News

CLICK ON THE PIC TO FIND OUT HOW YOU CAN APPLY TO SCALE UP WITH CAPITA

Posted by UKHotViews Editor at '08:16'

It ’s been interesting to watch the Indian-centric software and IT services (SITS) suppliers* over the twenty years that I have tracked the UK public sector market. For many years, they have acted with a lack of certainty in terms of their commitment to pursuing opportunities in this area of the UK market.

’s been interesting to watch the Indian-centric software and IT services (SITS) suppliers* over the twenty years that I have tracked the UK public sector market. For many years, they have acted with a lack of certainty in terms of their commitment to pursuing opportunities in this area of the UK market.

However, we have seen a distinct change in attitude over the last few years. It is, perhaps, unsurprising, considering that the public sector makes up a quarter of the UK SITS market, that this group of players has decided, albeit at different times, to make a serious play for a slice of the pie. No longer are they willing to miss out on the opportunities open to them.

In this report we have researched and analysed the Indian-centric SITS suppliers active in the UK market to determine the turnover they derived from the UK public sector SITS market in their last reported financial year (and the year-on-year growth). Seven companies feature in our rankings (where an Indian-centric SITS supplier is absent from our rankings, it is because we have determined their revenues outside the commercial sector are negligible.) Alongside the UK public sector SITS revenues of the seven ranked suppliers, we have also included a breakdown of their UK public sector revenues by subsector (as defined by TechMarketView): central government, local and regional government, health, education, police, and defence.

For the five Indian-centric suppliers with the most revenues from the UK public sector – Wipro, TCS, Mastek, Cognizant, and HCLTech – we have provided a profile outlining their performance, ambitions, and prospects in more detail. TechMarketViews’ PublicSectorViews subscribers can delve into the evolution of their public sector businesses, their existing clients and contracts, their go-to-market strategies, and where they are directing their investment.

To download the report, follow this link: Indian-centric SITS Suppliers: UK Public Sector Presence & Ambition | TechMarketView. If you are not yet a subscriber, or are unsure if your organisation has a corporate subscription, please contact Deb Seth about how to access this latest detailed analysis – there will be a range of options open to you.

*We define Indian-centric as those suppliers that are either Indian-headquartered, were founded in India, or have most of their employees based in India.

Posted by Georgina O'Toole at '15:27'

- Tagged:

offshore

defence

education

police

health

indians

suppliers

IPP

competitoranalysis

local+government

public+sector

central+government

competitivelandscape

competition

supplier+rankings

TechMarketView’s UK Police Software and IT Services (SITS) Suppliers, Trends, and Forecasts report is now available. It is the final report in our series covering the six subsectors TechMarketView tracks. It follows the UK Public Sector Software & IT Services Suppliers Trends, & Forecasts report, which was published in July 2022. It also follows our recent SITS market update—a public sector specific update will be published shortly.

TechMarketView’s UK Police Software and IT Services (SITS) Suppliers, Trends, and Forecasts report is now available. It is the final report in our series covering the six subsectors TechMarketView tracks. It follows the UK Public Sector Software & IT Services Suppliers Trends, & Forecasts report, which was published in July 2022. It also follows our recent SITS market update—a public sector specific update will be published shortly.

We have already published our subsector reports on Central Government, Defence, Health, Local & Regional Government and Education.

In this report you will find our analysis of the performance of the UK Police market in 2021. It also contains an update to our Top 10 SITS supplier rankings for the subsector, with analysis of what is driving each supplier’s performance, as well as an insight into those suppliers that are threatening to unseat the leading players.

We also look at the years ahead (2022-2025), with police forces trying to hit the 20,000 officer recruitment uplift target, whilst trying to improve retention and maximise the availability of resources. Forces are also facing increasing challenges related to the ever expanding quantity of data and lack of interoperability in the sector. We look at opportunities for suppliers, including cloud migration, automation and wellbeing support.

PublicSectorViews suppliers can find out the size of the UK Police SITS market, its future growth, and who the leading suppliers are by downloading Police Software & IT Services Suppliers, Trends & Forecasts 2022-2025 today.

If you are not yet a subscriber, or are unsure if your organisation has a corporate subscription, please contact Deb Seth to find out more.

