'Turbulent' is perhaps the word that best sums up September. A month which witnessed a near-meltdown of parts of the UK financial systems also saw stock prices fall sharply both here and in the US.

'Turbulent' is perhaps the word that best sums up September. A month which witnessed a near-meltdown of parts of the UK financial systems also saw stock prices fall sharply both here and in the US.

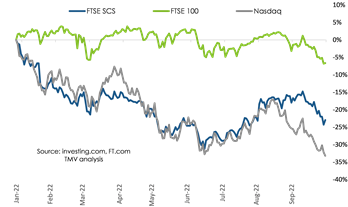

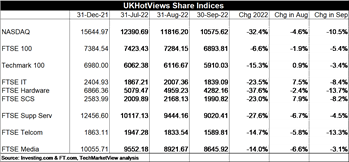

From a technology perspective, the NASDAQ is always the most sensible place to begin. After a strong opening to the month, it started sliding on the back of higher than expected US inflation data and continued to fall after the Federal Reserve ('Fed') increased US interest rates by 0.75% for the third time later in the month. It ended the month 10.5% down month-on-month ('MoM') or 32.4% down year-to-date ('YTD').

In the UK, the FTSE Software and Computer Services (SCS) index was boosted in late August by news of takeover discussions for a number of its main constituents. However, one of these fell through early in the month (Darktrace) and that - combined with nervousness over continued interest rate rises and the impact that would have on growth stocks - meant the index lost ground. It fell 8.2% MoM, now down 23.0% YTD.

In the UK, the FTSE Software and Computer Services (SCS) index was boosted in late August by news of takeover discussions for a number of its main constituents. However, one of these fell through early in the month (Darktrace) and that - combined with nervousness over continued interest rate rises and the impact that would have on growth stocks - meant the index lost ground. It fell 8.2% MoM, now down 23.0% YTD.

And finally, the UK's flagship FTSE 100 index has been a darling of investors so far in 2022. It has performed better than many other leading indices in developed markets on the back of a boom in demand for commodities and the continued weakness of sterling against the US dollar. But even the FTSE 100 could not hold out during the past two turbulent weeks in the UK economy, after the fright caused to both currency and bond markets by the government's mini-budget took its toll on investor confidence. It ended down 5.4% MoM and 6.6% YTD.

Company Performances

We track approximately 150 companies for this column. And it was a measure of investor unease that of those, fewer than 30 managed to avoid posting a loss during September.

Those weathering the storm included cyber specialist NCC Group, healthcare software provider Craneware and distributed computing company WANDisco.

Several companies saw share price rise on the back of acquisition discussions, including industrial software provider AVEVA, fraud and identity software specialist GB Group and e-commerce AI specialist Attraqt.

Several companies saw share price rise on the back of acquisition discussions, including industrial software provider AVEVA, fraud and identity software specialist GB Group and e-commerce AI specialist Attraqt.

At the other end of the share price performance spectrum were e-commerce retailer THG, used car retailer Cazoo, cybersecurity firm Darktrace, public sector IT services provider TPXimpact and education product and service specialist RM.

More details on the winners and losers, plus some thoughts on where tech stocks might be heading in this uncertain economic environment, are available in Share Performance in September 2022 - and where next for tech stocks, for HotViews Premium readers.

Posted by Tania Wilson at '07:27'

- Tagged:

markets

macro