Each year, at this time, I give a report on the Holway Portfolio.

Performance in last 12 years

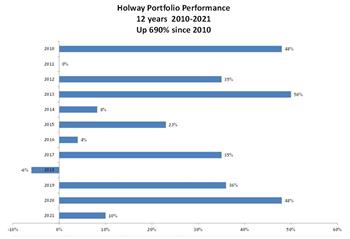

The Holway Portfolio has risen 690% in the 12 years since 1st Jan 2010. BTW - That excludes Dividends which have been rising the period.

The Holway Portfolio has risen 690% in the 12 years since 1st Jan 2010. BTW - That excludes Dividends which have been rising the period.

Best performers held throughout were Amazon, Apple and Microsoft. Best shares held for part of that 12 years were ARM, Tesla and Kainos.

Worst were Capita and Micro Focus.

You could have done better if had bought #ATT (where I was a director from 2007-2019) on 1st Jan 2010. You would have enjoyed a 1250% gain to date. All Hail Walter Price and his team in SF

Performance in 2021

2021 turned out to be relatively disappointing year for the Holway Portfolio. Up just 10% in the year. So I did worse than all the major indices. Walter Price at #ATT beat me again – but only marginally with a 14% increase in their share price.

Best performers in the Holway Portfolio in 2021 were Kainos, Microsoft and Apple: My second largest shareholding is in Amazon which rose a meagre 2.6% in 2021 YTD and significantly affected the Holway Portfolio performance overall.

Worst performers in 2021 were Blue Prism, Micro Focus and BT.

Privates

My investments in private start-ups and scale-ups have taken the lion’s share of my new investments in recent years – in part as a result of being a partner at ScaleUp Group. This year SUG had its first exit at Cloudtrade where the return was c8x.

Separately, I exited from Kimble registering a c9x gain.

As both of these were EIS investments, the equivalent gains after tax relief were even higher.

Outlook?

Another year on and another Covid crisis. When will it ever end?

C-19 has cemented tech’s position at the centre of our lives. Although the stellar gains of the last few years are unlikely to be repeated, I still see tech performing relatively well compared to the market as a whole. But we could be in for a fairly major ‘correction’ in markets and that will affect tech too.

My directly managed equity investments are only about 15% of my total investments. I intend to 'hang on' as I have always invested for the long term.

But if equities are a significant part of your assets...Hold onto your hats.

But if equities are a significant part of your assets...Hold onto your hats.

Extended version

A significantly extended version of this article is available on HotViews Extra. See Holway Portfolio Performance in 2021.

This is available to all subscribers including HotViews Premium which costs just £395 pa + VAT. To subscribe CLICK HERE.

Posted by Richard Holway at '10:50'