Posted by Dale Peters at '10:04'

- Tagged:

police

report

market+trends

law+enforcement

public+safety

public+sector

supplier+rankings

Wednesday 25 January 2023

TechMarketView recently revised its forecast for SITS expenditure within UK financial services. We have tracked the financial reporting of SITS vendors, monitored major contract awards and engaged in discussions with a variety of industry stakeholders. The hard data that has been fed into our forecasting model indicates that sentiment has improved since our previous detailed analysis was published (in June 2022).

Subscribers to FinancialServicesViews can download UK Financial Services SITS - Market Outlook Update now. Our latest forecasts indicate that total SITS spend by Financial Services companies in the UK exceeded £16bn in 2022. By the end of 2025 the market is now expected to reach £19.4bn. Overall, this revised figure represents an uplift of £712m on the previous forecast for 2025.

In light of the historically high level of inflation currently impacting the UK economy, we have also provided our headline statistics net of RPI growth (using 2021 as a base). Shown alongside the bare forecasts these "Real-Terms" metrics help to put the market’s growth into better context.

In light of the historically high level of inflation currently impacting the UK economy, we have also provided our headline statistics net of RPI growth (using 2021 as a base). Shown alongside the bare forecasts these "Real-Terms" metrics help to put the market’s growth into better context.

If you are not already a subscriber to FinancialServicesViews but would like to gain access to this research, or any other of our material, please contact Deb Seth for more information.

Posted by Jon C Davies at '07:07'

- Tagged:

insurance

banking

financialmarkets

wealthmanagement

financial+services

Have you heard about TechMarketView’s research theme for 2023?

Every year our theme is designed to sum up in a few words the key trends that we think will impact the tech market in the year ahead, and this year it is Pursuing Productivity.

The UK has had a productivity crisis for the last decade. Over that time, successive Prime Ministers have sought to understand the reason why and to implement policies to ‘get the country moving’.

In other words, productivity is not a new issue. And you’d be well within your rights to question why we think the pursuit of productivity will be such a defining feature of the next 12 months.

In our view, the biggest driver will be the UK’s labour shortage. With the country facing the lowest unemployment rate since 1974, we have already seen the worrying impact. Organisations are starting to cut output and delay investments.

This can only go on so long. Moreover, other factors – such as the enduring hybrid and flexible working model, rising inflation and squeezed finances, and a trend to deglobalisation and reshoring – are pushing organisations to try and better understand workforce performance.

We believe that 2023 will be the year when we start to see leaders look far more deeply at how they can get more out of the graft they are putting in. And, importantly, tech will play a big role in the answer.

We predict that investment in the productivity and resilience of the workforce will fall into two categories: employee-led, e.g., technology that will support mental health and wellbeing, that will allow employees to work smarter and faster, and that will enable them to embark on lifelong learning and training; and employer-led, e.g., technology that will enable better resource management, that will offer a better understanding of workforce performance, and that will provide the ability to make more informed, and faster decisions.

The pursuit of productivity will also extend to the ICT department. The many technologies that can make an ICT team more productive, from no-code/low-code/AI-augmented coding, to automated cybersecurity solutions, to hybrid cloud orchestration and management, will all be in demand.

Importantly, however, the pursuit of productivity will not be solved by technology alone. We must look to Japan and consider why, despite its openness to technology adoption, it has failed to improve its own productivity. The answer is that it has been inflexible in terms of cultural, organisational, and process change; without that, technology adoption has not had the desired effect. The winners in 2023 – as they look to support their clients improve their productivity, will be those that can support a wider transformation.

For a more in-depth look at our Pursuing Productivity research theme and what to expect from TechMarketView's expert analyst team over the months ahead, you can download our report, TechMarketView Research Theme 2023: Pursuing Productivity. You can also watch our short launch video.

If you are not yet a subscriber, or simply don't know if your company has a corporate subscription, please contact Deb Seth.

Posted by UKHotViews Editor at '09:30'

- Tagged:

2023

TechMarketView has released its updated outlook for the UK Software and IT Services market. In this new forecast cycle, we update the data published in Summer last year to reflect current economic conditions and market activity in Q3 and Q4 of 2022.

As we tracked quarterly supplier results and buyer sentiment/action through the second half of 2022, it became obvious that - despite some more recent reports of a slowdown in decision making - the market has continued to expand at an extremely brisk, in part inflation, fuelled pace.

