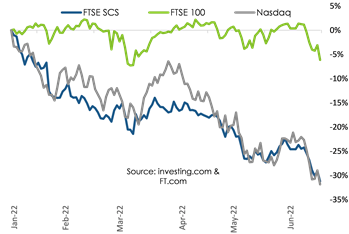

It has been a rough ride for tech stocks - and indeed for all stocks - in recent days with the mini-rally of late May/early June more than wiped out by fresh losses. The NASDAQ is now down 31.9% year-to-date (YTD), with the FTSE Software and Computer Services (SCS) index down 31.2% in the same time period. Even the FTSE 100, which had held steady during the tech stock rout of April and May as investors flocked out of growth and into value stocks, has taken a tumble and is now down 6.1% YTD.

It has been a rough ride for tech stocks - and indeed for all stocks - in recent days with the mini-rally of late May/early June more than wiped out by fresh losses. The NASDAQ is now down 31.9% year-to-date (YTD), with the FTSE Software and Computer Services (SCS) index down 31.2% in the same time period. Even the FTSE 100, which had held steady during the tech stock rout of April and May as investors flocked out of growth and into value stocks, has taken a tumble and is now down 6.1% YTD.

Worse than expected inflation data

Consumer price inflation data released in the US on Friday 10th was ahead of the prior month number and well above economists' forecasts. That was followed on Tuesday 14th by the announcement of an increase in US producer price inflation, which was again ahead of the prior month figure. The US Federal Reserve (Fed) reacted on Wednesday 15th by increasing its benchmark rate by 0.75%, the largest increase since 1994. This was seen as a clear signal of intent to be tough on inflation, even at the risk of recession.

US markets actually recovered slightly after the Fed's announcement, as the central bank made clear that such sizeable rate rises are not planned for the future. However, yesterday the Bank of England (BoE) and the Swiss National Bank (SNB) followed suit, along with other central banks, with raises of 0.25% and 0.5% respectively. Whilst the BoE move had been widely touted, the SNB increase was unexpected, representing its first rate rise since 2007 - and global markets tumbled.

Investor nervousness has now caught up with the FTSE 100. The continued weakness of Sterling against the US Dollar had benefitted those of its constituents with revenue streams denominated in dollars. But even the heavyweight household names in that index are not immune to falling investor confidence.

But all is not lost for tech

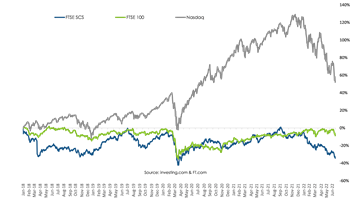

Tech stocks have fared particularly badly in recent months, as rising interest rates increase the discount rates applied to the future cash flows on which their valuations are based. But as the chart opposite shows, over a longer time horizon, the NASDAQ is still far outperforming the FTSE 100, the former up more than 50% since January 2018 and the latter some 9% down in the same period. (January 2018 was chosen as the starting point to split the timeline roughly evenly before and after the impact of Covid on the markets).

Tech stocks have fared particularly badly in recent months, as rising interest rates increase the discount rates applied to the future cash flows on which their valuations are based. But as the chart opposite shows, over a longer time horizon, the NASDAQ is still far outperforming the FTSE 100, the former up more than 50% since January 2018 and the latter some 9% down in the same period. (January 2018 was chosen as the starting point to split the timeline roughly evenly before and after the impact of Covid on the markets).

So all is not lost for tech, particularly when we think of the "value" (in the colloquial, non-cashflow sense of the word) that it has provided to consumers and businesses in recent years and especially during the pandemic. Tech is an increasingly embedded part of our personal and commercial lives and tech companies able to generate recurring revenues and articulate a path to profitability will see a way through the current economic cycle.

But meanwhile, inflation increasing ahead of expectations means the volatility is likely to continue for some time, no matter what sector you look at.

Posted by Tania Wilson at '07:32'

- Tagged:

markets

macro