News

It's around a decade since blockchain first came to the attention of the mainstream IT community and many have spent the intervening years looking for a problem for blockchain to solve. Now in 2019, perspectives have matured considerably and the previous era of unbridled hype and unfulfilled expectation has meant that the “gold rush” of speculative projects is a thing of the past.

It's around a decade since blockchain first came to the attention of the mainstream IT community and many have spent the intervening years looking for a problem for blockchain to solve. Now in 2019, perspectives have matured considerably and the previous era of unbridled hype and unfulfilled expectation has meant that the “gold rush” of speculative projects is a thing of the past.

Despite the relative lack of noise in public, there has been a great deal of activity around blockchain and distributed ledger technology (DLT) within the financial services industry of late. However, much of the recent development has effectively been going on “behind closed doors”.

Whilst blockchain’s greatest, long term benefits, are likely to be realised when it is applied in conjunction with other transformational technologies, one area of the financial services value chain has come to the fore recently as a sweet spot for the application of this technology.

Subscribers to our FinancialServicesViews research programme can download Trade finance emerges as blockchain's new sweet spot now.

If you are not currently a subscriber and are interested in accessing the research, please contact Deb Seth

Posted by Jon C Davies at '07:00'

Wednesday 30 October 2019

Make sure you don’t miss the highlight of the UK tech calendar next year – mark your diaries now for 10 September 2020, the date for the eighth annual Evening with TechMarketView, which will once again be held at RIBA, London

Make sure you don’t miss the highlight of the UK tech calendar next year – mark your diaries now for 10 September 2020, the date for the eighth annual Evening with TechMarketView, which will once again be held at RIBA, London

Just a month after the hugely successful TechMarketView Evening 2019 we are already thinking about next year, which will be centred around our 2020 research theme, taming Digital Chaos.

We look forward to spending the evening with more than 200 leaders from UK tech, as they take the opportunity to hear first-hand from TechMarketView’s expert analyst team and network with peers, partners and prospects over drinks and dinner.

If you are interested in sponsoring next year’s event, email the team at info@techmarketview.com for details of our 2020 sponsorship packages.

Posted by UKHotViews Editor at '08:30'

- Tagged:

events

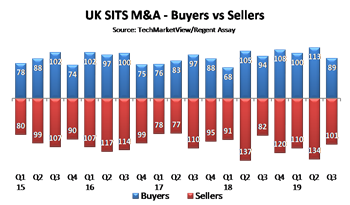

Merger and acquisition activity in the UK software and IT services (SITS) sector remained strong in Q3 but at a lower level than in the previous quarter as UK buyers undertook the lowest number of transactions since Q1 2018. Demand for IT services companies dropped to 38% of all UK SITS deals, as demand for software businesses surged.

Merger and acquisition activity in the UK software and IT services (SITS) sector remained strong in Q3 but at a lower level than in the previous quarter as UK buyers undertook the lowest number of transactions since Q1 2018. Demand for IT services companies dropped to 38% of all UK SITS deals, as demand for software businesses surged.

Download the latest edition of IndustryViews Corporate Activity, our quarterly review of the UK software & IT services M&A scene, for more detail.

Posted by UKHotViews Editor at '14:20'

- Tagged:

acquisition

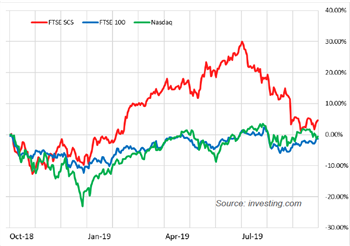

UK tech stocks had mixed fortunes during Q3 as international trade tensions and talk of a global slowdown weighed on shares.

UK tech stocks had mixed fortunes during Q3 as international trade tensions and talk of a global slowdown weighed on shares.

The FTSE SCS index, a proxy for UK listed software and IT services (SITS) companies, was the worst performer in the UK tech sector with a 17% fall. Micro Focus was a major contributor to the drop with its shares falling 45% in the quarter following a profit warning (see here).

The FTSE Telecom indices faired better, boosted by a 25% gain by Vodafone which lifted the FTSE Mobile index by 24% but stock price falls from BT and other fixed line providers resulted in a 9% drop in the FTSE Fixed Line index and limited the FTSE Telecom index to a 13% gain.

In the broader stock markets, the FTSE 100 was down very slightly (0.2%) as was the Nasdaq index (down 0.6%).

