News

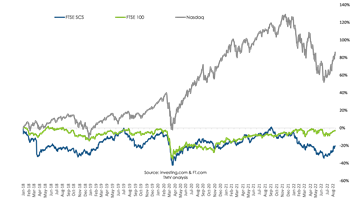

Tech stocks had a strong month in July - by 2022 standards at least - and the upward momentum has continued so far into August. The tech-focused NASDAQ closed on Friday 16.6% down year-to-date (YTD), compared to a low point of over 30% down YTD at mid-June. The UK FTSE Software and Computer Services (SCS) index has closely tracked the NASDAQ so far in 2022 and is now down 16.7% YTD. The broad-based FTSE 100 has also enjoyed a mini-rally in recent weeks and is now up 1.6% YTD.

All of this is in large part due to recent economic news out of the US, with inflation showing signs of easing, coming in below expectations for July. This led investors to believe that the Federal Reserve could temper the speed and magnitude of further interest rate rises. This in turn led to a rally in equities and particularly in growth stocks, which are especially vulnerable to rate rises because of the need to more heavily discount future earnings estimates.

The better-than-expected inflation news came just a few days after US employment data showing the labour market there remains hot. So, might it be that the world's largest economy is managing to bring inflation under control without triggering a recession? This is certainly the hope for markets - time will tell if it turns out to be the case.

Meanwhile, back in the UK the economic news is less promising. We await updated employment and inflation data this week. But the news on gross domestic product (GDP) posted on Friday already shows the economy contracting in the second quarter. The Bank of England is predicting a full recession by late 2022 and into 2023, as households feel the effects of inflation, which is predicted to continue to grow in the UK longer than in the US.

Meanwhile, back in the UK the economic news is less promising. We await updated employment and inflation data this week. But the news on gross domestic product (GDP) posted on Friday already shows the economy contracting in the second quarter. The Bank of England is predicting a full recession by late 2022 and into 2023, as households feel the effects of inflation, which is predicted to continue to grow in the UK longer than in the US.

And as for tech stocks? Of course, 2022 hasn't been a great year so far. But taking a longer-term view, the NASDAQ is now up over 86% since the start of 2018 and - as the chart shows - up a similar amount from the start of the pandemic in March 2020. The UK FTSE SCS and FTSE 100 have fared rather less well over this time horizon. Unfortunately, the UK economic picture suggests this dispiriting performance may continue for a while yet.

Posted by Tania Wilson at '13:48'

- Tagged:

markets

macro

« Back to previous page