Analysts have also been able to track how SITS buyers are responding to the wider national and global economic challenges. From increasing inflationary pressures, to continuing widespread supply chain problems, through persistent skills shortages, the bumps in the road for UK organisations large and small, public, and private continue to be both sizeable and extensive. While there are distinct vertical industry and horizontal service line variations, the overall pattern shows enterprises prioritising and increasing investment in technology to accelerate the pace of digital transformation.

TechMarketView now expects that the UK SITS market in 2022 will, at a headline level, both increase 10.2% (prior forecast 8.0%) and sustain a CAGR of 6.6% (prior forecast 5.9%) through to 2025. These figures are, however, buoyed materially by the impact of rising inflation. In real terms, UK SITS demand will be limited to a still healthy 5.6% in 2022 (prior forecast 5.0%) and a CAGR of 3.9% through to 2025 (prior forecast 3.4%).

TechMarketView’s more upbeat re-assessment of the prospects for the UK SITS industry is being driven by the resilience in demand for digital transformation. TechMarketView does, however, anticipate a cooling in market fervour as we go through 2023 and beyond with the pace of SITS expenditure increase – averaging over 5% per annum for the next three years – returning to historic norms.

Read the report for the full forecast update and the details behind the data. Get the market data and analysis that you can’t get elsewhere: Market Outlook Update: Trends and Forecasts 2022-2025 (for subscribers only).

For subscription information, please contact Deb Seth.

Posted by UKHotViews Editor at '09:35'

- Tagged:

forecasts

growth

outlook

TechMarketView is delighted to be partnering with the Surrey Institute for People-Centred AI, part of the University of Surrey, to produce a programme of research. The alliance will see TechMarketView Research Directors collaborate with the institute to bridge the gap between academia and industry and enable the cross-fertilisation of research into the way AI can be applied to improve the way we live our lives (see TechMarketView partners with Surrey Institute for People-Centred AI | TechMarketView).

The first report, entitled Building AI-aided workforce resilience, is available now for TechMarketView clients to delve into. It includes analysis of the role of AI/ML in workforce resilience and advice for suppliers operating in the market.

Technology is a critical workforce resilience building block, providing the digital infrastructure, and connecting business systems, processes, and data sources. The family of data intensive technologies - data science, automation, and AI/ML - has a high impact role in delivering the intelligence-based capabilities organisations and workforces need to prepare for - sense and respond to - disruption.

Building AI-aided workforce resilience looks at how AI/ML is contributing to workforce resilience by assisting, augmenting, and protecting human workers. However, this shift can only happen if human autonomy and oversight is recognised and prioritised, which is part of the bigger picture of humanising and explainable AI and technology. The report also examines current practices and building blocks, and some of the off-the-shelf solutions available to support the drive towards AI-aided workforce resilience.

Those who attended our sold out TechMarketView Evening Event in September would have had the pleasure of hearing from Dr Andrew Rogoyski, Director of Innovation and Partnerships at the Institute. We look forward to continuing our work with Rogoyski and his team in 2023 and bringing our expertise together in future reports.

To find out about becoming a TechMarketView client, please contact Deb Seth.

Posted by UKHotViews Editor at '10:00'

- Tagged:

AI

workforce

workforceresilience

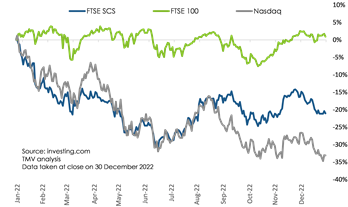

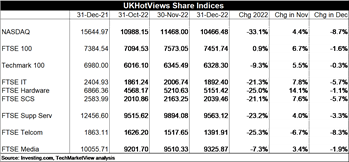

2022 was a bruising ride for tech. It was a year which brought war to Europe and the beginning of an economic downturn in many regions. And in that context, it is perhaps not surprising that investors discounted the technological future in favour of more conventional industries, such as commodities and defence.

The tech-heavy US Nasdaq closed 33% down year-on-year (YoY). The guessing game of how fast the Federal Reserve would increase interest rates to combat rising inflation caused much of the volatility visible in the chart. Further rate hikes are expected, although there are signs that US inflation is easing. The December 2022 figure just published is the lowest since October 2021.