TechMarketView Foundation Service subscribers can read more about the comparative performance of UK SITS stocks in IndustryViews Quoted Sector Q3 2019 Review by clinking here.

Posted by UKHotViews Editor at '16:37'

Following the news earlier this week that UK startup, Trad3r, had successfully raised around £1.2m in new funding from a group of respected angel investors (see: Trad3r secures £1.2m cash boost), I caught up with the company’s charismatic young founder and CEO, Gianni O’Connor (pictured).

Following the news earlier this week that UK startup, Trad3r, had successfully raised around £1.2m in new funding from a group of respected angel investors (see: Trad3r secures £1.2m cash boost), I caught up with the company’s charismatic young founder and CEO, Gianni O’Connor (pictured).

O’Connor is an extremely bright and enthusiastic individual with something of an infectious personality. In addition to his obvious energy and intellect, he is driven in part by altruistic sentiment, coupled with a healthy disrespect for the status quo. O’Connor hopes that Trad3r may help transform attitudes to financial services, both inside and outside of the established investment community.

The Trad3r app, which was launched in 2016, aims to broaden the appeal of trading to a wider audience by gamifying the stock market experience. Trad3r enables its users to gain their first experience of trading in an entertaining, low risk environment via innovative asset classes that are appealing to its target audience. As well as buying and selling traditional stocks, Trad3r enables users to trade other “virtual” commodities such as celebrities and footballers. Successful trading is rewarded with incentives such as points and prizes, as well as hard cash.

The 26-year old Londoner already has another successful startup under his belt, in the form of innovative free music streaming and social media app Micsu. O’Connor launched Micsu in 2013 whilst studying for a degree at Coventry University and first visualised the base code that was key to its success whilst sitting a mid-term exam.

TechMarketView subscribers including UKHotViewsPremium clients can learn more via UKHotViewsExtra (see: O'Connor and Trad3r look to change the rules).

If you do not already have access to our subscription content and you would like to learn more, please contact Deb Seth for details.

Posted by Jon C Davies at '07:00'

- Tagged:

funding

FinTech

Gamification

TechMarketView’s expert analyst team has been as busy as ever in October. Make sure you haven't missed a must-read!

Highlights include the latest report from Angela Eager, TechMarketView Research Director for Emerging Tech, Advanced: Developments and Differentiation. After the £2bn vote of confidence in Advanced by existing investor Vista Equity Partners and new investor BC Partners in August, Angela assesses the progress Advanced has made as a transforming and growing UK HQ’d company and where its opportunities lie.

Highlights include the latest report from Angela Eager, TechMarketView Research Director for Emerging Tech, Advanced: Developments and Differentiation. After the £2bn vote of confidence in Advanced by existing investor Vista Equity Partners and new investor BC Partners in August, Angela assesses the progress Advanced has made as a transforming and growing UK HQ’d company and where its opportunities lie.

And if you missed it earlier in the month, be sure to check out the UK Public Sector SITS Supplier Rankings 2019 report from our highly respected PublicSectorViews analyst team. The data-rich report provides the definitive Top 20 suppliers to the UK public sector tech market, plus Top 10 rankings for each of the subsectors we track (central government, local government, health, education, police and defence), and a snapshot of the ‘ones to watch’ from outside of the ranking tables.

You’ll also find a host of insightful UKHotViewsExtra articles hot off the presses. This week:

Marc Hardwick, who leads our BusinessProcessViews research, analyses the strategy and outlook for business process services specialist Liberata in Liberata – getting ‘match-fit for digital’.

VMWare’s plans for cloud native endpoint security specialist Carbon Black come under the spotlight in Carbon Black forms spine of new VMWare Security Business from SecureConnectViews’ Martin Courtney. The combination of the two companies looks set to propel VMWare into our Top 20 Cyber Security Players Ranking next year.

And our Chief Research Officer Kate Hanaghan shares insight on thriving Great British Scaleup Altius and sister company DataSparQ in Altius: A driving force in data science.

The UKHotViewsExtra articles highlighted in the section above (and some 500 others) are accessible to all our corporate subscription clients, as well as individual UKHotViews Premium subscribers. Reports are only accessible to corporate clients of the relevant research stream/s. Contact Deb Seth for corporate subscription details or sign up to UKHotViews Premium here.

