Tuesday 27 September 2022

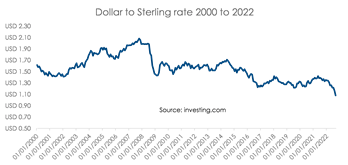

Sterling fell yesterday to a record low against the US dollar, as markets reacted negatively to the new government's tax-cutting 'mini-budget' last Friday. Although it is showing signs of slight recovery in early trading this morning, the direction of travel for the pound is far from certain.

Sterling fell yesterday to a record low against the US dollar, as markets reacted negatively to the new government's tax-cutting 'mini-budget' last Friday. Although it is showing signs of slight recovery in early trading this morning, the direction of travel for the pound is far from certain.

So, what does the currency turmoil mean for UK tech businesses?

The fall in sterling will have short-term benefits for those companies with revenue streams derived in currencies which are currently strong, particularly the US dollar. Their top line will grow relative to the cost base (assuming that is priced in pounds), which should improve short-term competitiveness and profitability.

Indeed we have seen this effect in recent months in the FTSE 100, which has a number of such companies (although admittedly few in the tech space). The FTSE 100 has outperformed most major indices in developed markets, with many of its biggest players exporting in dollars, although of course many of these are commodity-related companies which have seen a spike in demand.

But at some point, the benefit of a weaker sterling will be outweighed by the downsides, namely erosion of consumer and business purchasing power in the domestic market through higher imported inflation and ultimately weaker confidence. A currency is typically strong when risks in that domestic market are perceived to be low, leading to inflows of investment. Regrettably for the UK right now, the converse appears to be true.

For UK software and IT services (SITS) companies in particular, whilst they may benefit from sales in dollars, much of their cost base is labour, which is increasingly expensive due to the shortage of skilled workers who are feeling the pinch from higher inflation. So, any benefit from translation of overseas revenue streams into sterling is being partly offset by wage increases to retain staff. Similarly, tech companies producing a product using components sourced overseas or those who are intensive consumers of energy will face rising input costs.

The Bank of England has indicated it will move to reassure markets if needed. Its next rate setting meeting is not planned until November but there are suggestions it could move earlier, by increasing interest rates before then. This would affect all businesses with variable debt repayments, further squeezing their finances.

Ultimately, no matter how strong their overseas revenues, tech companies will be affected by a domestic downturn. Those first to feel the impact are likely to be those whose product or service is seen as discretionary.

A final observation is the possible impact on UK tech plc as a whole, where we are likely to see an increase in the number of acquisitions of domestic tech companies. We have seen this already with a number of big names subject to takeover discussions in recent months, although a falling currency is not the only factor at play. And fundamental weakness in the economy and the seeming lack of a coherent economic plan are both likely to make shareholders more willing to accept a takeover offer.

These are interesting times for the UK economy but regrettably for all the wrong reasons. Most of us - investors, businesses or consumers - will be hoping that sterling can stage a recovery soon.

Posted by Tania Wilson at '09:46'

- Tagged:

markets

macro