The tech-heavy US Nasdaq closed 33% down year-on-year (YoY). The guessing game of how fast the Federal Reserve would increase interest rates to combat rising inflation caused much of the volatility visible in the chart. Further rate hikes are expected, although there are signs that US inflation is easing. The December 2022 figure just published is the lowest since October 2021.

On the face of it, the FTSE Software and Computer Services index (SCS) appears to have fared rather better, dropping 21% YoY. But bear in mind the string of takeover offers for many of its major players, with a weakened sterling increasing the attractiveness of UK acquisitions. Investors jumped into those stocks, giving a boost to the index.

The FTSE 100 closed up 1% YoY. Its commodity and energy giants benefited from the post-Covid reopening and the geopolitical fallout of 2022. And many of its constituents have dollar-denominated revenue streams, which appreciated with the weakness of sterling, boosting profitability.

The FTSE 100 closed up 1% YoY. Its commodity and energy giants benefited from the post-Covid reopening and the geopolitical fallout of 2022. And many of its constituents have dollar-denominated revenue streams, which appreciated with the weakness of sterling, boosting profitability.

The other specialist technology and media indices we track reflect the same story of volatility during a year which ended squarely in negative territory for all.

In fact, of the 150 or so stocks we track, only around 20 managed to post a gain in share price over the year.

This might all look like the end of a golden age of tech investing. But in fact, the picture is more subtle. And whilst the stock market troubles of the biggest tech names might seem a world away for many of us, there are some useful lessons in the challenges they faced in 2022.

This might all look like the end of a golden age of tech investing. But in fact, the picture is more subtle. And whilst the stock market troubles of the biggest tech names might seem a world away for many of us, there are some useful lessons in the challenges they faced in 2022.

UKHotViews Premium readers can read more on 2022 and what may be in store for 2023 in Share Performance in 2022: the year tech fell (closer) to earth. And if you would like to discuss subscription options, please contact Deb Seth.

Posted by Tania Wilson at '14:35'

- Tagged:

markets

macro

Wednesday 11 January 2023

TechMarketView is delighted to be supporting the 2023 Enterprise Awards - ‘The Oscars of the Technology Industry’, which will once again celebrate and recognise the very best of the UK’s technology entrepreneurial talent at a ceremony in March. If you’re an entrepreneur in UK tech, now is the time to get your entry in!

Each year, hundreds of the movers and shakers of the UK technology sector – including entrepreneurs, investors and advisors – come together to honour the best of the best at the Awards, organised by our friends at ScaleUp Group in association with the WCIT.

The 11th Enterprise Awards Dinner sponsored by Evelyn Partners, ScaleUp Group, Silverpeak and TechMarketview will be hosted on 28th March 2023 at Drapers’ Hall in the City of London.

The 11th Enterprise Awards Dinner sponsored by Evelyn Partners, ScaleUp Group, Silverpeak and TechMarketview will be hosted on 28th March 2023 at Drapers’ Hall in the City of London.

Entries for the awards are now open and the judging panel, chaired by TechMarketView MD Tola Sargeant, is looking forward to the challenging task of judging entrepreneurs across the following categories:

Emerging Entrepreneur – £1m - £3m annual revenue

Developing Entrepreneur – £3m - £20m annual revenue

Green Tech Entrepreneur - for entrepreneurs whose business uses technology to reduce human impacts on the natural environment (min. £500k annual revenue)

Enterprise Entrepreneur – annual revenue over £20m

Scale Up Entrepreneur – > 50% growth pa (min. £1m annual revenue)

Public Sector Entrepreneur – for entrepreneurs targeting the public sector (min. £1m annual revenue)

Social Enterprise Entrepreneur – entrepreneurs with a business model that gives something back (min. £1m annual revenue)

Deep Tech Entrepreneur – for entrepreneurs with game-changing, innovative, unique, core technology (min. £1m annual revenue)

For further information on the awards and how to enter please visit www.enterprise-awards.co.uk and submit your details before the deadline of 31 January.

Posted by UKHotViews Editor at '08:49'

- Tagged:

startup

scaleup

event

entrepreneurship

TechMarketView has released its updated outlook for the UK Software and IT Services market. In this new forecast cycle, we update the data published in Summer last year to reflect current economic conditions and market activity in Q3 and Q4 of 2022.

