News

Thursday 16 February 2023

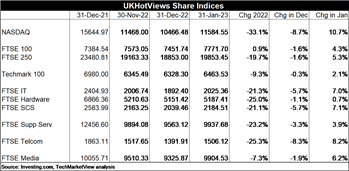

After a rough ride in 2022, January offered a positive start to 2023 for tech investors. The Nasdaq was up 10.7% month-on-month (MoM) and the FTSE Software and Computer Services (SCS) index, which most closely tracks the stocks that we in TechMarketView focus on, finished up 7.1% MoM. Indeed, all of the specialist UK tech indices finished up on the prior month.

After a rough ride in 2022, January offered a positive start to 2023 for tech investors. The Nasdaq was up 10.7% month-on-month (MoM) and the FTSE Software and Computer Services (SCS) index, which most closely tracks the stocks that we in TechMarketView focus on, finished up 7.1% MoM. Indeed, all of the specialist UK tech indices finished up on the prior month.

Broader UK indices were also up. The FTSE 100 has consistently outperformed in recent months and finished 4.3% MoM. But with around 75% of its revenues derived from overseas sales, it doesn't particularly reflect the strength (or otherwise) of the UK economy. Arguably a better measure of that is the mid-cap FTSE 250, which finished 5.3% up MoM - hopefully a sign of increasing investor confidence in UK plc.

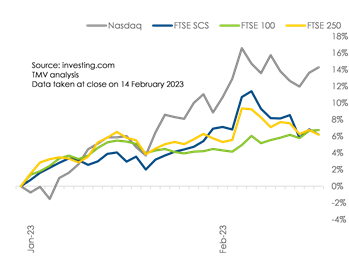

But despite the cheer in January, the volatility which characterised 2022 has returned in February, with investors again playing a guessing game over how the Federal Reserve will respond to US macroeconomic data. The answer on 1 February was an interest rate increase of just 0.25%, the lowest since Spring 2022, which sent tech stocks soaring. Those gains were tempered in the days that followed by higher-than-expected inflation data for January and signs that the jobs market remains hot - a perfect recipe for further volatility in the months ahead.

But despite the cheer in January, the volatility which characterised 2022 has returned in February, with investors again playing a guessing game over how the Federal Reserve will respond to US macroeconomic data. The answer on 1 February was an interest rate increase of just 0.25%, the lowest since Spring 2022, which sent tech stocks soaring. Those gains were tempered in the days that followed by higher-than-expected inflation data for January and signs that the jobs market remains hot - a perfect recipe for further volatility in the months ahead.

Already general themes are emerging in company performance, with cloud, hardware and advertising and e-commerce all feeling the pinch as wary customers rein in expenditure.

But the hype around OpenAI's ChatGPT suggests we may not have long to wait for the next tech boom, as Generative AI becomes the buzzword of the moment.

UKHotViews Premium readers can read more on the markets so far in 2023 and what may yet be in store in Tech Investors buckle up for a bumpy 2023. And if you would like to discuss subscription options, please contact Deb Seth.

Posted by Tania Wilson at '12:08'

- Tagged:

markets

macro

« Back to previous page