Summary

After a month to forget for tech stocks in April, it looked in the first half of May as though that month might shape up similarly.

After a month to forget for tech stocks in April, it looked in the first half of May as though that month might shape up similarly.

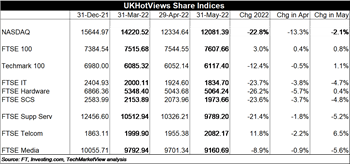

But the markets rallied towards the end of May. The NASDAQ still finished down 2.1% month-on-month (MoM) at 31 May, leaving it 22.8% down year-to-date (YTD). But compared to its 13.3% drop MoM during April, this is not as bad as some might have feared.

On the UK tech markets some specialist tech indices managed to post small gains during May, although the FTSE Software and Computer Services (SCS) index fell further in May than it did during April, with its YTD losses now exceeding those of the NASDAQ. And away from tech, the flight to value stocks so well represented on the FTSE 100 means that index put on 0.8% in May and is now 3.0% up YTD.

Winners and Losers

There was a mixed bag of winners in May, with THG (formerly The Hut Group), DXC Technology, VMware, Eagle Eye Solutions, Serco, Advanced Micro Devices, IDE Group and Oxford Nanopore Technologies all posting gains, though in several cases it was not sufficient to reverse losses earlier in the year.

Big Tech (the FAANGs plus Microsoft) had a calmer month compared to April, helping the NASDAQ to stablilise.

Companies losing out during May included LYFT, SNAP, Loopup Group, Induction Healthcare Group, Workday, TPX (formerly The Panoply), Darktrace and Twitter.

More detail on the Winners and Losers is available in Share Performance in May 2022 for HotViews Premium readers.

Outlook

The Bank of England the Federal Reserve both raised interest rates during May and the markets now seem to have priced in the expectation that further rate rises are to come. If these rises are enough to bring inflation under control, then markets should become less volatile.

But the era of cheap financing, which served the tech growth stock boom for so long, is unlikely to return anytime soon. Much of the inflationary pressure being felt across major economies is due to the conflict in Ukraine and strict Covid lockdowns in China and the consequent commodity supply shocks, which central banks can do nothing to control. (For a more detailed discussion of how inflationary pressures and in turn interest rates have influenced the technology stock markets recently, see my mid-May market round-up). Added to that, there is a significant quantitative easing programme to unwind in both the UK and US (and elsewhere), which has been partly responsible for keeping interest rates so low for so long and which the Bank and the Fed haven't really begun to tackle yet.

The result of all of this is likely to be investors becoming much choosier with their equity financing decisions and we will see tech companies under new pressure to deliver on cost management, growth forecasts, recurring revenue streams and ultimately profitability. Those companies that can do so will differentiate themselves from their peers and should see share price rewarded accordingly, as the tech stock wheat is sorted from the chaff.

In the meantime though, expect tech markets to react further if news on inflation gets significantly worse than expected - and watch out for PE-backed bids for high quality assets which they consider excessively undervalued by the recent sell-off.

Posted by Tania Wilson at '11:08'

- Tagged:

markets

macro