Posted by UKHotViews Editor at '17:42'

We did it!

We did it!

A TechMarketView team consisting of Managing Director, Tola Sargeant, Chief Analyst, Georgina O’Toole, and Research Director, Marc Hardwick, along with our families, completed the RBC Race for the Kids 5k for Great Ormond Street Hospital (GOSH), on a very wet Saturday in Hyde Park over the weekend…

Our times ranged from a brilliant 24 minutes for the older boys – William and Josh – to a very respectable 56 minutes for Thomas, as he tackled the 5k on his first prosthetic leg. It brought home to us how much extra energy is required running on a prosthetic (apparently 60% extra!), and how much more you need to concentrate on your breathing and technique. Thomas is determined to become a Paralympian one day (he just can’t decide on which sport yet...) so he’ll be working on improving over the coming months and years!

We are overwhelmed by the support we have received from family, friends, clients, UKHotViews readers and social media followers. The generosity exhibited has been amazing. The total raised is still edging up but we have, so far, raised £6,330.21 from 108 extremely kind supporters. Thank you! An astounding amount that makes getting soaked to the skin all worthwhile!

There is still time to donate to help give other children the same wonderful care and support that Thomas has received at Great Ormond Street Hospital over the last decade. Here’s the link: https://www.justgiving.com/fundraising/techmarketview-for-thomas.

Posted by UKHotViews Editor at '09:13'

- Tagged:

fundraising

charity

The recent £2bn vote of confidence in Advanced by existing investor Vista Equity Partners and new investor BC Partners was the latest in a series of developments that have enabled the company to expand and grow its own confidence levels.

The recent £2bn vote of confidence in Advanced by existing investor Vista Equity Partners and new investor BC Partners was the latest in a series of developments that have enabled the company to expand and grow its own confidence levels.

Our latest research assesses the progress Advanced has made under CEO Gordon Wilson (who was recently named by The Telegraph as one of the UK's 50 most ambitious leaders) and his team, as they transform and grow this UK HQ’d company.

“Advanced: Developments and Differentiation” is available for TechMarketView subscribers to download.

The bigger picture is that the Advanced story provides a view into the priorities and types of changes suppliers need to undertake, particularly software providers serving the mid-market: from in-house development, acquisitions and industry depth, to cloud transition and partner ecosystems. While dealing with these multiple moving parts, suppliers also need to identify what they are really good at - and have the discipline to stick with it.

If you’d like to find out more about our subscription services please reach out to Deb Seth.

Posted by Angela Eager at '17:37'

- Tagged:

cloud

software

machinelearning

Following on from Liberata’s renewal of its key contract with the London Borough of Bromley announced just a few days ago we spent some time with Chief Exec, Charlie Bruin to get a more detailed sense of what has been happening “under the bonnet” at the BPS specialist.

Following on from Liberata’s renewal of its key contract with the London Borough of Bromley announced just a few days ago we spent some time with Chief Exec, Charlie Bruin to get a more detailed sense of what has been happening “under the bonnet” at the BPS specialist.

It’s just over three years since Liberata was acquired by Japanese BPO outfit Outsourcing Inc (OSI), with the new owner willing to take a longer-term view than the previous Private Equity owners. The Liberata acquisition has always been part of a wider OSI strategy of diversify away from the cyclical nature of the Japanese economy. As a consequence, Liberata is being given the luxury of being able to invest to future-proof its business, whilst accepting a short-term impact with a view to delivering sustainable medium to long-term  growth.

growth.

Subscribers to TechMarketView’s in-depth research streams and UKHotViews Premium service can read a detailed account of how Liberata has been getting itself “match-fit for digital” - here

Posted by Marc Hardwick at '13:18'

- Tagged:

publicsector

localgovernment

digital

Wednesday 09 October 2019

With regulators having approved VMware’s offer for cloud native endpoint security specialist Carbon Black, the US$2.1bn acquisition is set to close in January next year in time for the end of the buyer’s financial year.

With regulators having approved VMware’s offer for cloud native endpoint security specialist Carbon Black, the US$2.1bn acquisition is set to close in January next year in time for the end of the buyer’s financial year.

The combination of the two companies looks likely to propel VMware into our Top 20 Cyber Security Suppliers Ranking in 2020, which means a new source of powerful competition for rivals targetting the same MSSP and enterprise markets.

