Summary

After some respite in May, June was another rough month for all the indices we track, with every index posting losses. Most of the damage was done by mid-month, largely due to market fright at higher-than-expected US inflation data (see my mid-month article here).

After some respite in May, June was another rough month for all the indices we track, with every index posting losses. Most of the damage was done by mid-month, largely due to market fright at higher-than-expected US inflation data (see my mid-month article here).

Stocks rallied during the second half of the month, only to fall again in recent days on the back of weak US consumer confidence data. This indicated consumers believe prices will continue to stay high, even as central banks tighten monetary policy to curb inflation. The data also presented a bleak picture of consumer sentiment on broader economic and labour market prospects.

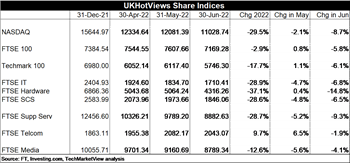

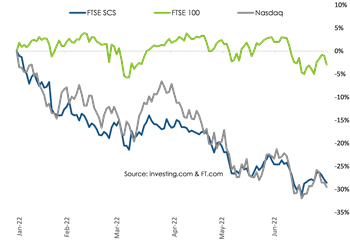

The tech-heavy NASDAQ fell 8.7% month-on-month (MoM) during June, leaving it 29.5% down year-to-date (YTD). The UK's FTSE Software and Computer Services (SCS) index fared worse in June than it had in May, which in turn had been worse than April. It fell 6.5% MoM, leaving it down 28.6% YTD.

The tech-heavy NASDAQ fell 8.7% month-on-month (MoM) during June, leaving it 29.5% down year-to-date (YTD). The UK's FTSE Software and Computer Services (SCS) index fared worse in June than it had in May, which in turn had been worse than April. It fell 6.5% MoM, leaving it down 28.6% YTD.

Even the FTSE 100, steady for much of the year and indeed a beneficiary of the continued weakness of Sterling against the US Dollar, faltered during June. It ended 5.8% down MoM and 2.9% down YTD, as fears of a downturn spooked investors.

Winners and Losers

It is an indication of overall downbeat market sentiment that of the 150 or so stocks we track for this column, fewer than 30 managed to avoid MoM losses during June.

Those that did perform strongly included healthcare software provider Emis Group (up 43.4% MoM), care management software specialist Craneware (up 30.5% MoM), recruitment and professional services business Parity Group (up 19.6% MoM), robotic process automation specialist UiPath (up 6.6% MoM) and business process outsourcer Capita (up 5.3% MoM).

The US Big Tech companies all lost out, contributing significantly to the fortunes of the NASDAQ, with Netflix now down an eye-watering 71.0% YTD.

The US Big Tech companies all lost out, contributing significantly to the fortunes of the NASDAQ, with Netflix now down an eye-watering 71.0% YTD.

Some of the many other losers outside Big Tech included analytics-as-a-service provider Actual Experience (down 72.5% MoM), French multinational Atos (down 47.7% MoM), e-commerce retailer THG (down 43.7% MoM), online car retailer Cazoo (down 46.7% MoM) and enterprise software giant Micro Focus (down 25.0% MoM).

More detail on the Winners and Losers is available in Share Performance in June 2022 for HotViews Premium readers.

Outlook

Inflation continues to be a significant concern with rates running well ahead of central bank targets. Interest rates are by now rising in response but much of the inflationary pressure is caused by supply chain disruption and so is largely beyond the reach of monetary policy.

Whilst the markets have by now priced in further interest rate rises, any unexpectedly high jumps in inflation rates are causing jitters. And the more the bad news on inflation piles up, the more consumers believe it is here to stay and act accordingly. An already tight post-Covid labour market is leading to announcements of sizeable wage increases. And those pay rises are in turn making it more likely that inflation will persist. (TMV subscribers can read my analysis of the latest UK employment data and what it means for the tech sector here).

Meanwhile early signs of economic slowdown are emerging, meaning central banks could soon have the task of trying to tighten monetary policy into slowing economies.

All of this is the perfect recipe for further volatility, with growth stocks in particular set to suffer if runaway inflation requires unexpectedly high interest rate hikes. But even the steadier value stocks, such as those on the FTSE 100, will suffer if economies do indeed slow and demand drops.

Faced with this turmoil, tech companies must continue to focus on communicating with their boards and investors around strategies for managing cost, generating recurring revenues and achieving or improving profitability.

And whilst the corporate sector can regrettably do little to stop the devastating conflict in Ukraine, they can and must double down on efforts to ease domestic labour constraints - for example, by offering flexibility where possible to attract back those currently not engaged in the workforce. For it is becoming increasingly clear that the scramble for talent in a tight labour market will play a significant role in the economic story of the coming months.

Posted by Tania Wilson at '11:47'

- Tagged:

markets

macro