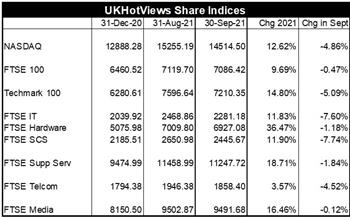

All indices in negative territory in September

I guess I’ve got used to starting my monthly reviews with words to the effect ‘Share prices surge…again’. This month was an exception with every one of the indices we track in negative territory.

Indeed, tech led the way with NASDAQ falling 4.9% (but still up 12.6% YTD), the TechMark100 off 5.1% (but still up 14.8% YTD) against the FTSE100 which only fell 0.5% (up 9.7&% YTD)

Indeed, tech led the way with NASDAQ falling 4.9% (but still up 12.6% YTD), the TechMark100 off 5.1% (but still up 14.8% YTD) against the FTSE100 which only fell 0.5% (up 9.7&% YTD)

The FTSE SCS Index, which is the closest to the UK IT Software & Services stocks we cover, fell by an even higher 7.7% (still up 11.9% YTD)

If you are a regular reader of my end of month reviews, you will be aware of my ever-growing list of ‘concerns’. Concerns which are not new but which the markets have chosen to ignore so far. We’ve talked about the growing dangers of inflation for some time. Everybody must have seen this already in every shop and service they buy. And that’s before the massive rise in energy bills in the period to come. I estimate our own energy bills will rise by a four figure sum in the next 12 months.

The conventional antidote to inflation in the past has been to increase interest rates. The BoE might now raise its interest rate from the miniscule 0.1% within months. This will filter through to mortgage rates. Most borrowers today have no experience or memory of the days back in the 1980s when mortgage rates were in double figures.

All this is denting consumer confidence and growth rates, which were recovering strongly, but are now back to flat-lining.

I’ve also said repeatedly that tech is so firmly embedded in the general economy that it cannot be completely immune to a general downturn/recession/depression.

You want more?

You want more?

All the detail, comment on the Winners and Laggards and the View on the Future Outlook in our Review of Share Performance in Sept 21 on HotViews Extra available to all subscribers including HotViews Premium.

Why not join them for just £395pa?

For more details CLICK HERE

Posted by Richard Holway at '19:19'