So we thought it was worth taking a more detailed look at what VMware intends to do with Carbon Black in terms of integrating their respective portfolios, embarking on joint product/service innovation and devising a fresh go to market strategy, both here in the UK and elsewhere.

Subscribers to TechMarketView’s in-depth research streams and UKHotViews Premium service can read a detailed breakdown of VMware's cyber security business plans in our UKHotViewsExtra article - Carbon Black forms spine of new VMware Security Business – here.

Posted by Martin Courtney at '17:44'

- Tagged:

acquisition

cloud

restructure

analytics

threatintelligence

firewall

containers

Kubernetes

endpointprotection

cybersecurity

The TechMarketView team has been as busy as ever over the last couple of weeks. Make sure you haven't missed a must read...

The TechMarketView team has been as busy as ever over the last couple of weeks. Make sure you haven't missed a must read...

One of the most popular reports from our PublicSectorViews team is hot of the virtual presses. Be sure to check out the UK Public Sector SITS Supplier Rankings 2019 report for the definitive Top 20 suppliers to the UK public sector tech market, plus Top 10 rankings for each of the subsectors we track (central government, local government, health, education, police and defence), and a snapshot of the ‘ones to watch’ from outside of the ranking tables.

One of the most popular reports from our PublicSectorViews team is hot of the virtual presses. Be sure to check out the UK Public Sector SITS Supplier Rankings 2019 report for the definitive Top 20 suppliers to the UK public sector tech market, plus Top 10 rankings for each of the subsectors we track (central government, local government, health, education, police and defence), and a snapshot of the ‘ones to watch’ from outside of the ranking tables.

If your interests lie in Financial Services, don’t miss the flagship report from our FinancialServicesViews research stream – UK Financial Services SITS Market Trends and Forecasts 2019. For the first time, this includes our new Digital Evolution Model (DEM), which highlights the shift in spending patterns from “Heritage” or legacy SITS to spend on the “New” transformational technology components (digital, platform and cyber).

The UKHotViewsExtra research published over the last week is also well worth a read:

-

As reports surface that Quantum Computing has broken an important milestone, our Research Director for Emerging Tech, Angela Eager, muses on ‘Quantum Usefulness’ in her UKHotViewsExtra article, Inside the dramatic world of Quantum Supremacy.

-

Duncan Aitchison examines the success of Cognizant’s European business, which has witnessed aggressive expansion over the last decade, in Proximity pays-off for Cognizant Europe.

-

Tola Sargeant analyses a transformed OLM Group, after an insightful conversation with CEO Peter O’Hara about his decision to develop a brand-new, cloud-native application to replace their flagship legacy social care application in OLM: A brave new cloud-native world.

-

Plus Jon Davies, Research Director for Financial Services, distills the key takeaways from Sibos, the world’s largest banking and payments conference, in Sibos 2019 exceeds expectations.

And finally, if you missed our annual shindig – An Evening with TechMarketView – you can download the slide deck here if you’re a TechMarketView subscription client, or why not ask one of our Research Directors to come and present to your team in person (email info@techmarketview.com for details)?

The UKHotViewsExtra articles highlighted in the section above are accessible to all our corporate subscription clients, as well as individual UKHotViews Premium subscribers. Reports are only accessible to corporate clients of the relevant research stream/s. Contact Deb Seth for corporate subscription details or sign up to UKHotViews Premium here.

Posted by UKHotViews Editor at '09:58'

We recently caught up with Simon Goldsmith, CEO of Altius. The firm in essence provides services to help clients get value from their data – in particular helping non-technical people understand the art of the possible.

We recently caught up with Simon Goldsmith, CEO of Altius. The firm in essence provides services to help clients get value from their data – in particular helping non-technical people understand the art of the possible.

Altius works with data-driven organisations to build advanced analytical and data science solutions, with a full spectrum of services from Board-level consulting, big data platforms, data science, visualisation and ongoing service management capabilities. It is focused around six industries: Retail & Hospitality (e.g. Whitbread), Travel & Transport (e.g. Rolls Royce), Financial Services (e.g. AIG Life), Public Sector (e.g. Department for Transport), Construction & Industrial (e.g. VolkerWessels) and Professional Services (e.g. Page Group).

Altius uses a blend of onshore data analytics and data science expertise, and offshore (India) managed service delivery. With no let up in growth and annuity revenues on the increase (30% of revenue today), the firm is clearly helping customers with key data challenges. More …..

