There were two stories running through the month of August for tech stocks.

The first was the eagerly-awaited meeting of global monetary policy leaders in late August in the US. This was a chance for the Federal Reserve (Fed) to communicate its position in relation to inflation. After a positive month in July and a strong start to August, investors began to get nervous even in the weeks before the meeting convened. Then comments by the Fed at the meeting, emphasising their resolve to increase interest rates further as needed, sent stocks tumbling.

The first was the eagerly-awaited meeting of global monetary policy leaders in late August in the US. This was a chance for the Federal Reserve (Fed) to communicate its position in relation to inflation. After a positive month in July and a strong start to August, investors began to get nervous even in the weeks before the meeting convened. Then comments by the Fed at the meeting, emphasising their resolve to increase interest rates further as needed, sent stocks tumbling.

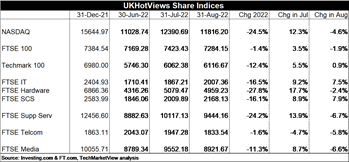

Of course, tech growth stock valuations are particularly vulnerable to rising interest rates because so much of that value is in future earnings and higher interest rates mean a heavier discount on those earnings. The tech-focused NASDAQ finished 4.6% down month-on-month (MoM), or 24.5% down year-to-date (YTD) - not its worst month in 2022 by any means but disappointing after a strong showing in July.

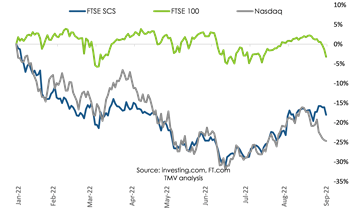

The second story concerns UK tech. We can see how UK tech markets are impacted by news in the US by observing how closely the UK FTSE Software and Computer Services (SCS) index has tracked the NASDAQ in 2022 so far.

The second story concerns UK tech. We can see how UK tech markets are impacted by news in the US by observing how closely the UK FTSE Software and Computer Services (SCS) index has tracked the NASDAQ in 2022 so far.

But there is another story unfolding here in the UK, with news of prospective takeovers of several of the largest UK tech players: Avast, Micro Focus, Darktrace and AVEVA. Market reaction to the news of takeover discussions was enough to tip the FTSE SCS upwards for the month, diverging from the NASDAQ and bucking the trend across other indices.

The broad-based FTSE 100 finished the month 1.9% down MoM, or 1.4% down YTD. The slide of sterling against the dollar is benefitting many of the FTSE 100 constituents, making it one of the standout indices in developed markets.

Winners and Losers

In July, around 100 of the 150 or so stocks we track for this column posted a gain. In August, the trend was reversed and we saw over 100 suffering a loss.

Amongst those to see their share price increase were the companies which are the subject of takeover talks: Micro Focus, Avast, Darktrace and AVEVA. Away from takeover speculation, several others enjoyed a strong month, including used car retailer Cazoo, analytics-as-a-service provider Rosslyn Data Technologies and asset finance software specialist Alfa Financial Services.

After the expectation attached to their quarterly results season in late July, August was a relatively calm month for the US Big Tech stocks. Of the traditional Big Five, Apple, Amazon, Google/Alphabet and Microsoft posted modest losses, with only Facebook/Meta posting a small gain. Netflix held steady, with both Twitter and Tesla down.

Some of those losing more heavily from the continued turmoil on the tech markets included edtech specialist RM, US multinationals Unisys and DXC Technology, SaaS bellwether Salesforce and digital learning specialist Learning Technologies Group.

Some of those losing more heavily from the continued turmoil on the tech markets included edtech specialist RM, US multinationals Unisys and DXC Technology, SaaS bellwether Salesforce and digital learning specialist Learning Technologies Group.

More details on the winners and losers is available in Share Performance in August 2022, for HotViews Premium readers.

Outlook

US monetary policy decisions, driven mainly by US macroeconomic data, will continue to dominate the fortunes of tech stocks. And amid signs that US inflation could be peaking, the Fed may slow the pace of rate rises and perhaps even engineer a so-called soft landing for the US economy, avoiding a deep downturn. All of this would be good news for tech - perhaps lifting share prices again in the short-term - and the global economy more generally.

But a possible uptick in tech stock prices may all come too late for the listed UK companies which are at various stages of exploring overseas takeover bids. If AVEVA is taken fully private and the merger of Avast with NortonLifeLock goes ahead, the FTSE 100 will be left with just one software and IT services company, accounting software provider Sage.

A dearth of major UK tech players is not good news for the UK economy. Looking beyond the current inflation crisis, we know this country must improve its productivity if we are to improve our living standards. Tech is surely a huge part of that productivity debate and (as I argued in my recent article) demand for technology solutions can only grow.

So it is an own-goal to fail to nurture the tech sector. In the end, if we don't support tech here in the UK, then other countries surely will and we will continue to see a steady stream of tech companies departing these shores.

Posted by Tania Wilson at '07:33'

- Tagged:

markets

macro