What a difference a month makes. After a bleak performance during June, markets rallied considerably during July, as many large global corporates reported earnings figures at least in line with expectations. The omens were already good by the middle of the month. Then came a 0.75% interest rate rise in the US on Wednesday, exactly as investors had anticipated, followed by weaker-than-expected US economic data on Thursday. The latter led investors to hope that the Federal Reserve may need to slow the pace and extent of further interest rate rises to avoid tipping the US economy into recession.

What a difference a month makes. After a bleak performance during June, markets rallied considerably during July, as many large global corporates reported earnings figures at least in line with expectations. The omens were already good by the middle of the month. Then came a 0.75% interest rate rise in the US on Wednesday, exactly as investors had anticipated, followed by weaker-than-expected US economic data on Thursday. The latter led investors to hope that the Federal Reserve may need to slow the pace and extent of further interest rate rises to avoid tipping the US economy into recession.

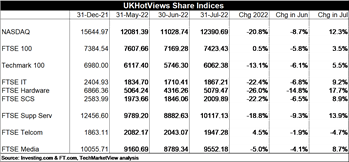

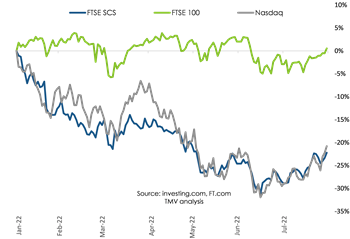

The tech-focused NASDAQ was up 12.3% month-on-month (MoM), on the back of strong earnings numbers from the largest tech players. It has recovered some of the ground lost earlier in 2022, now down 20.8% year-to-date (YTD).

The tech-focused NASDAQ was up 12.3% month-on-month (MoM), on the back of strong earnings numbers from the largest tech players. It has recovered some of the ground lost earlier in 2022, now down 20.8% year-to-date (YTD).

In the UK, the FTSE Software and Computer Services (SCS) index was up 8.9% MoM and mirrors the NASDAQ YTD at 22.2% down. The FTSE 100 was up 3.5% MoM, now 0.5% up compared to the start of the year.

Winners and Losers

Of the 150 or so stocks that we track for this column, fewer than 30 managed to avoid a loss last month. In contrast, we saw over 100 posting gains during July. The strongest performers included cybersecurity provider Darktrace, public sector and healthcare software specialist Kainos, learning and talent management specialist Learning Technologies Group, offshore players Mindtree and Happiest Minds, fraud prevention software provider GB Group, system software company Cerillion Technologies and genome sequencing technologist Oxford Nanopore.

Many of the Big Tech performed well on the back of strong earnings results, including Amazon, Apple, Microsoft and Alphabet/Google. Netflix also gained to claw back some of the ground lost during 2022 to-date. The weakest performer was Meta/Facebook.

Many of the Big Tech performed well on the back of strong earnings results, including Amazon, Apple, Microsoft and Alphabet/Google. Netflix also gained to claw back some of the ground lost during 2022 to-date. The weakest performer was Meta/Facebook.

There was a mixed bag of weak performers, including SNAP, Cazoo, THG, Attraqt, BT Group, IBM, Temenos, Made Tech and RM.

More detail on the Winners and Losers is available in Share Performance in July 2022 for HotViews Premium readers.

Outlook

This month's market activity drives home the importance of expectation management.

Firstly there are investors' expectations on inflation and how central banks will respond. July's narrative was around investors having a more confident understanding of Federal Reserve thinking than had been the case in previous months and building that into valuations. Secondly there are investors' expectations around company performance in the current environment, with the markets looking to companies to articulate the art of the possible in the current environment and then show they can deliver.

It is too early to tell whether the worst is over for tech stock markets in general. But this month's results suggest we may be starting to see the rehabilitation of those stocks which deliver what investors are increasingly looking for.

A promise of future growth is no longer enough - investors want to see a diversified suite of products and/or services generating recurring revenues, a predictable cost base in the face of high inflation and ultimately a path to profitability. And with expectation management so crucial, good communication is now more important than ever.

Posted by Tania Wilson at '19:11'

- Tagged:

markets

macro