Posted by Kate Hanaghan at '09:57'

- Tagged:

data

datascience

The countdown is on!

The countdown is on!

There’s only four days to go until TechMarketView’s Chief Analyst Georgina O’Toole, along with her sons William (14) and Thomas (10) will be taking part in the RBC Race for the Kids. And she’s absolutely delighted that some of the TechMarketView team – Tola Sargeant, our Managing Director, and Marc Hardwick, Research Director – will be participating with their families too.

The 5k sponsored run (or jog, or walk, or wheel!) is in aid of Great Ormond Street Hospital Children’s Charity. Some of you of you will already be aware that Georgina’s younger son (pictured) has been under the care of the Orthopaedic Department at Great Ormond Street Hospital for much of his life… indeed coinciding with Georgina’s time with TechMarketView.

Most recently the hospital supported Thomas and the rest of the O’Toole family through the difficult decision to have Thomas’ leg amputated. Without the whole-child and whole-family care of this wonderful hospital, the journey could have been so much harder.

Georgina has always spoken highly of the hospital for the amazing care it gives, thanks to the fantastic staff and facilities. Now TechMarketView is looking to raise some money to support the charity and make a difference to other children being treated there.

Thomas will be completing the 5K on his new prosthetic leg. Considering he only underwent his amputation in June, and only received his new leg in the middle of August, that is pretty impressive! And surely worth a few pounds’ donation?

We have set up a JustGiving page for donations – TechMarketView for GOSH - so please consider digging as deep as you can to support this very worthy cause.

We have set up a JustGiving page for donations – TechMarketView for GOSH - so please consider digging as deep as you can to support this very worthy cause.

Posted by UKHotViews Editor at '09:04'

- Tagged:

charity

UK challenger bank, Tide, has secured an additional $44m via a funding round led by a major Japanese investor. The latest cash injection has come via a funding round led by Softbank spin-off SBI (Strategic Business Innovator Group) and supported by existing investor Augmentum.

UK challenger bank, Tide, has secured an additional $44m via a funding round led by a major Japanese investor. The latest cash injection has come via a funding round led by Softbank spin-off SBI (Strategic Business Innovator Group) and supported by existing investor Augmentum.

Tide is one of an increasing number of providers targeting the small business banking sector in the UK (see: CGI partners with SME focused FinTech Ordo). In recent months there have been several new entrants launching their own banking offerings aimed specifically at this previously underserved segment (see: Scottish banking startup selects Temenos and revverbank selects Finastra for core banking).

The latest investment takes the total raised by Tide to date to more than $200m. The bank intends to use the cash to fuel its expansion efforts, as it seeks to establish scale in this increasingly competitive space. The impressive array of services now available to SMEs, after years of neglect by the established players, is clearly testament to the benefits of increased competition and the Open Banking reforms off the back of PSD2.

Posted by Jon C Davies at '07:50'

- Tagged:

funding

OpenBanking

challengerbank

Following the recent move to replace Mike Lawrie as its CEO (see: Salvino replaces Lawrie as CEO at DXC Technology) DXC Technology has announced the appointment of another new member of its senior leadership team.

Following the recent move to replace Mike Lawrie as its CEO (see: Salvino replaces Lawrie as CEO at DXC Technology) DXC Technology has announced the appointment of another new member of its senior leadership team.

In his first major appointment since taking the helm in September, DXC's new CEO, Mike Salvino, has installed Mary Finch (pictured) as the company’s new Chief Human Resources Officer (CHRO). Like Salvino, Finch is a former Accenture senior executive with impeccable credentials. She spent more than 14 years with the company, where she served as Chief Operations Officer for Global Human Resources. Most recently as the CHRO of AECOM, Finch transformed human resources by implementing a global talent strategy, incorporating new performance and productivity tools, coupled with training and development, career progression and workforce engagement initiatives.

Finch holds a degree in accounting and business management from Miami University. In 2016 she received the accolade of Most Powerful and Influential Women from the California Diversity Council. She is also a founding member of Her Story, an organization focused on improving the lives of single mothers and committed to helping people living in survival mode around the world by improving safety, health, income, and education. Via her involvement in Her Story, Finch is one of 20 female leaders funding homes for single mothers in El Salvador.

