive landscape. If you’re not a TechMarketView and ESAS research stream subscriber, reach out to Deb Seth for all the information you need to change that.

Posted by Angela Eager at '08:11'

- Tagged:

software

applications

suppliers

machinelearning

data

« Back to previous page