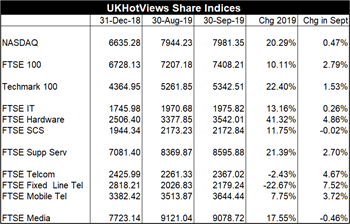

September was a mainly positive though relatively muted month for the major market indices that we track. The FTSE 100 was up 2.8% ahead of Nasdaq (+0.5%) and the FTSE IT index (all but flat). FTSE SCS – our proxy for UK-listed software & IT services companies – was also flat (though still up 11.8% ytd), outperformed by tech hardware (+4.9%). BT’s shares recovered by nearly 8% after last month’s 14% decline, and therefore so did the FTSE Fixed Line Telecom index. So far this year, Fixed Line Telecoms is the only sub-index below water, with the FTSE Support Services leading with 21% growth ytd.

September was a mainly positive though relatively muted month for the major market indices that we track. The FTSE 100 was up 2.8% ahead of Nasdaq (+0.5%) and the FTSE IT index (all but flat). FTSE SCS – our proxy for UK-listed software & IT services companies – was also flat (though still up 11.8% ytd), outperformed by tech hardware (+4.9%). BT’s shares recovered by nearly 8% after last month’s 14% decline, and therefore so did the FTSE Fixed Line Telecom index. So far this year, Fixed Line Telecoms is the only sub-index below water, with the FTSE Support Services leading with 21% growth ytd.

British tech companies topped the charts in September led by two acquisitions. Shares in Watchstone Group, the software and services outfit born from the ashes of the infamous Quindell Group ,were up 56% by the end of the month after news of the sale of the healthcare services businesses of its Canadian subsidiary, Quindell Services Inc.

News of the buy-out of Wimbledon based, financial services technology provider, StatPro, by US-based Confluence Technologies, saw its shares rise by nearly 50%. Confluence is owned by private equity firm TA Associates. Frankly this is the ‘right answer’ for StatPro, which has long been struggling with the transition to SaaS.

Meanwhile, Edinburgh-based, though totally US-focused, healthcare analytics specialist, Craneware, saw its shares rise 40% in the month on the back of a promising outlook from its FY results. And surprisingly (to us), shares in UK-based 'recruiter of two halves' Nakama Group were also up 40% in the month after what the market must have interpreted as a positive outlook from its FY results.

UK companies also championed the Wooden Spoon brigade, led by (or should that be trailed by?) financial services software player Brady, whose shares tanked by over 70% after an ugly set of half-time results. LoopUp Group, IDE Group and Quartix all saw their shares fall by over 30%.

Among the US stocks, the surprising leader was Unisys (+14%), recovering after a taking a bath in August. Even so, its shares are now worth some $7.4 compare to over $20 a year ago. Investors need a strong stomach for the roller-coaster ride on this ‘old soldier’. Worst performer was Pinterest (-23%), probably reflecting the negative sentiment to US tech unicorns (see just about anything written by our chairman Richard Holway).

Usual author Richard Holway is travelling. He will be back in the saddle in time for next month’s share performance roundup.

Posted by UKHotViews Editor at '08:43'