Finch replaces DXC’s former Chief of Staff, Jo Mason, who had presided over DXC’s global HR function since the company’s formation in 2017 and, alongside ex-CEO Mike Lawrie, had held a similar role at antecedant CSC. DXC’s approach and effectiveness in respect of human resources and talent management has long been been seen by some as an area of weakness for the organisation. It may thereforefore be no coincidence that Salvino appears to have recognised this and acted swiftly to make leadership changes. The advent of Finch marks a further postive step for DXC, as the tech giant seeks to improve its internal culture, in the face of its ongoing transformation.

Posted by Jon C Davies at '08:34'

- Tagged:

hr

appointments

It takes a brave CEO to decide, after nearly 30 years at the helm of an SME, to go back to the proverbial drawing board and invest to develop a brand-new, cloud-native application to replace their flagship legacy product. But that is exactly the decision that Peter O’Hara, CEO and founder of social care software provider OLM, made five years ago.

It takes a brave CEO to decide, after nearly 30 years at the helm of an SME, to go back to the proverbial drawing board and invest to develop a brand-new, cloud-native application to replace their flagship legacy product. But that is exactly the decision that Peter O’Hara, CEO and founder of social care software provider OLM, made five years ago.

“When we decided to build the system from the ground up with input from social workers, people called me crazy as it was a significant investment, but I knew it was the right thing to do,” O’Hara told us admitting that the challenge of creating something from the ground up was huge. He realised at the time that to have a successful future in the evolving UK social care market, OLM needed a cloud-native application that was built with an open systems platform approach.

The period following O’Hara’s bold decision wasn’t an easy one for OLM, coinciding with challenging trading conditions in the local government market as austerity measures led to reduced spending and pricing pressure. The evidence suggests that the investment was worth it, however.

Building a case management system from the ground up gave OLM the opportunity to look afresh at the care market ‘in the round’ and design a platform that enables a person-centred approach – supporting not just social care but health, education and not-for-profit services too. The result is ECLIPSE, a cloud-native platform benefiting from the public cloud, which was developed in the UK with input from some 500 social workers and launched by OLM earlier this year. Although competition in the UK social care software market remains strong, early indicators bode well for ECLIPSE’s success. More…

Subscribers to TechMarketView’s in-depth research streams and UKHotViews Premium service can read our detailed article profiling OLM in UKHotViewsExtra today: OLM: A brave new cloud-native world.

Posted by Tola Sargeant at '17:52'

- Tagged:

localgovernment

software

socialcare

healthcare

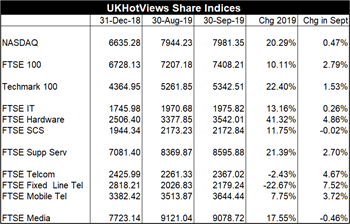

September was a mainly positive though relatively muted month for the major market indices that we track. The FTSE 100 was up 2.8% ahead of Nasdaq (+0.5%) and the FTSE IT index (all but flat). FTSE SCS – our proxy for UK-listed software & IT services companies – was also flat (though still up 11.8% ytd), outperformed by tech hardware (+4.9%). BT’s shares recovered by nearly 8% after last month’s 14% decline, and therefore so did the FTSE Fixed Line Telecom index. So far this year, Fixed Line Telecoms is the only sub-index below water, with the FTSE Support Services leading with 21% growth ytd.

September was a mainly positive though relatively muted month for the major market indices that we track. The FTSE 100 was up 2.8% ahead of Nasdaq (+0.5%) and the FTSE IT index (all but flat). FTSE SCS – our proxy for UK-listed software & IT services companies – was also flat (though still up 11.8% ytd), outperformed by tech hardware (+4.9%). BT’s shares recovered by nearly 8% after last month’s 14% decline, and therefore so did the FTSE Fixed Line Telecom index. So far this year, Fixed Line Telecoms is the only sub-index below water, with the FTSE Support Services leading with 21% growth ytd.

British tech companies topped the charts in September led by two acquisitions. Shares in Watchstone Group, the software and services outfit born from the ashes of the infamous Quindell Group ,were up 56% by the end of the month after news of the sale of the healthcare services businesses of its Canadian subsidiary, Quindell Services Inc.

News of the buy-out of Wimbledon based, financial services technology provider, StatPro, by US-based Confluence Technologies, saw its shares rise by nearly 50%. Confluence is owned by private equity firm TA Associates. Frankly this is the ‘right answer’ for StatPro, which has long been struggling with the transition to SaaS.

