A ‘Volatile’ month – to say the least!

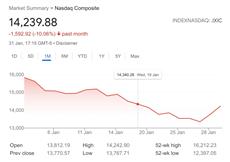

If you have been reading HotViews regularly in January (and if not, why not?) you will already know that NASDAQ entered ‘Correction’ territory on 20th Jan 22 when the index had fallen 10% from its Nov 21st 21 high. It then continued to fall recording some of the most volatile trading days I can remember. Sometimes losing 5% intraday and recovering all those losses by the close. See NASDAQ’s volatile trading day on 24th Jan 22.

If you have been reading HotViews regularly in January (and if not, why not?) you will already know that NASDAQ entered ‘Correction’ territory on 20th Jan 22 when the index had fallen 10% from its Nov 21st 21 high. It then continued to fall recording some of the most volatile trading days I can remember. Sometimes losing 5% intraday and recovering all those losses by the close. See NASDAQ’s volatile trading day on 24th Jan 22.

The volatility continued yesterday – the last trading day of January. NASDAQ put on a pretty amazing 5% gain and therefore ended January down ‘just’ 9% - it could have been a lot, lot worse.

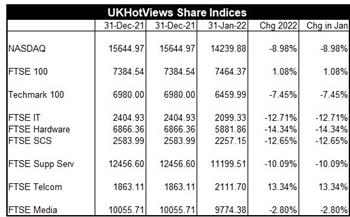

The other indices we follow were all over the place. TechMark100 followed NASDAQ with a 7.5% decline in January. But the flight from ‘growth’ to ‘value’ pushed the banking and energy-heavy FTSE100 UP 1%.

The UKHQed quoted software and computing services companies we cover had an even more torrid month – the FTSE SCS Index falling 12.7%.

The UKHQed quoted software and computing services companies we cover had an even more torrid month – the FTSE SCS Index falling 12.7%.

But the FTSE Telecomm Index was up an impressive 13.3%. The Index is dominated by two companies – BT Group whose share price rose 15.3% as it will either ‘get its act together’ with its current transformation programme or be subject to a bid. Vodafone rose by 15.8% as the epitome of the ‘value’ stock consistently paying high dividends. Neither of these companies could remotely be labelled ‘growth’ companies but both have stable and reliable revenue streams. Something that is highly prized in these unertain times.

Leaders and Laggards

The two main UK winners in Jan 22 were Triad and Micro Focus. Conversely the two main losers were Trustpilot and The Hut Group (#THG)

BIG TECH had a range of good and bad performances with Apple leading the pack. But we still await all important Q4 results from Meta/Facebook, Alphabet/Google and Amazon later this week.

Outlook

A ‘Correction’ was long anticipated. A ‘Bear market’ is defined as a 20% fall from a recent high. We are not there yet although nobody should rule that out.

There are just too many negative factors and risks at the moment. Inflation is clearly the #1 issue which could accelerate a move away from ‘growth’/tech stocks. Then we have a squeeze in consumer spend occasioned by increases in energy and taxes. On top of that we have global unrest in Ukraine and, of course, political unrest in the UK.

All that points to a continuation of the current volatility the stock markets.

You want more?

You want more?

Detailed comment on all the Winners and Losers in the Share Performance Stakes in Jan 22 as a whole in HotViews Extra. See Share performance in Jan 22 available free for all our main research subscribers or for just £395pa for HotViews Premium subscribers . For more details CLICK HERE.

Posted by Richard Holway at '09:54'