News

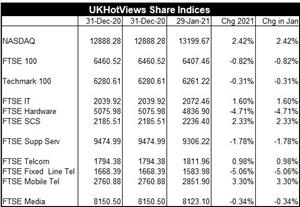

Anyone looking at the movements in the various indices we follow might conclude that nothing much happened in Jan 21. A 2.4% rise in NASDAQ and a 0.8% fall in the FTSE100 is hardly exceptional.

But in the World as a whole, and the UK in particular, it was one of the most momentous months in many a year:

But in the World as a whole, and the UK in particular, it was one of the most momentous months in many a year:

-

The US Capitol was stormed and a new President took over from Trump.

-

Retail investors in the US rose up against the short sellers and appear to have won – with great pain inflicted on the hedge funds. This led to some share platforms banning or restricting transactions in the affected shares – a pretty despicable move. This is a story that could have huge ramifications…

-

The UK finally left the EU.

-

Most of the world – incl the UK - went into lockdown as C-19 infections, hospitalisations and deaths soared.

-

At the latest count,3 vaccines have been approved for use in the UK but this number is likely to increase significantly in the near future. As of Sunday, the UK has given a first dose to nearly 9m people (including me!) A rare but major success story for the UK and its handling of the pandemic. Something that cannot be said for the EU – enough said on my views on their behaviour in the last week…

The FTSE SCS Index, which most closely tracks the UK quoted software and IT services companies that we track, rose by a respectable (but hardly spectacular) 2.3% in Jan 21. We report on the massive share fluctuations at Triad and the gains at Aptitude, Access, Aveva, Softcat etc. Also the falls at ATOS, Capita, the online property purveyors and others.

As the Oct-Dec 20 quarterly reporting season is in full swings, we report on Big Tech. We also look forward to a bumper period of London IPOs.

As the Oct-Dec 20 quarterly reporting season is in full swings, we report on Big Tech. We also look forward to a bumper period of London IPOs.

All the detail in our Review of Share Performance in Jan 21 on HotViews Extra available to all subscribers including HotViews Premium. Why not join them for just £395pa? Surely, a small price to pay! For more details CLICK HERE.

Posted by Richard Holway at '06:01'

« Back to previous page