Meanwhile, Edinburgh-based, though totally US-focused, healthcare analytics specialist, Craneware, saw its shares rise 40% in the month on the back of a promising outlook from its FY results. And surprisingly (to us), shares in UK-based 'recruiter of two halves' Nakama Group were also up 40% in the month after what the market must have interpreted as a positive outlook from its FY results.

UK companies also championed the Wooden Spoon brigade, led by (or should that be trailed by?) financial services software player Brady, whose shares tanked by over 70% after an ugly set of half-time results. LoopUp Group, IDE Group and Quartix all saw their shares fall by over 30%.

Among the US stocks, the surprising leader was Unisys (+14%), recovering after a taking a bath in August. Even so, its shares are now worth some $7.4 compare to over $20 a year ago. Investors need a strong stomach for the roller-coaster ride on this ‘old soldier’. Worst performer was Pinterest (-23%), probably reflecting the negative sentiment to US tech unicorns (see just about anything written by our chairman Richard Holway).

Usual author Richard Holway is travelling. He will be back in the saddle in time for next month’s share performance roundup.

Posted by UKHotViews Editor at '08:43'

Cognizant has been having a tougher time of it of late (see here). Five months ago new CEO, Brian Humphries had the dubious honour of marking his fifth week in post by announcing an almost halving the growth outlook for FY19. The story since January has so far been very much a tale of two territories for this technology major. The company’s North American business has only managed to grow constant currency turnover by some 3.6% during the first two quarters of this current fiscal year. Conversely, Cognizant’s European unit, which accounts for around a sixth of global sales, has surged ahead increasing revenues during the same period by over 14% yoy.

Cognizant has been having a tougher time of it of late (see here). Five months ago new CEO, Brian Humphries had the dubious honour of marking his fifth week in post by announcing an almost halving the growth outlook for FY19. The story since January has so far been very much a tale of two territories for this technology major. The company’s North American business has only managed to grow constant currency turnover by some 3.6% during the first two quarters of this current fiscal year. Conversely, Cognizant’s European unit, which accounts for around a sixth of global sales, has surged ahead increasing revenues during the same period by over 14% yoy.

We recently caught up with Cognizant’s European management team to find out more about what’s behind the strength of the performance on this side of the Atlantic. TechMarketView subscription clients, including HotViews Premium subscribers, can learn more via UKHotViewsExtra by clicking here.

We recently caught up with Cognizant’s European management team to find out more about what’s behind the strength of the performance on this side of the Atlantic. TechMarketView subscription clients, including HotViews Premium subscribers, can learn more via UKHotViewsExtra by clicking here.

Posted by Duncan Aitchison at '08:11'

- Tagged:

profile

systemsintegration

I’ve just spent a very interesting and informative few days at Sibos, the world’s pre-eminent gathering of the banking and payments industry. For 4 days every Autumn, the Sibos community gathers to discuss the latest pressing issues and to exchange views on the future shape of the industry. Banking institutions from all over the globe are represented, along with service providers and technology partners. As a result, a fair number of deals are set in motion at Sibos every year.

I’ve just spent a very interesting and informative few days at Sibos, the world’s pre-eminent gathering of the banking and payments industry. For 4 days every Autumn, the Sibos community gathers to discuss the latest pressing issues and to exchange views on the future shape of the industry. Banking institutions from all over the globe are represented, along with service providers and technology partners. As a result, a fair number of deals are set in motion at Sibos every year.

Sibos actually stands for SWIFT International Banking Operations Seminar and the event is named after SWIFT, the global financial messaging platform that organises the gathering. However, over the years, Sibos has grown into a much broader church than just the banks and the event is now a major destination for many different stakeholders in the financial services ecosystem.

If the record number of attendees at this year's event is anything to go by then Sibos 2019 appears to have been a tremendous success. For my part, I found the conference, exhibition and associated activities to be an extremely fruitful and informative use of my time.

TechMarketView subscription clients, including HotViews Premium subscribers can learn more via HotViewsExtra (see: Sibos 2019 exceeds expectations).

TechMarketView subscription clients, including HotViews Premium subscribers can learn more via HotViewsExtra (see: Sibos 2019 exceeds expectations).

Posted by Jon C Davies at '07:00'

- Tagged:

banking

Sibos

« Back to previous page