As we tracked quarterly supplier results and buyer sentiment/action through the second half of 2022, it became obvious that - despite some more recent reports of a slowdown in decision making - the market has continued to expand at an extremely brisk, in part inflation, fuelled pace.

Analysts have also been able to track how SITS buyers are responding to the wider national and global economic challenges. From increasing inflationary pressures, to continuing widespread supply chain problems, through persistent skills shortages, the bumps in the road for UK organisations large and small, public, and private continue to be both sizeable and extensive. While there are distinct vertical industry and horizontal service line variations, the overall pattern shows enterprises prioritising and increasing investment in technology to accelerate the pace of digital transformation.

TechMarketView now expects that the UK SITS market in 2022 will, at a headline level, both increase 10.2% (prior forecast 8.0%) and sustain a CAGR of 6.6% (prior forecast 5.9%) through to 2025. These figures are, however, buoyed materially by the impact of rising inflation. In real terms, UK SITS demand will be limited to a still healthy 5.6% in 2022 (prior forecast 5.0%) and a CAGR of 3.9% through to 2025 (prior forecast 3.4%).

TechMarketView’s more upbeat re-assessment of the prospects for the UK SITS industry is being driven by the resilience in demand for digital transformation. TechMarketView does, however, anticipate a cooling in market fervour as we go through 2023 and beyond with the pace of SITS expenditure increase – averaging over 5% per annum for the next three years – returning to historic norms.

Read the report for the full forecast update and the details behind the data.

Get the market data and analysis that you can’t get elsewhere: Market Outlook Update: Trends and Forecasts 2022-2025 (for subscribers only). For subscription information, please contact Deb Seth.

Posted by UKHotViews Editor at '09:45'

- Tagged:

MarketForecasts

marketdata

marketanalysis

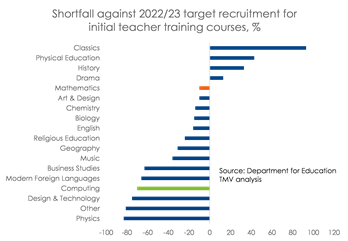

Rishi Sunak gave a speech on Wednesday hinting at plans to ensure all school pupils in England study maths in some form until the age of 18. Few could disagree that a more numerate workforce would be beneficial. But the speech has triggered a debate on what maths teaching is needed and how any change to the status quo could be achieved.

For the purposes of full disclosure – I am a maths geek. It was my favourite subject in school and I did a maths undergraduate degree. Now I am thrilled when I have a chance to help my kids with their maths homework!

But I don’t believe that forcing children to learn a subject is the way to encourage enthusiasm for it. Quite the reverse in fact. In my experience, forcing teenagers to do anything tends to have exactly the opposite effect to that which was intended.

By all means we should consider how we teach maths with the aim of encouraging more kids to want to continue it to age 18. This is a question not so much of syllabus content but more about teaching methods, engagement and use of and access to technology to facilitate different learning styles.

By all means we should consider how we teach maths with the aim of encouraging more kids to want to continue it to age 18. This is a question not so much of syllabus content but more about teaching methods, engagement and use of and access to technology to facilitate different learning styles.

But advanced calculus and geometry skills rarely pay the bills in adult life. Numeracy and digital skills on the other hand are essential. Surely what Sunak should be focused on is how schools can offer everyone lessons on things like personal finance, household budgets, core computing skills, coding….

However, to achieve more teaching of any numerate discipline, the government needs first to address the desperate shortage of teachers. It fell 10% short of its 2022 target level of recruitment to initial teacher training courses for maths. The equivalent shortfall for computing teachers was a woeful 70%.

Whatever the answer on making all kids learn maths, the challenge of reimagining the country’s approach to numeracy must start with teacher recruitment.

Posted by Tania Wilson at '10:14'

- Tagged:

skills

As the new year gets underway, TechMarketView analysts have released their Predictions for 2023. There is no doubt we face uncertain times and a tech scene that will be influenced by a whole range of factors – both positive and not so positive.

However, as we highlighted in our research report, The Impact of economic turbulence on UK SITS, it is TechMarketView’s belief that the tech market will display resilience over the next couple of years.

Indeed, our revised forecasts indicate that growth in 2022 will tick over into double digits at 10.2%. That is up from our original forecast of 8.0%, set in our previous round of forecasts in June.

