Summary

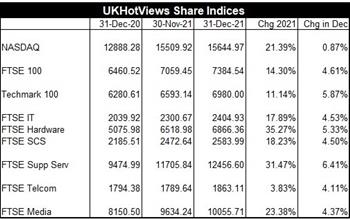

As it turned out, 2021 was a pretty good year for the indices we follow. The FTSE100 put on 14.3% and is now back to pre-pandemic levels – although still shy of its all-time highs. FTSE100 had a particularly good end to the year – rising 4.6% in Dec 21.

As it turned out, 2021 was a pretty good year for the indices we follow. The FTSE100 put on 14.3% and is now back to pre-pandemic levels – although still shy of its all-time highs. FTSE100 had a particularly good end to the year – rising 4.6% in Dec 21.

NASDAQ, however, continued to break records – closing 2021 up 21.4% on the year. But the UK-focussed Techmark100 only managed a 11.1% rise in the year.

However the FTSE SCS Index – which most closely tracks the UK Software & IT Services stocks we follow – was up an impressive 18.2%

Of the c150 stocks we follow, a pretty impressive 72% recorded a gain in 2021 and 10 managed to double (or more) their share price in 2021.

Winners

The standout winners in 2021 were the Indian HQed IT companies – Happiest Minds, Mindtree, Mastek, Mphasis, L&T, Wipro and Tech Mahindra. Indeed they made up nearly half of the those that doubled in value in 2021.

Alphabet/Google led the FAANG + Microsoft leader board (I tried to call them FANMAGs but it never caught on!) I used to subscribe to the Law of Large Numbers which basically warned that it got tougher to report mega growth the larger you became. But Big Tech obviously hasn’t read that part of the rulebook. Indeed, does Big Tech read ANY part of any rulebook?

Triad was the out and out UKHQed winner - more than doubling its share price in 2021 with a 143% rise. Followed by Endava +119%. And Instem +81%.

If you read the headlines in the media you might think that DarkTrace’s IPO was a flop. But they still ended the year up 68% on their 250p 30th Apr 21 debut. Oxford Nanopore is also up 64% since their IPO. Proving that the UK isn’t always such a bad place for tech IPOs.

Losers

PurpleBricks, Hut Group/THG, Deliveroo, Trainline, Cazoo and Blue Prism were the major UK losers.

ATOS was the major share price loser amongst the global IT Services players in 2021 with a 50% decline.

Outlook

Tech has had a stellar run for 5 years now. Indeed NASDAQ is up over 200% since Jan 2016. I’ve lost count of the number of times a ‘correction’ has been forecast. I’ve taken note of several such warnings myself. Only to sell and then see those shares reach ever higher. Whether is a ‘correction’ (down 10% from a recent high) or a Bear market (down 20% from a recent high) – or worse- is unknown.

The storm clouds are certainly there to see – inflation, energy price hikes, supply chain issues, tensions with Russia and China (even talk of invasions in Ukraine and Taiwan)

In 2000, tech was a peripheral sector. Now it is mainstream. Of course, if we get a global recession then tech just cannot be immune. However, it might well fare relatively better than others. Conversely, if Covid is finally put behind us and we accept it in the same way we accepted colds and the flue in the past, we could see major growth in most sectors and economies. Tech is well placed to ride that wave too - just as it did well out of the trough when the world was in lockdown.

Of course, in no way should you follow my advice. You really are on your own. But I do not intend to be a panic seller of my tech stocks anytime soon.

You want more?

You want more?

This is a mere summary. Far more detailed comment on all the Winners and Losers in the Share Performance Stakes in 2021 as a whole in HotViews Extra. See Share performance in 2021 available free for all our main research subscribers or for just £395pa for HotViews Premium subscribers . For more details CLICK HERE.

Posted by Richard Holway at '22:40'