Saturday 17 September 2022

A month ago, it looked as though the worst of the 2022 tech stock rout might be over. US inflation data for July came in below expectations, easing fears of further sharp hikes in US interest rates.

A month ago, it looked as though the worst of the 2022 tech stock rout might be over. US inflation data for July came in below expectations, easing fears of further sharp hikes in US interest rates.

But market relief was short-lived. The Federal Reserve (Fed) made it clear that the fight against inflation was far from finished, in a late August policy speech. Tech growth stocks - particularly vulnerable to rising interest rates due to the need to more heavily discount future earnings - started falling....

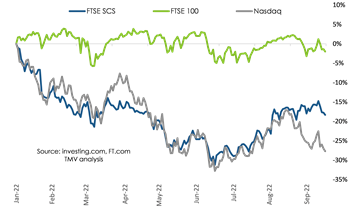

.... and after August inflation data for the US came in higher than predicted last week, they tumbled some more. It is near certain now that we will see a sizeable rate rise at the next Fed monetary policy meeting this coming week. The tech-heavy NASDAQ closed on Friday 27.7% down year-to-date (YTD), wiping out its August rally.

Stock markets globally went into reverse on the gloomy US news. Here in the UK, the FTSE Software and Computer Services (SCS) index, which had been enjoying a mini-revival on the back of takeover discussions for a number of its major players, slid as well. It closed on Friday 18.3% down YTD.

One characteristic of recent economic developments has been the negative outlook on Sterling. Indeed it is now at its lowest point against the US Dollar for 37 years. This is partly because of the perceived resilience of the US economy, partly because the Fed acted faster and more decisively than the Bank of England to tame inflation - and partly because the UK economy is simply seen by investors as weak and lacking direction.

But whatever the causes of sterling's troubles, the broad-based FTSE 100 has been a beneficiary, with revenue streams of many of its players denominated in dollars. But the UK economy is flashing recession warning signs. The latest came on Friday with the announcement of an unexpectedly large fall in August retail sales. And that, combined with US inflation difficulties, sent the FTSE 100 downwards too. It closed 2.0% down YTD.

All in all, the global outlook is miserable. This week has made it clear that what happens in the US impacts markets everywhere in a very significant way. If the US, with its greater resilience to the global energy crisis, cannot bring inflation under control without avoiding a recession, then that is bad news indeed for the rest of us.

All eyes are back on the Fed for their rate-setting announcement. The stakes are high that they make the right call.

Posted by Tania Wilson at '18:15'

- Tagged:

markets

macro