As we head into what is predicted to be one of the longest recessions the UK has ever seen, tech suppliers will clearly not be immune to the effects. However, there are various reasons to be optimistic. The biggest of those is that technology is now embedded in everything we do, as individuals, as corporates, and as Government.

Moreover, technology is widely viewed as something that can be used as a competitive differentiator, as an efficiency saving tool, and as a productivity enabler (see TechMarketView’s research theme 2023: Pursuing Productivity). It is not a nice to have. Organisations do not view spend on technology as dispensable. Indeed, delaying digital transformation is likely to be seen as folly that will have negative long-term effects.

In this report outlining TechMarketView’s Predictions for the UK tech market in 2023, we have focused on the areas that we think will thrive, i.e., where we think our clients should direct their attentions. But we are not ignoring the fact that ‘we all drink from the same trough’. If the end user organisations that tech suppliers service are cutting budgets, technology spend will not be entirely protected. Moreover, the abundant uncertainty being created by the current economic picture, will make buyers more cautious and more reflective of where they spend their money. And this is reflected in our latest forecasts, due for publication next week.

Available for TechMarketView clients are our key Predictions for 2023 – all of which are areas suppliers should focus in on to provide the best value to their customers in 2023. Those Predictions are:

-

Next generation IT delivery models will re-shape the outsourcing market

-

Cloud investment decisions will be driven by ‘Time to Value’

-

The customer and employee retention imperative will drive investment in observability

-

Automation will go strategic and intelligent

-

Improvements in interoperability will go hand-in-hand with data initiatives

-

The digital skills shortage will necessitate increased use of tools within IT

-

Fiscal pressures will drive investment in improved financial management.

Read the full report for further explanation, see TechMarketView Predictions 2023: Tech opportunities in an economic downturn. To become a TechMarketView client, contact Deb Seth.

Posted by UKHotViews Editor at '09:50'

TechMarketView is a very highly regarded brand in UK technology, and we are looking for someone new to join our fantastic team of analysts.

We are seeking an analyst with an understanding of Software & IT Services and technology. Your knowledge may be very specific, or it may be very broad. And, if you have an understanding of any aspects of the UK Public Sector that could be an advantage.

You may already be working as an analyst, have a role inside a vendor or enterprise/Government organisation, and are looking to progress your career.

We set the bar high at TechMarketView and you will be expected to have excellent writing skills, be comfortable with numbers, and be able to present to clients – both face-to-face and via video. You’ll need to be confident, enthusiastic, and keen to work with our sales team on the commercial front. Our clients are at the forefront of everything we do so you’ll need to enjoy helping people find solutions to their business challenges.

Our analysts are creative and have a significant amount of autonomy in following the research agenda. We work closely as a team here, regardless of your position, and are a friendly bunch.

For the right person, this is an excellent opportunity for career progression. The usual benefits apply, and we offer a competitive salary.

We’d love to hear from you if you think you might fit the bill or if you’d like to ask any informal questions.

Drop me a line: Kate Hanaghan, Chief Research Officer.

Posted by Kate Hanaghan at '09:00'

- Tagged:

careers

job

analyst

Wednesday 04 January 2023

UK HQ’ed Cybersecurity start-up SenseOn is looking to provide organisations with data driven hyper-automated security, helping security teams to reduce the manual effort of dealing with huge volumes of inaccurate alerts and consolidate the number of different security tools they are using. I recently caught up with Dave Atkinson, CEO and founder of SenseOn, and Christian Nagele, Head of Partnerships & Alliances, to get a better understanding of how the company is looking to stand out in a crowded cybersecurity market.

UK HQ’ed Cybersecurity start-up SenseOn is looking to provide organisations with data driven hyper-automated security, helping security teams to reduce the manual effort of dealing with huge volumes of inaccurate alerts and consolidate the number of different security tools they are using. I recently caught up with Dave Atkinson, CEO and founder of SenseOn, and Christian Nagele, Head of Partnerships & Alliances, to get a better understanding of how the company is looking to stand out in a crowded cybersecurity market.

Atkinson started his career serving in the British military, going on to pioneer new cybersecurity techniques in the UK’s special forces, and later at GCHQ and the MoD. He then spent two years as commercial director at Darktrace, before deciding to start SenseOn in 2017. His ambition behind founding the company was to address what he felt was a broken cyber security industry, with traditional tools poorly designed and placing an unnecessary burden on security professionals. Nagele has recently joined the company with an aim to help build out SenseOn’s channel programme, having previously spent 15 years at CentraStage (now Datto), a former TechMarketView Little British Battler (LBB) – See here.

