News

Past performance may not be an indicator of future trends, as they say in the classics. But in the case of Indian pure-play (IPP) growth rates it’s hard to draw a different conclusion.

Past performance may not be an indicator of future trends, as they say in the classics. But in the case of Indian pure-play (IPP) growth rates it’s hard to draw a different conclusion.

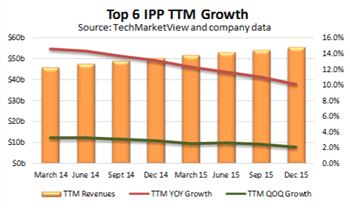

Aggregate trailing 12-month (TTM) headline revenue growth for the Top Six IPPs (TCS, Cognizant, Infosys, Wipro, HCL, Tech Mahindra) closed 2015 with a seventh consecutive quarterly decline, just topping 10% on a year-on-year (yoy) basis and 2% quarter-on-quarter (qoq).

And signals from Indian industry association Nasscom (see Nasscom downgrades forecasts – but still too high), followed days later by downbeat guidance from the usually supercharged Cognizant (see Cognizant sets scene for slow year), suggest that the deceleration is unlikely to reverse any time soon.

It therefore seems almost inevitable that 2016 will mark the first year that aggregate revenue growth for the leading IPPs will break through the 10% barrier—but in the wrong direction!

Subscribers to the TechMarketView Foundation Service can read more, along with our pithy commentary on the performance of the leading IPPs, in the latest edition of OffshoreViews, available for download right here, right now!

Posted by UKHotViews Editor at '07:52'

- Tagged:

offshore

« Back to previous page