In the five years since its inception SenseOn has grown strongly, with a team of 85 now supporting around 60 customers, including food and beverage manufacturer Yeo Valley, legal firm Harbottle & Lewis and social housing provider bpha. The start-up has raised around $35m, with the largest funding round of $20m (~£15m) in September 2021, led by Eight Road Ventures but also notably including an investment by the National Security Strategic Investment Fund.

The SenseOn platform has been developed from the ground up, and combines broad detection and response capabilities, with AI-based automation. Whilst it is certainly ambitious to enter what is a very crowded security platform market, SenseOn seems to offer a unique proposition, especially for mid-sized organisations. To fuel further expansion, identifying IT service integrators who can benefit from a creating a unique security proposition will be crucial to the firm’s success, enabling the company to build a strong ecosystem of channel partners.

TechMarketView subscribers, including UKHotViews Premium subscribers, can read more about SenseOn in our UKHotViewsExtra article - SenseOn to hyperautomate cybersecurity

TechMarketView subscribers, including UKHotViews Premium subscribers, can read more about SenseOn in our UKHotViewsExtra article - SenseOn to hyperautomate cybersecurity

If you are not yet a subscriber, or are unsure if your company has a corporate subscription, please contact Deb Seth to find out how you can gain access to our research and much more.

Posted by Simon Baxter at '15:49'

- Tagged:

startup

cybersecurity

Wednesday 04 January 2023

Just before we all 'broke up' for the Christmas break, our Chief Analyst, Georgina O'Toole published a new PublicSectorViews report: 'Crown Hosting II: Game changer?'. It has grabbed significant attention since it was published. So, in case you missed it, here it is again....

Just before we all 'broke up' for the Christmas break, our Chief Analyst, Georgina O'Toole published a new PublicSectorViews report: 'Crown Hosting II: Game changer?'. It has grabbed significant attention since it was published. So, in case you missed it, here it is again....

************************************************************************

At the beginning of November 2022, we wrote about the awarding of the Crown Hosting II framework to Crown Hosting Data Centres (CHDC) (see Crown Hosting II awarded to CHDC | TechMarketView). At the time, we saw it purely as an extension of the arrangements that have been in place since 2015. However, there have been some important changes. And those changes might herald a step-change for Crown Hosting.

For those readers unfamiliar with the Crown Hosting framework, it is a Government agreement, managed by the Crown Commercial Service (CCS), for the provision of data centre colocation facilities for the ICT of public sector customers. The sole provider under the framework – CHDC – is a joint venture between Ark Data Centres (75%) and the Cabinet Office (25%). Ark constructs, operates, and owns hyperscale data centres for rent, providing the colocation facilities and the associated specialist facilities management and electricity. CHDC is a tenant of Ark and provides public sector customers with access to the highly secure premises “across at least three locations separated by no less than 15km”.

According to the Cabinet Office, over the last seven years, Crown Hosting has “significantly overdelivered in terms of savings”: approximately £2bn of taxpayer’s money, a 75% reduction in electricity costs, and a 99% reduction in CO2 emissions.

In this latest research from TechMarketView’s PublicSectorViews team, we analyse the use of the Crown Hosting framework over the last seven years, the main factors – including the Government’s Cloud First Policy - that have influenced how public sector organisations tackle their technical debt, and how the changes evident within the latest iteration of the framework – alongside an evolving political and economic backdrop - could result in Crown Hosting being viewed by public sector bodies as a more viable option than previously.

The most notable changes to the framework are its extended scope to include migration support; a new shared hybrid infrastructure offering; and access to the framework for system integrator (SI) partners of public sector organisations. To delve deeper into our analysis, TechMarketView PublicSectorViews subscribers can download the report – Crown Hosting II: A game changer? – now. If you would like to find out how to gain access to this research and more besides, please contact Deb Seth or info@techmarketview.com and we would be pleased to help.

Posted by UKHotViews Editor at '09:02'

- Tagged:

strategy

cloud

policy

colocation

hosting

migration

public+sector

central+government

« Back to previous page